Summary:

- Google’s strategic focus on AI includes extensive distribution, horizontal adoption, model leadership, and technological infrastructure.

- Financial results in the last quarter were higher than expected due to AI efforts.

- My stock price estimation shows Google is undervalued by 18% with controlled risks.

Prykhodov

Overview

I envision that a few companies will lead the AI market, and those companies will have excellent finances because there will be just a few companies that will create a lot of value. So, investing now in those companies will provide good returns in the long term.

My thesis is that Google will be one of these players leading the AI market and the price is right, so I am recommending buying. I support this thesis based on that 1) Google has the differentiated levers to lead the AI market, 2) they are accelerating capex investment for AI, 3) even with all this transformation they are improving margins, 4) and AI is letting them improve market share in Cloud and revenue retention in search

Levers to lead the AI market

The main drivers of Google’s AI strategy are: 1) extensive distribution, 2) horizontal adoption in every product, 3) model leadership. Let’s evaluate each element of the strategy.

Google dominates in the distribution of AI functionality. Google enjoys a 90% market share in search activity, and Android runs in 70% of smartphones worldwide. That means that almost every person in the world is exposed to Google’s products. Comparing Desktop and Mobile traffic to measure the impact of Google over Microsoft (MSFT), 39% of web traffic is from desktop and 61% from mobile. Assuming this 70% Android market share, Google has 42% of web traffic in devices using its operating system. Notably, after a year of GPT launch, Microsoft hasn’t gotten much market share, just 3.6%, in the search market. It probes Google’s dominance, even lagging in AI functionality.

Google’s AI strategy is not limited to a few products, but instead focuses on expanding it to all the company’s offerings. This strategic approach aligns with Microsoft’s Copilot strategy, indicating that both companies are engaged in a fierce battle for a radical transformation in AI. This similarity underscores any differentiation between these tech giants.

AI plays a critical role for Google in the search product. This product alone generates $46 billion a quarter over total revenue of $81 billion. The initial market reaction, and mine, has cautioned a potential risk of cannibalization. My thoughts were that even if Microsoft doesn’t lead the market, it will take some part of it, and even if it is a small fraction, it is a lot of money: 15% of the market is $6 billion, which is an 8% of total $81 billion Google revenue in a quarter.

The management position on AI in search is quite audacious, and I like it. They are sure that AI will transform how people search, and Google will lead it. The main issue in this transformation is the search expansion towards more complex ones. That will mean more search activity and more revenue.

Conversely, I think it will be harder to make advertising agencies pay more for each search. One of the main issues is that Google can manage these more complex queries, directing users to websites. It is a rather complex issue because generative AI is so advanced in functionality. There is some good evidence to lower my uncertainty. Management states that links incorporated in AI-generated summaries are clicked more than on regular search results.

Chatbots are another critical product for the AI race, producing good results. 36% of Google’s Gemini users use the chatbot for shopping, compared to 23% of ChatGPT users. More functionality is coming, such as interacting with the chatbot with audio.

Google is perceived as a current AI leader. Tesla (TSLA) CEO Elon Musk funded OpenAI in part because he thought Google was too powerful in AI. Google launched its latest next-generation AI model, Gemini 1.5, in February. This model enhances performance and means a radical evolution of its models.

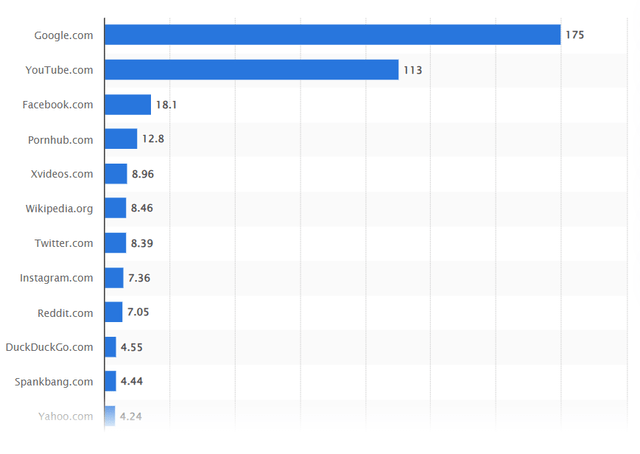

One of the critical points of the AI model is data, especially the question: “Who has more data?” I have talked about Google Search and Android reach, and this reach provides data to Google for training purposes. That is an advantage over OpenAI/Microsoft. In Figure 1, I show you its website to illustrate who can have more data. It is not a perfect benchmark, but it can give us insight.

