Summary:

- The bullish valuation setup for Google shares in January has flipped to a bearish setting in October-November.

- Rising interest rates during 2023 and a potential recession in 2024 will negatively impact Google’s future earnings and valuation.

- The increasing number of antitrust lawsuits against Google is a significant risk factor for the company and investors.

- My fair value target for share pricing of $125 earlier in the year has declined to $110 today.

Ole_CNX

I last wrote about Google/Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) with a bullish January viewpoint here. I projected a +30% to +50% gain for the year, which has largely played out as expected. However, far lower valuations 10 months ago, combined with easier to compete against bond yields no longer exist. In fact, the positive setup of January has flipped to such a degree that I am becoming increasingly negative on Google shares by the day. A mixed bag for Q3 results announced a week ago is not helping the situation. So, I feel I am forced to change my view for 2024, downgrading my rating to Hold/Neutral.

Seeking Alpha – Paul Franke, Google Buy Article, January 7th, 2023

The relative valuation argument vs. rising inflation and interest rates as an excuse to sell has been one I have repeated relentlessly since late 2021’s all-time Big Tech peak. Google will eventually suffer from the rise in interest rates, the same as others. Mathematically, the current earnings yield of less than 4% does not stack up well with risk-free Treasury rates near or above 5%. Then, a likely recession could cut sales and earnings growth in 2024.

An extra and material risk that hasn’t really been properly discounted in shares around $130 this autumn (in my view) revolves around the expanding number of antitrust lawsuits being filed since late 2020. In fact, two of them have moved to the trial phase since September. A total of three antitrust lawsuits are announced and in progress, requiring the company to defend itself in public and expend tens of millions of dollars (if not hundreds soon) annually on legal fees. Two lawsuits from various government agencies hit at some of the core profit-centers for the company, and one has been pushed by Epic Games, the maker of popular Fortnite.

A coalition of states and the Department of Justice opened a trial in September, seeking to drive a wedge into Google’s search dominance (its near-monopoly position garnered illegally, according to government plaintiffs), which is the company’s bread-and-butter money earner.

This week a second trial began, hearing the Epic Games complaint against Google. The trial revolves around how third-party mobile developers are treated on the Android Play Store. It is a similar case to the Epic Games 2021 lawsuit against Apple (AAPL), which operates the rival iPhone App Store. Both companies have been accused of charging excessive percentages on revenue collections. An additional complaint is app creators cannot communicate with their customers directly outside of Big Tech control.

Third, early next year the DOJ and a number of states are expected to argue their next case, an attempt to break up Google’s advertising business. The case has a stated goal of forcing divestitures to promote competition and a more-fair playing field for customers (ads represented $230 billion in Google revenue over the past 12 months vs. $297 billion in total).

Adjusted Earnings Yield Problem

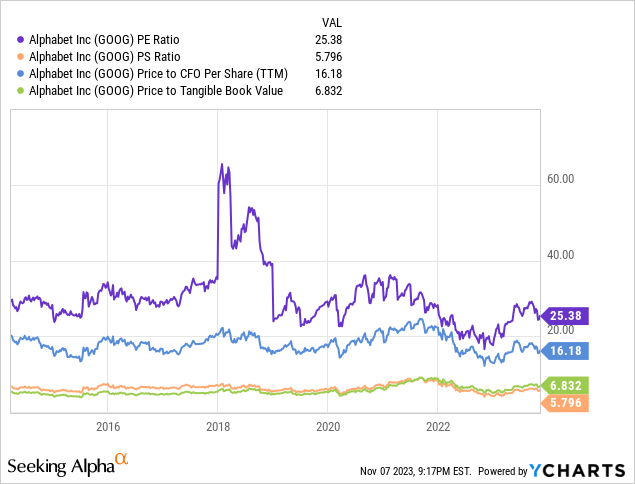

Anyone looking at basic fundamental ratio datapoints on Google might believe a normal valuation backdrop exists today. Honestly, I cannot blame you if you want to debate its valuation foundation supports even higher share quotes. Below you can review price to trailing earnings (25.4x), sales (5.8x), cash flow (16.2x), and tangible book value ratios (6.8x, mostly cash assets on the balance sheet) back to 2014.

