Summary:

- Google under increasing antitrust scrutiny, highlighted by recent prominent legal cases.

- Currently embroiled in the biggest anti-monopoly case in four.

- Verdict for the case expected to be revealed next month.

- We believe investors should take note of this.

kenglye/iStock via Getty Images

The Nasdaq Rebalance and Tech Dominance

The recent Nasdaq 100 special rebalance announced by S&P Dow Jones Indices grabbed our attention. This rebalancing was prompted by the heavy concentration of a few mega-cap tech stocks within the index. Stocks like Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Meta (META), Tesla (TSLA), and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) accounted for over 55% of the entire Nasdaq 100.

The reason for this high concentration is evident – these tech behemoths have powered a substantial portion of the overall gains in the index. Their market dominance in core segments explains this phenomenon. For instance, Google holds over 90% of the global search market, while its Android OS claims over 70% market share. Apple garnered over 60% of global app store revenue in 2022. Microsoft still leads the PC OS market with a 74% share.

The market dominance of these tech titans offers a compelling rationale behind their outsized presence and meteoric rise. However, it also exposes them to growing regulatory scrutiny and risks of potential antitrust action.

Antitrust Laws and Tests

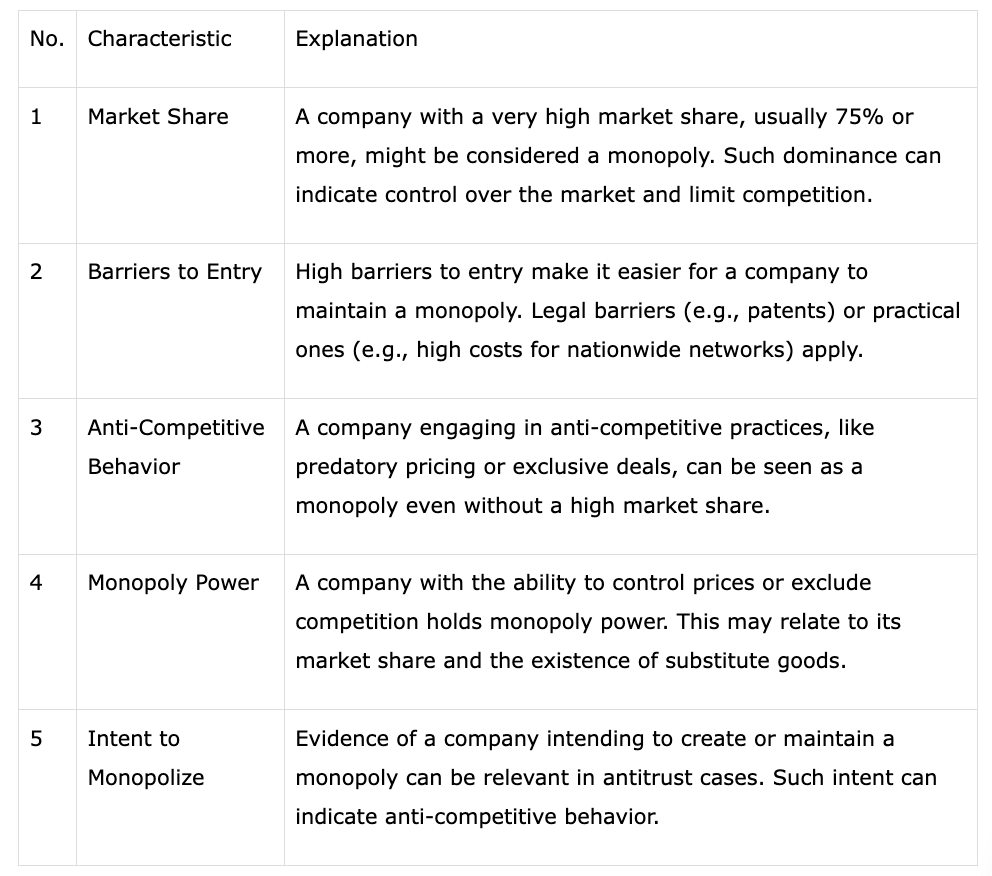

Shifting focus, let’s explore antitrust laws in the US, where influential legislations like the Sherman Act and Clayton Act govern potential monopolistic behavior. The antitrust authorities employ various tests to determine if a company has an unfair monopoly or engages in anti-competitive practices.

