Summary:

- Google and Meta are about to take their competition in 2023 to the next level.

- To tackle the rising threat from TikTok, both companies are beginning to aggressively promote their respective short-form video products to their users.

- This article highlights whether Google’s YouTube Shorts and Meta’s Reels would be able to gain a greater market share and create additional shareholder value for their investors along the way.

Chinnapong

Both Google (NASDAQ:GOOG)(NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META) for years have been competing with each other in the video segment of a broader digital advertising market. While the former managed to take the lead thanks to the aggressive growth of YouTube in recent years, the latter nevertheless has been actively exploring options on how to narrow the gap by promoting various video products within Facebook and Instagram. However, the rise of short-form video content in recent years that was made possible by the aggressive growth of ByteDance’s (BDNCE) TikTok has forced both companies to launch their own short-form video products. As a result, there is every reason to believe that the forecasted aggressive growth of such products is about to take Google’s and Meta’s competition in 2023 to the next level.

While in the past, I’ve already covered various products of both Google and Meta and noted that I’m holding stocks of both companies in my portfolio, the goal of this article is to highlight how the launch and monetization of Google’s YouTube Shorts and Meta’s Reels could help both companies capture a greater market share within the digital advertising industry. At the same time, the article will try to compare both products to each other and figure out whether they can gain greater popularity than TikTok in order to attract more users and create additional shareholder value for their respective companies along the way.

The Rise Of TikTok

As advertising spending is being cut due to macroeconomic headwinds, the one area that continues to experience growth within the broader digital advertising market is the short-form video segment. The aggressive rise of TikTok in recent years indicates that short-form video content is able to successfully encourage users to engage with such content, which at the same time leads to a better conversion rate and a greater return on ads spent for digital advertisers. That’s why in the last couple of years we’ve seen brands allocating greater resources to create and advertise short-form video content that’s able to decrease customer acquisition costs and scale sales for their respective businesses.

The biggest beneficiary of all of this is without a doubt TikTok that now has over 1 billion monthly active users and is on track to generate over $11 billion in revenues in the fiscal year 2022, which is greater than the forecasted revenues of Twitter and Snap (SNAP) combined. At the same time, TikTok’s business is expected to grow at an aggressive rate and generate close to $24 billion in annual revenues by 2024, which is almost as much as Google’s YouTube generated in 2021. Considering such explosive growth and an optimistic forecast, it becomes obvious that short-form video content is more than likely to continue to gain traction in the following years. However, while TikTok managed to take the lead in the short-form video segment, the rise of competitors such as Meta’s Reels and Google’s YouTube Shorts have the possibility to take some market share from their Chinese-based competitor and create additional shareholder value for their respective investors in such a turbulent macroeconomic environment at the same time.

Reels Vs. Shorts

After TikTok began to gain broader popularity at the beginning of the pandemic in 2020, Meta decided to launch a direct competitor called Reels, which is a short-form video product that’s available for all users within Facebook and Instagram platforms. The problem though is that due to being almost a copycat of its rival, it failed to properly gain traction at that time making it easy for TikTok to continue to acquire new users and content creators. Even a few months ago, the Wall Street Journal ran a story about Meta, which highlighted how the company’s management failed in the past to properly tackle the rising threat from TikTok and as a result made insignificant progress in promoting Reels. However, the latest data indicates that Reels are beginning to gain traction and could finally start to grab a significant portion of TikTok’s market share within the short-form video segment.

In addition to improving the overall algorithm that’s used to recommend what videos users could be interested in watching, Reels has also been better integrated within the overall Meta’s ecosystem of products and services, which made the product more accessible across the globe. At the same time, thanks to the growth of Instagram, which is expected to reach ~2.5 million monthly active users this year, Meta has managed to find a way to encourage users to interact with Reels, which made it possible for advertisers to use the product to run their ads there.

From personal experience, I could say that over the last few months, the ROAS of running ads on Instagram Reels has been similar to the ROAS of running ads on Instagram Stories, even though the former was launched a few years later after the latter. Considering that the management is seriously looking for ways to increase the popularity of Reels, there’s every reason to believe that it could become an even better product for advertisers to run their ads there in the long run since the short-form video content continues to gain traction to this day.

