Summary:

- Google Network revenue has witnessed contractions for several quarters. Aside from tough macro conditions, signs of ChatGPT’s damage may be showing already.

- The generative AI revolution will inevitably give rise to new ways of reaching consumers in a timely and more relevant context than Google’s network ads.

- Google’s financial performance may face turbulence in the coming years as it iterates its services and ad-based monetization strategies while dealing with intensifying competition and changing cost structures.

- Investors should only buy Google stock if they are brave enough to withstand the forthcoming turbulence in Google’s core advertising business.

400tmax

The fast-paced generative AI (artificial intelligence) revolution has certainly forced Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) aka Google to re-imagine its ad solutions that underpin its core advertising business. A key segment, Google Network, has witnessed strong contractions in revenue growth rates for a few quarters now, which could indeed signal that ChatGPT’s impact is manifesting itself already. Beyond Google Network, the tech giant’s larger Search business is also confronted with various dilemmas, casting a cloud of uncertainty over Google’s financial performance over the next few years. Google remains a “Hold” for now.

The last earnings report revealed that Google Network revenue, which made up nearly 11% of total revenue, declined for a third consecutive quarter, falling by 8% in Q1 2023 after falling by 9% in Q4 2022. For context, “Google Network” is the segment that generates ad revenue through AdSense and AdMob, which allow publishers/ website owners to sell ad spaces on their websites, and advertisers of products/ services to make impressions on content consumers. It is basically the ads you see on the sides of webpages when you are trying to read or watch something on a Google-listed website.

On the earnings call, when asked by an analyst about the ongoing pullback in network ad revenue, the executives did not get into too many details. They quickly changed the focus to segments that did see growth:

Mark Mahaney

…you talked about kind of a more of a pullback in network ad revenue versus Search and YouTube. Do you have any thoughts on why that was the case?…

Ruth Porat

…in network, really, it’s a continuation of what we talked about last quarter. We saw the ongoing pullback in advertiser spend. And I would contrast that last quarter, we talked about both a pullback in YouTube and network, and we were pleased that we saw the stabilization in ad spend on a sequential basis in YouTube. We still saw ongoing pullback in network, which tends to be a mix of businesses, as you know well.

CFO Ruth Porat, as well as other executives, claimed that the continued decline in network ad revenue was simply a reflection of the tough macro conditions. There may indeed be some truth to that.

The continued pullback could simply be a reflection of the macro environment, whereby advertisers limit their ad budgets to be spent on ad products with better ROI potential. Search ads are especially appealing given that users intently searching for something would offer better targeted advertising potential than network ad products, which primarily serve to build impressions, while users intend to consume content.

But then again, YouTube saw stabilization on a relative basis, declining by 3% in Q1 2023, after falling high single digits in the prior quarter. This suggests that tough macro conditions may not be the only factor behind the weakness in network ad revenue.

The shift towards chat-based searches

As more and more users use chat-based services like Google’s Bard chatbot and Search Generative Experience (a Search Labs experiment which integrates generative AI more directly into search), Microsoft’s (MSFT) Bing Chat and OpenAI’s ChatGPT to find answers, there is indeed a growing concern that users are less inclined to visit websites, especially as the summarized chat responses become increasingly useful and adept at answering users’ queries.

Hence, the decline in network advertising could indeed be a reflection of people visiting websites less frequently, or advertisers’ perception that their ads are less likely to be noticed on websites amid the rise of generative AI services, making them less willing to bid for these ad spaces. Moreover, publishers stand to lose out on advertising revenue, while their content is used to formulate chat responses. This could end up becoming a longer-term problem if Google does not find adequate means of compensating publishers amid the generative AI revolution.

Google is, of course, well-aware of just how important publishers are to sustaining its advertising business. In May, Google started offering citations and more succinct responses in Bard, in an attempt to direct users towards websites to learn more about subject matters. While this is a step in the right direction, it may not necessarily resolve the problem.

Certain users are likely to prefer responses that answer their queries adequately, without needing to visit websites to learn more. Moreover, users that are too lazy to read linked web pages may simply continue asking Bard follow-up questions until they receive the information they needed.

In fact, users that prefer more comprehensively useful answers, instead of having to scroll through linked web pages, have an alternative to turn to: ChatGPT. OpenAI is not an ad-supported business, hence is less focused on directing users to other websites. ChatGPT is monetized through APIs and subscription models instead. This enables it to focus on providing as much useful information as possible in its responses, thereby sustaining the convenience of the service.

On the other hand, Bard offering citations to weblinks could also offer advantages over ChatGPT. Reliability of is an increasingly important topic of discussion amid the rise of these chat-based services. By offering citations, Bard may be able to gain preference over ChatGPT, among users/ researchers that want to evaluate the reliability of the information/ sources used.

