Summary:

- Goldman Sachs is poised to capitalize on increased M&A and IPO activity, driven by favorable market conditions and regulatory changes.

- Despite trading at a premium, Goldman offers good value considering expected growth rates and potential benefits from a Republican administration.

- The firm’s strong earnings and strategic growth in private credit position it well for future gains, supported by a diversified service offering.

- Lower reserve requirements and lighter M&A regulations could lead to higher shareholder returns, making Goldman a strong buy recommendation.

v0v

Introduction

Goldman Sachs (NYSE:GS) is a almost like a synonym for the financial markets. The firm is seen as the epitome of risk-taking, making big deals and the ruthless pursuit of profits. Once rather referring to, in an unflattering manner, as a giant vampire squid, the firm is highly geared to capital markets activity and M&A activity. Some reputable commentators, such as Ed Yardeni, are calling for this decade to be the “roaring 2020s”. I see Goldman as exactly the type of name poised to capitalize on the opportunity.

Although the firm is trading at a significant premium to its recent historical P/E, adjusting for expected growth rates Goldman looks like good value. As we head into a probable lighter touch republican administration, many market participants are expecting a meaningful rebound in the so-called animal spirits of markets. Despite reporting very strong year-on-year numbers in their most recent release, Goldman noted that activity levels in markets are still below the ten-year average.

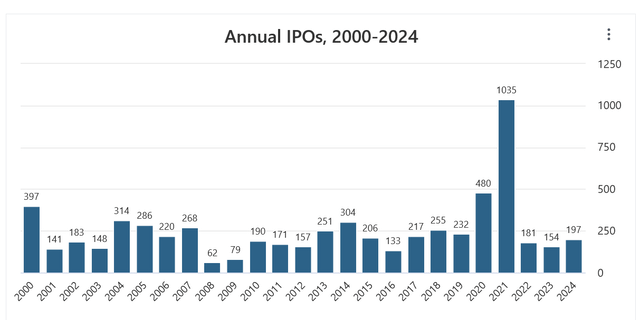

Healthy levels of deal making and IPOs, which would typically accompany equity markets at all time highs, have been absent as a confrontational FTC has dampened down would be activity. With the US election serving as a clearing event for markets I am expecting to see M&A and IPOs inflect to the upside, providing a substantial benefit to Goldman. As I result I initiate coverage of Goldman Sachs with a Strong Buy rating on a highly favorable outlook.

Lighter Touch

Typically in markets deal making is cyclical in that it follows the cyclical ups and downs of markets. Intuitively this makes sense as companies are drawn to IPO their businesses when equity market valuations are high versus when they are low.

I think Klarna is a good recent example of this characteristic, with equity markets booming in 2021 the firm raised additional capital at a valuation of $46B. Two years later the firm tapped the private markets again but this time its valuation had shrunk to just over $6B on higher interest rates. However, with marketing booming the firm is now preparing at last for an IPO, albeit with a more modest valuation than the 2021 zero interest rate anomaly.

Likewise in the M&A market, higher equity market valuations create more wiggle room for using stock as part of a takeover offer. It would seem that the ingredients have been in place for a booming period of M&A. However, this has not been the case, as the regulatory environment has created too much friction for would-be deals to get done. A dynamic set for a swift reversal with the pending dismissal or resignation of the existing FTC chair.

“I think there are long-term secular trends around M&A and market cap, which, by the way, are also meaningfully below trend I think that’s more driven by the current regulatory environment and the fact that there has not been a lot of large-cap M&A” (David Solomon, Q3 earnings call).

