Summary:

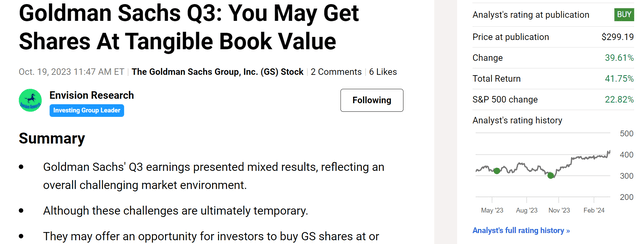

- Goldman Sachs stock has seen significant price appreciation since my last BUY thesis, outperforming the S&P 500 by also twofold.

- However, the heightened valuation risks and potential profitability pressure are weakening the BUY thesis.

- My specific profit concerns include uncertain macroeconomic conditions and operation costs escalation.

Michael M. Santiago

Thesis

My last article, published in Oct. 2023, argued for a BUY thesis on Goldman Sachs Group (NYSE:GS) when it was trading near its tangible book value at that time. As argued in our article:

Buying good banks such as GS at (or near) their tangible book value (“TBV”) is a no-brainer for us. It’s a deal where we are only paying for the hard assets (those that can be easily valued and liquidated) and getting everything else for free – such as its future earnings, brand name, customer relationships, et al.

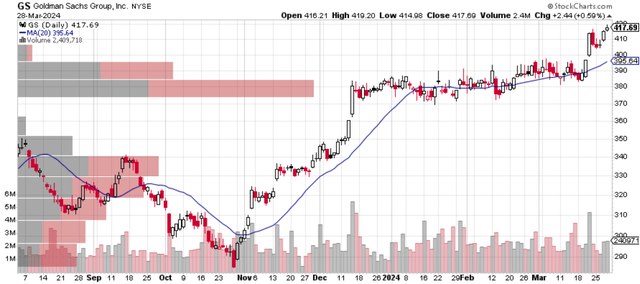

As seen in the chart below, the stock has indeed delivered market-beating returns since then. To wit, GS enjoyed a price appreciation of more than 39% and a total return close to 42%, almost doubling the S&P 500’s return in the same period.

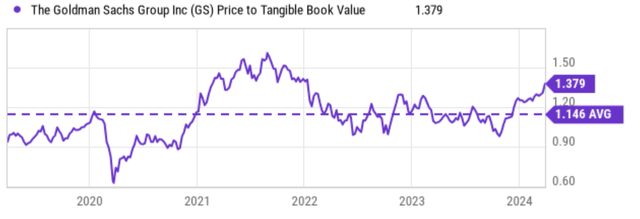

However, such a sizable price rally has weakened the BUY thesis because of the heightened valuation risks. The chart below shows the GS’ price-to-tangible book value ratio in the past few years. As seen, the stock traded below TBV a couple of times (and the Oct. 2023 time frame was one of them). Currently, the P/TBV ratio is 1.379x, not only far above my ideal entry point of 1x but also above its historical average of 1.146x by a good margin.

Next, I will analyze some of the other concerns that have developed since my last writing.

Profitability pressure

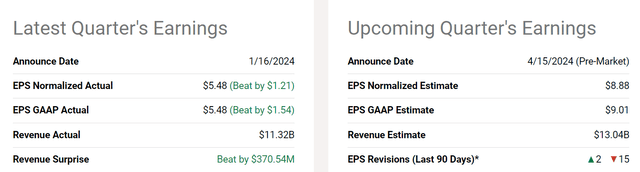

Besides the heightened valuation risks just mentioned, I also anticipate some profitability pressure in the near future. Other analysts seem to share the same view as reflected in the chart below. As seen, in the past 90 days, a total of 15 analysts revised the next quarter’s EPS forecast downward and only 2 revised it upward.

