Summary:

- Google exceeded Q3 expectations with $74.5 billion in net revenues and a 34% YoY increase in operating income, driven by AI and cost management.

- Google Cloud’s 35% YoY revenue growth and improved operating margin to 17% highlight its potential as a key growth driver alongside strong advertising revenue.

- Alphabet’s strategic integration of AI across its product portfolio enhances user experiences and opens new monetization opportunities, positioning it for continued growth.

- Despite regulatory challenges and competition, GOOG’s robust financial performance, reasonable valuation, and shareholder returns make it an attractive investment.

Ingus Kruklitis

Google Surpasses Expectations with Strong Q3 Performance

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), the parent company of Google, released its third-quarter earnings report on October 29th, and the results surpassed market expectations across the board.

Alphabet reported net revenues of $74.5 billion for Q3, exceeding analysts’ consensus of $72.8 billion. This represents a 16% year-over-year increase on a foreign exchange neutral basis. The company’s strong performance was driven by significant growth in its core businesses, particularly Google Cloud and advertising services. Underpinned by advancements in adopting artificial intelligence for labor efficiency, as well as broader effective cost management, Google’s operating income jumped 34% year-over-year, to $28.5 billion. With this, operating margins expanded to 32.3%, an increase of 450 basis points compared to the same quarter last year. Google posted an EPS of $2.12, significantly higher than the expected $1.85.

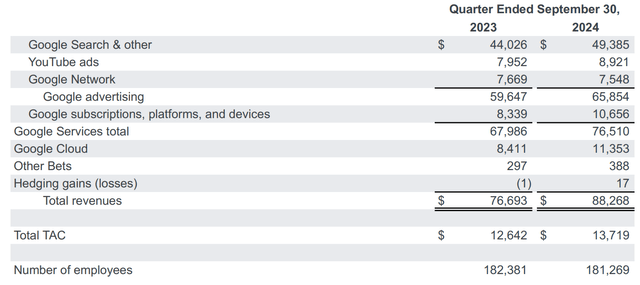

Google Earnings Report Q3 2024

Google Cloud Shines with Accelerated Growth

In Q3, Google Cloud emerged as a standout performer, with revenues increasing by 35% year-over-year to $11.4 billion, surpassing market expectations by close to 5%. Notably, Google Cloud’s Q3 growth marks a 6-percentage-point acceleration from the previous quarter. Moreover, the cloud segment’s operating margin improved significantly to 17%, up from 11% in Q2, indicating enhanced profitability on operating leverage.

On the momentum acceleration, there are likely two key factors that merit attention: First, I highlight that the growing adoption of AI solutions across industries and use cases is boosting demand for Google’s cloud infrastructure and services; Secondly, and building on the first, Google’s introduction of new AI-powered tools and solutions, such as the Customer Engagement Suite, has attracted more customers seeking advanced analytics and personalized services.

Advertising Revenue Remains Strong

While Google Cloud led the growth, the company’s core advertising business also delivered solid results: Firstly, revenues from Google Search increased by 12% year-over-year to $49.4 billion. This growth was achieved despite tougher year-over-year comparisons and indicates the resilience of the search business – defying fears that OpenAI would eat Google’s lunch. Secondly, YouTube revenues grew by 12% to $8.9 billion. The platform benefited from increased engagement and improved monetization strategies, particularly with the growth of YouTube Shorts. Thirdly, Google Network revenues were slightly ahead of expectations at $7.6 billion, showcasing stability in the broader advertising ecosystem.

Google Earnings Report Q3 2024

Alphabet: Strategically Positioned for Continued Growth

Alphabet’s strong Q3 performance is not just a reflection of past success but, in my view, also an indicator of the company’s strategic positioning for future growth. Several key factors suggest that Alphabet is well-equipped to maintain its growth momentum, while driving efficiency gains as over 25% of code at Google is now generated by AI, which accelerates development cycles and reduces the need for additional headcount.

