Summary:

- Like other tech giants, Alphabet was battered in 2022 and has been quiet about cost-cutting plans.

- However, the board just finalized an enormous pay package for CEO Sundar Pichai that appears to better aligns his interests with shareholders.

- Alphabet currently trades at a historic price-to-EBITDA disconnect.

JHVEPhoto

A Changing Landscape

Across the tech world, cost-cutting and headcount rationalization (corporate speak for large-scale layoffs) is suddenly in fashion. Facebook (META) has announced it will lay off 11,000 employees, and Amazon (AMZN) is cutting headcount by 18,000. Alphabet (GOOG) (NASDAQ:GOOGL), meanwhile, has so far been quiet on the layoff front, with the exception of a layoff of 15% of its staff in its Verily Life Sciences unit (about 200 employees).

In the heyday years of the 2010s, tales of workplace perks among tech giants were legendary. From nap rooms to free, full-service cafeterias and coffee bars, the workplace amenities of silicon valley were the subject of much envy. However, with rising interest rates, inflation, and squeezed margins, even tech companies are finding that they may have overspent on headcount, and that some of these perks are no longer defensible.

Some observers have wondered why Alphabet has been so quiet in recent months about any plans to reduce headcount and cut costs, especially since the stock fared so poorly in 2022, falling more than 30% even after a 20-for-1 stock split. Granted the company announced it would slow hiring in its Q3 call, but when everyone else in your cohort is reducing headcount and you’re not, it raises questions.

Employee expenses are by far Alphabet’s largest expense, after all. Headcount at Alphabet increased from 150,028 in Q3 2021 to 186,779 in 2022. This is a 24% increase year-over-year—hardly a snail’s pace. It only stands to reason that in the vast corporate landscape that is Alphabet, there would be some fat to trim somewhere. So, the question has gone, why hasn’t Alphabet been more proactive?

The Three Year Reset

We speculate – and it is true speculation – that Alphabet’s reluctance throughout the latter half of 2022 to announce meaningful cost-cutting initiatives at the company even as competitors were doing so might have something to do with the fact that Alphabet’s CEO, Sundar Pichai, was due for a re-evaluation of his triennial compensation package. Since CEO pay package negotiations can take months, it’s not perhaps surprising that the company wouldn’t undertake large changes while the leader of the organization is unclear as to how they will be compensated for such actions. The announcement of the new package was quietly dropped in an 8k filing on December 21st.

Pichai’s new comp package is enormous, but is also, on the face of it, good news for investors. The board explicitly states in the December 21st 8K that two design changes were made “such that more of the award’s vesting [is] dependent on performance.”

The first part of Pichai’s pay package are two tranches of Performance Stock Units (PSUs), each worth a target value of $63,000,000 in Alphabet Class C stock and have a potential payout range from 0%-200% of their target value. A nice feature of this is that Pichai will have to act quickly if he wants to secure this bundle of cash—unlike some executive pay packages with four or five year time horizons, Pichai’s first tranche of $63,000,000 vests based on a total shareholder return measured from 2023-2024, and uses the average weighted price of the Class C stock from November 2022 as its baseline.

The second tranche—in the same amount as the first—will be evaluated over a performance period between 2023-2025.

Importantly, the board increased the proportion of performance stock units from 43% of the overall package to 60%. The board also raised the performance requirement for PSUs to the 55th percentile of total shareholder return from the 50th, which means that Pichai’s hurdle for execution is higher. In the world of corporate pay packages—and silicon valley tech pay packages in particular—this feels like a significant shift, and perhaps a tacit admission from the board that they feel that not only is the stock being undervalued by the market, but that there are proverbial belts to tighten around the company.

In all, Pichai’s comp package totals out to an approximate maximum payout of stock-performance tied payout of $252,000,000 over the next three years. While the exact details of how the award calculations will be made—such as how much the stock needs to rise above its November 2022 average price—are yet to be published in the upcoming Alphabet 10k, we nonetheless have a nice window into what kind of incentives Sundar Pichai has to improve operations at Alphabet in the eyes of shareholders. And, if we could paraphrase Charlie Munger, understanding how executives are incentivized is a powerful tool indeed.

What Do We Think Will Happen?

