Summary:

- Google reported strong growth driven by AI, boosting Search advertising and Cloud revenue.

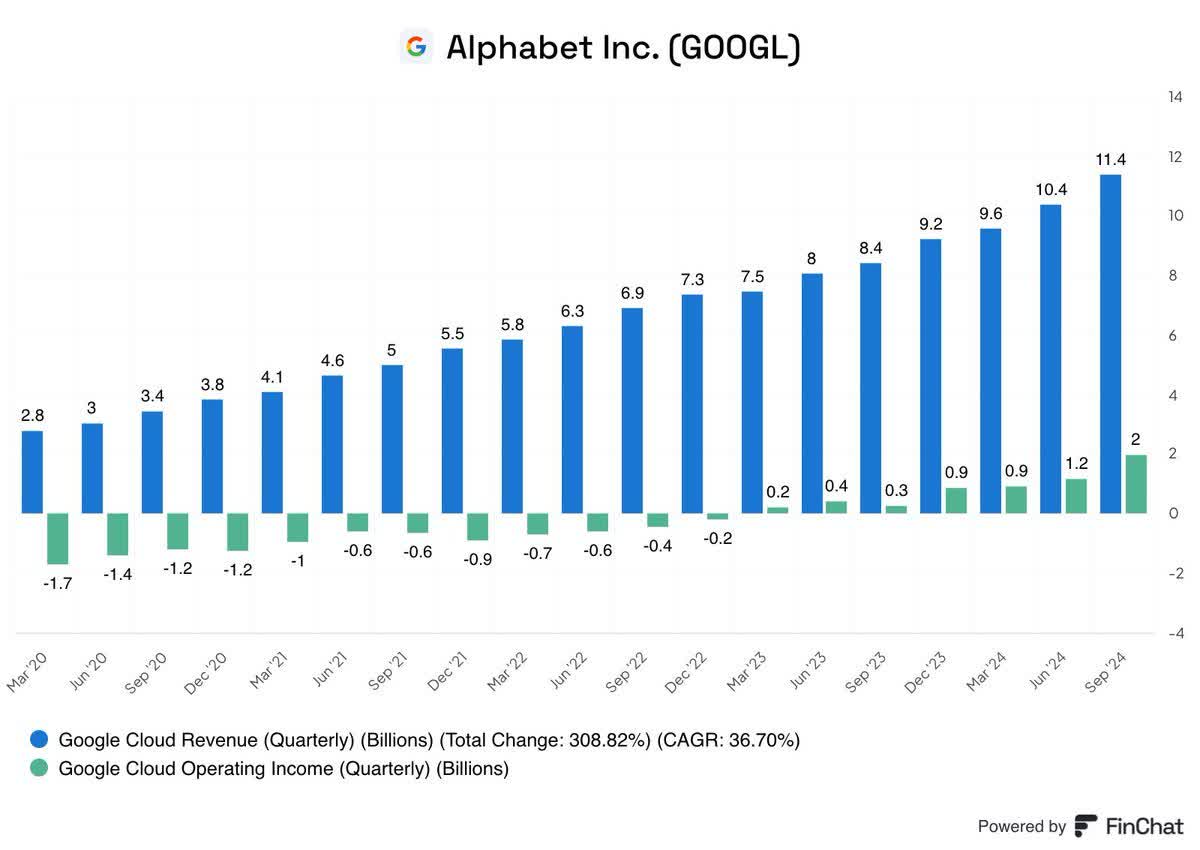

- The company smashed analyst estimates by $2.1 billion, with Cloud revenue growing 35% YoY, reaching an $11 billion quarterly run rate.

