Summary:

- There are a few solid reasons to believe that Chrome divestiture risks are exaggerated.

- Google’s core business, driven by AI advancements, shows impressive revenue and operating income growth, with significant contributions from Google Cloud.

- The company’s strong financial position, low leverage, and attractive valuation further support the bullish outlook.

Sundry Photography

Introduction

I had a ‘Strong Buy’ thesis on Google (NASDAQ:GOOGL) in September. The stock did really well and outperformed the S&P 500 until mid-November. However, the information regarding potential Chrome divestiture caused the stock price to drop by around 5% since November 20.

I prefer to remain bullish because Google is still stable-as-a-table fundamentally. The company’s financial performance is excellent, it has multiple robust long-term growth drivers behind its back, and it remains one of the largest AI boom beneficiaries. The stock is very attractively valued and remains a ‘Strong Buy’ in my opinion.

Fundamental Analysis

I believe in tackling the toughest questions first and that is the reason why I want to start with discussing the potential Chrome divestiture. I think that fears around this issue are highly likely exaggerated. First, this is not new information. I have searched the web and found out that the first mentions of the DOJ wanting to break up the largest tech companies date back to 2019. We are approaching 2025 now, and the DOJ appears to have made little meaningful progress on this front.

Second, Google is not the only big tech dominator in the U.S., frankly speaking. Apple undisputedly dominates the headset industry, Meta and Amazon are by far the largest social network and e-commerce players, and Nvidia owns 88% of the GPU market. Forcing any of these tech giants to divest or split up would set a dangerous precedent for the entire industry. Breaking up Google will mean that other aforementioned tech giants are also in danger, and it may cause an irreversible panic in the U.S. stock market. I do not think that a potential stock market crash is part of Donald Trump’s plan to ‘Make America Great Again’.

Third, a company like Google has vast financial resources to hire top-tier lawyers to protect its current structure. Google’s historically dominant position in the industry always meant intense regulatory scrutiny, and it is highly likely that its legal team has extensive experience in defending against antitrust risks.

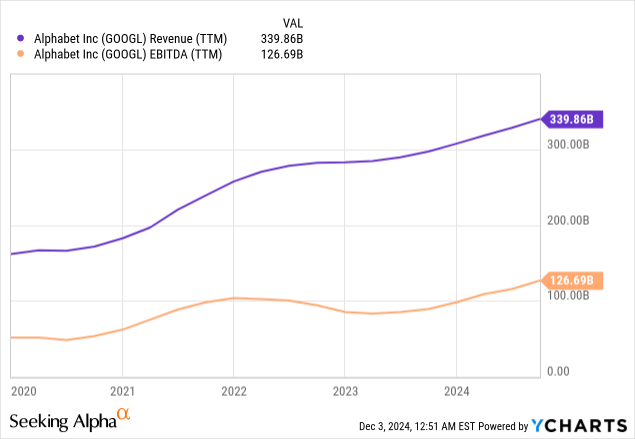

With that being said, I believe that while the DOJ’s proposal appears significant, the likelihood of its full implementation is low. Therefore, I prefer to focus on Google’s rock-solid fundamentals. Revenue and EBITDA demonstrate robust upward trends, underscoring Google’s excellent financial performance.

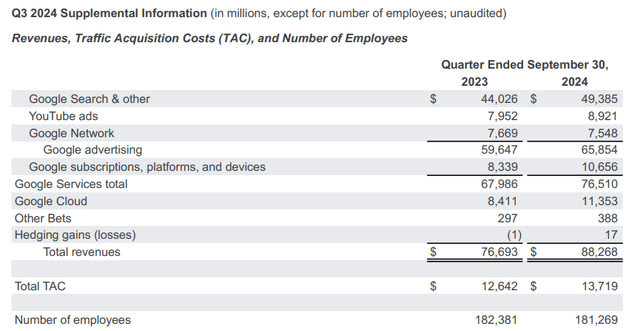

Consolidated revenue increased by 16.4% year-over-year to $88.3 billion. Strong performance was driven by solid growth across most business lines, which underscores the strength of Google’s business mix.

I am also very happy when I look at Google’s surge in operating income, which grew much faster than the top line with a 34% year-over-year growth. An impressive 450 basis points operating margin expansion reflects the management’s commitment to maintaining high-cost efficiency.