Earnings

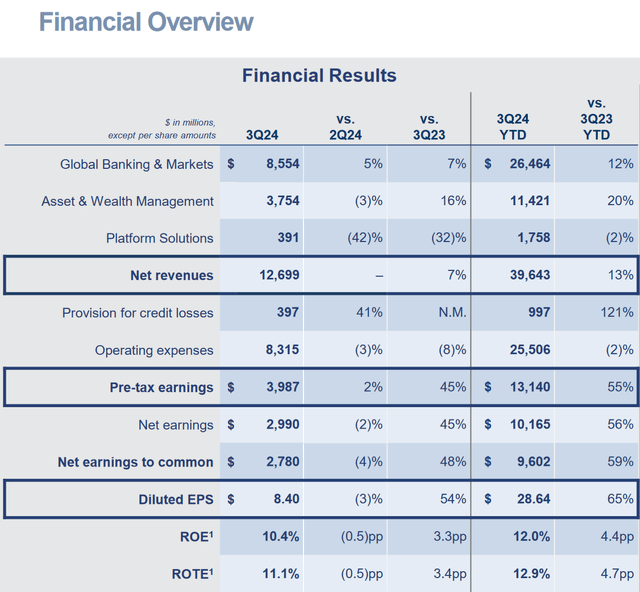

Goldman reported earnings on October 15th with numbers coming in well ahead of consensus. EPS of $8.40 was up 54% from the prior year and a full 23% better than consensus. The firm’s less volatile Asset & Wealth Management or AWM business grew an impressive 16%. The AWM business growth is a key part of Goldman’s strategy to produce more predictable earnings which tend to rewarded by markets with a higher valuations, a dynamic I wrote about previously when discussing Goldman’s peer Morgan Stanley (NYSE:MS).

Despite the impressive year-on-year numbers, market activity has yet to fully rebound even to average levels. Speaking on the Q3 earnings call, CEO David Solomon had the following to say about the current state of markets activity.

“I would say that I still believe we have some tailwind dynamics around the investment banking activity, and I just highlight that while investment banking revenues have improved, and we’ve made progress, we are still not operating at 10-year averages in M&A and equity volumes. M&A volumes year-to-date are 13% below 10-year averages”. (David Solomon, Q3 Earnings)

Private Credit

Private credit has unquestionably been a hot part of financial markets more broadly over the past two years. According to McKinsey the asset class has grown by 10x since 2009 and today stands at $2 trillion. Despite obviously rapid growth, the consultancy see private credit as an early innings story with a potential TAM of $30 trillion in the US alone.

Readers I’m sure will not be surprised to hear that Goldman have sensed this opportunity well in advance and have a dynamic franchise in private credit already established. As of Q3 the firm has $140B in private credit related assets making them one of the larger industry players despite private markets being just a side business for Goldman.

On their recent earnings call CFO Denis Coleman did a nice job of summing up how Goldman has a differentiated offering in private credit, as they offer a full suite of services from debt underwriting, origination, marketing to clients and distribution.

“If you think about where Goldman Sachs is positioned against this opportunity set. We have capacity to lend to alternative clients, for example, who are deploying into the private credit space. We have the capacity to underwrite and distribute different types of investment-grade and noninvestment-grade capital structures and we have the capacity to offer investment opportunities to clients who want to get exposed to the asset class. And while we compete with all of those different parties that David enumerated, I’m hard-pressed to find many people that have the breadth of exposure to each aspect of this ecosystem relative to us” (Denis Coleman, Q3 earnings).