YCharts – Google/Alphabet – Price to Trailing Fundamentals, Since 2014

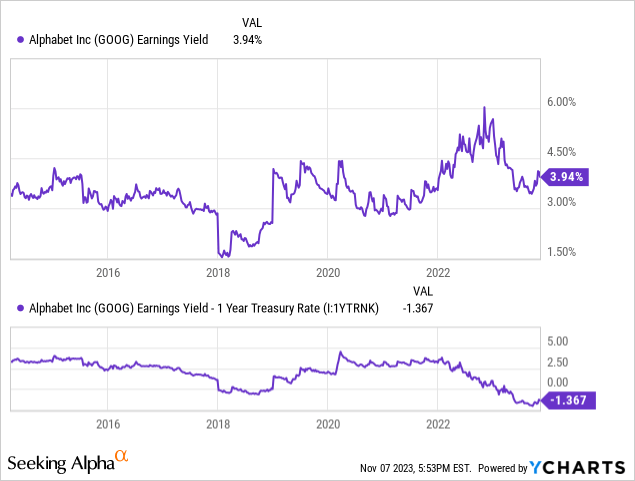

Nevertheless, when you adjust Google investment returns as a function of competing and safer bond market yields, the valuation story becomes one of extended pricing quickly. Below I have charted earnings yields as a spread idea to the available 1-year Treasury security investment. If I can get 5.3% in guaranteed yield in one year, on top of the guaranteed return of my upfront investment capital, why bother with any stock holding greater risk of investment loss (up to 100%), delivering far less in theoretical yield?

Today’s negative -1.37% “relative” business yield vs. what I can capture in the Treasury market is the most “overvalued” setup on the chart. This spread yield has been positive the entire time since 2014, outside of minor negative readings for a few months in 2018 and 2023 since early summer.

YCharts – Google/Alphabet, Earnings Yield vs. 1-Year Treasury Rate, Since 2014

In contrast, the peak spread in favor of Google investment yield on the 9-year chart came right after the 2020 pandemic panic appeared on Wall Street. I wrote a Strong Buy article here at the time (during late March, days before its low for the year, $51 split-adjusted), as real-world investment returns were too good to pass up.

In my mind, the autumn months of 2023 represent the flip side of the coin vs. March 2020’s screaming buy. Intelligent investors must seriously contemplate selling or avoiding Google/Alphabet today.

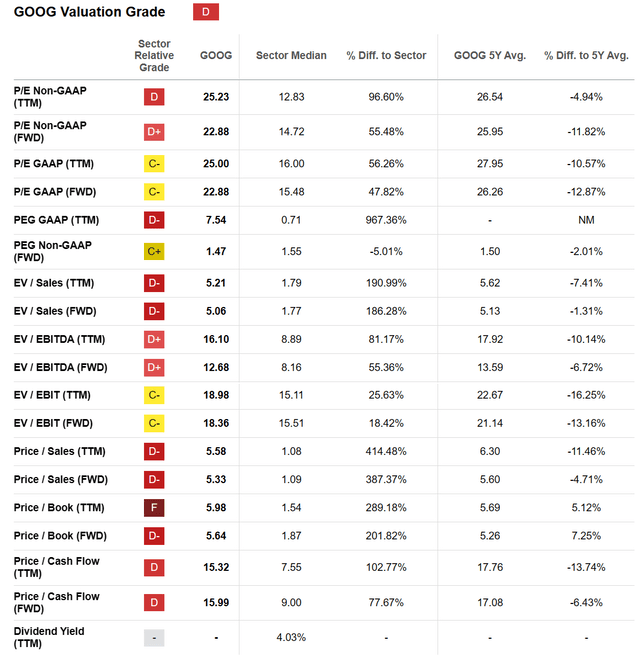

Seeking Alpha’s computer ranking system puts a Valuation Grade of “D” on shares presently. Why? Based on the company’s 5-year trading history and direct comparisons to peers in the Interactive Media and Services industry today, the math says Google is quite expensive vs. alternative equity investments.