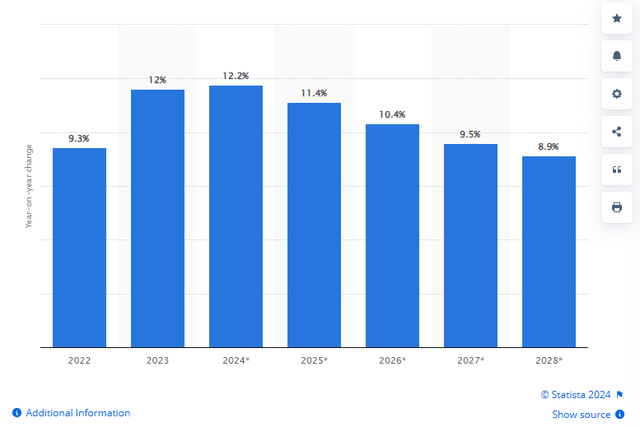

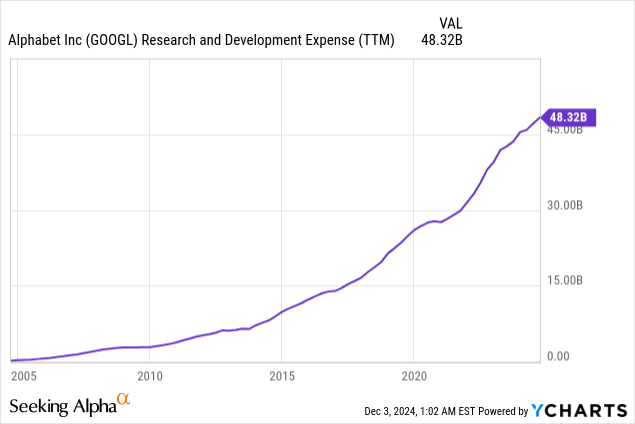

The company’s core business, Google Search and other delivered a 12% year-over-year revenue growth and prospects look good. The digital advertising industry demonstrated solid growth acceleration in 2023-2024 due to AI capabilities, which allowed it to increase advertising efficiency for businesses. This growth is expected to remain strong in the next few years, according to the above chart. Leveraging AI for its digital advertising offerings is Google’s competitive advantage, and the management plans to remain very aggressive in R&D and CapEx spending in 2025 as well.

Therefore, we can expect Google’s core business to continue thriving over the next few years at least. AI tailwinds will help, and the management is ready to invest aggressively in innovation and expansion.

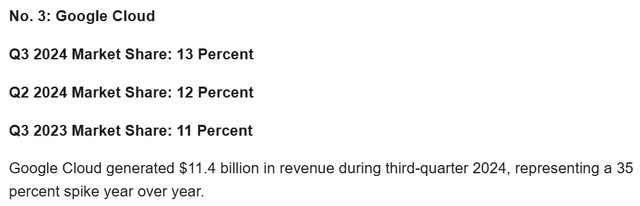

Another positive trend is that the company’s revenue mix is consistently becoming less concentrated. Google Cloud represented around 13% of the total Q3 2024 revenue, which is a 200 basis points improvement compared to the same quarter of last year. The segment delivered a 35% year-over-year growth in Q3, which is massive and far better compared to its main competitors. Google Cloud is still number three in the industry behind Amazon’s AWS and Microsoft’s Azure, but its market share is expanding almost every quarter.

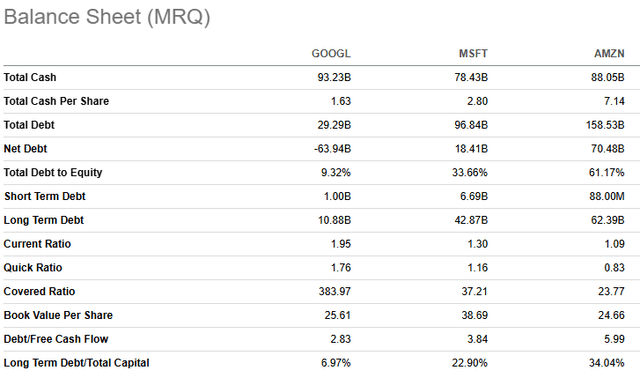

Last but not least, Google is much financially stronger compared to its main cloud competitors. Google does not only have the largest cash pile among these three giants but is almost leverage-free (relative to its market capitalization). This makes Google in a significantly better position on a net basis if we deduct the total debt from total cash. Therefore, Google is in an unmatched financial position, which gives it a large competitive advantage.