At the same time, as Meta is on a quest to catch up with TikTok with the help of Reels, Google is about to become another force to be reckoned with in the short-form video segment as well. Even though Google launched its own short-form video product called YouTube Shorts after the launch of Reels, the product has already managed to successfully gain traction across the globe. At the latest conference call, the company’s management announced that Shorts currently receive 30 billion daily views and attract 1.5 billion users each month.

In addition, in recent months Google added the ability to run ads within Shorts as standalone campaigns and as part of the Performance Max campaigns that utilize all of the company’s products to improve the conversion rates for advertisers. While the user engagement has been impressive so far, we would need to wait a few months before figuring out how much revenue Shorts are able to generate for Google, as advertisers only recently were given the option to run ads using the product, even though it’s been available for over a year already. However, the initial results indicate that Shorts could significantly help YouTube attract new users and drive engagement on the platform higher in the foreseeable future.

The Bigger Picture

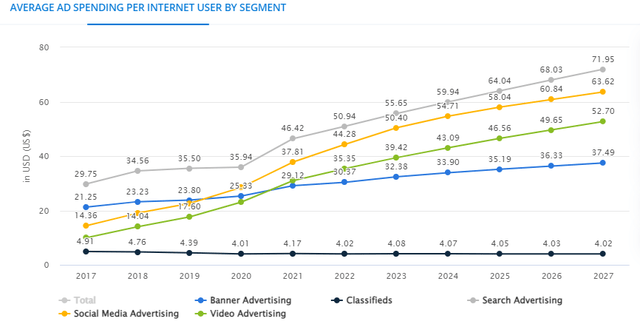

The latest successes of Reels and Shorts are making it possible for Meta and Google to improve their overall performance, as it appears that the short-form video content would continue to be popular among users in the foreseeable future. The data from the last year shows that brands continue to pour record resources into the short-form video segment at a time when the overall digital advertising budgets are being cut due to macroeconomic headwinds. At the same time, there are also reasons to believe that even more resources would be invested into this field, as various forecasts indicate that the average ad spending per user in the broader video segment would increase in part thanks to the growth in popularity of the short-form video content.

Average Ad Spending per Internet User by Segment (Statista)

While at this stage, it appears that TikTok would continue to hold its dominant spot in the short-form video segment, several issues could undermine its position in the field and make it possible for Google and Meta to capture its market share. First of all, as TikTok rises in popularity its parent company ByteDance is experiencing an increase in losses since the platform continues to be unprofitable as it constantly requires the reinvestment of the available resources to fund its growth. In 2021, the company’s operating losses were $7.15 billion, up from $2.14 billion a year before, and the business is on track to have another major year of losses in FY22 as it’s focused mostly on improving its top-line performance at the expense of its bottom-line.

That’s not the case with Google and Meta, both of which have been profitable for over a decade and have significant war chests to not worry about potential losses that are generated by Shorts and Reels as long as they’re improving engagement and creating value for the core businesses.

Secondly, despite its popularity, TikTok faces a creator backlash due to its unattractive payment model. While due to the lack of competition in recent years, TikTok managed to easily attract a significant portion of content creators without the need to directly pay them significant sums, it seems that it’s unlikely to do so in the future at the same scale. Last year, stories began to surface about TikTok’s monetization problems that highlighted how the platform greatly underpays for the content to its creators prompting the latter to look for alternatives. As of now, TikTok hasn’t fully addressed the issues of its payment model and as such, there’s a possibility that content creators could ditch the platform in the future considering that now there are viable alternatives such as Reels and Shorts.

Meta understands this and as a result, it has been actively providing various monetarization tools to its creators to encourage them to create content specifically for Reels. In addition to implementing a more generous bonus program at the beginning of 2022, Meta also began testing various advertising and subscription tools last month. Their goal is to give content creators more options on how to monetize their content to ensure that they stick with Reels and ditch other platforms.