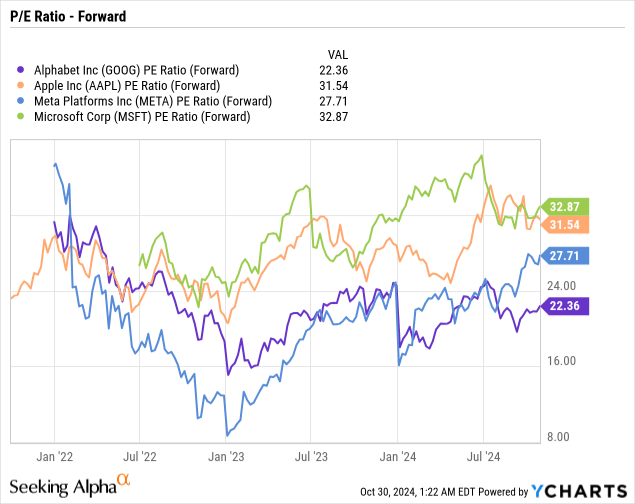

- Despite one-time charges, Google beat EPS targets, trading at 22x forward earnings, cheaper than Apple, Microsoft, and Meta.

- The stock only trades at 17x adjusted EPS targets, making Google easily the cheapest stock in the mega tech sector.

da-kuk

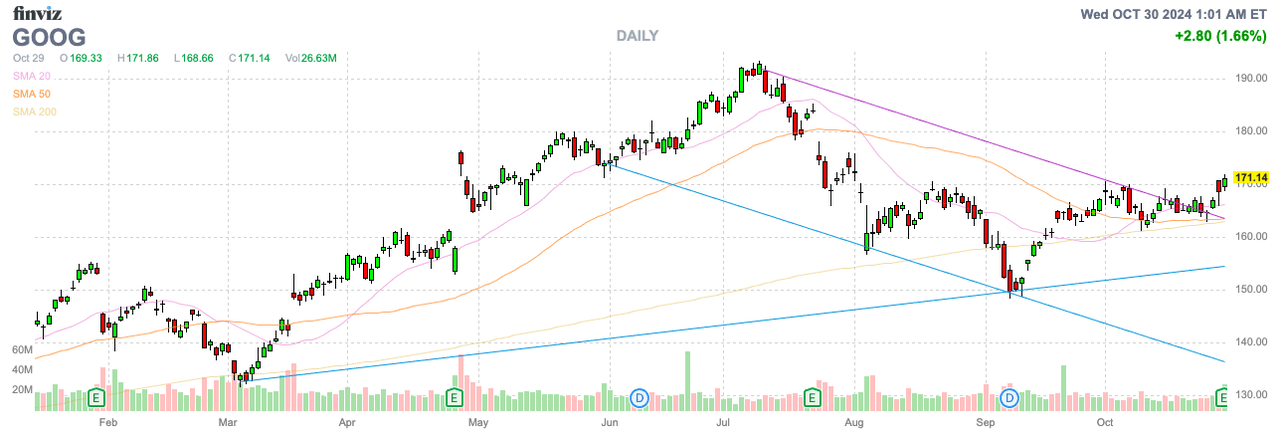

Alphabet Inc. (NASDAQ:GOOG), (NASDAQ:GOOGL), aka Google, just reported a strong quarter as AI led the way pushing search advertising and cloud revenue higher. The tech giant has traded at a discount in the last year, providing the opportunity for AI to contribute to growth, not destroying the search business as feared. My investment thesis remains ultra-bullish on the stock of an AI leader trading at a discount to other mega tech stocks.

Big AI Quarter

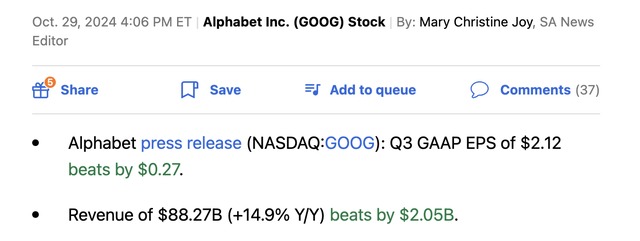

Google smashed analyst estimates by $2.1 billion to return to nearly 15% growth in Q3’24 as follows:

The market was concerned about growth slipping to below 14% in the prior quarter with fears AI would eat into growth, leading consensus estimates to target Google only reaching 12% growth in Q3. The AI Overview portion of Search is leading to higher growth from more usage tied to AI vs. the fears of users going directly to ChatGPT for AI questions and bypassing Google.

The tech giant saw strong growth in Search, reaching 12%, but the really strong growth came in Cloud at 35%.

