Summary:

- Alphabet’s YouTube has been overlooked amidst the AI frenzy, but it deserves attention as a significant component of the company.

- Increasing digital advertising combined with tremendous AI capabilities and computing power will push Alphabet forward.

- Growing relevance of social media and cord-cutting will drive growth for YouTube.

- Alphabet’s data superiority with a fortress of a balance sheet make the stock reek of undervaluation.

NurPhoto/NurPhoto via Getty Images

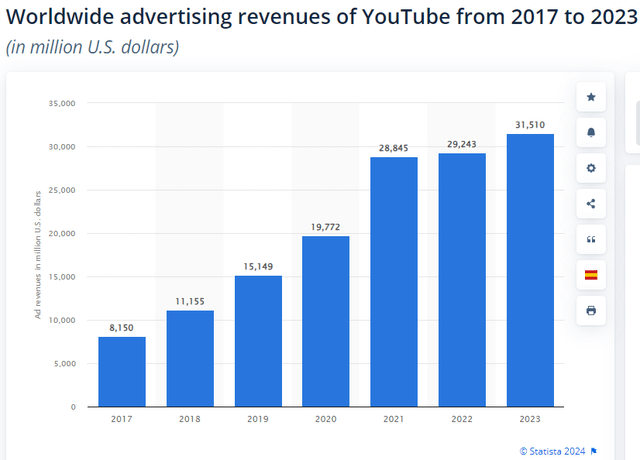

Since the start of 2023, Alphabet (GOOGL, GOOG) has been in the middle of an AI frenzy. Seeking Alpha has been flooded with hundreds of articles regarding topics such as Google cannibalizing its Search, AI chatbots from ChatGPT to Gemini and all the drama around it, and Google Cloud. Don’t get me wrong, all these topics are essential, but there’s a component of this company that has been left out a bit, in my opinion. YouTube hasn’t gotten the attention it deserves in the middle of this AI haze, so this article will almost solely focus on that unit. YouTube has ad revenues of over $31B, so it’s astonishing that an element of this magnitude is often overlooked. For context, that’s more revenue than prominent companies like Mastercard (MA) or ASML (ASML).

I will assign Alphabet as a Buy because of its relatively good valuation, great financials, and bright prospects.

Let’s get to it!

Quick Recap of Q4 and 10-K

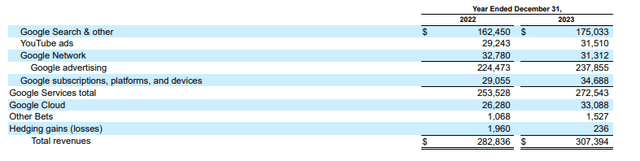

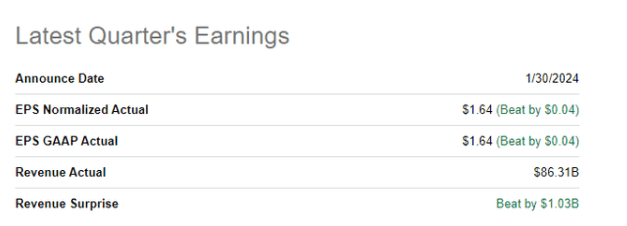

For Q4, Alphabet beat both top and bottom-line expectations. However, the stock sold off because of less ad revenue than expected. YoY, Google Services revenue was up by 12%, driven by returning advertisers as inflation is decreasing. Search and other increased 12%, while YouTube revenue was up 16% YoY.

Seeking Alpha

For 10-K, growth numbers aren’t so stellar for the ad business. Google Search & other revenue grew only 8%, and YouTube ad revenue had the same annual growth rate. Considering the macroeconomic environment, the lower growth rates are understandable. Google Cloud grew by 26%, a great sign that Google is staying in good growth in a competitive cloud environment. In total, revenue grew by around 9%, achieving the highest annual revenues ever for the company.

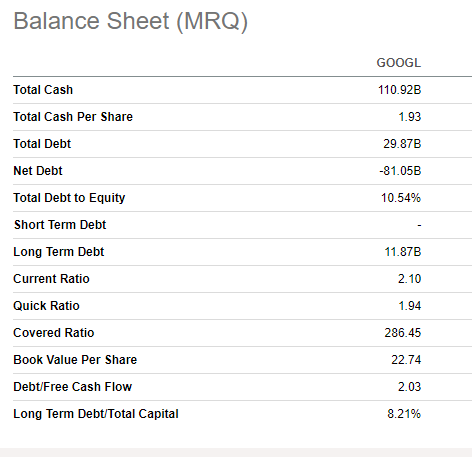

As for the balance sheet, it remains one of the best in the world. Google’s net cash position is currently at $81B, an astonishing war chest ready to be deployed however the company sees fit.

