Summary:

- A federal judge ruled Google violated US antitrust law by maintaining a monopoly through exclusive agreements with companies like Apple.

- Google’s roughly $20B payments to Apple helped establish Google Search as the default search engine, virtually eliminating competition.

- Possible remedies for Google’s monopoly include breakup, penalty, or restricting exclusive default agreements.

- Despite the legal case, Google’s stock remains a “Strong Buy” as the retained TAC cash should offset the market share loss.

- Google’s 50% revenue reliance on Google’s search is real, but the company owns other key assets such as YouTube, Waymo, and Android OS.

NoDerog/iStock Unreleased via Getty Images

Google’s Monopoly Ruling

“Google is a monopolist, and it has acted as one to maintain its monopoly,” the court concluded after the witness testimony in the high-profile case from 2020.

On Monday, A federal judge ruled that Google (NASDAQ:GOOGL) violated US antitrust law with its search business by spending billions of dollars to secure a dominant position as the default search engine on smartphones and web browsers.

Agreements with companies like Apple Inc. (AAPL) allowed Google to block out competitors such as DuckDuckGo and Microsoft’s Corporation (MSFT) Bing, unlawfully strengthening its dominance.

This is the federal authorities’ first major win against Big Tech in the last 25 years, and it has the potential to reshape the advertising industry and set a precedent in the industry.

Google will now engage in a lengthy appeal with the “remedy phase” potentially playing out well into next year or even 2026.

The court’s ruling could reshape Google’s business, impose hefty fines, force changes in the exclusive agreements, or even spin off some of the company’s core assets.

Let me show you whether investors should be concerned about the trial’s outcome and if the new information changes my previously bullish investment thesis on Alphabet, Google’s parent company.

The Legal Case

Google’s Search dominance is clearly visible when we look at the worldwide market share data across all devices, including PC, tablets, and smartphones:

- Google’s market share: 91.0%

- Bing’s market share: 3.9%

- Yandex (Russian search engine): 1.4%

On a global scale, no competitor comes even close to challenging Google’s Search dominance with minor year-over-year changes.

US domestic data paints a slightly different picture, with Google’s market share at 88.1% and Bing’s at 7.2%, yet the gap confirms a monopoly-like position and the unparalleled competitive advantages stemming from it.

Google is the single-largest beneficiary of data collection from online users and search queries, estimated to have 16x fresher data compared to Microsoft’s Bing, enabling Google’s ads to more accurately target customer demographics.

Google’s market dominance also brings the industry-leading installed customer base, making its search engine more attractive to advertisers who, in return, are willing to pay a premium per impression compared to its peers.

Google’s Search business is a core asset and primary cash cow with high margins, representing 57% of the company’s total sales as of Q2 2024.

Even though Alphabet’s business is not a one-trick pony, having under its umbrella well-recognized brands such as YouTube, the leading streaming platform by hours watched, the widest used OS, Android, and hardware maker FitBit, any material harm to their search engine could cost the company dearly.

Google is generally achieving the search engine dominance using three distinct ways:

- Smartphones with Android OS represent 71% of the world’s phone market. With Google’s ownership of the OS, most devices have preselected Google as the default search engine.

- Some consumers proactively change to Google Chrome as their default web browser and set Google as the default search engine on their smartphones, yet this happens very seldom.

- Or, paying Apple roughly $20B annually to be the default search engine in Safari on their devices as iPhone OS makes up 29% of the world’s phone market.

However, Apple is not the only company receiving compensation for setting Google as its default search engine; it’s the most significant and most relevant to the antitrust case, as Google pays back 36% of Safari’s search revenue to Apple.

In 2023 alone, Google spent $53B on traffic acquisition costs, commonly referred to as TAC. Roughly 40% of this went back to Apple, with Samsung receiving roughly half of what Apple received to set its search engine as default.

This “closed-end loop” restricts the growth of competing search engines, virtually making it impossible for them to gain new users and build market share.

With each 1% of the search market estimated to be worth up to $1.6B, Google recognizes the threat of losing the default with Apple’s Safari, which would result in significantly lower traffic, a drop in search queries, and, ultimately, deterioration of its bottom line.

While the court did not find Google to have a monopoly on advertising as such, Google’s exclusive deals with Apple and other major hardware manufacturers were anti-competitive, leading to a monopoly in internet search, paving the way for a second trial now set for September 4th to determine the remedies, after which Google will likely appeal with the final outcome expected no earlier than in 2 years’ time.

Possible Remedies

Judging from my point of view, any proposed remedies should be fair and focus on Google’s antitrust case, limited to the search engine’s monopoly, rather than the whole ads business, while being easy to implement and monitor.