Most notably, Alphabet continues to integrate AI across its product portfolio, enhancing user experiences and opening new monetization opportunities: The rollout of AI overviews in search results has increased user engagement and satisfaction. These AI overviews are now available in over 100 countries, reaching more than 1 billion monthly users. At the same time, Google Lens processes over 20 billion visual searches per month, with 25% of these searches having commercial intent. The company’s focus on visual search caters to younger demographics and aligns with emerging user behaviors. Meanwhile, I am bullish on YouTube’s introduction of AI-driven content creation tools, such as the upcoming DeepMind video generation model, which will likely boost content production and engagement. I also highlight that Google is making notable progress with Shorts, closing the monetization gap with traditional YouTube videos.

Even if the traditional advertising business would not grow double-digit growing forward, Q3 results clearly highlighted that Google Cloud can step up to be the main growth driver for the company and be able to move the needle on profits. In fact, the significant improvement in cloud operating margins indicates a sustainable business model. Management expects to maintain or enhance these margins as the cloud business scales.

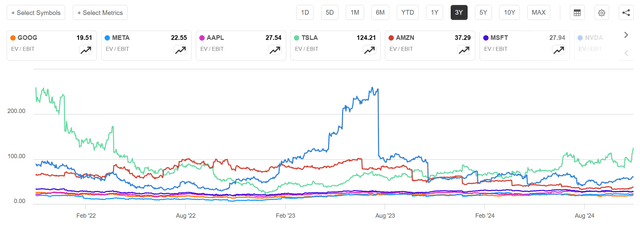

Valuation: The Cheapest Among The Mag 7

Google’s strong momentum and growth upside is not really rewarded with a rich valuation. In fact, based on the EV/EBIT ratio (see below chart), Google appears to be valued more conservatively compared to its peers in the “Magnificent 7” tech giants. Google’s EV/EBIT ratio of 20 is notably lower than those of companies like Apple (AAPL) at 28, Meta (META) at 23, Microsoft (MSFT) at 28, Amazon (AMZN) at 37 and Tesla (TSLA), at 124. In simpler terms, this means investors are paying a lower multiple on Google’s operating earnings relative to its peers. This lower valuation could suggest that the market perceives relatively lower growth or higher risk in Google’s earnings potential, or it may simply indicate that Google is undervalued compared to its big tech counterparts. In my view, this relatively lower EV/EBIT could make Google a more attractive investment for those looking for a large, profitable tech company at a more reasonable valuation, especially given its strong performance in AI and cloud, as highlighted in recent earnings reports.

Seeking Alpha

Addressing Potential Challenges

Relating to Google as an investment, there are 3 main headwinds to watch, in my opinion. With ongoing scrutiny from regulators, Alphabet faces a challenging landscape on both antitrust and political issues. That said, compliance demands and potential changes to business practices could impact operations if regulatory pressures intensify. This is a space to watch, as increased regulation could impose limits or costs on some of Alphabet’s core activities. At the same time, Alphabet is up against fierce competition in AI, cloud services, and digital advertising. Staying ahead will require continuous innovation and investment, but any significant advances by competitors in these areas could pressure Alphabet’s market position. Moreover, even if Google wins the AI search war, it is yet unclear if AI search monetizes at the same rate as traditional indexing search. Lastly, while Alphabet is reducing its reliance on advertising with new ventures in cloud services and hardware, the success of these ventures isn’t guaranteed. If these non-advertising streams don’t grow as planned, Alphabet could remain vulnerable to fluctuations in the advertising market, impacting overall stability and revenue growth.

Conclusion

Alphabet’s exceptional Q3 performance underscores its strong execution and strategic position to capture more growth upside in the age of AI. And on that note, with robust revenue streams, expanding margins, and a commitment to innovation and cost management, Alphabet is well-equipped to continue delivering value to shareholders. Concluding this article, I highlight that Google is paying out most of the value it creates to shareholders. In Q3, Google paid out $17.8 billion to its equity holders, of which $15.3 billion in form of share repurchases and $2.5 billion in form of dividends. This implies a 65-70% payout ratio compared to the $26.3 billion of net income generated in Q3. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.