Summary:

- Google’s GenAI monetization strategy has sparked a strong rally in its stock, fueled by accelerated growth in advertising and YouTube ads.

- As YouTube Shorts users continue to grow, the company is emphasizing monetization efforts, with the monetization rate doubling relative to in-stream viewing over the past 12 months in the U.S.

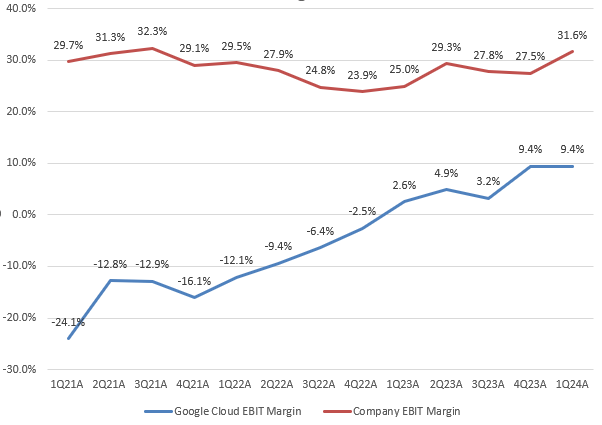

- Google Cloud’s operating margin has been steadily expanding, and with Google Services’ margin contributing, the company reached its highest overall EBIT margin last quarter since 3Q FY2021 at 31.6%.

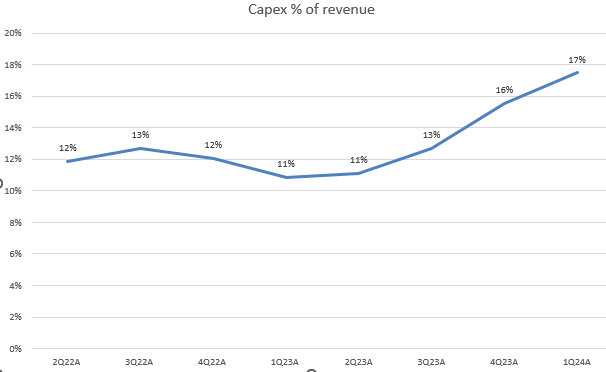

- Total capex in FY2024 is projected to grow by 52% YoY, focusing on the Gemini foundation model and other AI infrastructure, aiming to sustain its long-term AI growth story.

- The stock is currently trading at a non-GAAP forward P/E of 24.8x, which is 4% below its 5-year average and the lowest among the “Magnificent 7.”

400tmax

Investment Thesis

Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) GenAI roadmap since early this year has fueled a strong rally in its stock. From Gemini 1.5 to AI Overviews, the company is integrating GenAI features into all its products and services. I believe that GOOGL’s valuation will largely depend on the success of its AI monetization strategy, which has already shown early success in the last earnings report.

In my previous analysis, I upgraded the stock from hold to buy, driven by early signs of an online advertising recovery in July 2023. Since then, the company has experienced significant growth in Google Search and YouTube ads revenue, leading to a 40% stock rally, beating the S&P 500 index’s 20% gain. The recent rally did not significantly increase its P/E multiple, supported by an average 54% YoY increase in its EPS over the past three quarters. This suggests there is still potential for further upside in its valuation. Therefore, I reiterate my bullish view on the stock, driven by the anticipated 50% year-over-year increase in capex in FY2024 to sustain its top-line growth and margin expansion in the long term.

Accelerating AI Monetization

Last year, Google Search integrated with GenAI, helping users efficiently reach the content they wanted. Now, the company is adding a new Gemini model to make Google Search more intellectual. In addition, Google Search users in the U.S. can now get quick answers with AI Overviews, which was introduced in May. The management expects to reach over a billion users by the end of CY2024.

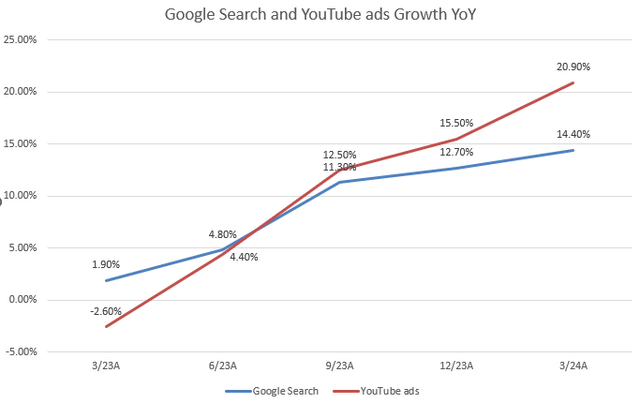

The 1Q FY2024 earnings results beat all market consensus. It was encouraging to see a continued growth acceleration in Google Search revenue, which comprised 57.3% of its total revenue in the last quarter. I believe the GenAI monetization in Google Search has materialized, as segment revenue growth improved significantly to 14.4% YoY in 1Q FY2024 from 1.9% YoY in 1Q FY2023, boosting the company’s total revenue by 15.4% YoY. This indicates that the pace of GenAI monetization is faster than the market expected.

