Summary:

- In Q2 2024, Google was able to beat the EPS and revenue estimate by a good margin, but the stock has been one of the worst performers.

- Google’s ad growth has been very modest compared to the numbers delivered by Meta and Amazon, which shows that the company is losing its market share in this segment.

- It is important to look at the ad-free subscription growth on YouTube and adjust the ad revenue projections accordingly.

- Alphabet’s Cloud and Waymo bet are showing strong progress, and we could see a growth inflection as new AI tools are launched.

- Alphabet stock is trading at 16.5 times the EPS estimate for the fiscal year ending 2026, which is the cheapest among big tech players and the current correction gives long-term investors a better entry point.

vzphotos

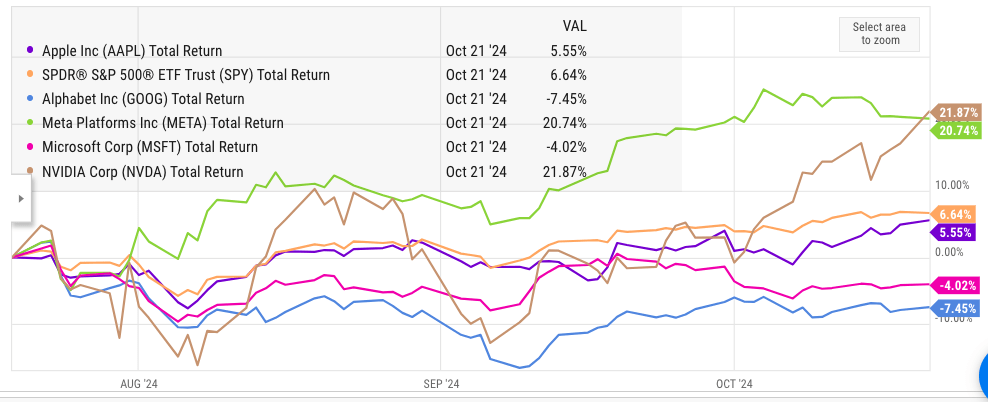

Alphabet (NASDAQ:GOOG) stock has been the worst performer since the Q2, 2024 earnings season. The stock shows negative 7.5% total returns compared to 20% returns in Meta (META) and Nvidia (NVDA). It is also lagging S&P 500 which showed 7% total returns in the last three months. Google was able to easily beat the EPS and revenue estimate in Q2 2024. However, Wall Street seems to focus on the ability of big tech companies to deliver returns on their massive AI investment. Meta has quickly built good AI tools that have helped advertisers and increased revenue growth for the company. This has led to a more bullish trend in Meta. In the upcoming earnings on Oct 29th, Google will need to show a clear path to generating returns on its AI investments. In the previous article, it was mentioned that Google’s stock will likely face challenges in the short term due to these investments.

It is very important to gauge the subscription growth in YouTube Premium. The ad-free subscription will inevitably have a negative impact on the ad growth of YouTube. We should also look at the strong progress of Waymo, which is rapidly becoming the main autonomous play in this segment. Tesla’s (TSLA) Cyber Day has not been received well by Wall Street, as the timeline for launch of these services is not guaranteed.

Investors looking for an entry among stable big tech companies will find Alphabet stock to be one of the cheapest. The EPS estimate for the fiscal year ending 2026 is $10 which gives the stock a forward PE ratio of 16.5. On the other hand, Apple (AAPL) is trading at close to 28 times the EPS estimate for fiscal year 2026. This makes Apple stock a whopping 75% more expensive than Alphabet. There is a better growth runway for Alphabet due to its cloud, subscription, Waymo, and other initiatives making it a Buy at current price.

