Summary:

- The rapid adoption of ChatGPT by Microsoft and OpenAI will require Alphabet Inc. to take action.

- To effectively respond to OpenAI’s competitive threat to Google, Alphabet must overcome several challenges.

- Despite the cost of a response, we believe that increased competition will likely push Alphabet to innovate and reach new heights.

David Gyung/iStock via Getty Images

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”), a widely recognized leader in artificial intelligence, is suddenly in the news for all the wrong reasons: will Microsoft Corporation (MSFT) and OpenAI’s viral ChatGPT hurt Alphabet’s Google search business? We believe it is too early to count Alphabet out, and that this competitive threat will likely force the company to show many of its “hidden” cards.

This article will delve into one of Alphabet’s AI capabilities, possible responses to ChatGPT, and a few of our concerns. We will also analyze the company’s financials and valuation to give readers a more comprehensive understanding of the potential risks and rewards of owning the stock.

Note: This article is for educational purposes only and does not constitute financial or investment advice. Please do your own due diligence and consider your unique financial needs and constraints before buying any stock.

What Happened?

Over one million users registered for ChatGPT in the first five days after its launch on November 30, 0222, as reported by Greg Brockman, President of OpenAI. The program’s capabilities have sparked a lot of discussion on social media, with users expressing amazement, amusement, and concern.

As reported by NYTimes, ChatGPT’s release prompted Google’s management to declare a “code red,” indicating a major threat to the company. Some fear that this could be a sign of an impending disruptive technological change that could significantly impact the company’s business. Google’s search engine has been the primary way for people to access the internet for over two decades, but new chatbot technology that could potentially replace traditional search engines could pose a significant threat to Google’s main search business. One executive at Google has described the situation to the NYTimes as a “make or break” for the company’s future.

Microsoft CEO Satya Nadella stated at the World Economic Forum this week that, “Every product of Microsoft will have some of the same AI capabilities to completely transform the product,” and tools like ChatGPT are necessary to boost productivity. Microsoft has also obtained an exclusive license to the underlying technology behind GPT-3 in 2020 and has a strong partnership with OpenAI. An update to GPT-3 called GPT-4 is expected to be released in early 2023 and be significantly more powerful than the current version, according to media reports.

What’s Next?

We expect Alphabet management to address the ChatGPT threat for the first time on its earnings call, which is expected on February 2nd.

The release of ChatGPT to the public and its popularity may pressure Google to speed up the integration of natural language AI capabilities into its core search. This could be particularly relevant as Microsoft is reportedly planning to launch a version of Bing that uses ChatGPT to answer search queries by the end of March. Speeding up the deployment of AI search could significantly increase the cost of operating Google’s search business due to the much higher computational complexity of an AI query. We believe Google will take this opportunity to test new business models to offset these additional costs.

Alphabet could intro a direct competitor to ChatGPT. Google’s subsidiary, DeepMind, has announced plans to launch its own version of ChatGPT, called Sparrow, which promises to be a safer form of AI assistant. DeepMind, a leader in AI research for the past decade and acquired by Google nine years ago, is considering releasing Sparrow for a private beta in 2023. Sparrow was introduced last year as a proof-of-concept in a research paper, describing it as a “dialogue agent that is useful and reduces the risk of unsafe and inappropriate answers.” Sparrow could offer at least two advantages over ChatGPT: it could cite sources and supporting evidence for claims, and it would defer to humans in areas where it has no confidence. These advantages could make Sparrow a much more reliable technology partner.

Deploying Alphabet’s Arsenal

It is worth noting that Google has been heavily investing in AI for many years and has advanced natural language capabilities through systems such as BERT (Bidirectional Encoder Representations from Transformers) and LaMDA (Language Model for Dialogue Applications)

BERT, a pre-trained language model introduced by Google in 2018, is widely used in natural language processing tasks such as question answering and language understanding. LaMDA, a neural network-based language model developed by Google in 2021, is specifically designed for generating human-like dialogue. In many ways, this is similar to ChatGPT.

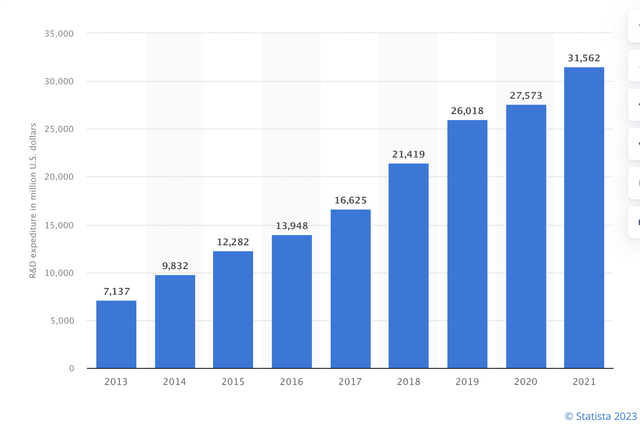

The eight hundred pound gorilla in the room is Alphabet’s size. Alphabet spent $31.5B on R&D in 2021 and is growing this budget to a place few can match. On the other hand, OpenAI has raised just $1 billion since inception, and generates no material revenue.

