Summary:

- Google’s efforts to durably reengineer its cost base, enabling it to expand operating margins even when it is investing in the future of the business.

- Google Cloud continues to benefit from cloud migration, and it is seeing market share gains and an increasing contribution from AI.

- AI will be a key long-term growth driver for Google, and the company is integrating generative AI into most parts of its business.

- Most of Google Cloud’s top 100 customers are already using its generative AI solution.

- While it is early days in terms of seeing the returns on investment on AI capital expenditures, management underscored that for Google, the risk of under-investing is dramatically greater than the risk of over-investing.

da-kuk

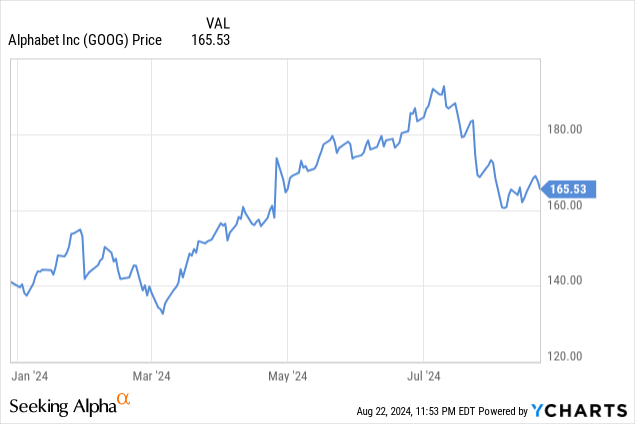

While the threat of OpenAI and generative AI has been a headwind for Google (NASDAQ:GOOG) (NASDAQ:GOOGL), the stock has done relatively well with a close to 20% year-to-date gain.

In this article, I will explore whether the opportunity set still looks attractive for Google, and whether the company is doing enough to offset the competitive challenges and stay relevant in the transition towards AI.

Specifically, I will focus on Google’s efforts to reengineer its cost base, its continued success and market share gains within Google Cloud, and its huge focus and investments into new generative AI features across its products.

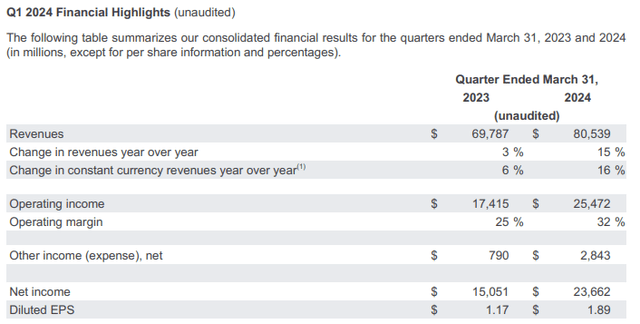

2Q24 results

Google produced strong 2Q24 results.

Total revenues came in $84.7 billion, growing +15% from the prior year from a constant currency perspective, coming in 1% above consensus.

Total operating income of $27.4 billion, or 32.4% operating margin, was 4% above consensus.

GAAP EPS of $1.89 came in above consensus of $1.84.

Now zooming in on Search business.

Search & Other revenues came in at $48.5 billion, up +14% from the prior year and 2% above consensus.

YouTube advertising revenue came in at $8.7 billion, up +13% from the prior year, 3% below consensus.

Aggregating all the sub-segments within Search, Google Services gross revenue came in at $73.9 billion, growing +11.5% from the prior year and 0.5% above consensus.

Google Services GAAP Operating Income reached 40.1% margin and coming in 7% above consensus.

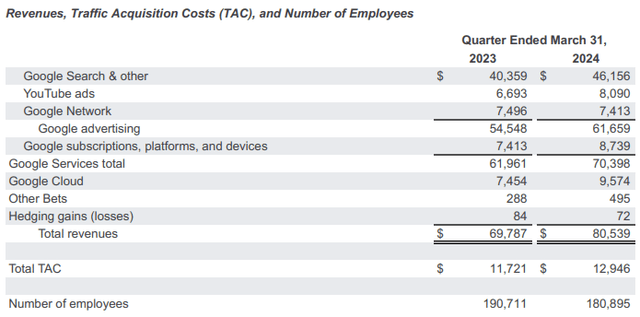

Breakdown of revenues (Google)

Durably reengineering its cost base

One of the reasons Google has done so well is that it has been able to demonstrate that it has the ability to durably reengineer its cost base amidst increasing investments in AI.