Seeking Alpha

YouTube Advertisement

To thoroughly understand the business, we must dissect it into four different aspects. These are: advertiser lens, platform lens, creator lens, and consumer lens. We look through these individual lenses and how they affect the overall picture. These aspects are also applicable more or less to operations with Meta (META), for example.

Advertiser Lens

In a hypothetical example, a gaming company wants to target young adults in their ads for their upcoming game. The company makes a bid based on the amount it wants to spend per ad impression and the specifics related to distribution (demographics, keywords, interests, location, etc.). Let’s assume the company wins the bid. The platform company, through its data and algorithms, distributes the ads to content that attracts the most applicable viewers per the advertiser’s wishes. In this scenario, it would be gaming creators, for example.

Considering the contract is based on viewed ad impressions, the advertiser company needs to pay x amount for every 1000 ad impressions showed in videos. The CPM(cost-per-thousand) is determined by the amount of competition and user engagement. If multiple gaming companies are gunning for the same ads in a popular space, the highest bid wins and gets the ads. However, a lower bid may win if the relevance for the lower bid advertiser is much higher for the targeted ad space. 45% of the revenue goes to YouTube (55% from Shorts).

The platform company also provides services and data in particular for the advertiser to be more efficient with its ads depending on the advertiser’s goals. This is what Senior VP & CBO Philipp Schindler had to say about what they do for their customers in the latest Q4 Earnings Call:

Over the last few calls, I have consistently highlighted how we’re putting Google AI to work for our customers to deliver profitability and help them achieve their goals in a do-more-with-less environment.

From a product perspective, in Q4, Performance Max remained a bright spot. We’re also excited about [demand gen] momentum. This is our big bet to help social advertisers find and convert consumers via immersive, relevant visual creatives across YouTube, including YouTube Shorts, Gmail and Discover. In a single campaign, you get access to over three billion users as they stream, scroll, connect and decide what to buy. Tens of thousands of advertisers are testing and on average seeing 6% more conversions per dollar versus image-only ads and discovery campaigns.

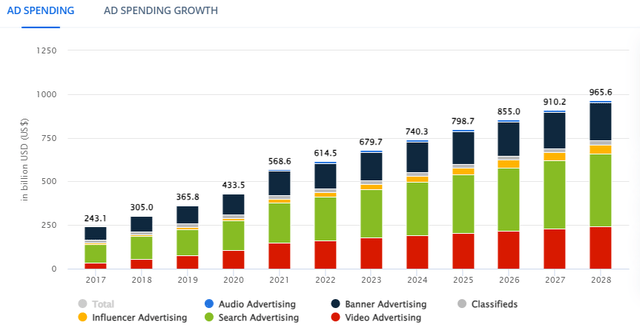

The following graph will illustrate how digital ad spending is expected to develop in the following years. For example, in 2024, Influencer Advertising is expected to be $35.1B, whereas in 2028, it’s poised to be $52.1B. This indicates a double-digit CAGR for the foreseeable future, and that’s just the Influencer Advertising.

Platform Lens

In the Statista graph below, one can see how YouTube revenues have grown over the past few years. The rapid deceleration of revenue growth is attributable to the macroeconomic environment and tough competition. Nonetheless, the revenue is expected to keep growing in the future.

Of course, the company’s main goal is to gather as much advertising and consumer engagement as possible. But how do they try to accomplish this?

As previously mentioned, data plays a big role. The better the platform can connect advertisers to their targeted audience, the better the customer experience. Thus, prosperous advertising partnerships. For example, L’Oreal (OTCPK:LRLCF) saw a 6% sales lift for its campaign on YouTube. Data analytics showed the majority of those 6% were new customers, which is important information for L’Oreal, as new customers could increase the company’s overall long-term customer base. In addition, the platform suggests videos based on your history data. Then these videos include the ads advertisers wish you to interact with.

The Google Performance Max saves advertisers time and resources by eliminating the need for multiple campaigns on different platforms because ads can now be distributed throughout the Google ecosystem wherever they’re the most effective. This is where AI comes in handy, as it can create variations automatically for advertisers in the most efficient manner. As told at the end of the last quote, this has made a difference by seeing 6% more conversions. There is also an ROI-focused tool, for example.