As for Google, the company is about to implement a revenue sharing agreement shortly under which it’ll pay 45% of advertising revenue to its Shorts creators and publishers creating an incentive for them to constantly create new content and publish it on the platform. This could potentially become the most attractive payment model for creators as it almost makes them partners under the agreement and sets no limits on how much money they can earn from their content. Thanks to this, there’s a real chance that the growth of Shorts would accelerate in the following months after the agreement is implemented, making it easier for Google to take some of TikTok’s market share and outcompete Meta at the same time.

Thirdly, there’s a real possibility that TikTok could be banned in the United States in the foreseeable future, creating an opportunity for Google and Meta to take over a lucrative and ever-growing market from their biggest competitor in the space in an instant. While in the past ByteDance managed to avoid regulatory scrutiny, this could no longer be the case. As of today, TikTok has already been prohibited from being used on state-owned devices in 22 states, and currently, there’s a bipartisan effort to fully ban the app in the United States especially after the report came out that the company’s Chinese employees can access the data of the U.S. users that use the platform.

A couple of months ago, the FBI director has noted that TikTok could pose a threat to national security and as a result, there’s a possibility that the app would be banned in the United States in the foreseeable future. A few years ago, India has already banned the app in its country, which made it possible for Reels to take over the top spot and made it easier for Meta to aggressively expand within the region. We could see the same thing happening in the United States if TikTok is banned there.

What’s Next?

All of the developments described above are making it possible for Meta and Google to become one of the biggest beneficiaries of the growth in popularity of short-form video content. Even though TikTok has managed to take the lead in the field in recent years, a number of financial, operational, and regulatory issues have a high chance of disrupting its business at a time when viable alternatives are beginning to gain traction.

Back in the summer, Meta has been saying that the annual revenue run-rate of Reels would be $1 billion in FY22, but during the latest earnings call the management revised its forecasts and said that Reels are on track to generate $3 billion in 2022. The final figure would be announced next month when the full-year results will be announced. However, an upward revision along with the increase in engagement in recent months indicates that Reels could help Meta soften the blowback caused by the change of Apple’s privacy policy that was forecasted to cost $10 billion in lost revenues for Meta in 2022 alone.

The latest results already show that some of those potential revenue losses were recouped thanks to Reels in recent quarters and given the expected continuous growth of the short-form video segment we could safely assume that the product would be able to continue to create additional shareholder value in the foreseeable future. That’s why I continue to believe that even after a disastrous year Meta’s stock has a decent chance of appreciating from the current levels as its fair value appears to be $161.37 per share and $196.89 per share in the base case and optimistic case scenarios, respectively.

As for Google, the successful initial launch of Shorts indicate that the short-form video content is more than likely to continue to resonate the most with users, which would encourage advertisers to pour more resources into the creation of such content to generate greater returns. While Shorts have been relatively late to the party in comparison to TikTok and Reels, Google’s upcoming revenue sharing agreement is one of the things that could help the product to grow at an aggressive rate and quickly narrow the gap, as it would encourage creators to create the content that’s unique to Shorts. Considering that Shorts engagement metrics have been impressive in recent months, there are reasons to believe that the product has great potential to help Google to establish an even stronger position in the short-form video segment and within a broader video segment of the digital advertising market. That’s why I continue to be bullish on the stock and believe that it trades at a discount to its fair value of $120.81 per share in the base case scenario.

The Bottom Line

As TikTok faces scrutiny in the United States at a time when its parent company bleeds cash to fund the app’s growth, we could safely assume that Reels and Shorts have everything going for them to capture some or even all of TikTok’s market share in case if the latter is fully banned in the country. The growth of Reels and Shorts in recent months already shows that both of them have the potential to attract users along with the creators and improve the overall top-line performances of their respective companies, so at this stage, it’s hard to point out who would be the ultimate winner in the short-form video segment.

That’s why I believe that owning both Meta and Google is currently the best option as even though they’re directly competing with each other there’s a case to be made that there’s enough room for growth for both of them at this stage. Therefore, I continue to hold a long position in both of the companies and think that the forecasted growth of their short-form video products would be able to positively affect their financial and business performance in the foreseeable future.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!