Valuation

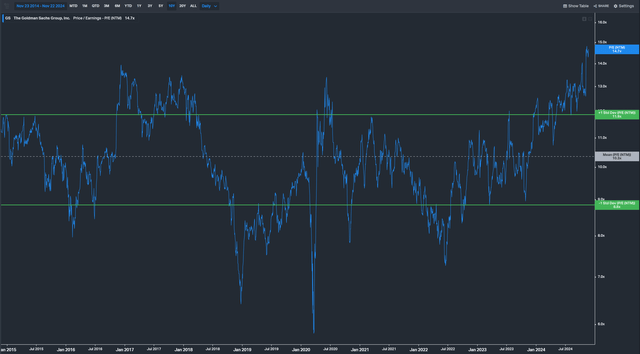

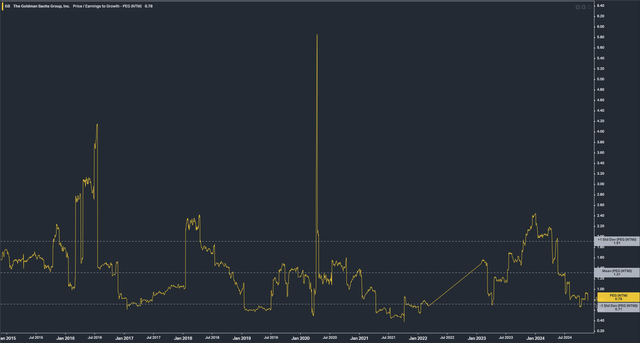

Turning to valuation, Goldman certainly looks expensive on a forward P/E basis relative to the past decade. The stock is trading at more than two standard deviations above the ten-year mean, and yet I am recommending a strong buy. The primary reason for this is the idiosyncratic nature of the past decade for banking stocks, in particular banks deemed to be Global Systemically Important Banks or G-SIBs. Following the financial crisis, regulators greatly enhanced the required capital buffers that had to be held by these financial institutions which includes Goldman Sachs.

However, recent media coverage has suggested the proposed final Federal Reserve capital requires, known as the “Basel Endgame”, will come in a significantly watered-down fashion. The net result of this would be lower reserve capital requirements than previously expected by the industry and the finalization is in itself a clearing event, a removal of uncertainty, from which the industry can plan ahead with greater confidence and investors too. After all, lower reserve requirements will directly translate into higher shareholder returns in the form of dividend and buybacks

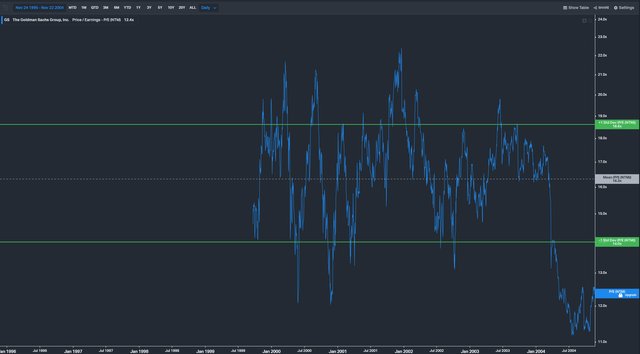

I think given the exceptional turn of events which has characterized the large cap banking space since the financial crisis, it would be best to go back in time to look at an earlier valuation standard for Goldman. In the first five years following its 1999 IPO, Goldman traded at a mean P/E of over 16x. I think as we finally close the chapter on the financial crisis era we potentially could see Goldman’s valuation find a sustainably higher floor which is more akin to its post IPO period than the past decade.

Finally, to round out the valuation discussion I think its worth looking at the PEG ratio for Goldman to see where the valuation sits in the context of growth. On this measure Goldman looks positively cheap. So, despite a high absolute valuation relative to recent history, the combination of lighter M&A regulations and lower reserve requirements means that Goldman is poised to capture significant growth in the coming years as deal making catches up with the run we have seen in public equity markets.

Risks

Goldman is by its nature a cyclical business which is a geared play on the performance of financial markets more broadly. The chief near-term risk which I am watching is inflation. Many economists make the claim the the new republican administration will lead to significant inflation on account of their tariff policies. If this turns out to be true we could see a rebound of inflation which could cause the Fed to reverse curse and raise rates once again.

While the raising of the discount rate would of course impact markets, I think the bigger risk here would be the hit to sentiment. Markets have been chugging along on the assumption that inflation has been tamed and the direction of travel for interest rates is to the downside, a change to that status quo could lead to a substantial lack of confidence, which in turn would damped any IPO market rebound.

Conclusion

To conclude, I see the stars aligning for Goldman and hence I recommend a strong conviction buy. The market environment has fundamentally changed with an upcoming leadership change at the FTC, a Basel endgame proposal that is substantially reduced in its impact and a clean cut US election which serves as a distinct clearing event for the markets. I expect an upward inflection in deal making with Goldman a chief beneficiary.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.