Summary:

- Google has shown strong Q3 2024 earnings results, announcing earnings per share of $2.12, an increase of 37% compared to the same quarter of the previous year.

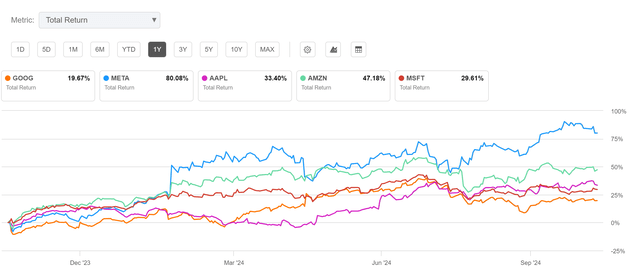

- Alphabet’s Total Return of 19.67% over the past 12-months has been significantly below that of Microsoft (29.61%), Apple (33.40%), Amazon (47.18%), and Meta (80.08%).

- Given its presently attractive Valuation (P/E [FWD] Ratio of 21.79), financial health and competitive edge, I maintain a strong buy rating for GOOGL.

- Behind Apple, GOOG is the second-largest position of my private portfolio and presently accounts for 1.52% within The Dividend Income Accelerator Portfolio.

400tmax

Investment Thesis

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) released its Q3 2024 earnings results on 29th October 2024. The company reported a revenue of $88.3B, which is an increase of 15% when compared to the same quarter of the year before.

At the same time, Alphabet announced earnings per share of $2.12. This is an increase of 37% compared to the same quarter in 2023.

Alphabet’s strong Q3 2024 earnings results confirm my theory that the company is on track when it comes to growth and underscores my current strong buy rating.

Alphabet’s attractive risk-reward profile, its significant competitive advantages (such as its strong brand recognition, its leading position in online advertising, its own ecosystem, and leading data and Artificial Intelligence capabilities) as well as its strong financial health (underlined by an EBIT Margin [TTM] of 31.03% and Return on Equity of 30.87%) are additional indicators that bolster my current strong buy rating for the company.

This conviction is reflected in my own private portfolio, in which Alphabet is presently the second largest position behind Apple (NASDAQ:AAPL). Additionally, it is worth highlighting that Alphabet currently represents 1.52% of The Dividend Income Accelerator Portfolio.

I believe that Alphabet’s currently attractive Valuation and its growth perspective provide investors with elevated chances of reaching strong long-term investment results when overweighting the company’s position in an investment portfolio. However, I suggest setting an allocation limit of 5% to reduce company-specific concentration risks.

Alphabet’s 12-Month Performance in Comparison to Meta, Apple, Microsoft and Amazon

When comparing the performance of Alphabet in the past 12-months period with the performance of competitors such as Meta (NASDAQ:META), Apple, Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) and Amazon (NASDAQ:AMZN), we can see that Alphabet has significantly underperformed.

The company has shown a Total Return of 19.67% within the past 12-months. In the same period, Microsoft’s Total Return was 29.61%, Apple’s 33.40%, Amazon’s 47.18%, and Meta’s 80.08%.

Despite this underperformance, Alphabet exhibits attractive growth rates and exhibits a lower Valuation when compared to these competitors.

While the company’s EPS Diluted Growth Rate 3 Year [CAGR] stands at 14.77%, Meta’s is at 13.15%, Apple’s at 8.73%, Amazon’s at 13.33%, and Microsoft’s at 13.60%, highlighting Alphabet’s attractive growth rates.

Alphabet’s P/E GAAP [FWD] Ratio of 21.79 stands significantly below the one of Meta (P/E GAAP [FWD] Ratio of 27.15), Microsoft (32.42), Apple (35.44), and Amazon (40.15), indicating that the company is the most attractive choice in terms of Valuation at this moment in time.

Alphabet’s low Valuation and attractive growth rates underline the currently elevated upside potential of the company in comparison to these competitors, further underscoring my strong buy rating.

Alphabet’s Current Valuation and Growth Outlook

At Alphabet’s current stock price of $165.23, I consider the company to be undervalued as things stand.

