Summary:

- Google is making significant moves in the AI industry, with its generative AI chatbot, Google Bard, and a $300M investment in AI company Anthropic.

- Google’s investment in AI start-up Anthropic is a direct attack on OpenAI’s ChatGPT. Broad-based roll-out of AI assistants on Google Cloud could result in a boost to the segment’s growth.

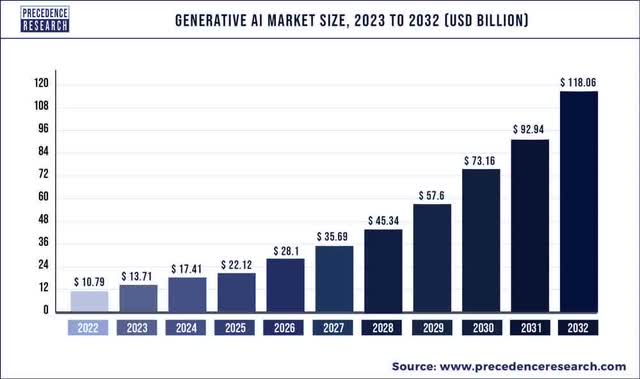

- The market size for generative AI solutions is expected to rise from $10 billion in 2022 to over $118 billion within the next decade, presenting a massive growth opportunity for Google.

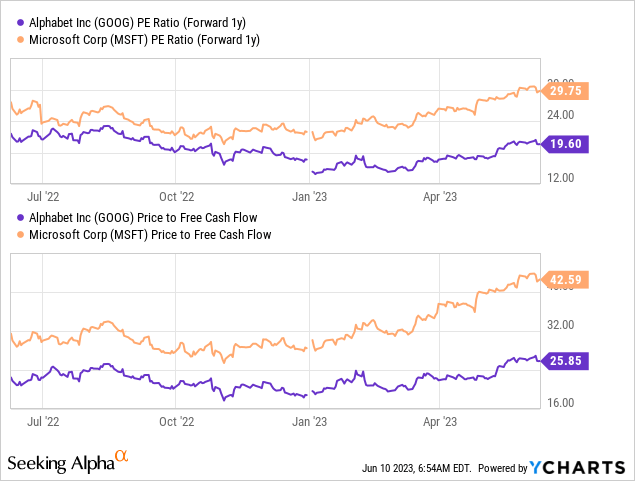

- Google’s potential in the AI market is undervalued relative to Microsoft’s as its shares are valued at a P/E of only 20X compared to Microsoft’s 30X P/E.

400tmax

The ascent of artificial intelligence has captured the imagination of investors after the AI chatbot ChatGPT exploded into the public domain. While Microsoft (MSFT) scored a homerun with its investment in OpenAI, the creator of ChatGPT, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is perceived as having fallen behind Microsoft in the AI race. However, Google is also making smart moves in the artificial intelligence space that I believe will leverage the company’s core strength of its dominant advertising business. Google recently announced that it was integrating AI capabilities into its Search results, which could result in massive growth as well as share price appreciation for investors. In my opinion, Google’s AI potential is discounted relative to Microsoft’s!

Massive AI potential, Google integrates AI technology into its Search business

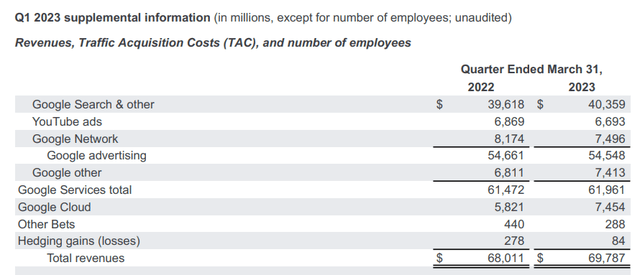

Google is still chiefly viewed as an internet advertising giant, and there are some very good numbers to support this claim. Google generated $69.8B in revenues in the first quarter… of which 78% came from its core advertising business. This advertising business chiefly relies on Google’s ability to place relevant products and services next to Google’s Search results and on YouTube. While the fastest-growing business within Google is currently Cloud, I believe Google could see a re-acceleration of its growth in its core advertising business due to the integration of artificial intelligence applications.

Going forward, artificial intelligence will make it even easier for people to find products and services, which gives Google a huge opportunity to boost its advertising business and leverage its key competitive advantage over Microsoft: its scale. The advertiser market suffered a broad-based advertiser downturn in FY 2022, but there are signs of stabilization.

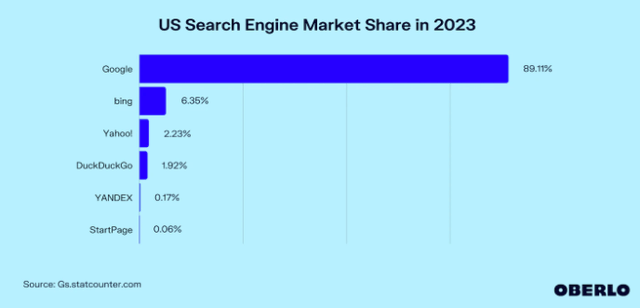

The key advantage for Google is that the company has a considerable lead over Microsoft in terms of its Search engine market share. Google is by far the most dominant search engine with a market share of 89% while Microsoft is a distant second with a market share of only 6%.