YouTube also seeks to monetize its platform by other means, and Shorts are an example of this. The executives at Alphabet have told multiple times that Shorts are a top priority for them. Per Philipp Schindler in the Q4 Earnings Call:

We continue to grow watch time across YouTube with strong growth in Shorts and Connected TV. Shorts remains a top priority. We have 2 billion-plus logged-in users every month, and we are averaging 70 billion in daily views.

Considering the stiff competition YouTube faces, 70 billion daily views is a respectable number. In contrast, the average daily Reels from Instagram are at over 235 billion, over triple YouTube’s daily views. This isn’t to highlight Meta’s leg-up in this contest but to showcase that YouTube isn’t doing that bad considering how much bigger of an advantage Meta has from its social media superiority. Moreover, YouTube has yet to capitalize on its Shorts monetization like Meta has, but I believe this will change in the near future. In August, it was reported that one-third of Instagram advertisers use Reels, and the ad revenue for Meta from Reels accounted for over $10B back then. I expect Shorts to increase engagement on YouTube.

Creator Lens

Creator Lens is something many investors haven’t probably given that much thought. It’s so obvious to focus on the macro environment that controls the advertiser sentiment, but this segment is more important than people realize.

For starters, YouTube offers performance-related data analytics for creators akin to advertisers. For example, the creators can see the average time a video has been watched, and what they skip, helping creators to optimize this data to make next videos more engaging. The more data YouTube can collect, the more data the creator has, and that data is transferable to additional revenue through optimization.

YouTube also offers other lanes for revenue apart from traditional ads in videos. One of them is building out your business connected to YouTube. For example, many bodybuilders have their own clothing brands and practice personal training by providing training programs. They could also partner with a business to directly advertise a product. The creator then takes up a portion of that revenue or is incentivized by some other means, free products, for example.

