Summary:

- Alphabet Inc. shares gained 5.34% on December 7, 2023, driven by the launch of Gemini, a large language model for AI applications.

- Gemini, available in different versions, powers Google’s generative AI chatbot, Bard, and competes with Microsoft-backed OpenAI’s ChatGPT.

- Gemini’s release challenges Microsoft’s monopoly on AI and could drive Google’s projected EPS figures higher in the medium term.

- But Google Cloud is clearly inferior to its direct competitors, which makes the whole growth picture even riskier.

- Google is a strong ‘Hold’ that should be part of every long-term investor’s portfolio. However, given the recent rapid rally in the company’s shares, I’d not take the stock’s allocation to extremely high levels.

Justin Sullivan

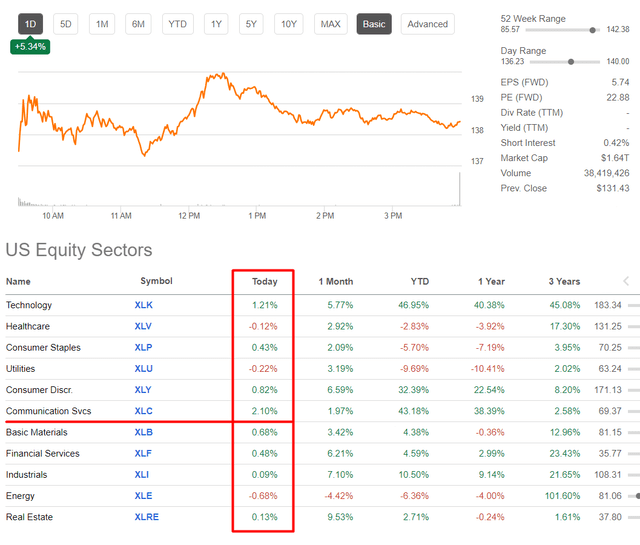

On December 7, 2023, Alphabet Inc. shares (NASDAQ:GOOG) (NASDAQ:GOOGL) gained 5.34%, dragging the rest of the market with them.

Seeking Alpha, author’s compilation

It was all thanks to the recently unveiled large language model (LLM) for artificial intelligence applications, called Gemini.

Gemini, available in Ultra, Pro, and Nano versions, powers Google’s generative AI chatbot, Bard, competing with Microsoft-backed (MSFT) OpenAI’s ChatGPT. Alphabet CEO Sundar Pichai praised Gemini’s Ultra version for surpassing state-of-the-art benchmarks in various tasks, the Seeking Alpha News team reported. Gemini LLM can simultaneously recognize videos, images, text, and voice, providing results in text or code.

Gemini Pro is going to initially power Bard, available in English across 170 countries from December 13. Google plans to integrate Gemini into various products like search, ads, Chrome, and Duet AI. Additionally, Google introduced the Cloud TPU v5p and showcased the AI Hypercomputer for AI applications.

GOOG shares did not initially react in any way to this publication (December 6th), until JPM analyst Doug Anmuth shared his views (December 7th) on how the company’s new LLM should change the balance of power in the industry.

The different sizes allow Gemini to be used efficiently across different use cases & hardware capabilities, from data centers to mobile devices, which should enable better cost management.

Model sizes and cost concerns came up frequently in our industry discussions last week at AWS re:Invent, w/our view that there is increasing demand for somewhat smaller, more cost-efficient models, in addition to demand for a wide range of models to avoid lock-in.

While it remains early, the Gemini launch represents significant innovation for Google as we enter year 2 of commercialized and widely distributed availability of Generative AI.