Clearly, Microsoft recognizes the potential of ChatGPT for its Search business, which is why the company invested $10B into ChatGPT-creator OpenAI earlier this year. Microsoft also recently said that it is integrating its Bing Search engine with ChatGPT in a bid to capture market share in Search. Additionally, Microsoft is including ChatGPT capabilities into its Microsoft 365 apps and has said that its AI assistant will be available on Windows 11.

Google is following suit and integrating generative AI into its Search results, which could lead to a more immersive search and shopping experience for users and higher conversions for advertisers on Google’s platforms. Google’s opportunity for AI goes way beyond just integration into its Search business, however, and AI-supported applications will likely be used in Google’s Cloud platform as well as in its suite of productivity tools such as Google Docs. Considering that Google still dominates the Search market, the market may have turned too bearish on Google’s place in the AI race.

Google Cloud generative AI upside

Google also recently announced a partnership with Twilio that is meant to enhance Twilio’s customer engagement. Furthermore, Google partnered with cloud database company DataStax in order to improve customer service. By offering generative AI assistants to its corporate clients, Google’s Cloud segment could see a re-acceleration of its growth… which in recent quarters has slowed due to corporations optimizing their IT spending. With these partnerships, Google is opening up new sources of growth for its Cloud business – especially in the customer service market – which is currently the third-largest public cloud infrastructure service provider based on market share, after Amazon’s (AMZN) AWS and Microsoft’s Azure.

The total addressable market for generative AI solutions is set to explode over the next decade

According to Precedence Research, the market size for generative AI solutions is set to rise from $10.8B in 2022 to $118.1B by 2032. The generative AI market is expected to grow by a factor of 11X over the next decade, which translates calculates to an annual average growth rate of 27%.

Obviously, Google has a huge opportunity to step into this market with its own AI products, including its AI chatbot Bard which was released in March, after ChatGPT took the market by storm. While Google did not have a home run investment like Microsoft had with OpenAI, the company recently invested $300M into artificial intelligence company Anthropic which is developing a ChatGPT rival, named Claude, and which focuses not only on AI research but also on the safety aspect of AI deployment.

One use-case for Anthropic’s AI assistant is the potential integration into Google’s Cloud business, which could help the technology company make inroads into the customer service market. Anthropic’s generative AI assistant is already being tested in the work chat app Slack, which is owned by the customer relationship management company Salesforce (CRM).

Since the use of AI is currently unregulated, Google could be a driving force in ensuring that a comprehensive AI regulatory framework is developed that focuses chiefly on the responsible use of artificial intelligence applications.

Google’s CEO Sundar Pichai has recently warned of the dangers of AI and a core focus on artificial intelligence safety could be a distinguishing feature for Google going forward, and help the company differentiate itself from the competition.

Google’s AI potential is massively undervalued relative to Microsoft’s

Two of Google’s key strengths are that its Search platform still continues to dominate the market and that the advertising business generates a ton of free cash flow. Google’s digital advertising business generates the majority of the company’s revenues and provides Google with leverage to apply AI integrations across its businesses. Given that Google is by far the most dominant Search engine, I believe the valuation gap between Microsoft and Google works in favor of the latter.

Google is currently valued at a P/E of 19.6X and at a P/FCF of 25.9X… which makes Google a significantly better deal than Microsoft. There is also no evidence that Microsoft is growing faster than Google in the near future. Based off of consensus estimates, Google is expected to see 17-18% annual EPS growth until FY 2025 while Microsoft is expected to grow EPS at 4-14% annual rates (Source) over the same time.

Risks with Google

Google is still heavily reliant on the digital advertising market as it generates 78% of its revenues from its core advertising services. While a slump in the digital advertising market is a risk factor for Google, a much bigger risk is if the company missed the boat on the artificial intelligence revolution, which is promising unprecedented productivity gains for corporations. Another risk factor is that AI proves to be so powerful that humans won’t be able to handle it, thereby limiting the potential for AI applications. Palantir’s (PLTR) CEO Alexander Karp has recently hinted at such a possibility. What would change my mind about Google is if the company started to lose market share to Microsoft’s Bing Search engine due to ChatGPT and if the use of AI assistants failed to boost Google’s Cloud growth.

Final thoughts

Microsoft’s initial investment into OpenAI has been a winner as the company upped its original investment to $10B and managed to make Bing ChatGPT’s default Search engine. Google, however, has two advantages over Microsoft: (1) Google’s Search engine remains the dominant way for users to get information and (2) Google’s enormous free cash flow allows the company to aggressively scale its AI tools and invest in (or acquire) AI-focused start-ups like Anthropic. As a result, Google has a huge upside in its core advertising business as AI-supported applications could further enhance the accuracy of Search results and the inclusion of generative AI products could improve the online shopping experience (and conversions). Considering that Google’s shares are much more attractively valued than Microsoft’s with a P/E ratio of 20X compared to a P/E ratio of nearly 30X, I believe investors get a lot of AI potential on top of Google’s core advertising business for a much better price!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.