Shorts is a Key Growth Driver for YouTube Ads

Now, let’s look at another positive signal. The YouTube ads segment has shown a strong rebound in growth, driven by both direct response and brand advertising, surpassing the 20% YoY threshold for the first time since 4Q FY2021. As GOOGL is approaching the two-year anniversary of the launch of ads on YouTube Shorts, the company has started to focus more on its monetization.

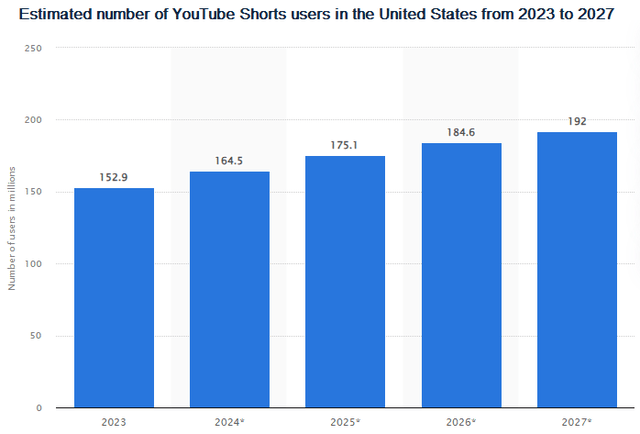

According to Statista, YouTube Shorts users are expected to grow at a CAGR of 4.7% from 2023 to 2027. While this growth rate is not significant, the company is working on its monetization strategy to improve ads revenue growth. In the earnings call, the management discussed how YouTube Shorts monetization continues to improve as AI drives higher ROI. Like most AI features from TikTok, YouTube Shorts previously introduced Dream Screen, allowing users to create AI-generated backgrounds for their short videos. Impressively, the number of channels uploading shorts grew 50% YoY last year. The monetization rate of shorts relative to in-stream viewing has more than doubled in the past 12 months in the U.S., which, I believe, will be a key growth driver of its ads revenue in the future.

Strong Margin Expansion Improves Earnings Outlook

The company model

Next, we move on to its cloud business. In 1Q FY2024, Google Cloud revenue grew 28.4% YoY, showing further acceleration from 25.7% YoY in the previous quarter, primarily driven by increases in average revenue per seat. This growth trajectory appears more robust compared to Amazon’s (AMZN) AWS, which grew 17.2% in 1Q FY2024, slightly up from 15.8% YoY in 1Q FY2023. Over the past three years, Google Cloud’s EBIT margin has been expanding, which is a positive sign, combined with its revenue growth rebound. Meanwhile, significant expansion in Google Services’ EBIT boosted the company’s overall EBIT margin to 31.6%, the highest since 3Q FY2021. This led to a 61% YoY increase in the company’s GAAP EPS in the last quarter, marking a further acceleration from 56% YoY in 4Q FY2023. I admit that the margin expansion was partly due to a YoY decline in operating expenses, but we still saw a strong top-line growth, which could justify an expansion in valuation multiples.

52% YoY Increase in Capex on AI Infrastructure in FY2024

The company model

We should know that all growth comes with a cost. As shown in the chart, GOOGL’s capex as a percentage of total revenue has been increasing since 3Q FY2023. In 1Q FY2024, capex grew almost 100% YoY to $12 billion. Management expects quarterly capex throughout the year to be roughly at or above $12 billion. If we assume $12 billion in each of the next three quarters of FY2024, the total capex in FY2024 is expected to grow 52% YoY to $48 billion, up from $32.3 billion in FY2023.

When an analyst asked Ruth Porat, the President & CIO of the company, about the recent uptick in capex despite GOOGL’s long-term investment in AI, she implied it was largely due to the Gemini foundation model. They also expect investment in office facilities to be less than 10% of total capex in 2024. Therefore, I believe that GOOGL will maintain its current growth trajectory through significant investments in GenAI and continued monetization of AI innovations over the long term.

Valuation

Despite the stock reaching an all-time high recently, I believe GOOGL is still currently undervalued. It is currently trading at 28.5x GAAP P/E TTM, mostly in line with its 10-year average. This multiple is even slightly below the S&P 500 index’s P/E TTM of 28.7x. According to Seeking Alpha, its non-GAAP P/E forward is trading at 24.8x, which is 4% below its 5-year average. Given GOOGL’s growth rebound in its core advertising business and strong margin expansions under increasing capex on AI innovations, its non-GAAP P/E forward is the lowest among the “Magnificent 7” (including Meta’s (META) 25.4x, MSFT’s 39x, AMZN’s 43x, NVDA’s 47x, TSLA’s 97x, and AAPL’s 33.6x). Therefore, I believe GOOGL is the most undervalued AI play among the “Magnificent 7” and has plenty of upside potential from the current price level.

Conclusion

In summary, GOOGL is leveraging its GenAI monetization strategy to drive significant growth across its product ecosystem. This move has already spurred a strong rally in its stock, supported by significant growth in earnings, boosted by accelerated revenue growth in Google Search and YouTube ads. We also saw a continued margin expansion in Google Cloud. Despite recent stock highs, GOOGL remains the most undervalued stock in the “Magnificent 7” in terms of its non-GAAP P/E fwd, trading at 24.8x and poised for further upside as it continues to innovate and invest heavily in AI infrastructure in FY2024. Therefore, I maintain my buy rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.