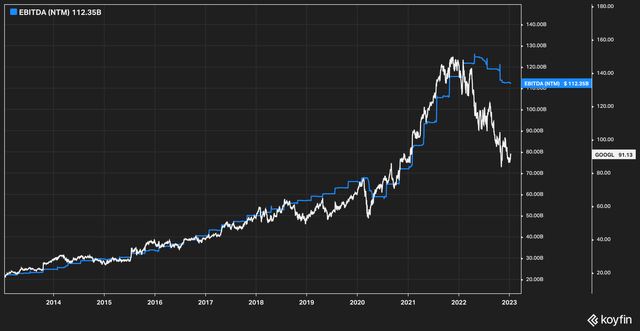

For one, we think the playing field is tilted in Pichai’s favor given that Alphabet’s valuation is, like so many tech firms, plumbing depths not seen for many years. A metric we favor for valuing a firm against its historical average is its stock price vs. next twelve month (NTM) EBITDA estimates. Alphabet has, for many years, tracked its EBITDA estimates very, very closely. 2022 brought a change to all that, and a gulf now exists between the two that has not existed in the past ten years.

GOOGL Price vs NTM EBITDA (Koyfin)

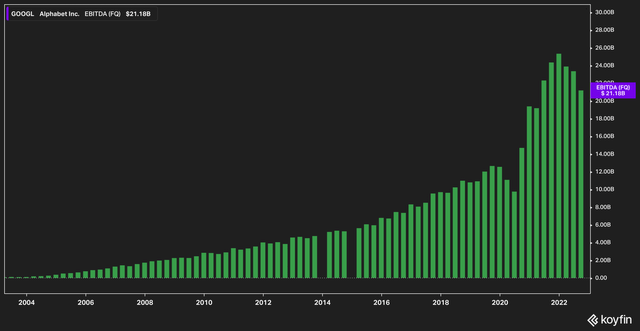

This is, we believe, most certainly an overreaction on the market’s part. Just a quick glance at Alphabet’s quarterly EBITDA reports going back 20 years shows a company that has been able to expand and maintain margin at a maniacal pace.

GOOGL 20-year Quarterly EBITDA (Koyfin)

The sudden disconnect between price and valuation is, to us, a bit of a head scratcher. To be sure, FX headwinds and a deteriorating macro picture have hurt Alphabet a bit as marketers reduce their ad spend—this can be seen in the recent slump in the chart above of Alphabet’s quarterly EBITDA. But we remind readers that the core business of Alphabet hasn’t changed and that the use of Google remains a staple of most people’s lives.

Nonetheless, it provides Alphabet’s CEO with a rare opportunity. He has just been awarded an enormous compensation package tied to the price of his company’s stock, and his performance will be judged based on Alphabet’s average stock price from November 2022 – one of the most value and price-depressed times in the company’s history. Given that he can earn up to 200% of his awards should the stock perform well enough (again, we’ll have to wait for the Alphabet 10k to determine just how well), we can say that he is certainly well-incentivized.

So, what will he do? Of course we can endlessly speculate, but in our mind the most likely course of action is to reduce headcount and other costs where possible and to continue to buy back shares at this reduced valuation. Other deployments of capital—increases in R&D, paying down debt—won’t be seen by the street as immediately impactful, especially given Alphabet’s stalwart balance sheet and exceptional leverage ratios.

The Bottom Line

Alphabet presents a very interesting scenario for investors right now. To recap, Alphabet:

- Is a company with a monopolistic enterprise in Google and another near-monopolistic property in YouTube.

- Has a large historical price-value disconnect.

- Has a CEO who has recently been awarded an enormous compensation package tied to the positive performance of its stock.

- Has plenty of cash on hand to deploy for shareholder-friendly activities like additional stock buybacks.

- Has plenty of places in its business to cut costs and further improve margins.

With what we know at this time, this seems to be a recipe for success over the next 12-24 months. Risks to this idea are that when the company publishes its 10k, the actual performance metrics tied to Pichai’s performance are quite weak. Another risk is that leadership may elect to eschew Wall Street’s preference for shorter-term thinking and plough money that could be used for things like stock buybacks into more of its moonshot-type ideas.

At the end of the day, though, we think investors would do well to give Alphabet a closer look and to keep a close watch over the next few months.

Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.