Valuation Analysis

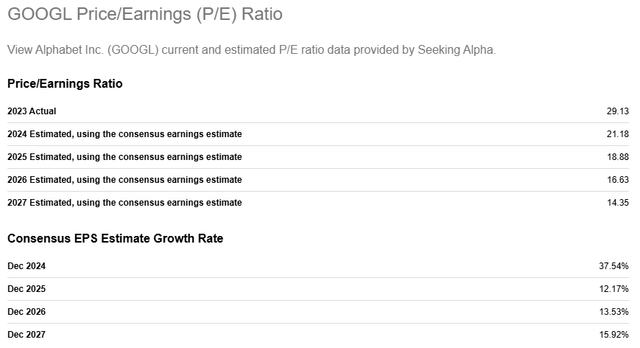

Google is extremely cheap from the forward P/E ratio perspective. The company’s current non-GAAP P/E ratio is not only the lowest among the Magnificent 7, but is also expected to shrink below 15 by FY 2027.

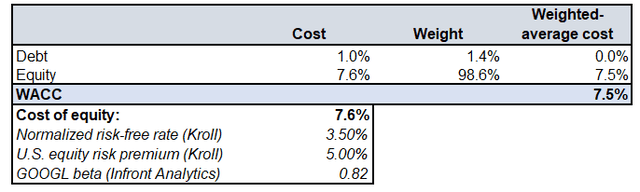

My discount cash flow (‘DCF’) model also has to be updated in line with the changing environment. Google’s WACC is 7.5%, based on my calculations. Cost of debt was figured out based on the company’s TTM interest expense divided by the outstanding total debt.

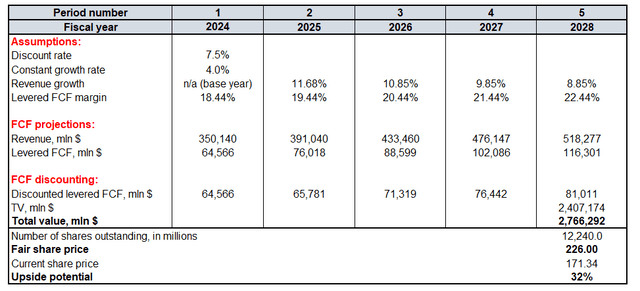

At least 40 Wall Street analysts cover Google’s revenue forecast for the closest three fiscal years, which is a solid representative sample. Therefore, my DCF FY2024-2026 revenue projection relies on consensus. For years after FY2026, I apply a 100-basis points revenue growth rate decrease every year. The average levered FCF margin over the last few years is 18.44%, which will be my base-year assumption. Google’s Q3 performance demonstrated robust operating leverage, meaning that applying a 100 basis points per year expansion for the FCF margin is fair.

A 4% constant growth rate looks fair for a company like Google, with multiple secular growth drivers behind its back. According to Seeking Alpha, there are 12.24 billion shares outstanding.

The fair share price is $226. The current share price is around $171, meaning that there is a compelling 32% upside potential.

Mitigating Factors

Apart from the antitrust risks which I have mentioned in my fundamental analysis, there are a few more worth discussing.

Despite the fact that Google is in a much stronger financial position compared to Microsoft and Amazon, it is still significantly behind in terms of market share. According to Statista, AWS commands a leading 31% market share and Azure boasts 20%. These two global cloud leaders are also quite aggressive in their R&D and CapEx spending. The competition is fierce and there is a risk that Google might remain in the third spot for longer.

Uncertainties in the macro environment keep snowballing. Google generates about half of its revenues outside the U.S., meaning that the global geopolitical uncertainty is a risk for the company.

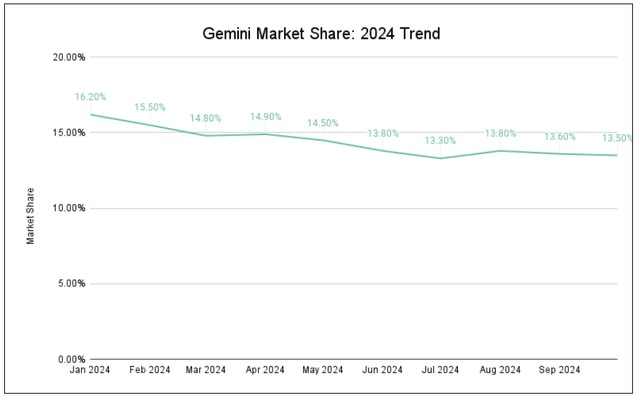

A warning trend above suggests that Google struggles to compete in the generative AI space. Its Gemini chatbot’s current market share is notably lower compared to January 2024. On the other hand, the industry is still very young and yet to be monetized, giving Google ample time to stage a comeback.

Conclusion

Google remains fundamentally rock-solid, and it is highly likely that fears surrounding a potential Chrome divestiture are exaggerated. In fact, the fear-driven pullback has created an even more attractive buying opportunity, as the stock now offers a rare 32% upside potential for a company of this caliber.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.