Summary:

- Alphabet Inc.’s Q2 earnings surpassed analysts’ expectations, driven by robust revenue and earnings performance, particularly from Google Search and Google Cloud.

- The earnings call was dominated by AI. However, the stock is still trading at a reasonable price compared to other AI names.

- Despite a complex macroeconomic environment, Google’s resilience and ability to deliver exceptional results make it an attractive option for investors, seeking exposure to AI, tech stocks and NASDAQ.

Seftian Anderson/iStock Editorial via Getty Images

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) remains an intriguing stock in the current market, and its recent second-quarter earnings announcement has only heightened interest among investors. This article is a follow-up from my initial coverage of one year ago Google Is A Buy Despite Disappointing Quarterly Results. The company delivered surprising results by passing analysts’ expectations, showing robust revenue and earnings performance, driving a surge in Alphabet’s stock price during after-hours trading. While I write, GOOG shares are priced at an impressive $130, showing positive market sentiment.

Second Quarter Highlights

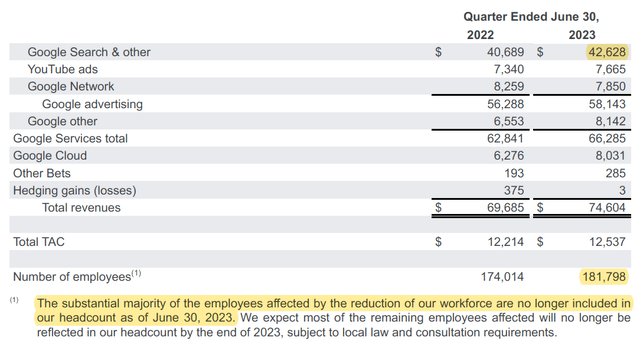

The outstanding Q2 results were primarily driven by two key segments of Alphabet’s business: Google Search and Google Cloud. Both of these divisions demonstrated remarkable growth. While Google Search remains the larger revenue generator, Google Cloud showed impressive growth when considering percentages. Additionally, YouTube ads experienced a healthy increase of approximately 4% in revenue.

One notable factor contributing to the positive earnings surprise was the successful implementation of the headcount reduction initiative. This strategic move reduced costs, enhancing overall efficiency within the company. The total headcount is anyway higher than one year ago.

However, it is essential to dig deeper into the numbers and thoroughly investigate the crime scene (aka financial statements) for any hidden clues. Google’s strategic decision to extend the useful lives of servers from four to six years, and network equipment from five to six years, had a significant impact. This change led to additional revenue being channeled directly to the bottom line, contributing an extra 6 cents per share. It is important to note that this boost in earnings is a result of accounting practices rather than actual operational performance.

Even after adjusting for the $0.06 increase, Google’s EPS still stood at an impressive $1.38, reflecting a remarkable 14% year-on-year growth for the quarter. This result shows Google’s resilience and its ability to thrive even in the current complex macroeconomic environment.

Forward Estimates And Comparison With The S&P 500

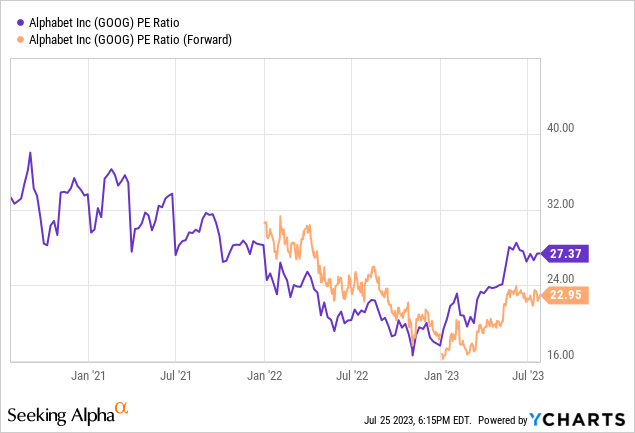

Looking ahead, considering the $130/share Alphabet’s stock price during after-hours trading, GOOG is trading at a forward PE ratio of approximately 22.4x. This places the company in a valuation range considered neither cheap nor expensive, signaling that investors are willing to pay a small premium for a stake in GOOG, if we compare it to the market multiple.

Taking a longer-term view into 2024, the stock is trading at a 19.3x PE (2024) multiple. This projection is based on an expected earnings growth rate of 18%.

We see that GOOG looks slightly expensive, compared to its historical P/E multiple.

Anyway, to gain a broader perspective, it is essential to compare GOOG multiples and growth with that of the S&P 500 (SP500). The first difference is in the current situation of the index compared to GOOG stock. While GOOG achieved an impressive 19% growth in earnings in the current quarter, the S&P 500 index is expected to face a negative earnings growth (-7.9% expected for Q2). This strong difference underlines Alphabet’s robust business model and ability to thrive, even in times of uncertainty.

On a longer-term horizon, the valuations between GOOG and the S&P 500 remain comparable, with Google’s forward PE ratio at 19.3x, slightly higher than the S&P 500’s 18.5x for 2024. However, Google’s expected earnings growth of 18% for 2024 surpasses the projected 12.5% growth for the broader index, indicating the company’s strong potential to outpace the market. That makes GOOG an interesting stock to gain exposure to NASDAQ and tech sector in the current market.

Q2 Earnings Call

As everyone could expect, the call was all about AI. What puzzles me is that the same company management explained how many of the AI processes have been part of their instruments supporting ad campaigns for quite some time. Speaking of AI, in previous conference calls, AI wasn’t frequently mentioned despite Alphabet’s investments in the field. Even the CEO, Sundar Pichai, has previously described AI as being in its “early innings, only nine months ago. The current focus on AI might be just excessive.

An interesting question addressed Google’s ability to grow amidst a competitive macroeconomic environment. Unlike many suffering companies in the ads business, Google’s approach focuses on helping its partners achieve maximum efficiency and profitability. Alphabet’s instruments can support customers to achieve optimal results in terms of ads spending.

Conclusions

Google’s Q2 earnings have clearly demonstrated the company’s resilience and ability to deliver exceptional results, even in a complex macro environment. Despite the notable increase in its stock price, Google’s valuation remains reasonable, presenting a compelling opportunity for investors seeking exposure to the tech sector and the NASDAQ.

While Google may not appear undervalued, it might be a good opportunity to get delta exposure to the market, while S&P 500 appears overall overvalued, with some high flyers name that increase the index multiple.

In conclusion, Google’s good Q2 performance and strong market prospects make it an attractive option for those seeking to gain exposure to the technology sector. Therefore, I confirm my buy rating as I see GOOG more attractive than the overall S&P 500.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information in the article is provided for informational purposes only. It should not be construed as investment advice or advice on buying, selling, or other types of transactions relating to an investment in products or services, much less an invitation, an offer or a solicitation to invest. The information in the article is provided solely by virtue of the fact that everyone will independently make their own investment decisions: the report does not take into account investment objectives, nor specific needs or financial situation. In addition, nothing in the article represents or is intended to express financial, legal, accounting or tax advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.