Summary:

- Google’s AI-powered Search is accelerating growth, with total Q2 revenues increasing by 7% and Search growth rebounding to 5%.

- Competitors’ generative AI chat platforms, such as Microsoft’s Bing with ChatGPT, have had limited impact on Google’s revenue growth.

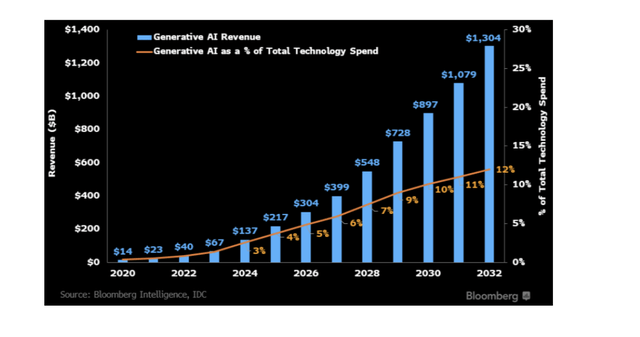

- Google is well-positioned to benefit from the growing generative AI market, estimated to reach $1.3 trillion by 2032.

- The stock remains cheap at 15x EV/EPS targets for 2024.

Supatman

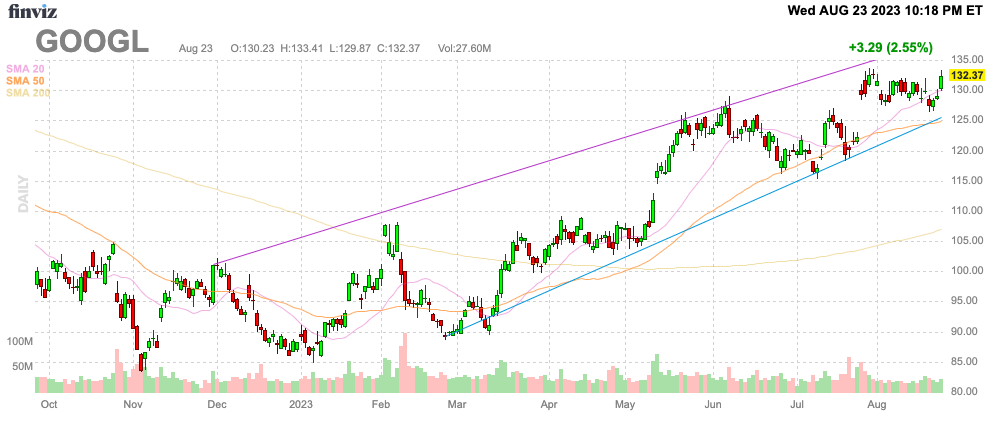

Going on a year since the generative AI chat phenomenon started and Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka Google, hasn’t seen any real impact. Most thought Microsoft (MSFT), via an investment in ChatGPT developer OpenAI, was going to sink Google, but the business is in AI growth mode now. My investment thesis remains ultra Bullish on the stock even after the rally since March.

Source: Finviz

AI-Powered Search

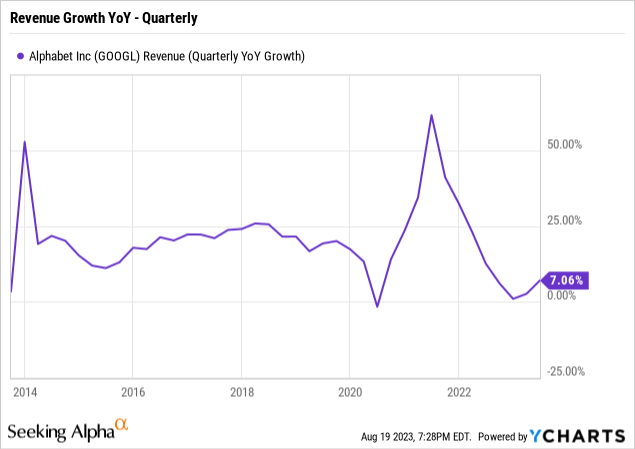

At the end of July, Google reported Q2’23 results that reinforced AI as set to power Search, not replace it. The search giant reported revenues grew 7% led by a sharp rebound in Search growth to 5%.

The Microsoft Co-pilot program is only getting off the ground, but the tech giant launched Bing with ChatGPT back in February. Google reported Q2 revenues continued to rebound with sequential growth gains despite this launch by Bing.