Source: Google Q3’24 earnings release

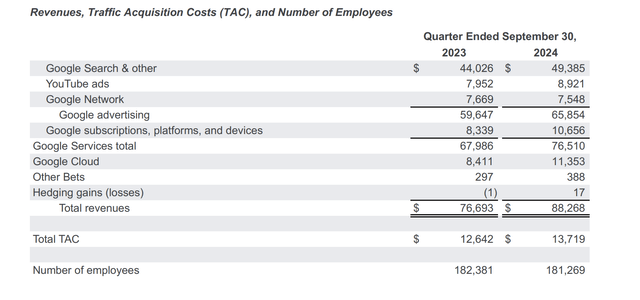

Cloud gained nearly $3 billion in revenues YoY to top $11 billion. The business is now running at a $45 billion annual run rate and the growth is boosted by AI demand with the segment seeing growth slip back in 2022.

Source: FinChat

The Cloud business has become very profitable as well with a 17% operating margin, partly due to lower depreciation charges. Overall, Google has cut employees while adding revenues. The company grew revenues by more than $11 billion year-over-year in the process of cutting employees to improve efficiency.

Confusing EPS Picture

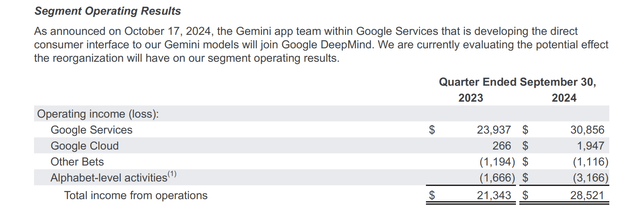

The whole earnings picture remains convoluted due to Google including one-time charges in the Q3 results plus the normal problems with Other income included in the EPS numbers. Also, Alphabet has now included a separate category for operating results called Alphabet-level activities with $3.2 billion in costs for the quarter.

Source: Google Q3’24 earnings release

In a way, this is the Reality Labs type spending account from Meta Platforms, Inc. (META), but the amount also includes company-level costs, including the $607 million incurred for office space charges. These total costs jumped $1.5 billion YoY and were mostly related to AI model building costs (or at least it appears that way).

The company would be highly served to eliminate non-cash and one-time charges from the EPS number as follows:

- $607 million in office space charges.

- $1.8 billion in net gain on equity securities.

- $5.8 billion in stock-based compensation charges.

In total, Google faced $6.4 billion in charges included in the financials and $1.8 billion in net benefits from equity gains for a $4.6 billion hit. The company beat EPS targets of $1.85 by $0.27, partially due to the $1.8 equity gains not easily modeled into EPS targets by analysts while the charges are generally modeled into analyst targets.

Based on after-hours trading at $180, Google only trades at 22x forward earnings. The stock is the cheapest in the tech sector with both Apple Inc. (AAPL) and Microsoft Corporation (MSFT) trading at over 31x forward EPS estimates and even Meta trading at nearly 28x forward earnings.

The odd part is that Apple appears far behind in AI with iPhones just obtaining Apple Intelligence this week with the release of iOS 18.1. Google is already generating revenue boosts from AI while Apple is just now entering the game by using external AI models.

As discussed in past research, stock-based compensation included in GAAP EPS targets actually makes the stock appear more expensive. Google is forecast to earn $8.70 per share in 2025 and the stock would see a nearly $2 boost from SBC charges approaching a $25 billion rate.

Google only trades at 17x 2025 adjusted EPS targets of $10.70. The stock is exceptionally cheap with revenues back to growing at a 15% clip and signs AI will boost Search growth, not detract.

The company even has $80 million in net cash with nearly $18 billion in free cash flow produced in the quarter. The stock would have an even cheaper enterprise valuation, but Google’s valuation limits the boost from cash.

Takeaway

The key investor takeaway is that Google remains relatively cheap trading at $181 with a $2 trillion market cap. The tech giant is starting to see tangible benefits from heavy AI spending due to increases in Search ads and Cloud revenues.

Investors should use the current price to continue loading up on Google with the stock being the cheapest in the mega tech space. The stock continues to face the ultimate fears of superior AI features stealing market share from Search, but the company has successfully navigated this worst-case scenario.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.