Summary:

- Google is going to submit its Q4’22 earnings sheet in two weeks.

- I believe investors may want to focus on the 3 most important metrics.

- Google’s valuation remains attractive heading into earnings.

400tmax

Alphabet (NASDAQ:GOOG) is going to report earnings for its fourth-quarter on February 2, 2023 and I believe the technology company has a decent chance to beat low earnings expectations. Google suffered in the third-quarter from a pull-back in advertiser spending which pushed the company’s top line growth into the single digits. Although the EPS trend is negative for Google — analysts expect a 21% decline in earnings per-share in the fourth-quarter compared to the year-earlier period — I believe expectations have become too bearish and Google has potential to revalue higher this year. Three key metrics are especially important in Google’s upcoming earnings release and they could determine Google’s recovery potential in FY 2023!

First metric: Google’s Q4’22 top line growth

Google’s shares have lost 34% of their value in the last twelve months, chiefly because of a moderation of the company’s top line which was driven by a down-turn in the online advertising market following a period of hyper-growth during the pandemic. Google grew its revenues — which include revenues from YouTube, Google Network and Google Cloud — only 6.1% in Q3’22 which was the firm’s slowest growth in a decade. Google’s revenues soared 41% year over year in Q3’22. The slowdown in revenue growth has led to low expectations for Google’s Q4’22 which the company could easily beat.

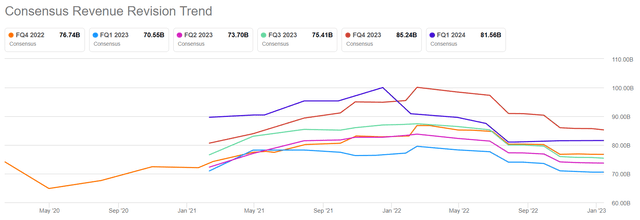

The top line growth figure will be the first key metric to watch in February as investors are eager to know whether the ad slump continued in Q4’22 and whether financial numbers reveal a potential turnaround in FY 2023. The expectation is for Google to report revenues of $76.7B for Q4’22 which implies a year over year growth rate of only 1.9%. The revenue estimate trend has gotten worse lately (revenue down-ward revisions for Q4’22 outnumber up-ward revisions by a ratio of 28:1), indicating that analysts expect Google’s top line growth to continue to moderate into FY 2023.

Source: Seeking Alpha

Second metric: Free cash flow (margins)

The second most important metric after top line growth figure will be Google’s free cash flow because this figure is essentially what the entire investment case for Google rests on. Google has a history of generating a ton of free cash flow each quarter, thanks largely to its Search business. In Q3’22, Google generated $16.1B in free cash flow which translated to a free cash flow margin of 23.3%. In the last twelve months, Google generated total free cash flow of $62.5B which equals a FCF margin of 22.2%. Both free cash flow and margins were very consistent and even the beginning of the ad down-turn in the second half of FY 2022 didn’t change this very much.

|

$millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

|

Revenues |

$65,118 |

$75,325 |

$68,011 |

$69,685 |

$69,092 |

|

Net cash provided by operating activities |

$25,539 |

$24,934 |

$25,106 |

$19,422 |

$23,353 |

|

Less: purchases of property and equipment |

($6,819) |

($6,383) |

($9,786) |

($6,828) |

($7,276) |

|

Free cash flow |

$18,720 |

$18,551 |

$15,320 |

$12,594 |

$16,077 |

|

Free cash flow margin |

28.7% |

24.6% |

22.5% |

18.1% |

23.3% |

(Source: Author)

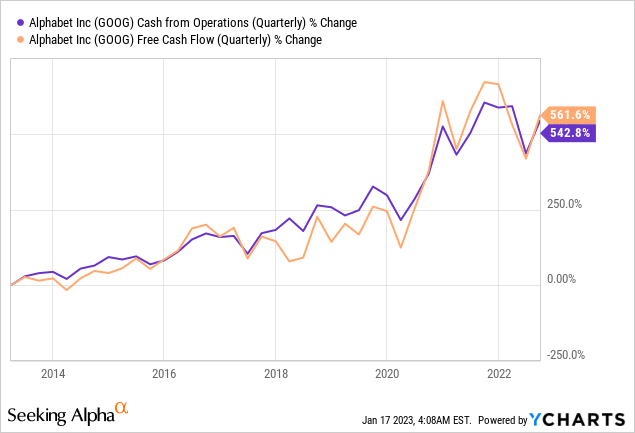

Google’s operating and free cash flow are in a long term up-trend and I don’t see how a temporary advertising slump is going to change is.

