Summary:

- Google stock is an analyst battleground. The majority of analysts are lowering expectations for Google’s earnings while a substantial minority of analysts are raising expectations.

- The long-term value for Google is clear with the shares at a substantial discount to slower-growing peers.

- While Google isn’t the screaming deal it was when the stock was 15% lower, I believe the stock currently has the best risk-reward prospects in big tech and is worth buying on a pullback under $100.

400tmax

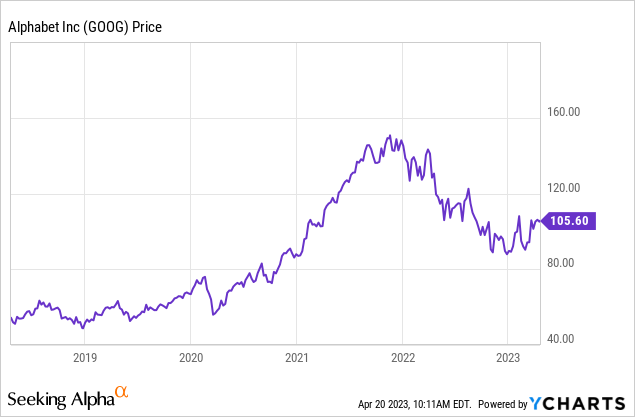

Since ChatGPT went mainstream late last year, shares in Google (NASDAQ:GOOG) (NASDAQ:GOOGL) have become an unexpected battleground, with some venture capitalists and tech analysts claiming Google’s business model would be swiftly crushed by competing AI chatbots. On the other side of the debate are value-oriented investors who bought Google stock at a deep discount to peers. Google is up nearly 20% this year, but the debate continues with most analysts revising Google’s earnings forecasts down. However, a substantial minority of analysts are now actually revising Google’s 2023 earnings estimates upwards while the overall consensus is for the company to grow EPS at double-digit rates for the next three years. For these reasons, I believe Google is the best value in big tech and is worth snapping up on a pullback. Tech in general looks overvalued, and I’m fairly negative on the sector going into earnings. I’ve written about how the market doesn’t seem to be pricing in the corporate tax hikes for tech stocks.

However, if you can buy some Google for under $100, your long-term compensation should be more than enough to beat the market. Google reports earnings after the bell on Tuesday, April 25, which will give more information about this business and may give a nice entry point for investors.

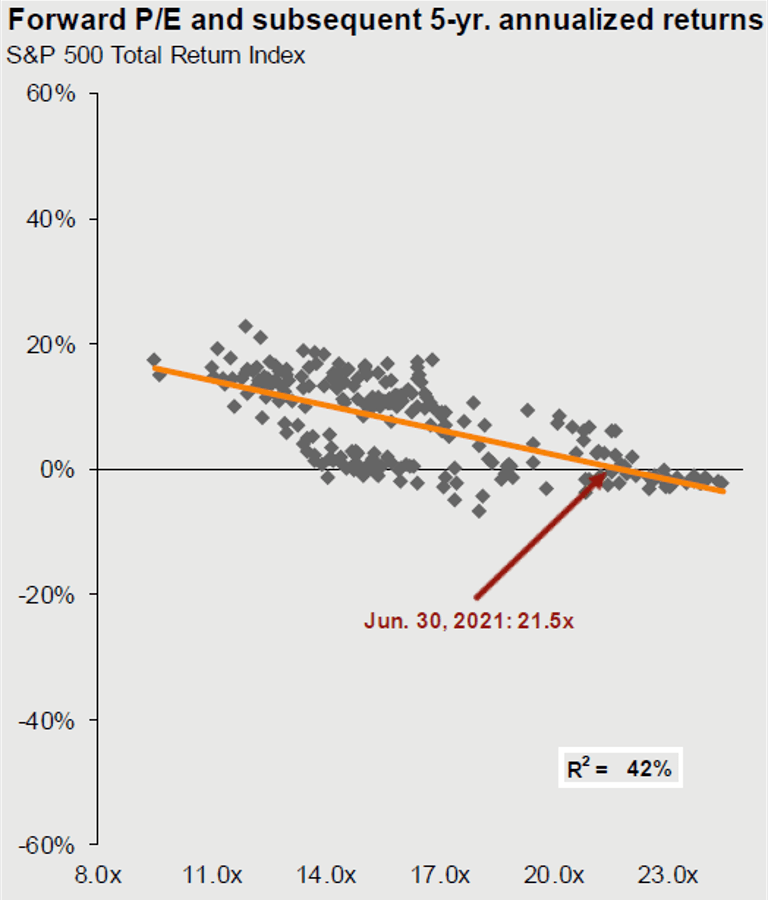

Ignore Valuations At Your Peril

I’ve had a few conversations with friends who invest, and I’ve asked them whether they factored valuation into the investments they make, even at all. And most answered no! This is an unscientific sample of retail investors, but I think it’s instructive. Many retail investors do not factor P/E multiples into their investments at all. They’re indifferent to paying 10x earnings and paying 100x. When valuations did nothing but go up from early 2019 to early 2022, this allowed people to develop terrible habits.