Capex investment acceleration

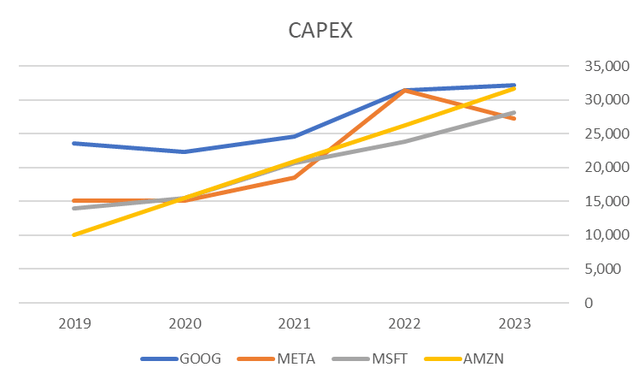

This new model, Gemini 1.5, along with a new generation of TPUs, Tensor Processing Units, has reduced machine costs by 80%, and this data introduces the last point: technological infrastructure. As shown in Figure 2, I analyze the evolution of the capital expenditure on the main AI infrastructure players. I assume the total CAPEX is for cloud technology, and have changed the CAPEX value for Amazon (AMZN) because they have a meaningful CAPEX on fulfillment and transportation of its core business. I estimate the CAPEX on Amazon as 60% of capex and with a linear curve from 2019. CAPEX is calculated as the last four quarters.

The graph concludes that Google is a clear leader in AI investment. Amazon is catching up firmly, and Microsoft is behind. Meta Platforms (META) has reduced its CAPEX, and the market has penalized the stock for perceiving it out of the fight.

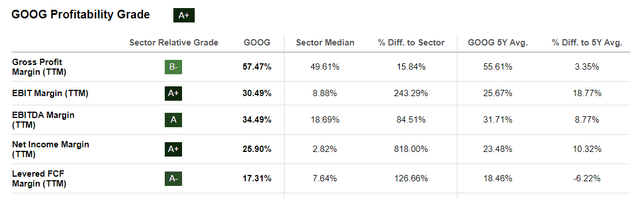

Improving margins despite big transformation

The EBITDA margin is 34.5%, up from 31.7% in the previous five years (Figure 4). This expansion is due to a reduction in headcount and slower hiring. Management states there is room for improvement in support areas like procurement or real estate optimization. I value management efforts to control and reduce costs with good results in a context of significant expansion in AI where energy costs are high. I like reorganization efforts to unify teams, like concentrating on DeepMind for all AI efforts. That brings Google more agility, lower costs, and better products.

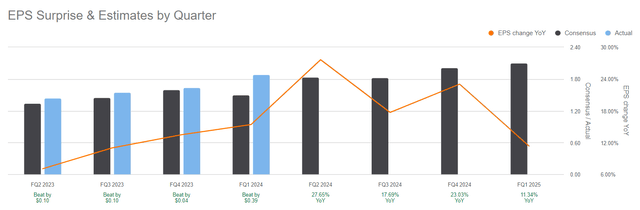

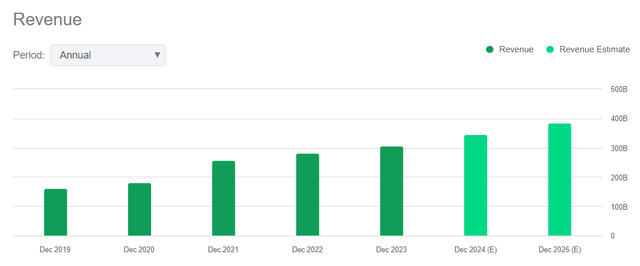

Google keeps beating estimates, and I expect them to do so in the future (Figure 5).

Improving market share and revenue retention

Consolidated revenues were $80.5 billion, up 15% in the quarter. More than the annual 8% 2023 growth rate and more than 12% growth rate are expected for 2024 and 11% for 2025 (Figure 3).

This revenue growth rate is due to higher organic and monetized searches and a solid YouTube growth rate of 20%. Short videos, or Shorts, are doing quite well, even though they cannot monetize as well as traditional videos.

AWS revenue was $25.0 billion in the latest quarter, up 17.3% year-on-year. Microsoft Cloud grew 21% to $26.7 billion (including Server unit). Google Cloud grew 28.4% to $9.6 billion. Even when Google lags against its main competitors, it is growing healthy and gaining market share.

Valuation

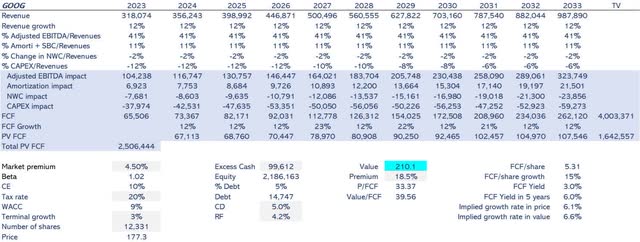

As usual, I set revenue at total revenue for the last four quarters to capture the latest quarterly results. So, my 2023 revenue is $318 billion, 12% higher than last year’s. I expect to grow at 12% during the next ten years, and later on, the growth rate is set as 3% forever. This constant 12% revenue growth assumes that all the AI efforts will be made to maintain this growth rate, which won’t be easy. As I have said, AI will increase the number of searches and new subscribers, but it won’t get a higher price premium over the services. Without AI, revenue growth rate would decline

Adjusted EBITDA has been 41% (EBITDA + SBC). I project this margin over the next ten years. That means Google can refrain from or even reduce AI costs, especially energy costs.

