Summary:

- Despite antitrust issues, Alphabet’s core financial performance, especially in Cloud and Search, remains strong; investors should focus on its robust earnings and free cash flow, not on headlines.

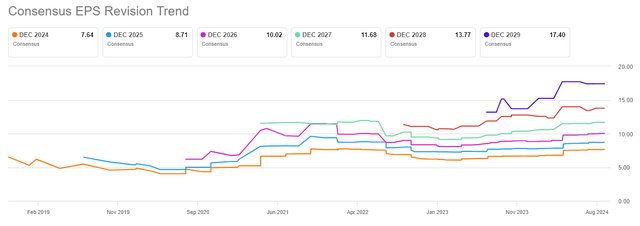

- Analysts’ positive EPS estimate revision momentum, strong FCF and Cloud strength make Google a buy ahead of the Q3 earnings release next month.

- Google’s valuation is attractive at a forward P/E ratio of 19X, making it the cheapest large-cap tech company, despite its high free cash flow profitability.

- The main risk is a potential slowdown in Google Cloud business, but continued AI investments should drive long-term growth and profitability.

da-kuk

Although Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) business is crushing it in a number of ways, especially in Cloud and Search, the company’s shares have recently suffered after a judge determined that Google was running an illegal ad monopoly. Alphabet generates the majority of its revenues from its Search business, which is why investors seem to have been more hesitant lately to touch the company’s shares. However, I believe investors are too worried about Google’s antitrust issues and the EPS estimate revision trend is still quite favorable, indicating that investors are too worried about Google’s earnings potential. I recommend to buy the antitrust issues ahead of Google’s third-quarter earnings release which is likely going to see new revenue and operating income records in Cloud as well as strong free cash flow.

Previous rating

Strong second-quarter earnings, especially with regard to Cloud and Search results, translated to a strong buy rating: Valuation Makes No Sense. Google generated a ton of free cash flow — something that should be expected for Q3 as well — and the EPS estimate revision trend indicates the company is set for a strong second half of FY 2024. The antitrust issues are nothing but a distraction, in my opinion, and negative news should soon be replaced by a more constructive focus on Google’s AI-driven Q3 earnings. After Google’s Gemini event, I believe the tech company remains a top AI growth for investors… and one that trades at one of the best valuations available in the sector.

Antitrust issues

Google is embroiled in a legal stand-off with the Department of Justice which alleges that the tech company is engaged in an illegal search monopoly that systemically disadvantages rival search platforms like Microsoft’s Bing or DuckDuckGo. A U.S. judge ruled in August that Google was in violation of the Sherman Antitrust Act which has created negative sentiment overhang for Google’s shares.

While the antitrust issues are clearly a challenge for Google, there is precedent that indicates that the issue is not as threatening as some investors may believe. Microsoft (MSFT) was sued for antitrust violations by the Department of Justice in the late 1990s and was expected to split up into two companies, chiefly because of concerns of Microsoft’s dominant position in the market for computer operating systems. Microsoft was initially ordered to split into two separate businesses, but the ruling was later overturned by a federal appeals court in 2001.

It is very difficult and legally challenging to break up a large tech company, and I believe the odds of Google being broken up at very slim at best. The most likely outcome, in my opinion, is a settlement that would affect Google’s long-term earnings and free cash flow profitability.

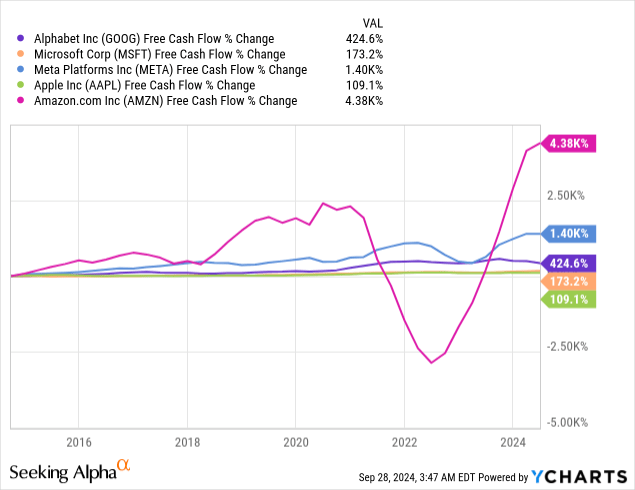

Microsoft today is still very much kicking and alive. In fact, it is one of the most free cash flow-profitable companies in the world today (outside the natural resources sector): in the last year, Microsoft generated $74.1B in free cash flow, the second-highest amount in my industry group which includes Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Microsoft and Google.

For context, Google generated $60.8B in free cash flow in the last four quarters, on a cumulative basis, with a free cash flow margin of 18.5%. In terms of total free cash flow dollars, Apple achieved the highest amount of free cash flows: $104.3B. In terms of free cash flow growth, no company did as well as Amazon in the last ten years.

Google’s free cash flow margins have come under pressure lately, however, as the company is ramping its spending on CapEx, especially AI GPUs, in order to train and run its large language models: in the most recent quarter, Q2’24, Google generated a free cash flow margin of 15.9% compared to 29.2% in the year-earlier period. Going forward, I continue to expect Google to spend billions of dollars each quarter on its AI infrastructure, but these investments should pay off in the long term. In FY 2025, I expect a rebound in free cash flow and incremental revenue gains from Google’s AI investment ramp which should then also yield higher free cash flow margins.

Favorable EPS estimate trend

Despite the antitrust issues, which again I believe to be a distraction, analysts are increasingly optimistic as far as Google’s business is concerned. In the last 90 days, analysts have revised their full-year earnings estimates upward 32 times, which compares to just 17 downward revisions. The consensus EPS estimate for FY 2024 is $7.64 per-share, which implies a year-over-year growth rate of 32%.

