Summary:

- Search advertising revenues make up the bulk of Alphabet’s top line. As I had anticipated last year, growth has been strong. This is driven by strength in APAC Retail.

- But now, I see a slowdown in APAC Consumer Sentiment and weaker than expected Retail Sales activity in the US too. I expect this to affect Alphabet’s Q3 FY24 financials.

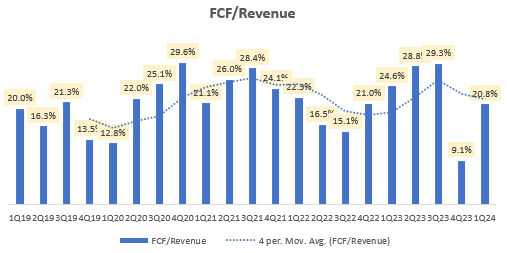

- Consolidation of team structures has led to headcount and office space efficiencies and hence higher operating margins. But I expect FCF margins to be lower due to AI tech spend.

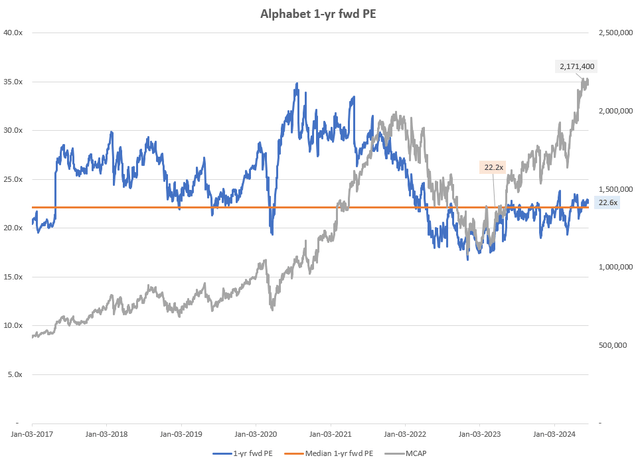

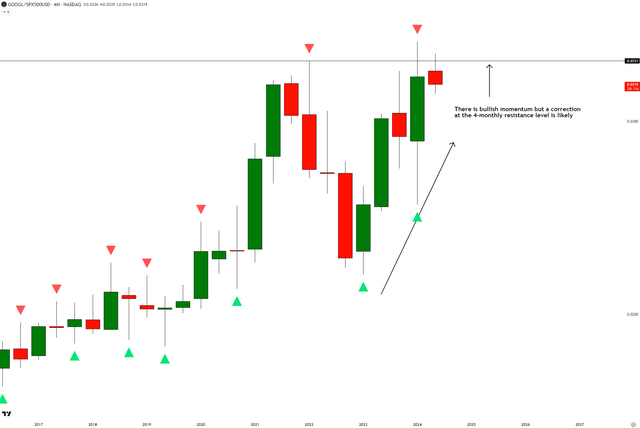

- At a 22.6x 1-yr fwd P/E, valuations don’t show a discount to make buys compelling. The technicals vs S&P 500 show a bull trend encountering 4-monthly resistance.

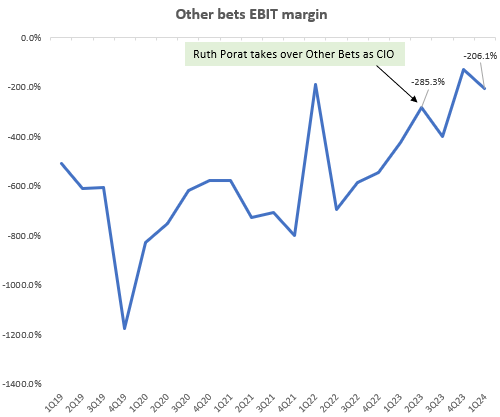

- I recognize upside risks if Other Bets’ EBIT margins breakeven, as this may sidestep FCF margin erosion. Also, the stock’s upside has so far been driven mostly by earnings growth. Multiple expansion in the stock is an upside risk.

brightstars/iStock Unreleased via Getty Images

Performance Assessment

I had a ‘Neutral/Hold’ stance on Google (NASDAQ:GOOG) (NASDAQ:GOOGL) in my last article. Since that update, Google has generated an active return over the S&P500 (SPY) (SPX) of +8.55%:

Performance since Author’s Last Article on Google (Author’s Last Article on Google, Seeking Alpha)

I consider that to be meaningful enough to call the ‘Neutral/Hold’ stance a bit of a miss.