The remedies should be practical and give competitors a chance to gain a footing in the search market without significantly punishing Google’s search engine, giving an unfair advantage to dominant companies like Microsoft, leading to unfair pricing, market abuse, or, even worse, a new monopoly.

1. Break-up of Google (Least likely)

Perhaps the most urgent question each Google investor is asking is whether the company could be broken up into smaller entities, similar to Standard Oil 1911, now that it has been declared a monopoly.

The key to understanding this outcome, which, in my perspective, has a very low chance of occurring, is that the court has found Google’s monopoly only in its search business, not in online advertising; hence, breaking the company should not be perceived as one of the realistic outcomes as it is not directly related to the alleged conduct of monopoly.

A possible remedy could be a forced divestiture of Google Chrome, restricting exclusive deals between Google and the new owner of the web browser and giving users a choice of selecting their preferred search engine. However, such an outcome would be rather challenging to implement and potentially negatively impact consumers with a lack of future innovation. Google Chrome is regarded as the technically most capable web browser.

Chrome is not only a web browser with the default Google search engine. Instead, it is being utilized as a password manager synced across different devices and bookmark libraries. It is further integrated with Google’s Gmail, Google Photos, Google Translate, and many other vital features. With that, forcing Google to divest Chrome would be virtually impossible. It would be difficult to draw boundaries where the ties need to be cut with basically impossible execution and monitoring alike.

Chrome’s vertical integration into Google’s environment enhances user privacy and data security against adversaries. Hence, a spin-off of this core asset would ultimately harm consumers, not only Google, with lesser protection, removed features, and inferior product innovation.

Nevertheless, the chances of a forced break-up are not zero; if it comes to the worst, this is what a “New Google” could look like:

- Search Engine Divestiture & Data Sharing Restriction: A forced divestiture of the Search Engine, restricting data sharing between the new entities, would be Google’s worst-case outcome, as the business is a core asset, representing 57% of its sales. With each entity having to handle its data independently, Google would no longer benefit from the economy of scale across different platforms, reducing today’s Google data advantage.

- YouTube Spin-off: The spin-off of YouTube into a standalone company is rather unlikely, as the antitrust case found a monopoly in Google’s search engine. Yet Google leverages the data of YouTube users to enhance its search engine capabilities, again positioning it ahead of its competitors.

- Android Spin-off & Restriction of Exclusive Agreements: As already discussed, Google’s ownership of Android OS in most instances ensures Google’s search engine default on Android devices; hence, forcing a divestiture of Android and preventing exclusive agreements in the future could be a path the court would pursue, with significant impact on Google’s search market share and lesser dominance in smartphones.

2. Penalty (50/50 Likelihood)

Given Google’s antitrust violation, a penalty or hefty fine might seem like the most obvious course of action for the court. However, this is generally not the primary way the American system enforces the law.

If we consider Google’s market cap of over $2T and annual revenue run rate at trailing twelve months of $328B, a financial penalty would be a drop in the ocean for the juggernaut, with little to no impact.

Even if the court fines Google $20B, that’s the equivalent of what the company pays Apple annually to retain its default search engine position or 23% of its 2023 operating income.

On the other hand, a financial penalty that could threaten the continuous day-to-day operation of a business employing over 182K people would not bode well from a political standpoint, especially during an election year. It would potentially jeopardize future innovation and jobs in an already weakened economy.

Altogether, a standalone financial penalty, even if hefty, would not solve Google’s monopoly, and more effective measures would have to be taken to force a change in its business model. In my view, a financial penalty would be justified only in combination with another remedy tailored to address Google’s dominant position, hence a 50/50 likelihood.

3. Restricting Exclusive Default Agreements (Most Likely)

Google’s search business brought in $142B in 2023, with Google reportedly paying Apple anywhere around $20B annually. That’s 14% of the critical segment revenue, ensuring the default in Safari’s web browser on iPhones, iPads, and MacBooks.

If we gauge Google’s size of business against its closer competition, Microsoft’s Bing, which earned $6.9B in search revenue in 2023, Microsoft would need to pay 2.9x of its search engine revenue to Apple to secure the default position in Safari.

Naturally, overpaying for just doing business without guaranteed returns is mind-boggling. Yet, Microsoft offered Apple $15B to be chosen as the default search engine, which was rejected in favor of Google. For smaller search engines, the cost is prohibitive, virtually eliminating the competition from the industry.

With that, the most likely outcome of the antitrust case might be restricting any future Google payments to Apple, Samsung, and others to fix Google’s search engine as default.

Instead, consumers should be presented with the opportunity to select their preferred search engine from a predefined selection when using a new device for the first time, ensuring competitiveness from the get-go.