Expectations for Q3, catalysts for an upside revaluation

There are a number of catalysts that I see for Google with regard to the upcoming Q3 earnings release:

- Cloud likely continued to see growing AI product up-take throughout the third-quarter, especially with regard to Gemini, Google’s gen-AI chat assistant

- Google spent a ton of money on GPUs in Q3 as it is going full in on the gen-AI growth opportunity. Any comments about investment returns specifically as it relates to AI investments could have a big stock impact

- Google generated 26% operating income growth in the second-quarter, momentum that was chiefly driven by Google Services (+27% Y/Y) and Google Cloud (+198% Y/Y). The momentum clearly benefits Cloud right now, and I would not be surprised to see a segment-specific revenue acceleration in Q3 given growing interest in Google Cloud AI services

- I expect Google to report Q3 free cash flow between $14-15B and a free cash flow margin around 17-20% of which a considerable percentage was likely returned to shareholders as stock buybacks

- Any AI-related revenue and operating income gains are likely to get at least partially returned to shareholders in the future as well. This means that investors could potentially see an up-size in the company’s stock buyback authorization (which currently stands at $70B).

Google’s valuation

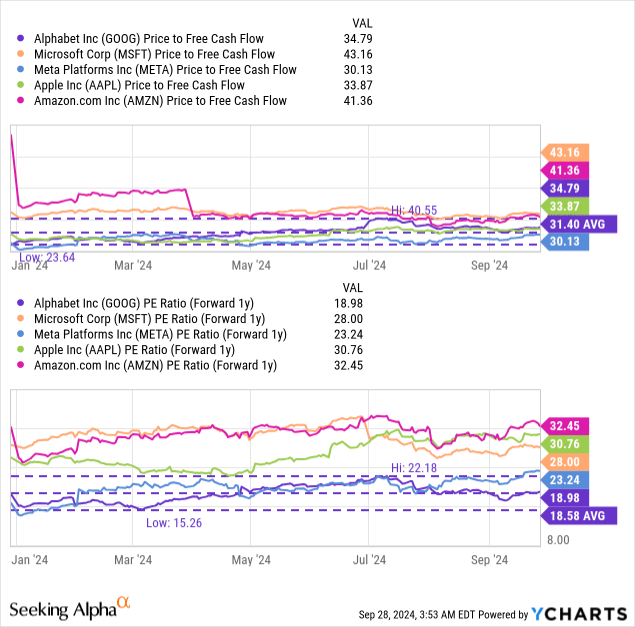

I will admit that while antitrust issues have created negative sentiment overhang for Google’s shares lately, the primary reason why I like Google is its cheap valuation based off of earnings and free cash flow. Google is currently priced at a forward P/E earnings ratio of 19X, which makes it by far the cheapest large-cap tech company in the market. The industry group average P/E ratio here is 26.7X which means that Google’s shares trade for a 29% discount to the average valuation ratio.

Google is not as cheap on a free cash flow basis, but shares are not expensive relative to large-cap rivals: Google’s P/FCF ratio is 34.8X, while the average company here is valued at a 36.7X free cash flow multiplier.

Google is widely free cash flow profitable and would be deserving to trade at the industry group average P/E ratio, in my opinion, especially as the company ramps its revenue and operating income growth in Cloud. If Google were to revalue to the average P/E ratio, shares of the tech company could have 41% upside revaluation potential and a fair value closer to $232. With Google also set to double down on gen-AI products and potentially up-sizing its stock buyback program in FY 2025, Google is one of the most exciting AI companies to own, in my opinion.

Risks with Google

The biggest risk for Google, as I see it, is a potential slowdown in the Google Cloud business, which, I believe, is only going to become more important from an operating income perspective. While Search is the biggest business in terms of revenue contribution, a significant (and growing) amount of operating revenue and income comes from Google’s Cloud segment. If Google were to see slowing corporate spend on its AI products, including Gemini, the tech company may see a deceleration of its top line and free cash flow growth going forward, which could cause me to down-grade my rating.

Final thoughts

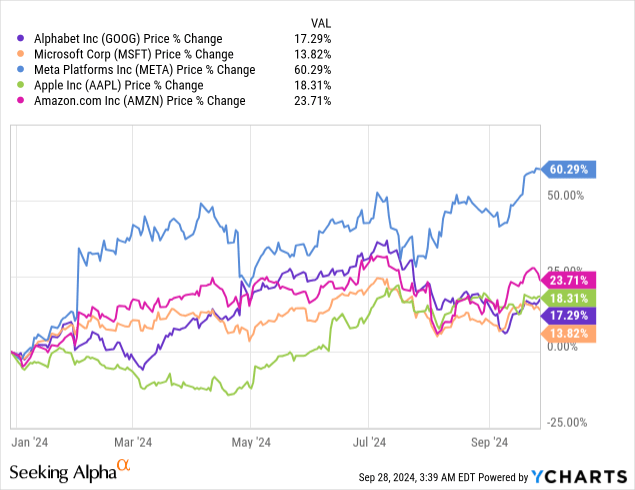

Shares of Google have risen 17.3% in the first nine months of the year, the second-weakest return in the tech industry group in 2024. Investor concerns about antitrust issues related to Google’s default search status have led to this under-performance, in my opinion. However, Q3 results could represent a vital catalyst for Google as the tech company likely had a strong third-quarter, driven by AI-driven gains in its Cloud segment. The EPS estimate trend is overly favorable, and the antitrust issues here have distracted investors from realizing that Google is one of the free cash flow-strongest companies in the U.S. Shares are cheap and investors can look forward to a strong earnings release next month.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, AAPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.