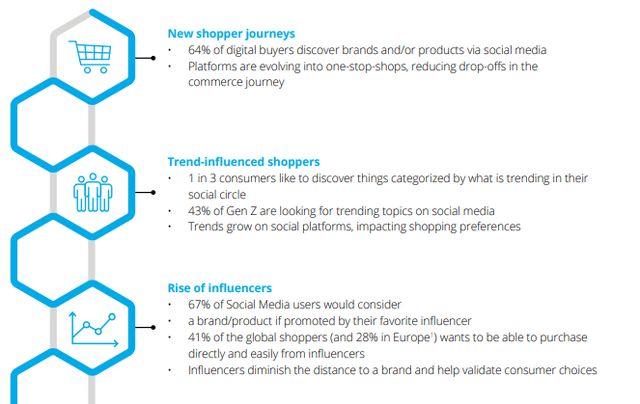

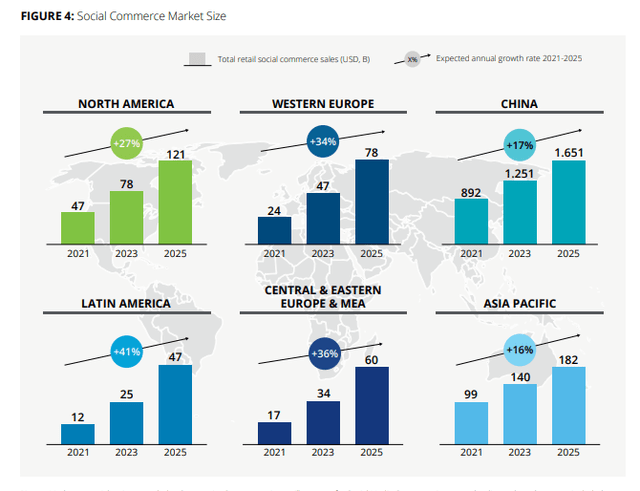

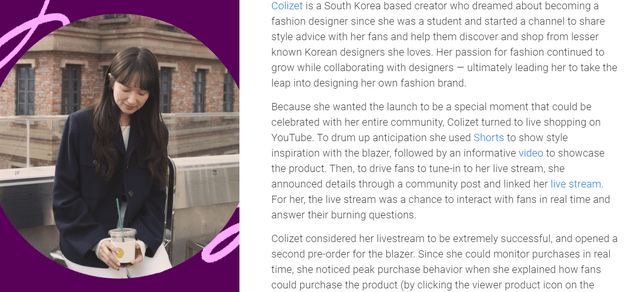

A topic I will touch on also is live streaming and social commerce. The most popular in China, online shopping combined with live streaming is relatively new in the Western world. The creator wears, showcases, or tries different products and services. This is another marketing trick of the advertisers, as an astonishing number of teenagers and Gen Z get their fashion and accessory inspiration from popular influencers. In contrast, last April it was reported that only 18% of US adults have tried live shopping. Facebook, Instagram, and TikTok dominate this space, but e-commerce companies such as Amazon (AMZN) and Alibaba (BABA) have gone into the space too. For YouTube, this is a natural space to be in, but the competition will be brutal.

The graphs above showcase the potential that comes with the newer generation coming online as physical shopping continues to lose relevance. And who is there, ready to embrace this new order of shopping? YouTube, among other social media giants. Social commerce is yet another avenue of revenue for creators, platforms, and advertisers, furthering the allure of digital advertising and being a content creator. As YouTube develops and becomes increasingly a marketplace, that should bring additional advertisers into the game.

Live Stream Example (YouTube Official Blog)

The true story above is just one of the examples social commerce and social media overall can bring to young people. Content creation is already considered a profession to be pursued, and millions of teenagers dream of becoming one. Some stories seem absurd, such as nine-year-old Like Nastya with 110 million followers. In a few years, Olajide “KSI” Olatunji went from playing FIFA in his bedroom into one of the highest Pay-Per-View boxing matches of all time and co-owned Prime Hydration partnerships with several top-tier sports teams such as FC Barcelona and Bayern Munich. Then there’s MrBeast, with an estimated $500 million net worth.

All these examples make it more alluring for more creators to set up shop on YouTube. As the content grows and new generations of consumers and creators emerge, YouTube is at the center of this, building its ecosystem and growing.

Consumer Lens

This is probably the lens that the majority of us are most familiar with. There are a lot of interesting consumer-related statistics regarding YouTube, especially when it’s overlooked as much as it has been for the last year or so.

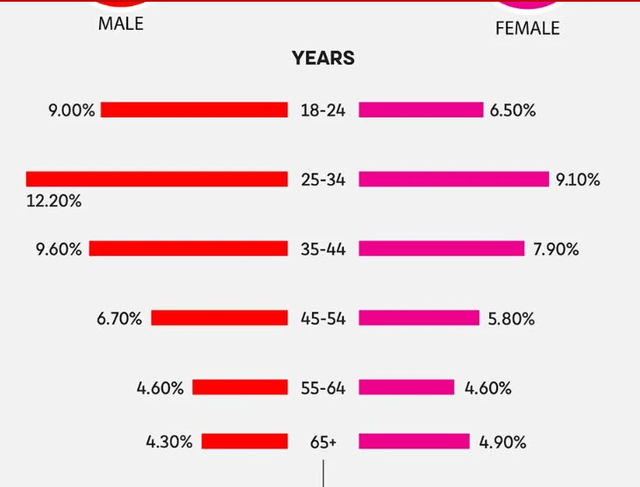

For example, YouTube is the second most visited website globally with 2.49B monthly users, behind only none other than Google. Also, only Facebook with 3B users is the more visited social media platform than YouTube. Out of these two, only Facebook is experiencing headwinds from demographics. New generations don’t even bother making a Facebook account, or if they do, they seldom use it. YouTube, on the other hand, is being integrated into new generations’ lives and behavior from childhood, with Instagram, Snapchat (SNAP), and TikTok. However, YouTube is more child-friendly, as research shows 80% of parents with children aged 11 or under say their children watch YouTube videos. Nowadays, platforms such as Instagram are being viewed as potentially harmful for young children, so the starting point of integration starts at later ages compared to YouTube. For reference, over 50% of YouTube’s user base is from people born after 1981, and nearly 90% of teenagers actively use YouTube.

Distribution of YouTube users worldwide (Global Media Insight)

Every new generation will be introduced and integrated with this platform, making them sticky consumers for life.

I interviewed my 15-year-old brother while doing research, and it validates my thoughts. He stated that he uses YouTube almost daily for at least an hour. If he’s playing a game with his console, YouTube is going on in the background from his phone, listening to an interview or a podcast, for example. This can result in multiple hours of platform usage, and he’s definitely not the only one doing this. This resembles the way traditional TV or radio used to work and still do; people put them on while doing something else simultaneously. He also said that Instagram and TikTok are mainly used for “scrolling”. On average, these two combined in the US account for 88.8 minutes per day. The average watch time for US citizen on YouTube is 48.7 minutes per day.