One has to ask, though, if most customers were satisfied with Google’s search engine in the past, which is arguably the most technically advanced with good accuracy of search results, why would all users not automatically choose Google’s Chrome again, implying the harm has been already done and gaining any footing for the competition will be challenging even if Google’s default is eliminated as long as Google is not forced to share its IP and data to allow the peers to catch-up.

The legal case predominantly focuses on Apple devices, which have an installed base of 29% of the world’s smartphones.

Yet another critical issue is that the majority of the other smartphone makers operate on Android, which is Google-owned. Hence, Google’s search engine is predetermined in most instances. If the court rules to change the exclusive agreement even with Android, it would be a larger-scale issue for Google, exposing it to potentially more tangible market share loss.

The most likely remedy is to restrict Google and other competitors from making payments and securing its default search engine position with the hardware makers. This outcome is easy to enforce and monitor, opening up a gateway for others to compete under more fair market circumstances.

Is Google’s Stock Buy, Hold, Or Sell?

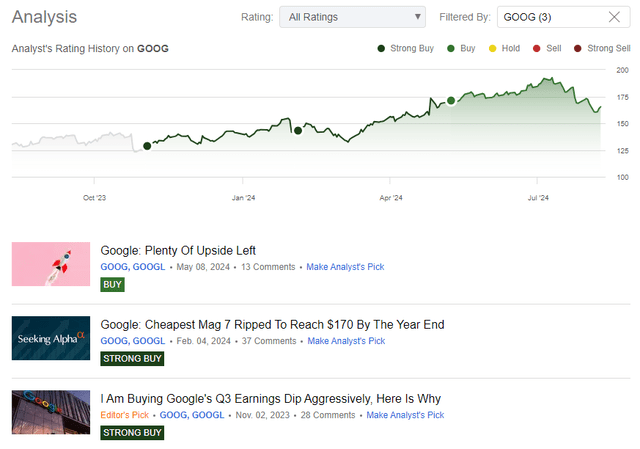

I have been covering Google’s stock on SA since November 2023 with a bullish outlook as the ad market recovered, boosted by the US presidential election campaign, Google’s cloud unit accelerating growth partially thanks to its AI-enabled features, with customers renewing contracts for longer durations compared to what we have previously seen.

So far, all my three bullish calls played out well:

Previous Coverage (Seeking Alpha)

Google has now been declared a monopoly, with the final outcome uncertain with a potential to reshape its most important high-margin business, the search engine.

From my perspective, the most likely outcome of the antitrust case is a restriction of Google’s future payments and any other search engine per se to companies like Apple and Samsung, giving smaller search engines a chance to thrive.

This outcome will result in Google retaining $20B, which the business would otherwise pay to Apple, and roughly $10B to Samsung, which is an unofficial figure. This money will flow directly to the bottom line. Still, such an outcome will undoubtedly result in some of the market’s share deterioration as users select different than Google’s search engine as default on their devices.

If we estimate that each 1% of the market share may be worth up to $1.6B of revenue (Google’s 90% market share and 2023’s search revenue of $142B) and assume that Google’s search engine business has a 50% operating income margin, retaining $30B in the bottom line could be offset by a market share loss of 24%, resulting in a zero-sum game for Google, as long as we do not consider in the equation the loss of queries resulting in worse data collection leading to loss of competitive edge.

Google’s Search is the most popular search engine not only because it’s predefined in devices but also because its search delivers the best search query results. It’s highly unlikely Google will lose such a portion of market share; instead, a loss of 5% to 10% might be likely, offset by the retained cash.

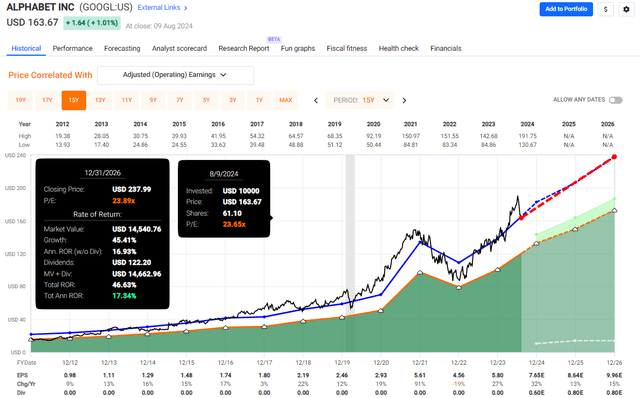

Trading at 23.6x its Blended P/E, following the 13.5% drop from its all-time high, Google presents a reasonably good investment opportunity with a valuation in line with the previous 15 years as the business should continue thriving thanks to its valuable assets, such as the search engine, YouTube, Android OS, and Waymo.

Google remains the second-largest holding in my portfolio, and expecting a total ROR of 17% annually over the next three years is absolutely feasible, hence my “Strong Buy” rating, even during times of uncertainty.

GOOGL Valuation (Fast Graphs)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.