Google’s expansion of margins in 2Q24 demonstrated its ability to “durably reengineer its cost base”, a term often used by Google management in prior earnings calls.

The focus to durably reengineer its cost base is to either reduce spending in some areas or moderate expense growth in other areas so that Google has more capacity to invest in technical infrastructure needed for Google Cloud and AI.

In particular, as more investments are made in technical infrastructure, the depreciation and expenses associated with these investments into the technical infrastructure will grow.

Google’s operating margin guidance for 2024 is to expand operating margin relative to 2023, and this was once again reiterated in 2Q24.

To achieve an expansion in operating margins when the company is investing in technical infrastructure, Google therefore needs to durably reengineer its cost base.

As evidence for Google’s focus on durably reengineering its cost base. It reduced headcount in the second quarter of 2024, and also slowed the pace of hiring, both of which are actions which the company has been taking for most of the first half of this year.

That said, there will be a slight increase in headcount in the next quarter as Google brings in new graduates and invests in the top engineering and technical talent in cloud and technical infrastructure.

Management also shared that next quarter’s operating margins will be affected by pulling forward of hardware launches into the third quarter, higher levels of depreciation and expenses associated with the investment in technical infrastructure.

In the most recent quarter, we saw Google’s capital expenditures come in at $13 billion, which was overwhelmingly driven by its investment in technical infrastructure, with the largest component being servers and second-largest being data centers.

Management expects quarterly capital expenditure to be around the same level as the first quarter’s capital expenditure of $12 billion.

Google will commit $5 billion in a new multi-year investment into Waymo to continue to invest in its technical leadership and improvement in operational performance. To be clear, this level of investment is consistent with recent annual investment levels into Waymo.

Google CFO Ruth stated that there are more ways in which the company can improve cost efficiency and, thus, its cost base. This includes product and process prioritization, which has been reflected in Google’s hiring and headcount numbers. Google has been unifying teams, like the devices team, services team and platforms and ecosystems team, to help with product execution, and this has helped with efficiency and velocity at Google. In addition, Google is working to improve efficiency around technical infrastructure, use of AI to improve efficiency across the organization and optimize its real estate portfolio.

In my opinion, this durable reengineering of Google’s cost base is something that is not often mentioned in the mainstream press, but it has a considerable impact on helping the company grow its operating margin despite growing capital expenditures into AI. As such, these actions taken by Google is helping to ensure that it is a leaner and more efficient organization while having more financial resources to invest in the future growth of the business. At the same time, it should provide some chances of a decent upside surprise to operating margins if management is able to improve efficiency by a larger than expected margin.

Google Cloud acceleration and focus on AI

The Google Cloud business accelerated in the second quarter to grow 29% from the prior year.

This growth was higher than the average growth rate within the cloud industry, illustrating market share gains.

In addition, Google saw an increasing contribution from AI.

With the acceleration in cloud, new AI demand is likely one of the factors that drove this. Most of Google Cloud’s top 100 customers are already using its generative AI solution, so clearly this increasing adoption of AI solutions is helping accelerate growth in cloud.

Generative AI offensive

Google is attacking on all fronts within generative AI.

Even within Search, Google’s newly introduced AI Overviews are seeing positive progress.

AI Overviews are driving increased Search usage & higher user satisfaction, with stronger engagement from 18- to 24-year-olds. Users who are looking for help with complex topics are engaging more and keep coming back for AI overviews.

Google continues to emphasize that ads are increasingly placed either above or below AI Overviews, providing options for users to connect with businesses. Google also shared that Shopping ads will soon be tested in AI overviews as well.

Continuing within Search, generative AI has been embedded in multiple other products. For example, within Google Lens, visual search is enabled, and you can even ask questions by taking a video on Google Lens. Another feature that is recently made available to Android devices is the Circle to Search feature.

Google announced 30 new AI-driven ads features & products during 2Q to bolster ad creation, Pmax, Shopping campaigns, workflows.

Google also noted that it is leveraging different sized LLMs to optimize costs around queries and not to overpower AI Overviews.

Google is innovating and investing in every layer of the AI stack.