I expect tax savings on non-cash items to be 11% of revenues, which aligns with last year’s. Investment in net working capital will be 2%, like in 2023, conservative, as the earlier years have been much lower. I expect CAPEX to be 12% of revenue, which aligns with the earlier years. I assume Google will maintain this investment intensity in AI until 2027, and then I will reduce it to 6% in 2033.

Cash flows will be discounted at a 9% WACC because the beta is 1.02 and risk-free at 4.2%. There is a 5% debt over capital and a terminal value of 3%.

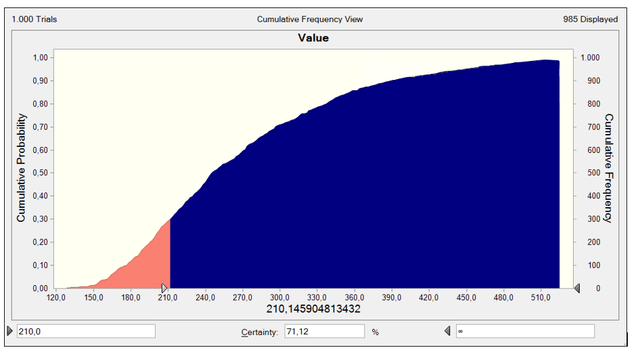

As shown in Figure 6, my value estimate is $210 per share, an 18.5% premium over its current stock price.

Risks

I see two relevant risks in Google: 1) losing market share in Search, especially from Microsoft, but it could be too from Amazon and Meta, and 2) costs in AI do not reduce as expected.

The way people search for information is going to change. Many players are building models over chats that aim to change how we search. The biggest threat for Google is that competitors create chatbots that use generative AI without external links. That will kill a big part of the $51 billion business. Those competitors can do it if they get a new financing source besides adding links; that is not easy either because they have to finance AI infrastructure, energy, and operating costs.

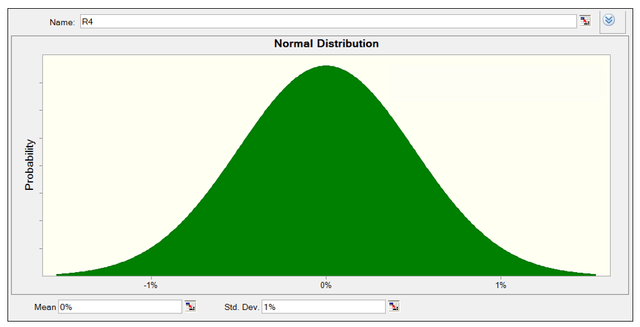

If Google loses another 10% of the market, it will lose $5 billion, 1.5% of total revenue. So, I model this uncertainty with a variable over revenue growth that is a normal distribution with a mean of 0% and a standard deviation of 1%, as shown in Figure 7.

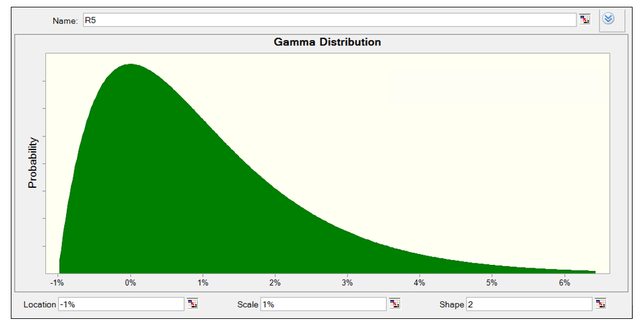

The second risk is that AI costs will not be lower than management expects. I estimate that energy costs could be 30% of cloud costs with a 30% margin over revenue of $9 billion, which could be under $2 billion. Assuming those costs are maintained, with a management expectation to lower 80%, it would impact 1% in Adjusted EBITDA. This risk is asymmetrical, as I don’t expect an upside. So, I model it with a variable over Adjusted EBITDA with a gamma distribution with location -1%, scale 1%, and shape 2, as shown in Figure 8.

Then, I run the discounted cash flow, or DCF, model, and the model’s output is the stock value. Figure 9 reflects the cumulative probability of the stock value, a sensitivity graph showing the different ranges of stock value based on each of the other growth rates, and an Adjusted EBITDA margin with the variables I have just described. With all the risks described, there is a 72% chance that long-term value is greater than the current price. It is not too high, but enough for me to consider risks under a controlled limit.

Conclusion

I analyzed Google’s strategic focus on AI and concluded that it is one of the leaders in this promising field, transforming the world. Financial results in the last quarter have been higher than expected, and my value estimation is undervalued by 18%. Analyzing risks, there is a 71% chance of getting a value better than the current price, which is controlled for me, so I recommend buying the stock.

I envision that a few companies will lead the AI market and those companies will have an excellent economics because there will be just a few companies that will create a lot of value. So, investing now in those companies will provide good returns in the long term. My thesis is that Google will be one of these players leading the AI market and the price is right, recommending buying. I support this thesis based on that 1) Google has the differentiated levers to lead the AI market, 2) they are accelerating capex investment, 3) even with all this transformation they are improving margins, 4) and they are improving market share and revenue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.