The reason for this is Alphabet’s P/E [FWD] Ratio of 21.79, which stands 16.94% below its 5-Year Average. This metrics indicates that the company is presently undervalued.

This undervaluation is further confirmed when considering Alphabet’s attractive growth metrics such as those mentioned. The company not only exhibits an attractive EPS Diluted Growth Rate [FWD] of 24.04%, which is significantly above the Sector Median of 7.11%, but also an EBIT Growth Rate [FWD] of 18.35%, which is well above the Sector Median of 5.92%.

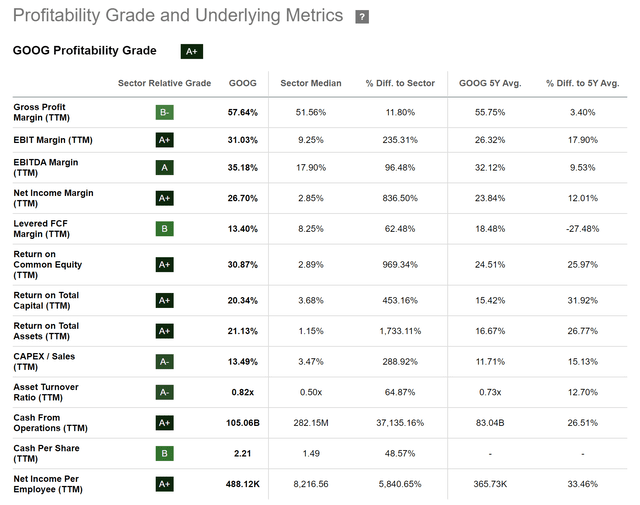

Alphabet in Terms of Profitability

Alphabet’s excellent competitive position is reflected in its EBIT Margin [TTM] of 31.03%, which stands well above the Sector Median of 9.25%.

Additionally, it is worth highlighting that Alphabet’s financial health is particularly underscored by a Return on Equity of 30.87%, which stands significantly above the Sector Median of 2.89% and its Net Income Margin [TTM] of 26.70%, which is well above the Sector Median of 2.85%.

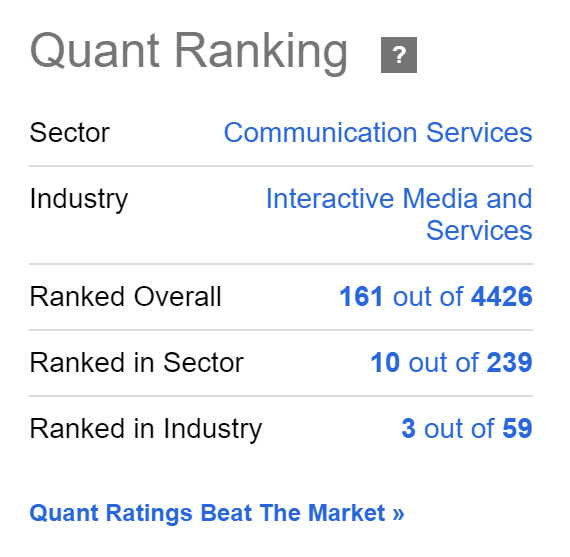

Alphabet, According to the Seeking Alpha Quant Ranking

Alphabet’s attractiveness is further reflected in the Seeking Alpha Quant Ranking, in which the company is ranked 3rd out of 59 within the Interactive Media and Services Industry. Moreover, it is 10th out of 239 within the Communication Services Sector and 161st out of 4426 within the overall ranking. The Seeking Alpha Quant Ranking underlines my own strong buy rating for Alphabet.

Source: Seeking Alpha

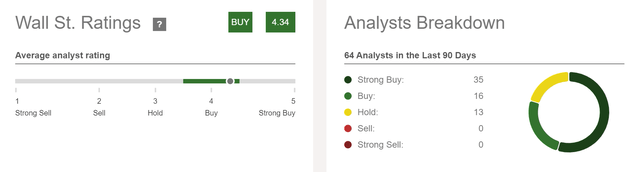

Alphabet, According to the Wall Street

According to the Wall Street, Alphabet is presently rated as a buy: 35 analysts rate the company as a strong buy, while 16 analysts rate it as a buy. Only 13 analysts give Alphabet a hold rating. The Wall Street Rating further underscores my own strong buy rating for the company.