As many have probably noticed on YouTube, there are different kinds of ads based on length, type, or whether the ad is skippable or not. One of the newest additions is the non-skippable 30-second ads on ConnectTV.

I can see the strategic reasoning behind these ads. Mobile users are usually more engaged with the content, so it’s more tiresome to watch a 30-second video when you can’t do anything in the meantime. However, with ConnectTV, people can use phones during the ad, or maybe it’s just playing in the background. In my opinion, the non-skippable 30-second ads are a good move, since it’s enough time for YouTube to get paid, and it doesn’t affect the consumer sentiment that negatively. CBO Schindler also stated in the Q4 Earnings Call that ConnectTV users are growing at the most rapid rate of all platforms, so it will be beneficial for the company to see a rapid growth user segment combined with a growing revenue segment. With mobile usage, the ads are much shorter, and most ads are 5-15 seconds long, which is very tolerable. Compared to multiple 8-minute-long commercial breaks in traditional TV, even two minutes of ads isn’t that bad.

YouTube’s Future

Advertising

First, let’s talk about how YouTube’s ad revenue could change going forward.

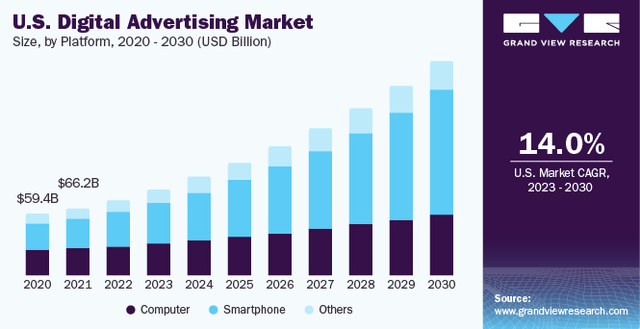

Global digital advertising market CAGR is expected to be 15.5%, and US digital advertising market CAGR is expected to be 14%, as is stated in the graph below.

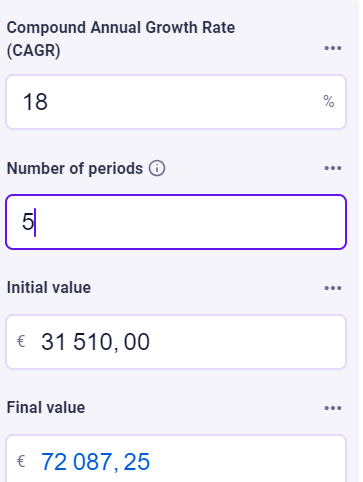

Also, as can be calculated from the graph in the Platform Lens, YouTube’s global ad revenue has grown with a CAGR of 21.31% since 2017. In addition, the revenue stagnated briefly, which makes the growth all the more impressive.

Considering all the stated statistics, and the fact that Shorts are doing well, it’s realistic(but a bit optimistic) to forecast a CAGR growth of 18% for the next 5 years.

Omnicalculator

As can be seen from the calculation above, YouTube’s ad revenue could reach $72B in the next five years. These assumptions are based on the case that there isn’t a hard landing in the US economy.

YouTube Subscriptions

While most of Google’s revenue stems from advertising, subscriptions are an increasing portion of the company’s revenue. This is a welcome sight, as it gives more predictable earnings that could result in earnings multiple expansion. YouTube Premium and YouTube Music Premium were reported to have amassed over 100 million subscribers. Google didn’t give specific numbers on different parts of the subscription business, but revenue was reported to be $15B in total. This is 5x since 2019. However, this segment also includes Google One (storage), Google Workspace (business accounts), and YouTube TV. CEO Sundar Pichai did state in the Q4 Earnings Call that the growth in the Subscriptions was powered by multiple segments. The growth is very encouraging. More and more people want ad-free Premium to watch YouTube, and I expect this trend to continue. In just a year, Premium added 20 million subscribers.

