Summary:

- We take a look at the themes to watch for in the second-quarter earnings for Goldman Sachs.

- The bank is benefiting from a resilient economy and strong sentiment in capital markets.

- With the stock up more than 50% over the past year, a pricey valuation premium warrants some caution.

Monty Rakusen/DigitalVision via Getty Images

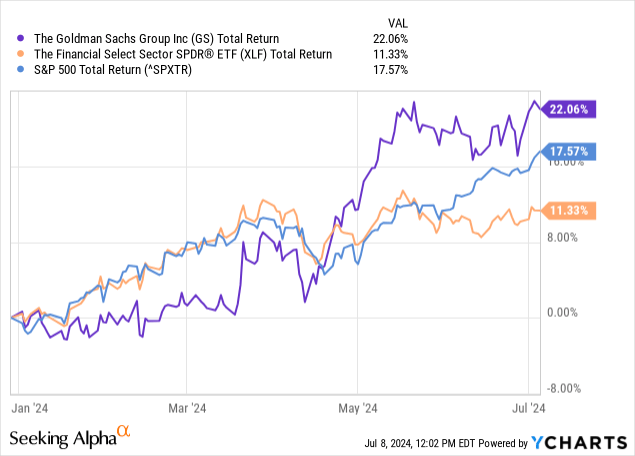

The Goldman Sachs Group, Inc. (NYSE:GS) is set to report its second-quarter earnings on July 15, ahead of the market open. This will be an important update from the global investment banking giant to reaffirm its impressive financial momentum over the past year. The stock is up 22% in 2024, outperforming sector benchmarks and even the S&P 500 Index (SPX).

We last covered GS following its Q1 result, highlighting how the bank was benefiting from resilient economic conditions and the strong gains in capital markets. While those tailwinds remain in place, our update today considers the latest developments and themes to watch into the second half of the year.

Can the stock price rally keep going? Here’s what you need to know.

GS Q2 Earnings Preview

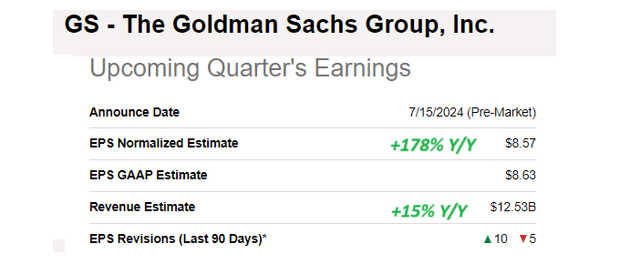

According to consensus estimates, Goldman Sachs is forecast to report Q2 EPS of $8.57 (for the period ended March 31), representing a 178% increase from the $3.08 result in the period last year. The context considers that Q2 2023 was a historically weak period for investment banking deal-making and also the market volatility surrounding the banking industry turmoil last year.

By this measure, Q2 represents a continuation of Goldman’s rebound in key segments with a revenue forecast of $12.5 billion, up 15% year-over-year, marking the strongest second quarter since 2021 at the height of the pandemic-era boom.

Seeking Alpha

The expectation is that higher financial prices support strong trading activity, while also contributing to a valuation gain for Goldman’s wealth management assets. In Q1, the firm was ranked number one globally in announced and completed mergers and acquisitions with indications higher advisory fees will add to the bottom line this quarter.

Efforts to cut costs, including streamlining its employee headcount and focusing on operational efficiencies should also play a role in earnings this quarter.

Compared to fears in recent years that the U.S. could be slipping into a recession and corporate defaults or bankruptcies would surge, the resiliency in credit markets has been the big story in 2024. Naturally, this is a positive for earnings this quarter into net interest income, while areas like exposure to commercial real estate and consumer loans could be an uncertainty.

The size of the group’s adjustment to the provision for credit losses, reflecting management’s assessment of underlying market conditions could mean the difference between an earnings beat or miss this quarter.

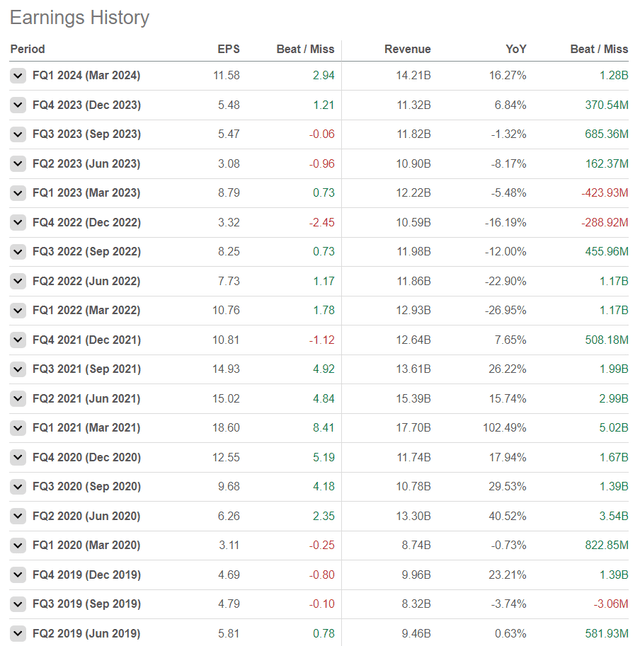

On this point, the data shows that Goldman’s earnings have been inconsistent between exceeding and underperforming Wall Street EPS estimates in several quarters since 2019. Management comments projecting confidence or caution towards the global outlook will be critical to how GS performs on the results.