Thesis

I’ve had an optimistic outlook on Google’s Search and Advertising business since mid-2023. That thesis has played out well so far. However, now I am getting some clues to believe some moderation may be hitting this core segment (which makes up 57.3% of overall revenues in Q1 FY24). Overall, I am maintaining my ‘Neutral/Hold’ stance based on the following:

- Search growth is driven by APAC Retail but that may be slowing down

- Alphabet may generate higher operating margins but FCF margins be lower

- Valuations don’t show a discount to make buys compelling

- Momentum is bullish but nearing a major resistance

Search growth is driven by APAC Retail but that may be slowing down

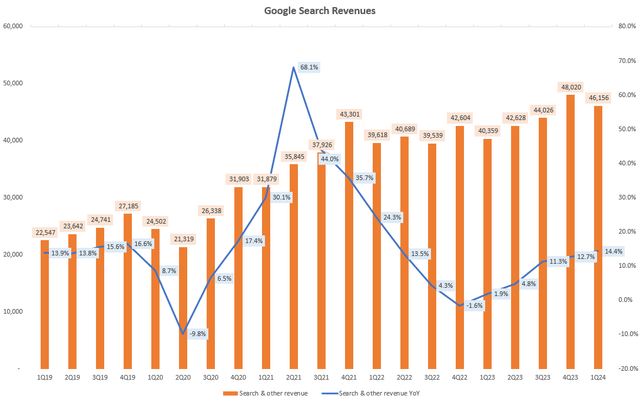

Google’s Search revenues have been growing well over the last 3-4 quarters:

Google Search Revenues (Company Filings, Author’s Analysis)

For multiple quarters now, the company has attributed much of the growth drivers here to be buoyancy from the Retail segment, which has boosted advertising revenues. Q1 FY24 was no different:

Search and other revenues grew 14% year-on-year led again by solid growth in the retail vertical with particular strength from APAC-based retailers, which began in the second quarter of 2023

– Chief Business Officer Philipp Schindler in the Q1 FY24 earnings call

As per my earlier anticipation, strength in APAC Retail has been present since Q2 FY23. And the CFO indicated that there is a 1 quarter lag for good conditions to flow through in the financials:

…strength in spend from APAC-based retailers, a trend that began in the second quarter of 2023 and continued through Q1, which means we will begin lapping that impact in the second quarter

– CFO Ruth Porat in the Q1 FY24 earnings call

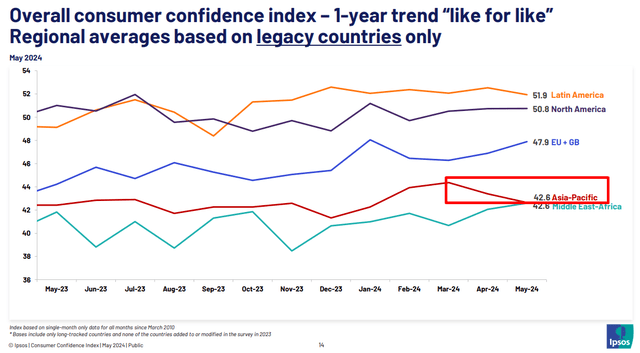

For the future outlook, however, I am getting a bit more cautious as I note a consistent and meaningful decline in APAC’s overall consumer confidence so far in Q2 CY24:

Falling Consumer Confidence in APAC in Q2 CY24 (Ipsos Global Consumer Confidence Index, Author’s Highlight)

As consumer confidence drives retail sales, this is not a good indicator of continued strength in retailers for driving Google’s advertising revenues. Also note that US Retail sales too came in lower than expected in May 2024.

Overall, I think this could contribute to weaker than expected Search revenues in Q3 FY24 (accounting for that 1 quarter lag impact).