Concerns

The increasing competition faced by Alphabet could present challenges in various ways.

First, there is the classic problem of the Innovator’s Dilemma. Alphabet has a business model issue. If it provides perfect answers to every query, users may not click on any ads. This fear of disrupting its own business model could be a significant limiting factor for Alphabet in its competition with OpenAI and others.

Second, Alphabet’s numerous stakeholders could limit its ability to respond quickly. The company has been hesitant to share its technology widely because, like ChatGPT and similar systems, it can produce false, toxic and biased information. Unlike small competitors without revenue, Alphabet must balance the needs of many customers, employees and shareholders, and therefore must be cautious about introducing disruptive products. Smaller companies tend to have fewer concerns about releasing these tools, forcing Google to join the competition or risk being left behind.

Third, the complex structure and massive size of Alphabet’s technology stacks and business models can also limit its ability to rapidly deploy AI. We believe that Google has gradually integrated AI advancements into its search function to benefit both users and advertisers, allowing the company to maintain double-digit revenue growth for its search segment even after two decades in operation. However, given its dominant position in search and the potential impact of even small algorithm changes on search performance and monetization, we believe the company has been cautious in integrating more advanced AI capabilities, especially those based on natural language, into its search engine.

Fourth, Alphabet’s culture of secrecy may impede its ability to compete with OpenAI. While OpenAI has been transparent about the capabilities of its AI systems such as ChatGPT and DALLE-2, which were made available to consumers in 2022, Google has been more secretive about the capabilities and intended use cases of its own systems. This secrecy is likely driven by concerns about the company’s technological power and size. Like other large tech giants such as Amazon and Meta, Alphabet has been facing increasing regulatory scrutiny. Even if the company wants to be transparent, fear of its power could limit its ability to do so.

Lastly, we estimate that the cost per query for ChatGPT is significantly higher — 5 to 10 times higher — than Google’s due to its greater computational complexity. If Google were to rapidly implement AI, it could lead to increased costs, narrowed profit margins and potentially negative impact on the stock performance.

Financials and Valuation

Consensus estimates forecast that the strong growth seen in 2021, with sales rising by over 41%, will begin to slow down in 2022 and 2023, with projections of a +10% and +8% growth respectively. The primary reason for this deceleration is the challenging comparison to previous years and a deteriorating macroeconomic environment impacting advertising expenditure. Despite this, these projected growth rates are still strong and indicate that the company will continue to gain market share from traditional advertising channels such as television and radio.

Despite a projected decline in earnings per share for 2022, with a decrease of 16% compared to the previous year, it is forecasted that free cash flow will remain steady at around $67 billion. This strong cash flow makes it difficult to bet against the company’s success. For 2023, it is projected that both EPS and free cash flow will increase, with EPS growing by 10% and free cash flow increasing by 15.5% — a robust recovery year for earnings and free cash flow.

Although 2023 is projected to be a year of resurgence, GOOG’s current trading value is close to a 5-year low in terms of next-year consensus EPS at 17.5x. This low multiple indicates that investors are apprehensive about the potential impact of a deteriorating macro environment on advertising and believe that current estimates may be too optimistic.

Given the uncertain macro environment, we prefer not to make predictions. However, we find the combination of a low multiple, negative investor sentiment, and the potential for the company to showcase its previously hidden AI capabilities to be an attractive combination tilting the odds in favor of owning Alphabet.

Conclusion

In our opinion, the rapid adoption of ChatGPT by Microsoft and OpenAI will require Alphabet to take action, even if it is reluctant to do so. If the company fails to respond, it runs the risk of losing its position as the leading AI company in the world and losing market share to Bing. The buzz surrounding ChatGPT may also make it more difficult for Alphabet to attract scarce AI talent.

To effectively respond to OpenAI’s competitive threat, Alphabet must overcome several challenges, such as the Innovator’s Dilemma, the complexity of its technology stack and business operations, and regulatory scrutiny. However, we believe the company has the resources to develop a credible response and reassure investors.

Despite the cost of a response, we believe that increased competition will likely push Alphabet to innovate and reach new heights.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.