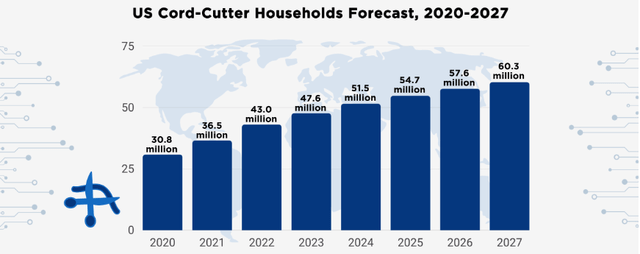

Then there’s YouTube TV, one of the best live TV streaming services. As cord-cutting is expected to continue going forward, these customers are seeking new alternatives. YouTube TV has currently over 8 million subscribers and a basic plan of $73 per month. 8 million subscribers may not sound a lot, but that makes YouTube TV the fourth largest pay-TV service provider in the US, behind Comcast (CMCSA), Charter (CHTR) and DirecTV. In addition, YouTube had only 5 million subscribers in July 2022, so that’s a 3 million bump-up in a little over a year. In Q3 2023 alone, YouTube TV added 600,000 new subscribers per Leichtman Research Group, while the other top providers all lost subscribers. For example, Comcast lost 490,000 subscribers. In Q4, Comcast was reported to have lost 389,000 subscribers.

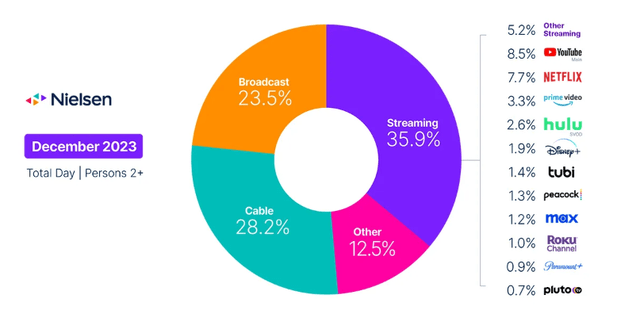

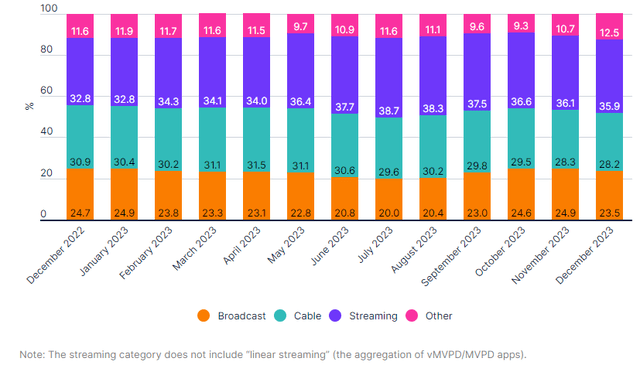

Broadband Search Watch time (Nielsen.com) Share of TV trended (Nielsen.com)

As the graphs above illustrate, trends like cord-cutting go straight into YouTube’s pockets. Every quarter, YouTube TV is set to grow its subscriber base as people switch from traditional TV, in my opinion.

Another aspect driving YouTube TV growth is its exclusive 7-year NFL Sunday Ticket, which garnered an estimated 1.3 million sign-ups on its first year. The management didn’t provide any particular numbers regarding their first year with the NFL. This is what Philipp Schindler stated in the Q4 Earnings Call Q&A:

So on the NFL Sunday Ticket side, look, as I said earlier, NFL Sunday Ticket supports our long-term strategy and really help solidify YouTube’s position as a must-have app on everyone’s TV set.

You asked about some of the learnings. Maybe I start with a viewing experience. We’ve received great feedback so far. People like the navigation, MultiView, the chat, the lack of latency, a really, really positive feedback on this one. You asked about the ads and the subs. Maybe I start with the subscribers.

We’re pleased with the NFL Sunday Ticket sign-ups and all for a season both as part of the YouTube TV bundle and as a stand-alone offering on YouTube Primetime Channels. Remember, you can access them via both. Nothing more to share on the sub side today on this one.

The NFL also attracts a lot of advertisers. Considering that Super Bowl LVIII had a record-breaking 123.7 million viewers, the ad space for YouTube in this endeavor is in very high demand and will continue to be in the foreseeable future.

So, how much can we expect to have subscribers in the following years?

Considering the current rate discussed earlier, we could see over 20 million TV subscribers before the decade is over, even more. I don’t see the pace slowing considerably, since cord-cutting is a slow erosion phenomenon. Furthermore, YouTube has ambitions globally, and we may see aggressive moves to attract international consumers. I expect YouTube to venture into more sports and different entertainment venues to keep growing its user base. As YouTube gathers more people under its streaming umbrella, it also has an uplift for advertising. Moreover, as YouTube continues to expand its ecosystem, more consumers are drawn to its other products and services.