Alphabet may generate higher operating margins but FCF margins may be lower

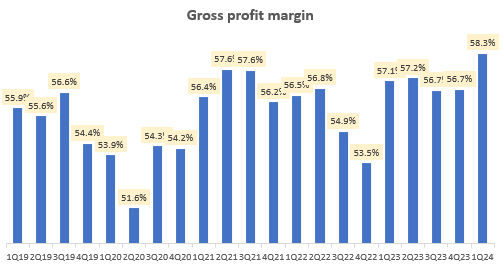

Alphabet has made great strides in improving its profitability over the last year. Gross margins have increased by 100-150bps:

Gross Profit Margin (Company Filings, Author’s Analysis)

I have excluded the one-time impacts of severance and office space costs in the gross margins calculation.

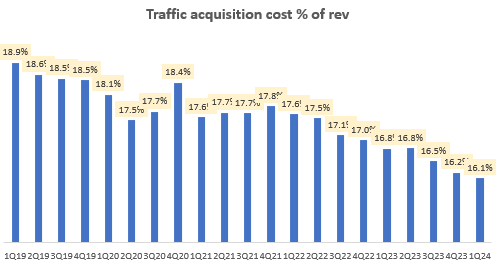

This is driven partly by a structural decline in lower traffic acquisition costs for their Search and Advertising business:

Traffic Acquisition Cost % of Revenue (Company Filings, Author’s Analysis)

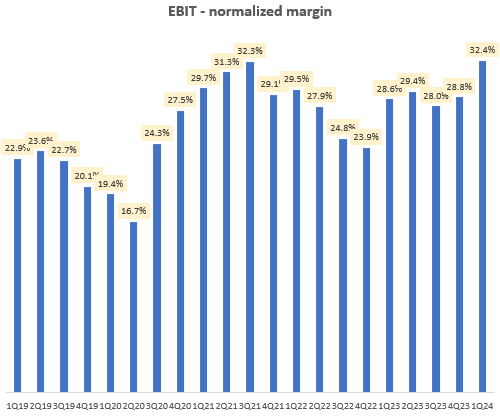

However, 150-200bps of margin improvement have come from good opex control initiatives:

Normalized EBIT Margin (Company Filings, Author’s Analysis)

I have excluded the one-time impacts of severance and office space costs in the Normalized EBIT margins calculation.

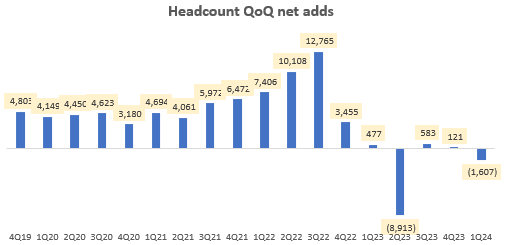

Alphabet is going into a more focused mode now as they simplify and consolidate team structures in Search, Google DeepMind and the Platform & Devices teams. These consolidations have led them to realize both headcount and office space efficiencies:

Headcount QoQ Net Adds (Company Filings, Author’s Analysis)

This discipline in headcount cost control is expected to continue as it has led to reduced new hiring intensity too:

You can also see the impact in the quarter-on-quarter decline in headcount in Q1, which reflects both actions we have taken over the past few months and a much slower pace of hiring

– CFO Ruth Porat in the Q1 FY24 earnings call

All these efforts are being taken to mitigate the impacts of higher depreciation and other expenses as the company invests in AI capabilities. Overall, FY24 operating margins are expected to be higher:

Looking ahead, we remain focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure. We believe these efforts will enable us to deliver full year 2024 Alphabet operating margin expansion relative to 2023.