Seeking Alpha

Goldman Dodd-Frank Act Stress Test Implications

One question mark is how the bank plans to address implications from the results of the recent Federal Reserve’s 2024 Dodd-Frank Act Stress Test. While Goldman Sachs cleared the baseline requirements, the final results suggested a higher Standardized Common Equity Tier 1 (“CET1”) ratio requirement of 13.9% going forward, increasing from the 13.0% level mandated in 2023.

It appears Goldman was disappointed by the assessment, which implies the bank will need to set aside more capital as a buffer during a hypothetical financial shock. CEO David Solomon made the following comments in a press release:

“This increase does not seem to reflect the strategic evolution of our business and the continuous progress we’ve made to reduce our stress loss intensity, which the Federal Reserve had recognized in the last three tests. We will engage with our regulator to better understand their determinations.”

While the change could in theory limit Goldman’s ability to invest in its business and increase shareholder distributions, the firm still moved forward with a dividend increase, hiking the quarterly rate by 9% from $2.75 to $3.00. Our takeaway is that the group maintains overall solid fundamentals with the 2024 Stress Test not undermining its earnings trajectory.

What’s Next For GS?

The attraction of Goldman Sachs is its global leadership within investment banking. The good news is that the macro backdrop remains supportive for Goldman and the broader financial services sector.

An environment where corporate earnings continue to climb, while inflation stabilizes lower, and the Fed has room to cut interest rates into 2025 allows the group to keep growing and drive earnings higher.

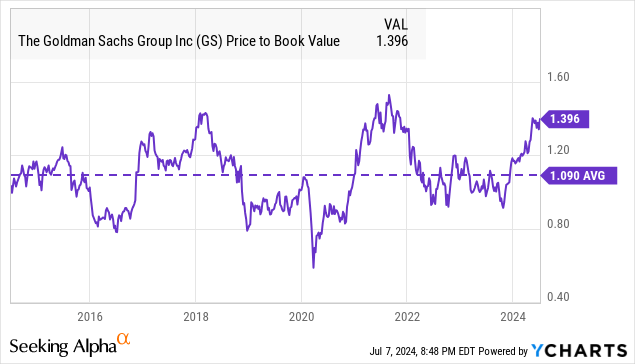

On the other hand, these factors are hardly a secret given the stock price performance over the past year where shares of Goldman have returned a remarkable 50%. The challenge is that valuation has shifted from an otherwise compelling and inexpensive position at the end of 2023 toward what is a historically pricey premium today.

We’re looking at shares of GS trading at a price-to-book multiple of 1.4x, well above the 1.1x average over the past decade. Notably, the other two times the stock reached this premium level, shares faced some selling pressure as the valuation reset lower.

While not necessarily a reason that the stock needs to decline today, the concern is that the next leg higher will require an expansion of these same multiples that becomes harder to achieve.

Ideally, we’d like to see Goldman’s revenue and earnings accelerate above and beyond their 2021 peaks to justify a higher valuation. For reference, the group posted EPS of $59.45 in 2021 compared to the $36.21 consensus estimates this year or even $40.03 in fiscal 2025.

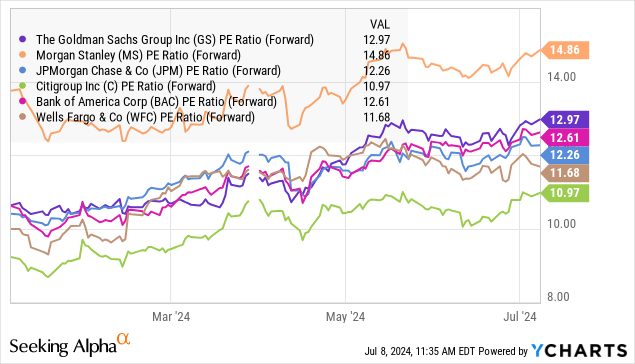

Shares of GS trading at a forward P/E ratio of 13x are at a premium to most other mega-cap bank stocks with the expectation of its investment banking peer Morgan Stanley (MS) trading at a 15x ratio. Ultimately, the appearance is that all bank stocks have become pricier in 2024 given the strong sector performance which we believe warrants some caution if many of the strong points have already been priced in.

Final Thoughts

We’re sticking with a hold rating for shares of Goldman Sachs, implying a neutral view on the near-term direction of the stock price. Recognizing a positive long-term outlook, we’d say that the upside over the near term is limited with a base case scenario for shares to consolidate recent gains.

For the Q2 earnings report, key monitoring points include the trends in equities trading and the fixed-income, commodity, and currencies (FICC) business. We’d like to hear a strong update regarding the outlook for investment banking advisory and wealth management assets under supervision.

Investors interested in picking up shares may find a more attractive entry point following the results. In terms of risks, a significantly weaker-than-expected report or concerning guidance could open the door for a new round of volatility and force a reassessment of the earnings trajectory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.