Why I Added Alphabet to The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s objective is to generate income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to its broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

Given its attractive risk-reward profile, Alphabet is a company which I would typically overweight in an investment portfolio. This is reflected in the fact that Alphabet is – behind Apple – the second largest position of my private portfolio.

Given The Dividend Income Accelerator Portfolio’s stronger focus on dividend income, I have not allocated an elevated proportion to Alphabet at this moment in time. Presently, the company represents 1.52%.

Despite Alphabet’s relatively low Dividend Yield [FWD] of 0.49%, I believe that the company strongly aligns with the investment approach of The Dividend Income Accelerator Portfolio, due to its presently attractive Valuation, its competitive advantages, financial health and attractive risk-reward profile in addition to its strong dividend growth potential.

I am convinced that Alphabet will be an important strategic core-element within our dividend portfolio in the future, providing investors with strong potential for dividend growth and contributing to attractive long-term results.

The Main Risk Factor When Investing in Alphabet and How to Reduce This Risk

There are several risk factors investors should consider.

The principal risk for Alphabet investors is the company’s dependency on its advertising revenue, since the largest proportion of its revenue is generated by its advertising business unit. In 2023, more than 75% of the company’s revenue was generated from online advertising. This number is a strong indicator of Alphabet’s online advertising dependency. I see this dependency as the largest risk-factor Alphabet investors need to take into consideration.

However, I believe the company’s elevated dependency on online advertising will decrease in the years ahead, considering its elevated investments in cloud services and Artificial Intelligence.

Another risk factor I see for Alphabet investors is that the company’s growth rates could slow down in the years ahead compared to the elevated growth rates shown in the past years, as indicated by an EPS FWD Long Term Growth Rate [3-5Y CAGR] of 16.90%.

However, I believe that Alphabet’s stock price already reflects more moderate growth expectations (such as indicated by a relatively low P/E [FWD] Ratio of 21.79, which is below the company’s 5-Year Average of 25.85), meaning that a slowdown would likely have a limited negative effect on its stock price.

Setting an allocation limit for Alphabet to reduce the company-specific concentration risk of your portfolio

Given Alphabet’s attractive risk-reward profile, I generally suggest overweighting the company in an investment portfolio. I am following this approach with my private portfolio, in which Alphabet is the second largest holding.

Given The Dividend Income Accelerator Portfolio’s primary focus of balancing dividend income and dividend growth, Alphabet currently represents a smaller percentage of the overall portfolio, such as mentioned previously.

To reduce the company-specific concentration risk of your portfolio, I generally suggest setting an allocation limit to 5% for the Alphabet position.

Conclusion

Alphabet’s strong Q3 2024 earnings results have confirmed its positive growth outlook, underlining my strong buy rating for the company.

Given Alphabet’s attractive risk-reward profile, its presently appealing Valuation (P/E [FWD] Ratio of 21.79), growth metrics (EPS Diluted Growth Rate [FWD] of 24.04%), significant competitive advantages and financial strength (Net Income Margin [TTM] of 26.70% and Return on Equity of 30.87%), I believe the company remains an excellent choice for your investment portfolio.

Furthermore, I am of the belief that Alphabet’s relatively low Valuation in combination with its attractive growth perspective offer strong upside potential and the opportunity to reach attractive investment results when overweighting the company within a portfolio and when following a long-term investment approach.

My conviction of Alphabet’s attractive risk-reward profile is reflected in the company representing the second largest position of my private portfolio, and accounting for 1.52% within The Dividend Income Accelerator Portfolio.

I suggest setting an allocation limit of 5% for the Alphabet position to reduce your portfolio’s company-specific concentration risk.

The company’s growth outlook, relatively low Valuation, attractive risk-reward profile and potential for future dividend growth underline my strong buy rating.

What is your opinion on Alphabet’s latest Q3 2024 earnings results? How do these earnings results influence your investment strategy? Feel free to share your thoughts in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, AAPL, AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.