For the fourth-quarter, I expect Google to report free cash flow in a range of $16.0B to $17.0B and FCF margins of 20-22%. Google’s resilient free cash flow is a top reason to buy the stock, in my opinion, in large part because it allows a significant increase in the company’s $70B stock buyback in FY 2023. I also believe that the diversified nature of Google’s business — Search, YouTube, Network and Cloud — provides tech investors with enough protection to ride out the advertising down-turn.

Third metric: Cloud revenue growth/share

We all know that the advertising market is struggling, so it will be most interesting to see to what extent Google’s Cloud business contributed to Google’s overall growth in the fourth-quarter and to what extent the segment was able to offset weakness in the advertising business.

The Cloud business has been an anchor of stability as well as a growth engine for Google in recent years. The Cloud business grew 37.6% year over year in Q3’22 to $6.9B and grew its revenue share from 7.7% in Q3’21 to 9.9% in Q4’22. For the fourth-quarter, I expect 35-37% top line growth in the Cloud business which would translate to revenues between $7.5B to $7.6B.

Cloud will remain immensely important to Google’s revenue growth prospects. I believe Google Cloud, in the longer term, could achieve a 20% revenue share as companies continue to adopt Cloud services and more workloads shift to the Cloud.

Google’s valuation is still attractive

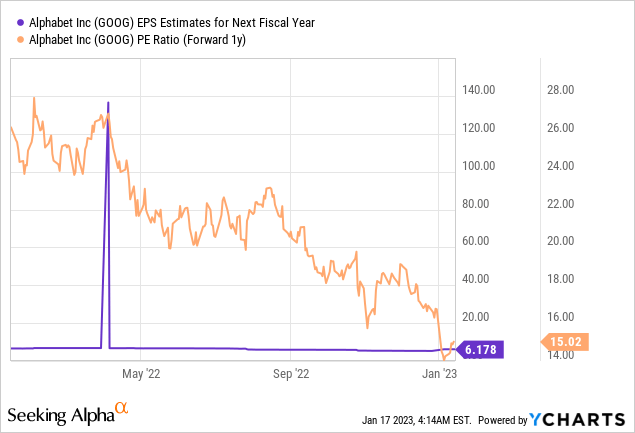

Google is attractively valued after a 33% down-ward revaluation: Google trades at a P/E ratio of 15 X (based off of $6.18 per-share in expected earnings) and considering that Google has about $60-70B in annual free cash flow potential, I believe shares are a bargain heading into Q4’22 earnings.

Risks with Google

The down-turn in the digital advertising market is a problem and a challenge for Google, but it is not an existential risk. Companies like Meta Platforms (META) are much more exposed to the pull-back in advertising spending and have less diversification built into their business models to offer investors protection from a cyclical adjustment in ad-spend. Google, on the other hand, operates a very successful and growing Cloud business that provides investors with down-side protection in case the advertising slump goes on for longer than expected.

What I see as a potential risk for Google is ChatGPT, the artificial intelligence bot that went viral recently. ChatGPT is owned by OpenAI which received an investment from Microsoft in 2019 and the AI bot has already won recognition for its ability to execute complex queries. If ChatGPT proves to be a viable alternative to search engines, then Google’s core Search business could be challenged.

Final thoughts

Google is going to report earnings for its fourth-quarter in about two weeks and I believe investors are overly bearish regarding the technology company. While Google’s consolidated top line growth is likely to see only single digit growth in Q4’22, Google is set to report strong free cash flow and Cloud results due to growing business momentum and rapid customer adoption. I believe the risk profile for Google’s shares is very attractive before earnings which means Google could easily beat low expectations in February!

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.