The top concerns on my mind are uncertain macroeconomic conditions and operation costs. Inflation remains stubbornly elevated, and as a result, there is no definitive direction or timeframe for interest rate changes in my view. Sure enough, if interest rates (and inflation) stay elevated, it could buoy GS fixed income business. Nevertheless, high rates mostly like would cause a slowdown in some capital market activity and negatively impact GS’s other segments. Also, if inflation persists, I anticipate operating costs, mostly compensation and benefits expenses, to further increase. And such increases would weigh on its bottom line. I think the bottom has already been feeling such pressure recently as reflected in the data provided below.

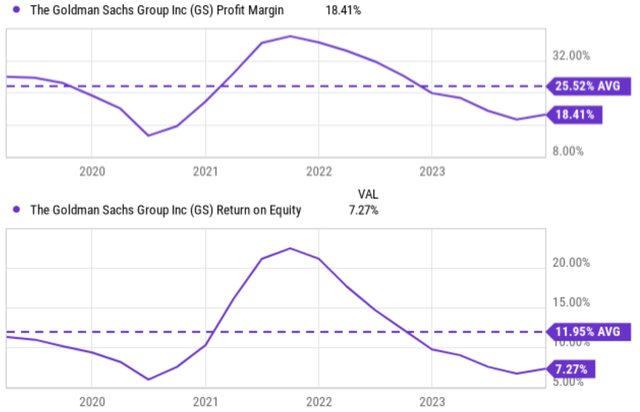

To wit, the chart shows GS’s profit margin (top panel) and its ROE, return on equity (bottom panel), compared to its historical average in the past few years. As seen, GS’s profit margin has recently slipped from its peak substantially. Its profit margin currently hovers around 18.41%, not only far below its recent peak level of around 34% but also far below its historical average of 26.52% by a good gap. The bottom panel paints the same picture in terms of its ROE. Despite the help of higher interest income due to elevated rates, its current ROE of 7.27% is only about 1/3 of its recent peak of around 21% and also below its historical average of 11.95% by a large margin.

Other risks and final thoughts

Besides the above valuation and fundamental factors, its technical trading pattern also sends mixed signals to me. The next chart shows its trading pattern in the past 6 months. Combined with the fundamental analysis above, I think GS could be trading in a sideways consolidation window of around $400 for the next few months to come. On the positive side, the stock recently broke out the $400 resistance level (also happens to be about the 20-day moving average) and has stayed there thus far. However, now how little trading volume has occurred in this price range (shown by the horizontal volume bars on the chart). Such low volume indicates a lack of conviction from both new buyers at this new price level in my interpretation. In contrast, the vast majority of volume for recent trading occurred in the $380 to $390 range (as shown by the two longest horizon bars). The stock would have a difficult time finding a definitive upward momentum until investors in this range are replaced by more enthusiastic ones.

I want to be crystal clear that I am not arguing for a bearish thesis on GS. It is a strong investment bank in my view and there are plenty of positives going on also, especially in the long term. It is the leader in M&A activity and equity underwriting in my view. And I have no doubt that it is best poised to benefit if/when the capital markets begin to show signs of pickup. Management has also been making some key strategic improvements to position its growth in the future. For example, the company has been streamlining its consumer businesses, divesting its non-core GreenSky portfolio, and completing the selling of essentially all of its Marcus personal loan portfolio in 2023. These efforts should help to better focus the bank on its core business, help to control costs, and also bolster margins in the future.

To conclude, the goal of this article is to downgrade my rating on GS from BUY to HOLD. To reiterate, I am NOT trying to argue that GS is a bad bank. To the opposite, my view is that it offers compelling long-term growth catalysts with its strong brand recognition, talent pool, and focus on high-margin investment banking activities. My downgrade is mainly motivated by near-term risk/reward analysis. The current valuation appears stretched compared to historical averages and I see a few signs of profitability pressure. Additionally, weak technical indicators suggest a sideways consolidation window in the near term. Given these considerations, I do not think GS would be able to provide the level of returns it did in the past few months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.