Summary:

- Alphabet’s shares are under pressure due to regulatory issues and AI competition fears, but these concerns are overblown, presenting a buying opportunity.

- Alphabet’s valuation is undemanding, trading at a discount to the market and its historical norms, despite strong business growth and a robust financial position.

- Alphabet’s search business remains dominant and growing, with ChatGPT posing minimal threat; regulatory issues are unlikely to have a significant long-term impact.

- Risks include potential antitrust impacts and macroeconomic downturns, but Alphabet’s strong cash position and diversified revenue streams offer substantial protection.

Klaus Vedfelt

Article Thesis

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) has recently seen its shares come under pressure due to legal battles with regulators and due to worries about what ChatGPT might mean for Alphabet’s search business in the future. But I believe that these risks are overblown. At the same time, Alphabet now trades at a very undemanding valuation while continuing to deliver highly attractive business growth. I believe that this presents a nice buying opportunity in this high-quality stock — it’s time to be greedy when others are fearful, as Warren Buffett has taught us.

Past Coverage

I have covered Alphabet here on Seeking Alpha several times, most recently in April. Close to half a year has passed since then, with Alphabet reporting quarterly earnings results for Q2 in the meantime, while GOOG’s valuation has also come down. Last but not least, regulatory issues have progressed, which is why it’s time for an upgrade.

Why Being Greedy When Others Are Fearful Can Make Sense

The above phrase is used by Warren Buffett, one of the best-known and most successful value investors in the world. Markets tend to overreact from time to time, both to the upside and to the downside. Good news can result in very substantial share price gains in some cases, but it may turn out that these gains were overblown — think, for example, about the COVID vaccine gains for Moderna (MRNA), BioNTech (BNTX), and Pfizer (PFE). They all have seen their shares fall substantially, as their valuations were too high as the market was greedy. In a similar manner, markets can also be too fearful. Meta Platforms (META) saw its shares crash not too long ago when the market feared that the company was overspending on its metaverse investments. But the company corrected its course, and profits soon soared again. Those that used the panic to buy shares on the cheap when the opportunity arose have seen their investments grow by hundreds of percentage points in a short period of time. When markets are irrationally bearish on a quality stock, that can make for a great buying opportunity. I believe that this holds true for Alphabet today.

What The Market Fears

Over the last two months or so, Alphabet has seen its shares pull back from a 52-week high of $193 to the $140s, making for a very substantial pullback. This was not driven by weak results — quite the contrary, as Alphabet beat estimates easily when it reported its Q2 results a couple of weeks ago. The share price pullback also wasn’t driven by negative analyst revisions. As Seeking Alpha explains, the majority of revisions for both Alphabet’s top line and its bottom line were upwards over the last three months, with more than 30 upwards revisions for both lines in that time frame.

Alphabet’s weak share price performance in the recent past was thus neither driven by weak results in the present nor by expectations for weaker results in the near term. Instead, it looks like investors have some rather vague worries about competition from Artificial Intelligence-driven search, while political and regulatory worries exist as well. Let’s take a closer look:

ChatGPT has made a big splash around two years ago. The Large Language Model has a weekly active user base of around 200 million, which is a success for OpenAI for sure. They don’t seem to use the service very often, however, as monthly web hits total around 2.4 billion, which pencils out to around 80 million per day. Google, meanwhile, is used for 22 billion searches per day. When we compare to web hits that ChatGPT gets per day with the searches done via Google, the latter number is around 275x larger. While ChatGPT is a success for OpenAI, it is still abysmally small compared to Google Search. And Google Search is just one of Alphabet’s many business units, with YouTube, cloud computing, and so on providing additional revenue.

During the most recent quarter, Alphabet’s revenue was up 15% in constant currencies, with growth accelerating from the previous year when the growth rate had been 9%. Google Search revenue was up 14% year over year during the most recent quarter, showing an in-line growth rate compared to the rest of the company (company-wide reported revenue was up 14%, there was a small currency headwind). Despite the interest that some have in ChatGPT, it does not look like ChatGPT is hurting Alphabet’s Search business at all — Search is many times bigger, and continues to grow. With growth even accelerating, there is, I believe, little reason to worry that Google Search will run into major problems. In a growing market, both ChatGPT and Google Search can grow, with the latter growing from a way higher base.

Also, it’s important to note that Alphabet has its own Large Language Model. Even if LLMs were to gain massive market share, Alphabet would likely not be left out, as Alphabet’s Gemini would likely be among the successful LLMs should such a scenario occur.

