Summary:

- Alphabet continues to show resilient revenue growth and robust margins.

- Google Cloud generated a surprise profit and remains unrepresented by the stock valuation.

- The company is aggressively repurchasing shares and has over $100 billion in net cash.

- I outline the path to well over 50% potential upside based on conservative assumptions.

SpVVK

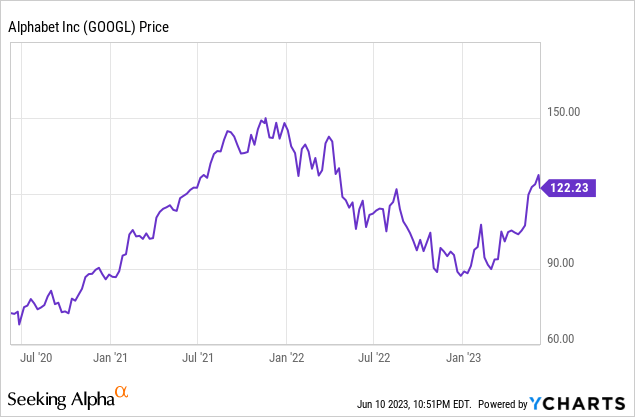

Despite a recent rally, Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) stock continues to trade at a discount relative to some of its mega-cap tech peers. While the company is showing resilient fundamentals and a willingness to continue repurchasing its cheap stock amidst a tough macro environment, Wall Street seems to remain skeptical, fearful of the threat that Microsoft (MSFT) may pose to its core search business. It may be tempting to allow that fear to dominate the narrative, but GOOGL is a strong operator of its own and one that has proven very willing to invest aggressively for long term growth. It is too simple to assume that MSFT can easily win market share due to AI developments, as GOOGL has substantial AI ambitions of its own along with other long term growth projects. GOOGL remains one of my top picks and one of my largest holdings in my portfolio today – I reiterate my strong buy rating.

GOOGL Stock Price

During a period in which peers like MSFT and Meta Platforms (META) have continued to soar, GOOGL is still trading range-bound.

I last covered GOOGL in March, where I rated the stock a buy despite rising fears related to ChatGPT. It appears that such fears have consumed investors as the stock continues to trade at deeply discounted valuations in spite of very visible improvements in the fundamentals.

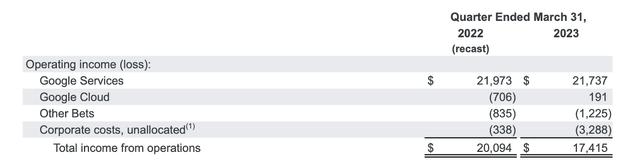

GOOGL Stock Key Metrics

In the most recent quarter, GOOGL generated 3% YOY revenue growth (6% constant currency), representing a significant beat over consensus estimates. GAAP diluted EPS declined by 4.9% YOY but that was mainly due to unrealized gains and losses of its investment portfolio. Excluding those non-cash line items, EPS was flat year over year.

Google Cloud revenues showed strong growth, growing 28% YOY, but the most significant detail is that this segment generated a surprise $191 million profit. Google Cloud has historically been a loss generator for the company and that lack of profitability has made it appear inferior to the cloud offerings of MSFT and Amazon (AMZN) in the past. Given this inflection in profitability, I was quite surprised by the lack of enthusiasm on the Street.

On the conference call, management noted that they are seeing the same cloud optimization headwinds as other cloud operators and that it was “uncertain” when such headwinds would moderate. Yet much of the attention was placed on their artificial intelligence offerings and how they might compete against those of MSFT. In stark contrast with MSFT, management stated that they would introduce AI to their products in a “thoughtful and deliberate way.” That is not obviously a bad decision, but it appears that the market instead was hoping for GOOGL to take a more aggressive approach like that of MSFT.

Management outlined their various initiatives to increase operational efficiencies, a topic one would have expected to resonate with investors. Management noted that they are finding efficiencies in data centers by “redistributing workloads and equipment where servers aren’t being fully used.” Management also noted efforts to improve external procurement and manage their real estate portfolio.

GOOGL’s previous 6% layoff dwarfs in comparison to those seen at META or AMZN, but still represents a clear commitment towards driving operational efficiencies. Management noted that investors should see some of the benefit of their efficiency efforts this year with more of the benefit seen next year. I am of the view that GOOGL has taken a more balanced approach than some in the current environment – aiming to drive some operational efficiencies to appease investors while still investing aggressively in long term growth ambitions.

Is GOOGL Stock a Buy, Sell, or Hold?

At recent prices, GOOGL might not look obviously cheap, but the value is apparent, with the stock trading at around 23x earnings versus double-digit growth in the years to come.

GOOGL continues to benefit from the secular growth story of online advertising, generates strong profit margins and is returning all of free cash flow to shareholders through share repurchases. Those attributes are arguably worthy of a PEG ratio more around 2x, implying upside of nearly 50%.

But GOOGL stock is cheaper than it appears. Valuing GOOGL on the basis of earnings is implicitly assigning a negative value to any loss-generating businesses, including Google Cloud and the Other Bets. Excluding those losses would increase earnings by roughly 10%, leading the PE ratio to decline to around 20.5x. GOOGL also has $115.1 billion in cash and $31.2 billion in non-marketable securities versus $13.7 billion in debt. Excluding those non-marketable securities still yields $101.4 billion in net cash or $7.92 in net cash per share. Google Cloud generates $29.8 billion in annualized revenues. Based on my assumption for 30% long term net margins (arguably conservative given where AWS margins stand today), 25% forward growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), Google Cloud is worth around 11.3x sales, $335 billion, or $26 per share. Even assuming no multiple expansion at the online advertising business, the sum of the parts suggests nearly 30% upside. Assuming that core-Google is valued at 25x earnings, I see upside to around $182 per share.

What are the key risks? MSFT and its Bing search remain the main risk at this point. While a weak macro cannot be ruled out, I am of the view that GOOGL’s properties remain an important driver of the economy and should remain highly profitable over the long term. That said, if Bing were to take market share, then GOOGL may face long term headwinds as advertisers shift advertising dollars towards the competition. If GOOGL was the kind of company aiming to maximize every profitable dollar at present day, then I might be more concerned, but this is a company which continues to show a preference for aggressive investment in innovation and growth – I expect the company to show a tenacious defense of its market position. Nonetheless, the mere fear of such disruption may cause the stock to trade even lower due to poor sentiment, perhaps similar to how Apple (AAPL) stock traded down to low double-digit earnings multiples less than a decade ago. However, GOOGL is already repurchasing stock with all of its free cash flow, showing an optimal balance between investing for growth while taking care of shareholders. I find it unlikely for the multiple to contract so much and even if it does, note that such an outcome would not be so bad over the long term due to the company’s ability to repurchase more shares at lower prices. The market has shown a great willingness to value profitable businesses at premium valuations so long as they have some semblance of long term growth – MSFT and AAPL are clear examples. I continue to see a clear path for GOOGL to eventually trade at 30x to 40x earnings (the latter would obviously require a shift in the interest rate environment), though even a re-rating to just 25x earnings (net of the adjustments detailed above) implies great upside. GOOGL remains one of my largest positions and I reiterate my strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!