And of course, this doesn’t work in the long run. Many of these same investors are now down 30% or more from the highs. In the fullness of time, this kind of first-order thinking will get you in tons of trouble. Similarly, it’s not enough to know that the University of Georgia will crush Tennessee-Martin in college football. To make any money from betting on it, you need to know whether they will cover the point spread. In investing, you need to find the best assets for the best price, not just pick any business that’s growing quickly.

PE Ratio vs. Stock Returns (Pebble Valley Wealth Management)

In the words of Benjamin Graham, the market is a voting machine in the short run but a weighing machine in the long run. If you overpay for stocks, you don’t make much money in the long run, although you can for short periods of time in bubbles like the late 1990s and early 2020s.

High PE stocks underperform (FactSet via Barclays Research)

Nosebleed valuations are often associated with fads. Fads in recent years have included cannabis stocks, sports betting stocks, SPACs, and now AI-adjacent stocks. These are frequently facilitated by Wall Street to hustle retail investors who don’t understand valuation or capital structure.

But to succeed in investing, you need to buy the best businesses for the best prices, similar to how professional sports teams operate under a salary cap or sports bettors operate with point spreads. Google is nice in this regard because it’s a highly profitable business with strong growth prospects, yet it doesn’t trade at an obnoxious valuation.

Google Doesn’t Deserve Its Discount To Peers

Google trades at a bit less than a 21x P/E, vs. 28x for Apple (AAPL), 31x for Microsoft (MSFT), 41x for Amazon (AMZN), 29x for Netflix (NFLX), and 22x for Meta (META). None of these companies are truly recession proof, nor are they immune to rising rates, and all of these except for Google and possibly Meta strike me as being overvalued by 25% or more. Unsurprisingly, these higher valuations often correlate not with higher earnings prospects, but with higher ownership by price-insensitive retail investors. Roughly 41% of Apple shares are held by retail investors, while 42% of Amazon is held by retail. By contrast, only 24% of Google Class A shares are held by retail investors. In truth, all of these stocks are fairly popular with retail investors – Visa (V) for example is only 4% owned by retail investors. Mutual fund managers are just as capable of herding as at-home retail investors, but they don’t tend to be quite as blatant about it, and market pricing tends to be more inefficient when retail ownership is higher.

I liked Google better in the $90s than I like it now after the rally, but when comparing future earnings growth estimates vs. current valuation, Google is clearly the cleanest shirt in the big tech laundry basket. The higher the valuation you pay for a growth stock, the riskier the buy is if things don’t turn out according to plan. Tech investors have gotten sucked into a narrative that Google is vulnerable while ignoring the elephant in the room that they’re paying near-bubble valuations for the names they prefer. A similar play (albeit a riskier one) came when Meta traded for nearly 10x earnings in the fall, placing the stock firmly in value territory.

Investors got riled up by the possibility that Samsung would switch Google from the default search engine on its phones to Microsoft Bing, but it’s not clear whether this is even possible in the US under the current software agreements that they have. Similarly, investors are focused on the possibility that Apple could drop Google as the default search engine on iOS, but the reason why Apple hasn’t made its own search engine over the last 20 years is that it can’t at least not in a way that makes more profit than Google already pays for being the default search engine on iOS. Apple lacks the decades of link and search data that Google has, which has allowed Google to gradually improve its algorithm and prevent competition from catching up.

This stuff isn’t new. Siri was Apple’s best attempt to replace Google, but they switched from Bing to Google in 2017. Chat GPT has been heralded as the biggest tech innovation ever, but it seems to me like it’s too early to tell whether wildly bullish predictions about its use will come true and whether Google itself will be able to compete in the field. I certainly wouldn’t be paying skyrocketing valuations for AI-adjacent stocks, human nature ensures that much of the value of innovation flows to private owners rather than public shareholders, while many of the public “opportunities” are designed by copycats looking to exploit hype.

Bottom Line

The popular narrative is one thing, but if you look at the actual analyst earnings estimates, Google is forecasted to grow EPS faster than AI competitor Microsoft over the next few years. With 2024 earnings estimates of about $6 and assuming the multiple shrinks a bit, Google should be able to trade back up to about $120 sometime in 2024. After the run-up in the share price this year, I don’t think paying $105 is a slam-dunk deal, but it’s not a bad one either. As always, you’re better off buying Google’s Class A stock (GOOGL) vs. the more heavily traded Class C (GOOG) shares. They’re equivalent, but Class A is cheaper. Are investors getting enough compensation at current prices by buying Google stock? It’s a close call, but despite Google being in the best shape of popular tech stocks, I would lean toward waiting for a pullback.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.