Monopoly power test (Department of Justice)

Scrutinizing Google’s Dominance

Now, specifically looking at Google’s case…

- Market Share: Google has overwhelming market shares of 92% in search and 71.8% in mobile operating systems with Android. These high shares suggest potential monopoly power.

- Barriers to Entry: Search and mobile OS markets have high barriers like expertise and data access. Google’s resources and user base reinforce the barriers.

- Anti-Competitive Practices: Google faces allegations around self-preferencing its services and pre-installing Android apps, raising anti-competition concerns.

- Monopoly Power: Market dominance gives Google significant control over prices and competition, especially in online ads.

- Intent to Monopolize: While difficult to prove intent, some practices like acquisitions and favoring own services point to potential monopolistic motivations.

Will Google be Broken Up?

Google faces mounting antitrust scrutiny, evident in recent high-profile lawsuits – The largest anti-monopoly case in 40 years!

The verdict is to be announced next month.

The U.S. Department of Justice’s antitrust action against Google will begin trial in September. This case is the largest breakup case in U.S. history since the 1982 AT&T case. The trial is expected to last for 70 days and holds significant milestone significance. It will not only have a major impact on Google’s digital advertising business but also could potentially lead to its forced breakup.

The DOJ’s antitrust lawsuit alleges Google has monopolized the digital ad tech market violating the Sherman Act through practices like:

- Acquiring rivals like DoubleClick to eliminate competition

- Self-preferencing its ad products in search results

- Impeding rivals’ access to data and publisher adoption

What Does it Mean for the Stock?

If Google loses, potential remedies could include:

- Divesting parts of its ad tech business

- Ceasing self-preferencing

- Removing barriers for rivals

Consequences may involve:

- Forced breakup of businesses

- Billions in fines

- Barring anticompetitive practices

- Losing market share

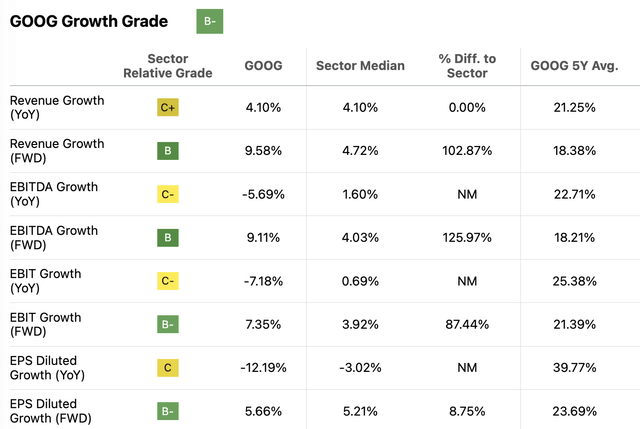

For Google’s stock, we attribute its historical growth to its monopoly power. Google has demonstrated resilient earnings growth, increasing its EPS at a low double-digit percentage rate over the past five years despite challenging macro conditions like the pandemic and high inflation.