Google expects Nvidia’s Blackwell platform to be delivered to Google Cloud in early 2025, while it continues to invest in TPUs. Trillium is the sixth generation of Google’s custom AI accelerator, and it achieves almost 5 times increase in peak compute performance per chip than the TPU v5e, and it is 67% more energy efficient compared to TPU v5e.

Within the models space, Gemini has been used by more than 1.5 million developers, and it now comes in four sizes, each with its own use cases.

In fact, Gemini makes Google’s own products even better. All six of Google’s products with more than 2 billion monthly users now use Gemini.

In my opinion, Google Cloud continues to be well positioned to gain market share, and with the investments made into AI, the AI features released by Google across its products will help improve relevance of its products while bringing innovation to the market, which will help its businesses in the long run.

ROI of AI capital expenditures

One of the more interesting questions from the earnings call was a question about whether the hyperscalers like Google are overbuilding AI capacity and the return on invested capital with the AI capital expenditure cycle.

I think this is a very valid question and one that has been on my mind since we saw hyperscalers pile in on Nvidia’s hardware.

Google’s answer here is three-pronged.

First, AI is a very transformative technology, and we are clearly at an early stage today, but with AI being a huge opportunity in the future, there is a need to aggressively invest upfront, especially when AI is utilized across Google’s own products like Search, YouTube and other services, while at the same time fueling growth in the Cloud business.

Second, because it is a huge opportunity and transformative technology, according to Google CEO Sundar Pichai, “the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing”. In short, to not invest in such an opportunity could have a more significant downside for Google.

Thirdly and finally, the AI infrastructure buildout is useful for its own business and thus, can be applied to improve its own businesses while having long useful lives. On top of that, as you will see in the durably reengineering the cost base segment, Google is looking to improve the efficiency around its technical infrastructure spending, and as such, ensure that every dollar it spends is worthwhile.

Valuation

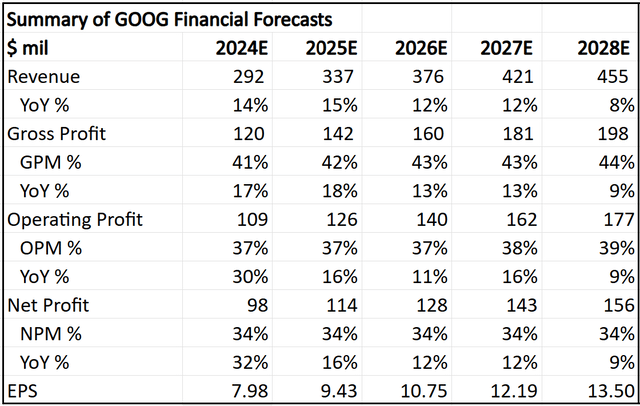

My 5-year financial forecasts for Google can be found below.

The revenue CAGR over the 5-year period is 12%, while the EPS CAGR over the 5-year period is 16%. This is based on the global search advertising market growth CAGR of 8%, with an expectation that Google will continue to outpace the industry given efforts to drive AI improvements in the business. The higher EPS CAGR of 16% relative to the revenue CAGR is due to the reengineering of the cost base, which was mentioned extensively above, and operating leverage in the business.

Summary of 5-year financial forecasts (Author generated)

My intrinsic value for Google is $172.

The key assumptions here include a terminal multiple of 20x and 11% cost of equity. The 20x terminal multiple is reasonable here given that Google has been trading at a 30x 5-year average P/E, but with the slower growth rate from 2024 to 2028 compared to the prior five years, I assumed a more conservative 20x terminal multiple to Google.

My 1-year and 3-year price targets are $189 and $244, which imply 20x 2025 and 20x 2027 P/E multiples, respectively. Again, these multiples are reasonable in my view given what was mentioned above.

Conclusion

Google, like all other hyperscalers, was scrutinized for the returns on investment on its capital expenditures, specifically, the large amounts being spent on AI.

The message that Google is trying to convey is that the risk of under-investing is dramatically greater than the risk of over-investing, and that the buildout of AI infrastructure has long useful lives that can benefit the company for many years to come.

On top of that, Google is durably reengineering its cost base so that its operating margins are not hurt by the growing investments in capital expenditures.

In addition, Google is attacking on all fronts within generative AI, launching new AI features across its products to ensure that it stays relevant and grow its advantage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.