Source: Seeking Alpha News citing JPM

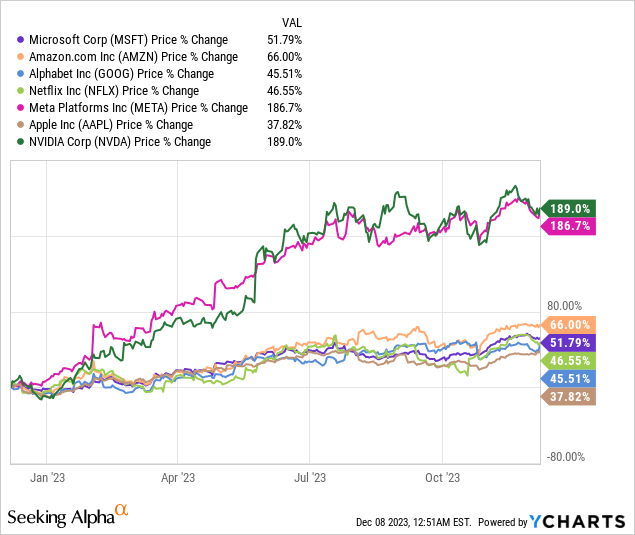

Last year, Google shares were among the underdogs compared to other Magnificent 7 stocks, apart from Apple (AAPL), whose underperformance in the group can be explained by difficulties in manufacturing and the ‘China factor‘:

In the case of Google, the underperformance was most likely caused by the widespread belief that since Microsoft was first in the AI endeavor (indirectly through OpenAI), all the credit for the future growth potential of this bottomless market (the absorption potential is truly impressive) should go to the brainchild of Bill Gates.

I myself partially shared this position, as I rated Google as a ‘hold” and believed that its AI future was already priced in. Time has shown that the company was not sitting still and was actively developing to prevent the loss of existing markets and to avoid losing new markets to its long-standing competitors.

Positioned as a significant leap in AI, Google DeepMind asserts that Gemini surpasses GPT-4 in 30 out of 32 performance measures, although MIT Technology Review’s reporters describe the differences between the two as subtle.

MIT’s article suggests that despite its impressive capabilities, Gemini might not introduce entirely novel functionalities. But in my opinion, that’s not the point: Google has set a precedent and provided a clear sign that Microsoft no longer has the monopoly on AI among the big tech companies.

By a monopoly on AI, I don’t mean the ability to implement LLM and other machine learning models into the business processes to optimize them, or to develop new products based on AI to subsequently market them – there is no monopoly in this regard. I’m talking about a leadership position in this area where Microsoft was considered the dominant player. Even if we assume that Gemini offers no particular advantages over OpenAI’s GPT-4, the mere release of Gemini to the general public makes Microsoft’s valuation premium (which already includes the promise of OpenAI’s future) less fair to Google.

That’s why Google shares rose so sharply on December 7 – I think market participants were just repricing the valuation differences.

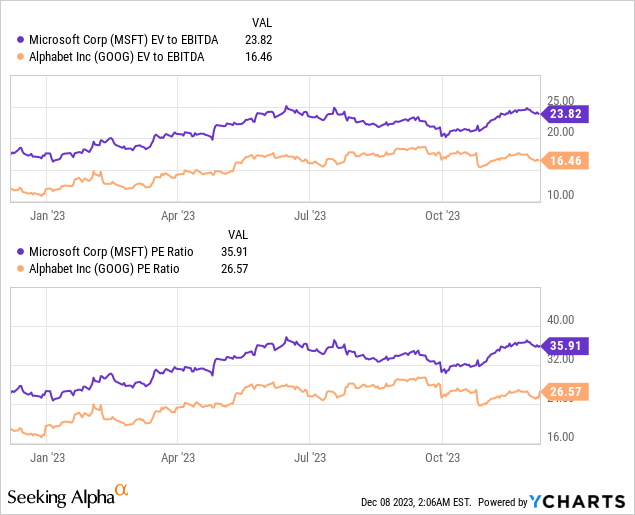

Of course, we must not forget that MSFT and GOOG are completely different companies in terms of their content and addressable markets. So it would be silly to show Google’s P/E of 26.6x and say that it is 26% undervalued, as MSFT’s P/E is almost 36x.