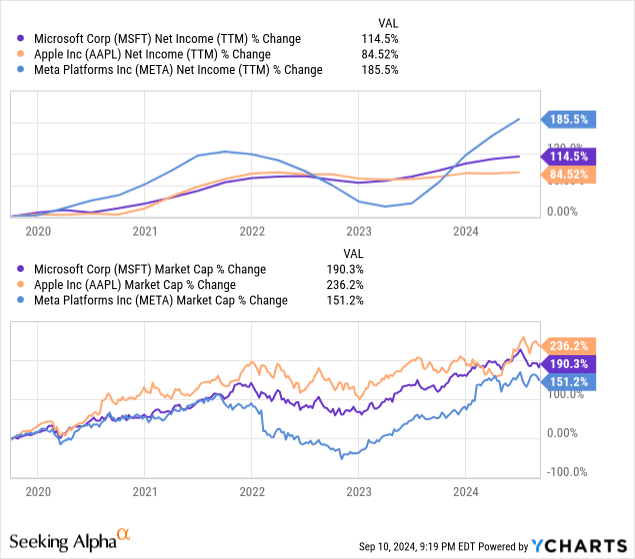

Some investors are also worried about regulatory issues. Alphabet is being attacked by the DoJ over its Google advertising business, with the DoJ claiming that Google is illegally operating a monopoly. There have been many antitrust cases against Big Tech companies in the past, including Microsoft (MSFT), Meta Platforms, and Apple (AAPL), but these cases never hurt these companies meaningfully in the long run. These companies did not get split up, nor did profits fall — quite the contrary: Microsoft, Apple, and Meta Platforms are more valuable and more profitable than they have ever been:

At least in the past, antitrust cases were thus more of a nuisance than a real threat for Big Tech companies. I believe that there is a good chance that the same will hold true for the current antitrust case against Google. And even if the trial is successful and the DoJ wins, I assume that there would be some minor concessions. Alphabet also could be forced to pay fines, but even a multi-billion dollar fine would not be an issue at all — Alphabet sits on $101 billion of cash. Would a fine of $1 billion, $5 billion, or even $10 billion be a negative development? Yes, that would be true. But it wouldn’t be a threat for the company — Alphabet’s investors would likely not even notice, after all, there is no huge difference between a $101 billion cash position and a $91 billion cash position. Alphabet’s operating cash flow totaled $105 billion over the last year, thus even a hypothetical fine of $10 billion would be equal to just a couple of weeks worth of cash flows.

Alphabet: A Great Deal

Alphabet combines many positives: An excellent market position in the cash cow Search market, a strong position in the fast-growing cloud computing space, a fortress balance sheet, strong business growth, and tight cost controls that make its margins grow higher and higher.

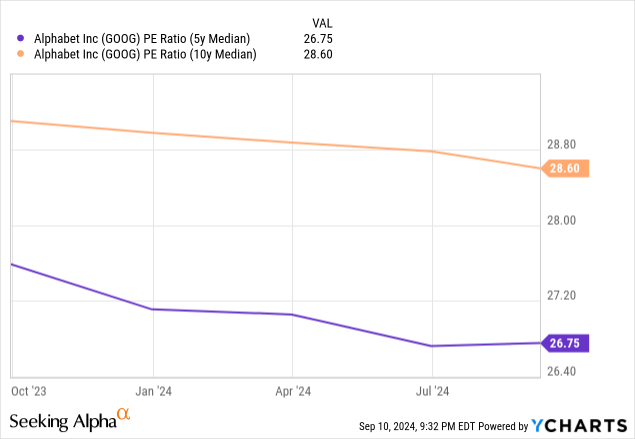

And yet, Alphabet is a pretty cheap stock, I believe. Based on current estimates for this year, Alphabet trades for just below 20x forward net profits. When we consider that the company has a clear history of beating estimates with six earnings per share beats in a row, it would not be too surprising if the consensus earnings per share estimate for 2024 is too low, which would result in an even lower valuation. When we consider Alphabet’s sizeable net cash position, the cash-adjusted earnings multiple is lower as well. But even without these adjustments, Alphabet trades at a sizeable discount compared to the market and its own historic valuation norm. The S&P 500 trades at around 26x 2024’s expected profits right now, meaning Alphabet trades at a discount of around 20%. In terms of brand strength, business growth, margins and returns on capital, and so on, Alphabet seems like an above-average quality company for sure. The fact that it nevertheless trades at a huge discount to the broad market is thus surprising.

In the above chart, we see that Alphabet was mostly trading with a mid to high-20s earnings multiple in the past. The current sub-20 earnings multiple is thus historically low.

Overall, I believe that Alphabet’s very undemanding valuation, in combination with its various strengths and compelling growth outlook, makes shares look attractive.

Risks To Consider

No investment is risk-free, and that also holds true for Alphabet. It is possible that this antitrust case is different compared to other Big Tech antitrust cases and that there will be a major impact, although I don’t see this as very likely. Even if the company were to be split up, the sum of the parts would still be highly valuable, of course.

During a potential recession, advertising budgets could get cut, which would have a negative impact on Alphabet’s advertising business. Alphabet is thus not completely resilient versus macro troubles, although its huge cash pile would offer a lot of protection in any downturn, I believe.

Alphabet is spending large sums of money on its AI ventures, which includes the purchase of NVIDIA’s (NVDA) AI data center chips. It is possible that the return on this investment will ultimately be unattractive. In that case, Alphabet would have burned a significant sum of money, although this would not be a company-threatening problem at all.

These risks shouldn’t be ignored, and it makes sense for investors to keep an eye on them. That being said, I believe that the potential rewards outweigh the risks — when a high-quality growth company is on sale and trades at a huge discount to its historic valuation norm and to the broad market, it makes sense to be greedy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!