Beating estimates might not be enough

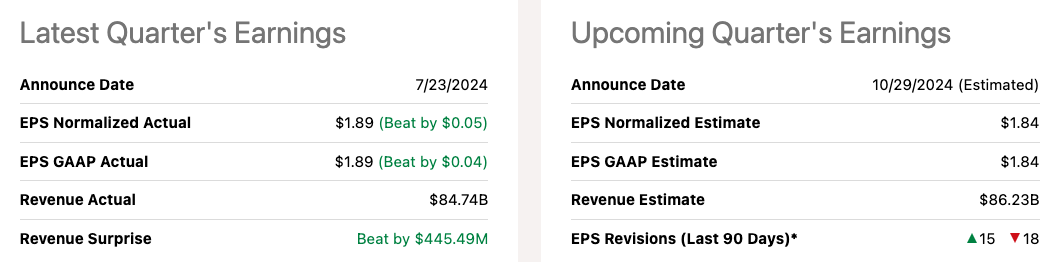

Alphabet was able to beat EPS and revenue estimates in Q2 2024, but the stock has not performed well since the last earnings. One of the remarks on AI by the CEO has particularly worried Wall Street when he mentioned that “underinvesting in the technology is a larger risk”. Google’s CapEx has increased significantly as the company buys expensive chips to boost its AI services. These services have not delivered a big growth momentum till now. The management hopes that over the next few quarters, new AI tools and services can be monetized to deliver the returns expected.

Ycharts

Figure: Alphabet’s poor performance since the last earnings seasons. Source: YCharts

Besides the key metrics, Wall Street will also closely watch the comments from top executives of Alphabet. It is important that they provide some prudent direction about the future investment in AI chips.

Seeking Alpha

Figure: Alphabet’s key metrics in Q2, 2024. Source: Seeking Alpha

In the previous earnings, Meta’s top management was able to clearly show the impact of AI services on its ad business. This is one of the main reasons behind Meta’s bullishness and its strong YTD performance. Earlier this year, Google stumbled during the launch of new AI services. However, on the positive side, none of the doomsday predictions for Google Search in the AI era have remotely been correct. Google Search continues to control a massive market share in its segment, and Microsoft (MSFT) or other competitors have not been able to gain a good market share in search despite massive AI investments and new tools.

This shows the strong moat for the company and should improve the long-term valuation multiple for the stock. A lot depends on the management’s comments on the upcoming earnings. I believe that Google could show decent results in the earnings call because all the core services continue to see good demand and a positive macroeconomic climate. A reliable roadmap about future AI investment returns should be enough to deliver a more bullish sentiment towards the stock.

Ad revenue and other initiatives

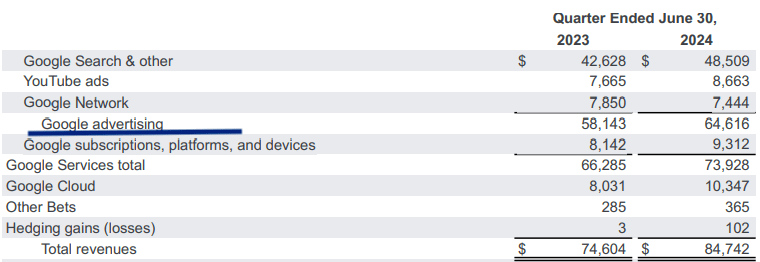

Google’s ad revenue growth has also been very modest in the last quarter. Google reported 11% YoY revenue growth in ad sales, compared to 20% YoY growth by Amazon’s (AMZN) advertising segment and 22% YoY growth by Meta. This means that Google is losing market share in the digital advertising segment. Google has recently replaced its top executive for the search business. The company seems to be taking its core search business seriously and is launching new AI tools for advertisers in order to improve the growth momentum in this segment.

Google Filings

Figure: Modest growth in the advertising segment of Google in Q2, 2024. Source: Google Filings

However, we should also look at the recent growth of subscriptions for ad-free YouTube Premium service. Earlier this year, Google announced reaching 100 million subscribers for YouTube Premium. YouTube Premium has likely overtaken Apple Music in subscriber count and continues to show strong growth potential. Faster growth in YouTube Premium will likely be a headwind for YouTube ads in the near term, but it will provide a more stable revenue for the company. A good subscription base should also allow Google to monetize new services.