While the management hasn’t given specific numbers on subscriptions, I think it’s a fair estimation that the segment will drive over $30B in revenues annually before the decade is over. That would be double the current $15B. My estimation may be conservative, but I think it’s prudent to be conservative in a high-interest-rate environment.

As such, if Subscriptions would have $30B in revenue by 2029 and YouTube ads reach my forecast of $70B+, these would amount to over $100B in revenue. How profitable these will be is an entirely different question. The NFL Sunday Ticket costs over $2B annually for Google, so there are significant costs to drive down profitability. It’s also unclear what kind of margins YouTube TV will enjoy in 2029.

Valuation

I will keep this relatively short and simple. I will value Alphabet as a whole based on its EPS(Earnings Per Share).

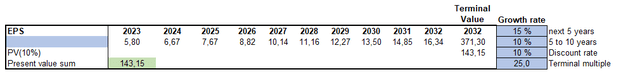

The table below illustrates my base case for Alphabet from 2023 to 2032.

As you can see, I’ve forecast a 15% EPS growth for the next five years, and 10% after five years. I’ve applied a 10% discount rate, which suffices for a company of this caliber. Terminal multiple is set at 25, which is also rather conservative. The table below shows you that the EPS growth in my model is also on the more conservative end, as the majority of years are estimated to be above 15% by analysts. My model states that the fair value of Alphabet is $143.15 per share, which is only 4% higher than the current share price of $137. So, based on these facts and my conservative assumptions, I’d say Alphabet is fairly valued. If we were to twig the model that Alphabet would also grow 15% between 5-10 years(which would still be below expectations), the intrinsic value would jump to $171 per share. That would translate into an upside of approximately 25%. Also, consider that I haven’t taken the company’s net cash position into an account. The net cash position is about 8% of Google’s market capitalization, providing an additional margin of safety.

What could make my base model flawed? On the upside, EPS could grow more if Alphabet chose to ramp up the buyback program. In addition, cost reductions similar to Meta have been called out for a while now, so that’s a potential catalyst too. Capital allocation will be one of the key figures investors should be paying attention to during fiscal year 2024. On the downside, EPS growth could stagnate if interest rates stay higher, discouraging advertisers from returning in full force. Also, higher capital expenditure could slow the earnings growth.

Risks

Competition

For YouTube, the battle for user engagement is going to persist. Meta and TikTok will give YouTube a run for their money as they battle out for every minute consumer has to spare. I don’t see YouTube losing its position in the market, but the competition will be brutal. However, there’s a possibility YouTube will miss a step and start to lose creators and advertisers. Unlikely, but possible.

Regulation

This applies to everything related to Alphabet. There have been and will be multiple antitrust lawsuits. Currently, there is an ongoing lawsuit that accuses Alphabet of being a monopoly in Search and Search advertising. The outcome of this could lead to multiple variations of changes in the business. The worst outcome would probably be that Search is to be separated from other business segments. Thus, transferring data from Search to YouTube could be in jeopardy. What would happen to Apple/Alphabet partnership as a default Search in Safari? All of these are unknowns. As daunting as these scenarios sound, I think Google would manage to survive and thrive in the end. Look at Microsoft, they had to break up in 2000, and they are doing pretty okay. In addition, targeted ads face scrutiny, so there will probably be fines in the near future, at the very least.

As the market gets more euphoric and obsessed with AI, everything related to it becomes under a huge microscope. In other words, the market turns from long-term to short-term and rational to irrational. This can lead to dislocations in price relative to fundamentals and future earnings. This irrationality is what currently makes Alphabet undervalued for the long term, in my opinion.

Conclusion

In my view, YouTube is an underrated portion of Google’s assets in the middle of this AI frenzy. I see a strong double-digit CAGR for the upcoming years as the company expands its ecosystem and has the “network effect“. This growth reinforces the company’s predictability and could result in a multiple expansion, as subscriber business makes up a bigger portion of earnings. Aside from YouTube, Google continues to push forward with its AI capabilities and its computing prowess with Google Cloud. Data is today’s currency, and Alphabet is the most data-rich company on the planet. Hence, I deem it a worthy long-term Buy even in this volatile environment, with its undemanding valuation, fortress of a balance sheet, and bright prospects across the board.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.