Revenues only grew 1% back in the December quarter and had already rebounded to 3% growth in the March quarter. Google actually reported Q2 constant currency growth accelerated to 9% showing generative AI chat from competitors is having no impact on revenue growth.

According to StatCounter, Google search market share remains above 92%. In fact, search market shares are above the year ago levels, possibly an indication some users shifted to ChatGPT and have returned to Google search.

The company is emphasizing the launch of an upcoming Search Generative Experience (SGE) to further advance the search experience. Google will clearly be a leader in the growing generative AI market opportunity with the search product currently in the test phase.

Bloomberg estimates a generative AI market reaching $1.3 trillion by 2032. Besides the opportunity in cloud with Google Cloud, Google will benefit greatly from the $89 billion market for generative AI assistant software and an estimated $192 billion spent on AI driven ad spending.

The tech giant will play a focal point in the generative AI growth via search or even personalized assistants along with cloud infrastructure spending. Per the Q2’23 earnings call, Google Cloud is highly focused on AI unicorns leading to the potential to outgrow the industry in the years ahead after 28% growth in Q2 as follows:

Our AI-optimized infrastructure is a leading platform for training and serving generative AI models. More than 70% of gen AI unicorns are Google Cloud customers, including Cohere, Jasper, Typeface and many more. We provide the widest choice of AI supercomputer options with Google TPUs and advanced NVIDIA GPUs, and recently launched new A3 AI supercomputers powered by NVIDIA’s H100. This enables customers like AppLovin to achieve nearly 2 times better price performance than industry alternatives.

In addition, Google is set to benefit from the quickly growing opportunity for robotaxis having further expanded services in San Francisco to unlimited vehicles. California regulators approved Waymo to operate at up to 65 mph while Cruise (GM) was restricted to only traveling at 35 mph and AI will play a pivotal role in the expansion of robotaxi services.

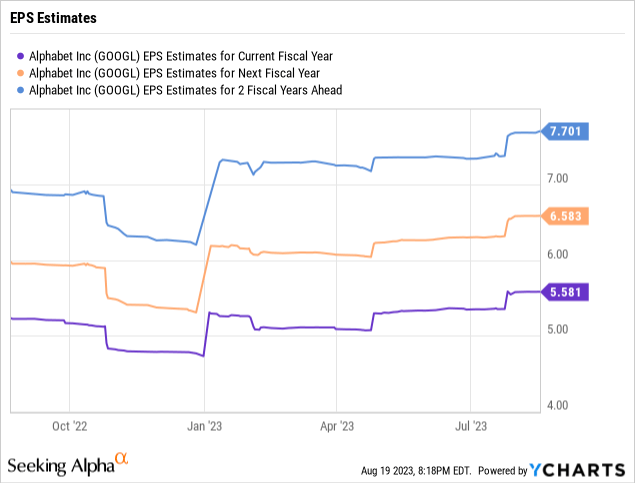

Accelerating Earnings

While Google did discuss some increasing infrastructure costs to support AI services, the accelerating revenue growth is leading to analysts boosting EPS targets. The consensus GAAP EPS estimates are now $6.58 for 2024 while the stock trades at only $132.

While Google was promoting a goal for 20% efficiency gains, operating expenses were actually up 4% in Q2. The employee count even grew nearly 7,800 employees over last Q2 to reach 182K.

Investors probably better just hope Google continues to expand revenue growth, as cost controls don’t appear a part of the culture. The company even grew stock-based compensation expenses to $5.8 billion in the quarter, up by $1.0 billion from last Q2.

The company has spent $11.1 billion on SBC during the 1H of the year. At an annualized rate, Google will spend over $22.2 billion on SBC and a prime reason investors focus on the free cash flow. For the June quarter, Google generated $21.8 billion in FCF alone, while the company still spent $6.9 billion investing in capex.

As highlighted in previous research, the SBC charges impact EPS by ~$1.50 per share. The non-GAAP EPS for 2024 would reach $8+ and 2025 jumps to $9+ based on adding back to the SBC charges to the consensus estimates.

The enterprise value is only $1.5 trillion due to over $100 billion in net cash. The stock trades at only 15x EV/EPS targets for 2024.

Takeaway

The key investor takeaway is that the massive AI-powered Search growth opportunities lead to a great growth opportunity for Google. The stock is cheap based on this growth opportunity and relative to other tech giants recently trading as much as 30x forward EPS targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.