However, not only is Bard late compared to Bing Chat in offering citations, but Microsoft also recently announced a Bing plugin option for ChatGPT. The plugin enables ChatGPT to respond with more up-to-date web data available through Bing, as opposed to only being able to respond with information preceding its training cut-off date (September 2021). The plugin will also entail citations, the way Bing chat does, helping drive traffic to Bing-indexed websites.

Nevertheless, citations do offer publishers the chance to attract traffic to their websites to a certain extent. But even if Google is successful in directing users towards websites, the amount advertisers are willing to bid for these websites’ ad spaces could diminish over time. The generative AI revolution will inevitably give rise to new ways of reaching consumers in a timely and more relevant context than Google’s network ads that are more oriented towards building impressions alongside websites’ content. Whether it is Google or another company that offers these advanced advertising solutions for the AI-era, Google’s network ad solutions may not see the same level of bidding demand as the pre-ChatGPT era.

In the bigger picture, while Google Network revenue has been growing over the past several years, its contribution to total revenue has been declining. In 2017, Google Network contributed 16% to company-wide revenue, falling to 12% in 2022. While the faster-growing Google Cloud is making up a growing portion of total revenue (9% in 2022), which will likely continue as it is a more obvious beneficiary of the AI revolution, compared to Google’s advertising business.

Nonetheless, despite Google Network’s shrinking contribution to revenue, continuous growth in Google-listed websites and subsequent content is vital to the sustainability of Google’s core business, as it inevitably interlinks with the company’s largest advertising segment: Google Search & other.

Generative AI’s impact on Google Search

“Google Search & other” revenue is generated from ads displayed on top of the Search Engine Results Page (SERP), as well as other digital properties like Google Maps and Gmail. These ads primarily target users’ commercial searches looking for goods and services. In Q1 2023, “Google Search & other” comprised nearly 58% of total revenue.

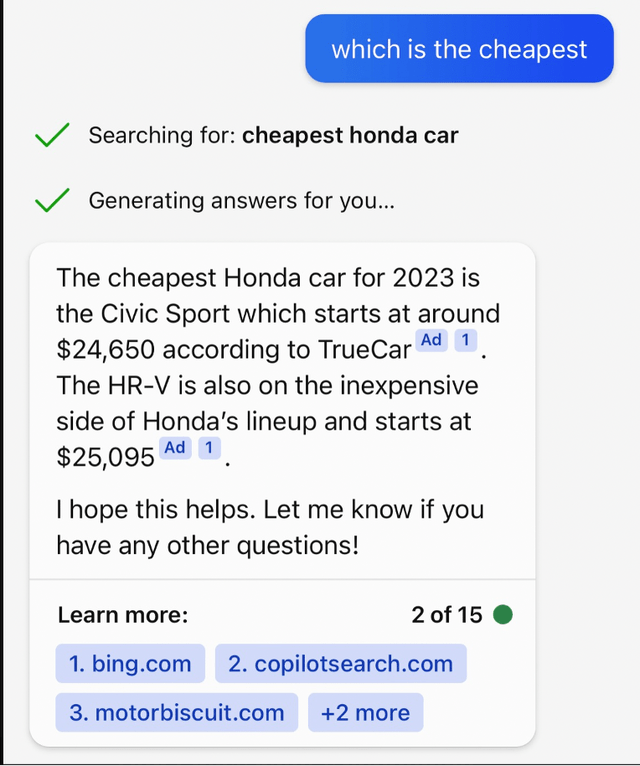

Both Google and Microsoft have already started testing ads in Search Generative Experience and Bing Chat, respectively, without giving advertisers the ability to opt out, frustratingly. While we don’t know what Google’s test ads look like yet, we did get a snapshot of Bing Chat’s conversational ad that was shared on Twitter.

Firstly, the way Microsoft is going about advertising raises more questions than answers, and manifests the concerns industry observers are having over how this shift towards chat-based search will impact advertising. The primary concern is: will the chat-based ads be shown based on the most useful product/ service available in response to the users’ query, or simply the product/ service of the highest bidder.

Secondly, the focus has been on how the tech giants will strike the right balance between providing the most relevant solutions and highest-bidding advertisers’ products/ services, in response to users’ commercial searches. However, there is another concern investors need to consider: will these new ad formats appeal to advertisers? Generative AI could indeed result in advertisers losing control over their ad placements.

Let’s be honest, the way Bing Chat has gone about advertising through the text-based format in the example above is mundane. Google and Microsoft are likely to have to go through several iterations, experimenting with the combination of text, images and video, before they find effective ad solutions that appeal to both users and advertisers.

This comes at a time when the generative AI race is in full swing, with many new competitors entering the space. This should give birth to new forms of ad solutions and inventory that investors could not have imagined yet. This raises the question, will Google and Microsoft’s search engines be the most effective channels for advertising in the future, or will these incumbents be thwarted by new, more exciting innovations?