– CFO Ruth Porat in the Q1 FY24 earnings call

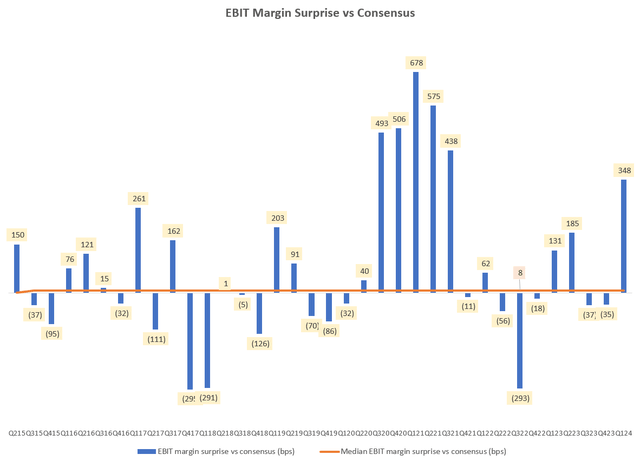

I am inclined to believe Porat’s outlook comments on margins as the company has a great track record in meeting consensus expectations since she took her post as CFO in 2015:

EBIT Margin Surprise vs Consensus (Company Filings, Author’s Analysis)

However, the higher $12 billion/quarter capex spends expected for the rest of FY24 would have an impact on free cash flow (FCF) margins:

FCF/Revenue (FCF Margin) (Company Filings, Author’s Analysis)

Despite operating margin expansion, I believe the company will print 500-600bps of lower FCF margins for FY24 and possibly beyond. I anticipate a FY24 exit FCF margin of around 23%.

Valuations don’t show a discount to make buys compelling

Google is currently trading at a 1-yr fwd PE of 22.6x, which is close to the median levels of 22.2x since 2017. Given the revenue headwinds and worse FCF margin profile expected, I don’t believe the buys have a compelling case at these valuation multiples:

Alphabet 1-yr fwd PE (Capital IQ, Author’s Analysis)

However, I do recognize an upside risk in the form of multiple expansion. So far, the 1-yr fwd PE multiple has been in a range whilst the market capitalization has increased. This suggests that most of the appreciation in company value has been due to earnings growth.

Momentum is bullish but nearing a major resistance

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of GOOGL vs SPX500

GOOGL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative ratio chart of GOOGL vs SPX500, I notice a healthy bullish momentum on the 4-monthly charts. However, the ratio prices are near a key resistance level, which I think may halt buyers’ progress for a while.

Profitability Improvement in Other Bets Can Be An Unexpected Source of Margin Upside

Since Ruth Porat became CIO and took over responsibility of the Other Bets segment, improving the profitability of Other Bets has been a key theme:

Other Bets EBIT Margin (Company Filings, Author’s Analysis)

Porat has delivered some improvements on this already. For a sense of scale, the EBIT contribution of Other Bets has improved from ~-6% to around -3.5% over the last 2 quarters. If Porat is able to move this piece to breakeven in a reasonable way, without sacrificing too much on future growth bets, then FCF margins may not need to erode at all despite higher capex spending. This is a thesis-changing monitorable I am tracking.

Takeaway & Positioning

Google Search Advertising revenues (57% of overall revenues) have been growing well for the past year, driven by higher activity in APAC Retail. However, I notice that APAC Consumer Sentiment figures have started to fall so far in Q2 CY24. Combined with weaker than expected Retail Sales performance in the US, this makes me cautious about growth falling short of expectations in Q3 FY24.

On the margins side, the company has been doing an excellent job in improving both gross margins and operating margins through a mix of focus initiatives that have led to consolidation of major business units. This exercise has enabled Alphabet to find efficiencies in their use of both labor and office space. However, I believe the operating margin expansions that result from these efforts may not be enough to offset a FCF margin decline due to higher capex spending on AI infrastructure. That said, I do recognize upside risk here if CIO Ruth Porat is able to get the Other Bets segment to breakeven as that would sidestep FCF margin erosion.

From a valuations’ perspective, the company is trading at its longer term median multiple of around 22x 1-yr fwd PE. For incremental buys, I would prefer a bit of a discount given the headwinds I anticipate in Google Search and also lower FCF margins. Technically, the stock relative to the S&P500 is on a bullish trend but near a key 4-monthly resistance level. This may halt the buyers’ progress for a while.

Hence, overall, I am maintaining my rating of ‘Neutral/Hold’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.