Seeking Alpha Table – Google/Alphabet, Valuation Grade, Made November 6th, 2023

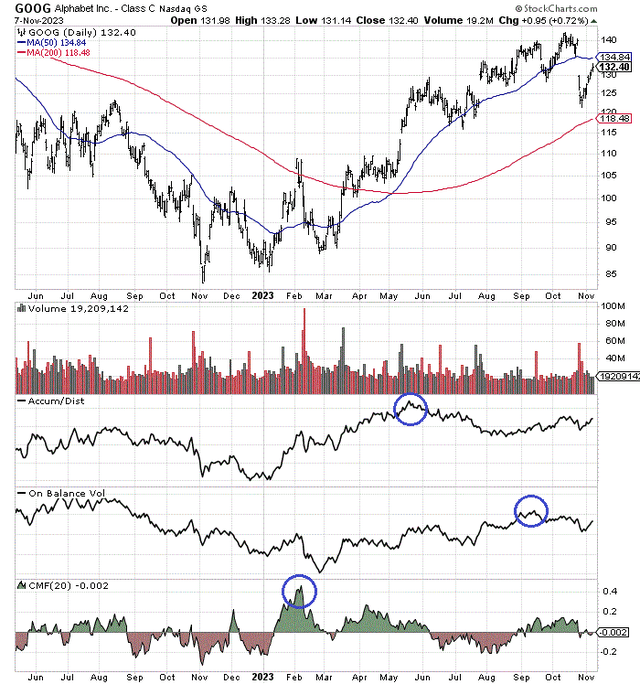

Technical Chart

The trading chart is also showing signs of an impending top in price, possibly for a number of months, if not years. Price is now well underneath its 50-day moving average, and this indicator is turning down for the first time since March.

Bullish momentum appears to have peaked earlier in the year. I have circled in blue the best readings for the Accumulation/Distribution Line, On Balance Volume, and the 20-day Chaikin Money Flow creation. Do any of these weakening technical indicators guarantee a top is in place? No, but a serious price downturn cannot be ruled out in coming months. I would term the overall momentum pattern as average for the Big Tech group in early November.

StockCharts.com – Google/Alphabet, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

All told, the impressive profit-machine online business model built over greater than 20 years is now under direct attack by the U.S. government, with no guarantees on the eventual trial outcomes by next summer.

The antitrust suits of 2023-24 won’t necessarily end the Google/Alphabet saga for bullish investors. However, my view is the stock could take a breather at the end of this year and all of next, as investors digest what I believe will be bad news on the legal front. It’s even possible, 12 months from now we will be discussing breaking off parts of the business into separate ownership vehicles.

For shareholders, either interest rates need to decline to support growth-stock valuations again, or prices for Big Tech names will have to come down to better balance with the yields available from bonds (like they have throughout Wall Street history). The fact Google does not pay a cash dividend will act as a huge weight on price, when 5%+ yields are available everywhere, including other equities, bonds, cash, etc.

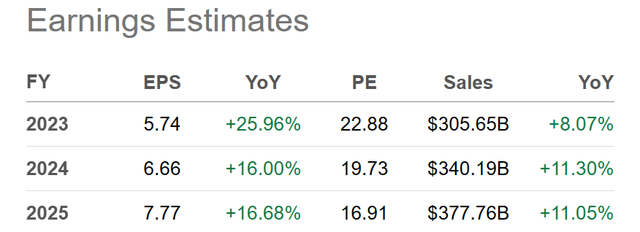

The real bummer could come with a prolonged recession that produces a string of earnings/sales misses and lowered guidance from today’s optimistic bent. Current analyst estimates are tremendously rosy in my view, assuming a robust economy and clear sailing for Google Search, Google Cloud, YouTube, and all the other divisions in operation.

Seeking Alpha Table – Google/Alphabet, Analyst Estimates for 2023-25, Made November 6th, 2023

In terms of the latest Q3 earnings release, weaker cloud revenue growth largely masked a decent report overall, in my view. I don’t have any issues with 2023 operating numbers to date. I am, however, quite concerned a weakening economy will hold sales growth well under 10% annually in 2024, with EPS expanding at a similar clip of 15% or lower YoY, depending on the developing recessions effect on internet advertising spending.

Logically, there are plenty of reasons to ease up your bullish enthusiasm for Google/Alphabet. Aggressive traders and overexposed owners might want to lighten up their position size. Prudence dictates now may be a great time to review the pros and cons of holding a stake.

Putting together the whole investment puzzle, I am worried risks are beginning to outweigh potential rewards for 2024. A downgraded outlook, with a flat to slightly lower share price forecast in 12-18 months, is my bottom-line suggestion. Does this mean Google’s share quote will never rise again? No. But I would wait for a 15% to 20% correction before buying, to better rebalance its overvaluation vs. interest rates, while discounting a looming recession and troublesome antitrust lawsuits.

My current “fair value” number is around $110 per share (20x my $5.25 EPS estimate for 2024 to match risk-free cash investment returns of 5%), accounting for a lower-than-normal valuation (closer to 10-year lows for price to sales of 5x) in preparation of disappointing operating results and bearish trial news during 2024. I strongly feel Google shares are susceptible to uncommon outlier legal risks, which may cause investors to rethink their bullishness in 6-12 months. An old Wall Street adage is “don’t buy into a major lawsuit.” If investors heed this advice, Google is now a clear avoid for new investment.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.