Google has many questions to answer about the future of its ad-driven business model. On the last earnings call, an analyst asked about Google’s progress in monetizing the new, conversational-based search formats:

Justin Post

…Can you talk about revenues? I think on one hand, you will see better relevancy and maybe better results with higher conversion. But on the other hand, there might be fewer areas for ads or fewer queries because people get answers quickly – more quickly. Are you optimistic on that transition, and maybe give us your thoughts there?

Sundar Pichai

So, first of all, throughout the years, as we have gone through many, many shifts in Search, and as we evolve Search, I think we have always had a strong grounded approach in terms of how we evolve ads as well. And we do that in a way that makes sense and provide value to users. It – the fundamental drivers here are people are looking for relevant information. And in commercial categories, they find ads to be highly relevant and valuable. And so that’s what drives this virtuous cycle. And I don’t think the underpinnings of the fact that users want relevant commercial information, they want choice in what they look at, even in areas where we are summarizing and answering, etcetera, users want choice. We care about sending traffic. Advertisers want to reach users. And so all those dynamics, I think which have long served us well remain. And as I said, we will be iterating and testing as we go. And I feel comfortable we will be able to drive innovation here like we have always done.

While search has gone through many shifts, none have been as disruptive as generative AI enabling conversational search. Hence, past performance may not be a good indicator of Google’s future advertising performance. Pichai is referring to a time when Google was a leader in search innovations, bolstered by its monopolistic position. This would give Google ample time to update ad solutions amid search advancements. This is not going to be the case going forward as the generative AI revolution invites new competition into the market, with innovations moving much more rapidly.

CEO Sundar Pichai repeatedly emphasized that the new generative AI-powered services will go through various iterations and testing, as Google strives to find its ground in this revolutionary era. Google wants to deploy a gradual roll out to better examine user experience/ behavior, and determine how to best monetize the service.

While intensifying competition is already a concern as it requires speedier roll outs and monetization strategies, Google has also proven to be slow in monetizing new formats. More specifically, the rise of TikTok several years ago forced Google to introduce its own short-form video service, YouTube Shorts. Almost three years since launch, the most that executives are willing to share on earnings calls is that they are progressing nicely with monetizing YouTube Shorts, without going into much detail, while YouTube ad revenue continues to decline, albeit at a slower pace now. Keep in mind that the growth of YouTube Shorts was also aided by the adverse political sentiment towards China, inducing governments to restrain the use of TikTok. YouTube contributes less than 10% of total revenue (Q1 2023), subduing its impact on company-wide performance.

“Google Search & other,” on the other hand, constitutes almost 60% of total revenue. Therefore, sluggish progress on monetization here amid the generative AI-driven shift would be much more concerning. Intensifying competition may put pressure on Google to roll out advancements faster without effective ad solutions in place, casting a dark cloud over revenue growth trends going forward.

That being said, there are some reasons to be positive about Google’s outlook. The generative AI revolution will give rise to many new, innovative technology companies, which will be powered by cloud providers. While Google Cloud will not necessarily power all of them, it is indeed well-positioned to power the AI-revolution given its industry-leading AI cloud solutions. More and more AI-centric companies using Google Cloud will be conducive to more applications and integrations being built around Google’s cloud services, fostered by a virtuous network effect. This will offer Google insights into how smaller companies are deploying AI, and subsequently use these cloud ecosystem solutions to advance Google’s own first-party services to sustain competitiveness.

Furthermore, it is common practice for tech giants to open up accessibility to their models to other companies, allowing them to build their own technology on top of such models, integrated through APIs. Earlier this year, Google offered a Generative Language API, initially powered by LaMDA, and has since also released its PaLM model API, accompanied by its MakerSuite tool to allow third-party developers to build on top of Google’s industry-leading AI models.

While these practices indeed invite competition, the usage of Google’s APIs across the tech industry can grant Google insights into various domains, use cases, and user behaviors, enabling the tech giant to enhance its own models’ performance, as well as advance its own solutions to cater to a wider range of applications. However, it is important to note that developers are able to opt out of their usage data being collected for model improvement purposes, and also tend to be protected by certain data privacy measures. Nonetheless, insights into how their models can be deployed in different contexts should aid Google’s own innovation efforts.

All in all, Google’s financial performance is likely to witness turbulence over the next few years, not just in terms of revenue growth trends as it goes through multiple iterations of its services and ad-based monetization strategies, but also in terms of its cost structure. Traffic Acquisition Costs [TAC] are likely to differ from the pre-ChatGPT era, as it needs to fend off intensifying competition against its core Search service, as well as figure out how to adequately compensate publishers for their content amid the generative AI revolution.

Nexus Research maintains a hold rating on Google stock. Investors should only buy Google stock if they are brave enough to withstand the forthcoming turbulence in Google’s core advertising business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.