Waymo has recently announced that it is completing over 100,000 paid robotaxi trips weekly. This is twice the rate from an earlier announcement a few months back. Waymo is rapidly expanding its services and has received good reviews from customers and regulators for its safety and operations. Tesla’s recent Cyber Day has once again disappointed Wall Street. GM’s (GM) Cruise had earlier failed in its robotaxi service, which shows that it is not easy to reach adequate safety levels. It is possible that Waymo will gain a significant market share in autonomous driving over the next few quarters. This should rapidly increase the revenue base of this service and also improve the bullish sentiment towards the stock. I believe Waymo could reach 1 million paid robotaxi trips weekly by the end of 2025. At this rate, Waymo could report over a $1 billion annualized revenue by the end of next year.

Alphabet stock is the cheapest among its peers

Investors looking to buy a stable big tech company will find Alphabet as one of the cheapest options in terms of valuation multiples. Alphabet’s consensus EPS estimate for the fiscal year ending Dec 2026 is $9.99. The stock is currently trading at 16.5 times the EPS estimate for fiscal year 2026. This is a modest level for a company showing rapid EPS growth and a strong moat.

Seeking Alpha

Figure: EPS estimates of Alphabet for the next few years. Source: Seeking Alpha

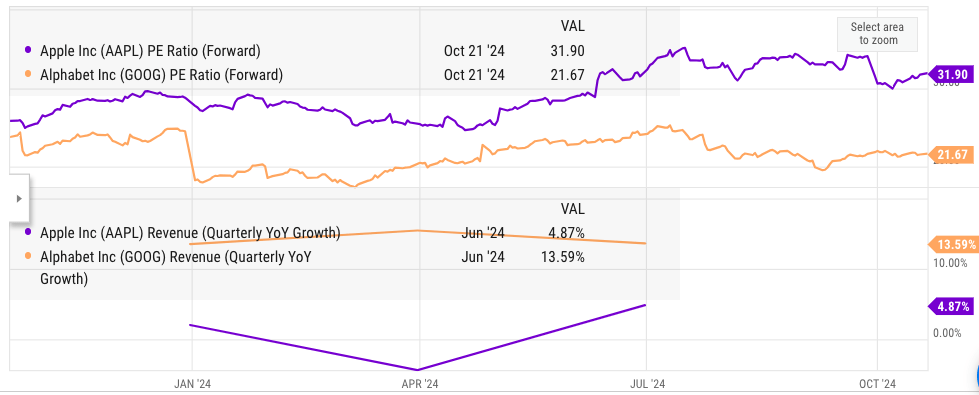

On the other hand, Apple’s EPS estimate for fiscal year 2026 is $8.3 and the stock is trading at 28 times this estimate. Hence, Apple is trading at a whopping 75% premium to Alphabet stock when we look at the forward PE ratio. Apple’s growth momentum is significantly lower than Alphabet. Alphabet’s forward growth runway is quite strong with rapidly growing services like Cloud, subscriptions, Waymo, and others.

Ycharts

Figure: Forward PE ratio and YoY revenue trajectory of Alphabet and Apple. Source: YCharts

One of the risks for Alphabet is that its massive investment in AI takes longer than expected to give the desired returns. However, the company has the resources and talent to deliver good AI tools and services over the next few quarters. The current price provides a good entry point for longer-term investors who can ride out short-term volatility in the stock.

Investor Takeaway

Alphabet delivered good results in Q2 2024, but the stock has underperformed S&P 500 and other peers. The modest growth rate in ad revenue is one of the headwinds for the company, but we have also seen a strong growth in subscriptions, which builds a more stable revenue stream for the company. If the ad revenue growth in the upcoming quarter exceeds expectations, we could see a better sentiment towards the stock. The management will also need to provide a clear roadmap for future AI investment.

Alphabet stock is trading at only 16.5 times its EPS estimate for the fiscal year ending Dec 2026. This is quite modest when we compare it to Apple, which is trading at 28 times its EPS estimate for fiscal year 2026. A strong growth trajectory in Cloud and other services should improve the margins for Alphabet, which can also lead to upward revisions of EPS, making it a good option at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.