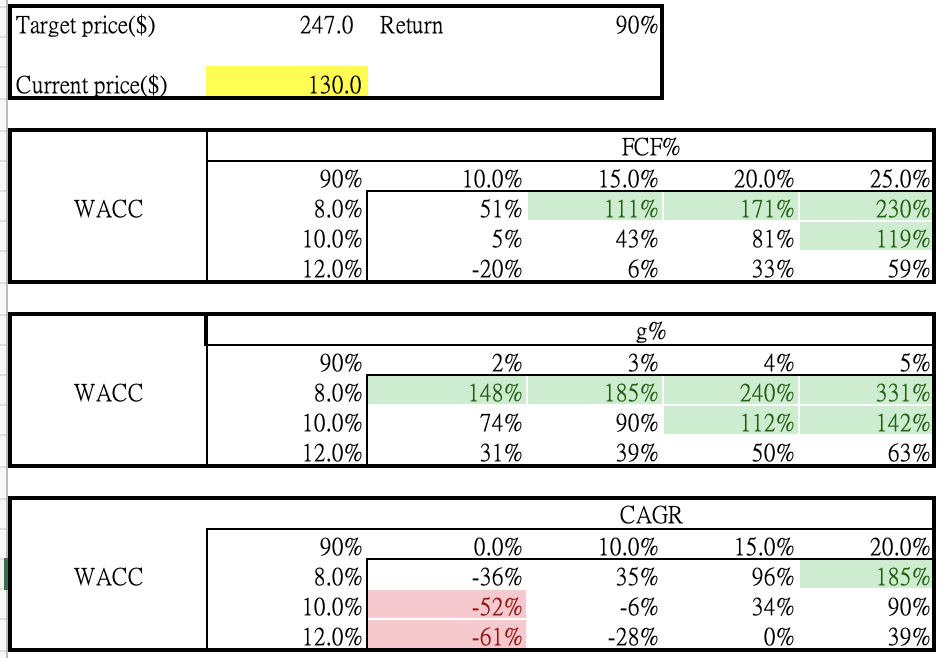

If its monopoly remains intact, we assume a 20% CAGR for the next 10 years and 3% terminal growth. With a 10% WACC and 21% free cash flow margin (FY2022), this suggests a $3.2 trillion market cap ($247 per share), indicating a 90% upside.

Even with a stressed 15% CAGR, our analysis shows 34% undervaluation.

Sensitivity test (LEL Investment)

Therefore, only outcomes significantly impairing Google’s monopoly power and growth could warrant a stock downgrade. For example, if regulatory impact cuts its CAGR below 10%, a downside is likely. We only see potential break-up as a major risk. Other remedies may have a short-term impact but not impede its enduring dominance.

Google’s AI Collaboration with Microsoft

We recently analyzed Google’s potential in AI and believe they have competitive products. However, Google’s recent partnership with Microsoft appears to be shifting the AI landscape. This alliance suggests Google sees its best interests as forming a duopoly with Microsoft to maintain leadership in AI.

Rather than compete head-to-head, Google likely aims to collaborate with Microsoft to entrench both companies at the top of the burgeoning AI sector. The partnership enables Google and Microsoft to set standards, amass resources, and ward off emerging rivals.

While Google’s technical capabilities remain strong, its motives now seem geared toward securing dominance through a two-player oligopoly. Teaming up with Microsoft allows Google to consolidate power instead of risking its supremacy in a more competitive, open AI field.

Looking ahead, the implications of the alliance will emerge as AI proliferates. But for now, Google seems intent on keeping its seat at the head table by cooperating with Microsoft rather than competing. Their pact aims to preserve the status quo and avert disruption of their privileged positions. The deal reflects the immense power big tech wields in steering the course of AI along mutually beneficial lines.

Negative: Exacerbating Income Inequality

The tech industry’s monopoly problem exacerbates income inequality trends. Tech giants amass huge profits, concentrating wealth at the top, while average wages stagnate.

This disparity is evident in tech salaries. The median IT professional earns $101,323 annually. But software engineers at Amazon and Google earn starting salaries of $168,535 and $212,617. These figures dwarf the $57,564 median income for full-time U.S. workers.

The tech wage gap illustrates the divide between the elite tech workforce and average earners. Tech monopolies hoard profits and lavish salaries on highly-skilled employees. Yet most workers struggle with stagnant incomes and declining purchasing power.

This growing canyon between the haves and have-nots highlights America’s deepening income inequality. Tech monopolies sit atop the winner-take-all economy while inequality rises. Addressing this imbalance requires tackling tech dominance and boosting broader worker incomes. If left unchecked, tech monopolies and income inequality will continue to rise in tandem, further polarizing the nation.

Conclusion

Tech investors have enjoyed strong gains from giants like Google. Our analysis shows Google’s stock still looks attractive on a valuation basis even amid the antitrust scrutiny.

However, the regulatory risks should not be discounted. As tech monopolies exacerbate income inequality and inflationary pressures, the political will to restrain their power grows. The widening wealth gap between tech workers and average Americans adds fuel to this fire.

While Google retains strengths that suggest an upside, the regulatory storm clouds appear to be gathering. We maintain our buy rating but advise monitoring legal and political developments closely. Though breakup risks seem remote now, the landscape could shift rapidly amid the backlash against Big Tech’s dominance.

Google faces resilient growth levers, but its privileged perch is increasingly precarious. Investors must weigh the company’s upside potential against its vulnerability to antitrust crackdowns. In the end, Google’s legal and regulatory challenges could pose underappreciated risks even for its formidable franchise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.