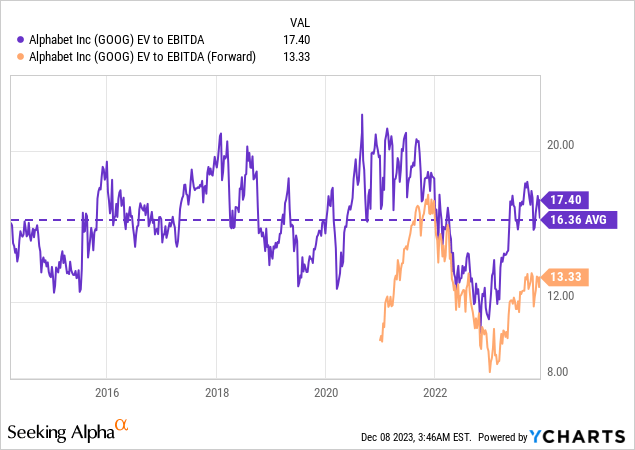

And while we’re on the subject of valuation, I think GOOG shares appear fairly valued today from a historical EV/EBITDA ratio perspective, as their TTM ratio is only slightly above the long-term (10-year) average figure. However, looking at the forward ratio, we see that a multiple contraction of ~18.5% of the average is built into the company’s valuation.

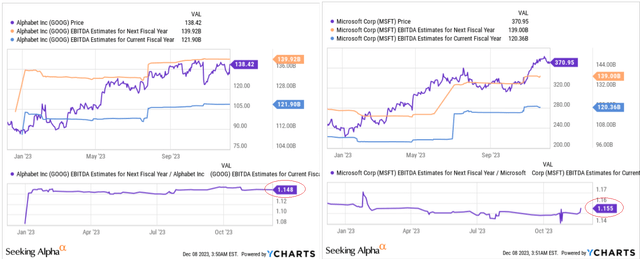

At the same time, to stick with the comparison with Microsoft, we see roughly the same level of growth in the EBITDA forecasts for next year. Google’s EBITDA will grow 70 bps (or just 0.7%) slower in FY2024, but the company’s EV/EBITDA is ~69% lower than MSFT’s [16.46x vs. 23.83x]. The dynamics of estimate revisions are also on GOOG’s side:

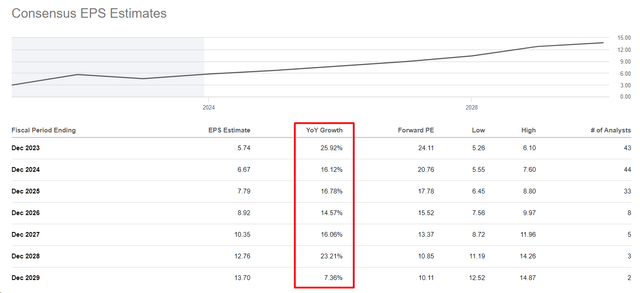

In many ways, however, I cannot dismiss my words from the July article on Google that its valuation is based on the assumption of rapid EPS growth with no downside for years to come, which is unrealistic in a recession scenario, if not in 2024, then in 2025 or 2026.

Seeking Alpha, Google’s EPS estimates

In addition, Google Cloud doesn’t perform as well as its competitors AWS from Amazon (AMZN) and Azure from MSFT. The chief financial officer of Snowflake (SNOW), a large cloud data storage and processing company, recently said that only 3% of its customers use Google Cloud. One reason for this is that Google Cloud is more expensive for customers than AWS or Azure:

<…> GCP is up to 3% right now. Microsoft Azure is the fastest-growing one, but AWS is still 76% of our business with Microsoft being 21%.

As I said, GCP is 3%. And I will tell you, 1 of the reasons why GCP is not as big as just so much more expensive for our customers to operate in GCP than it is in AWS and Azure.

Therefore, GOOG has certain obstacles to future cloud expansion, and there are definitely downside risks to the Wall Street EPS estimates that we see today.

The Verdict

Yesterday, Google shareholders clearly had reasons to be so enthusiastic and drive the share price up. The stock looks relatively cheap compared to its direct competitor Microsoft, despite the fact that it has breached its AI monopoly. In the medium term, I expect Gemini’s release to drive Google’s projected EPS figures even higher, supporting the current recovery rally.

However, this assumption of mine harbors a major risk, as the company is already expected to rapidly increase its earnings per share over the next 10 years without a recession being priced in. Furthermore, Google Cloud is clearly inferior to its direct competitors, which makes the whole growth picture even riskier.

As I have written several times in previous articles, Google is a strong ‘Hold’ that should be part of every long-term investor’s portfolio. However, given the recent rapid rally in the company’s shares, I would be cautious and would not take the stock’s allocation to extremely high levels.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!