Summary:

- ChatGPT came out at a time when Google’s compensation expenses increased dramatically from 2021 to 2022.

- Google’s advertising revenue continues to increase despite them losing market share.

- I am optimistic that Google’s Bard chatbot can improve dramatically in the years ahead.

JHVEPhoto

Introduction

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) hires some of the best minds in the world and they are paid well. Google services went from operating income of $91,855 million on revenue of $237,529 million in 2021 to operating income of $86,572 million on revenue of $253,528 million in 2022. The 2022 10-K explains that the $5.3 billion decrease in operating income was mainly due to increases in compensation expenses and traffic acquisition costs (“TAC”). ChatGPT came out in late 2022, a year when compensation at Google hit record levels. Since the 2016 10-K, Google has been saying it’s their mission to organize the world’s information. An artificial-intelligence (AI) chatbot is an excellent way to organize information and connect people with it so many were surprised that ChatGPT wasn’t introduced by Google. My thesis is that Google has been disappointing in recent years but it is still a good company.

Chatbot Comparisons

ChatGPT was released to the public before Google’s Bard alternative and many say ChatGPT is better. I’ve done some of my own comparisons and the results from these anecdotes have been mixed. I looked at Russia’s historical GDP for one comparison. The war in Ukraine has been awful and it is disturbing that Russia, a country with less than 3% of the world’s GDP, can cause so much disruption. Being curious about the way Russia’s GDP has changed throughout history, I asked Bard and ChatGPT about this and both answers were useful. It seems Russia had a double digit percentage of global GDP after World War 2 but it has declined over time. Here is the question and answer with Bard:

Here is the same question with ChatGPT:

Both chatbots did a nice job presenting information succinctly such that I didn’t have to scour through a bunch of sources like Wikipedia.

Asking a question about plate tectonics, I found Bard to be more useful than ChatGPT. California didn’t exist when the North American plate was part of Pangea. The Rough-Hewn Land: A Geologic Journey from California to the Rocky Mountains book by Keith Heyer Meldahl explains this well:

California owes its very existence to the continent’s westward migration. Before North America started west, there was no California (or Oregon, Washington, western British Columbia, or western Mexico, for that matter). Bits and pieces of old ocean floor collected against the prow of the advancing continent to assemble the Golden State-and plant gold there, too.

[Kindle Location: 149]

Based on the way I asked ChatGPT about this, the answer was wrong:

The question was phrased the same way for Bard but the answer given by the chatbot was correct:

The WSJ interviewed Google CEO Sundar Pichai recently and he did a nice job stating that they’re still in good shape despite the fact that ChatGPT was first to market:

Throughout our history, there are many areas where we haven’t been the first to market something. We didn’t develop the first search engine or we didn’t develop the first browser or the first email product or the first mapping product and so on. So there are times when being first matters a lot. There are some times it doesn’t matter.

These statements by CEO Pichai make me optimistic that Bard will improve quickly in the years ahead.

US Digital Ad Market

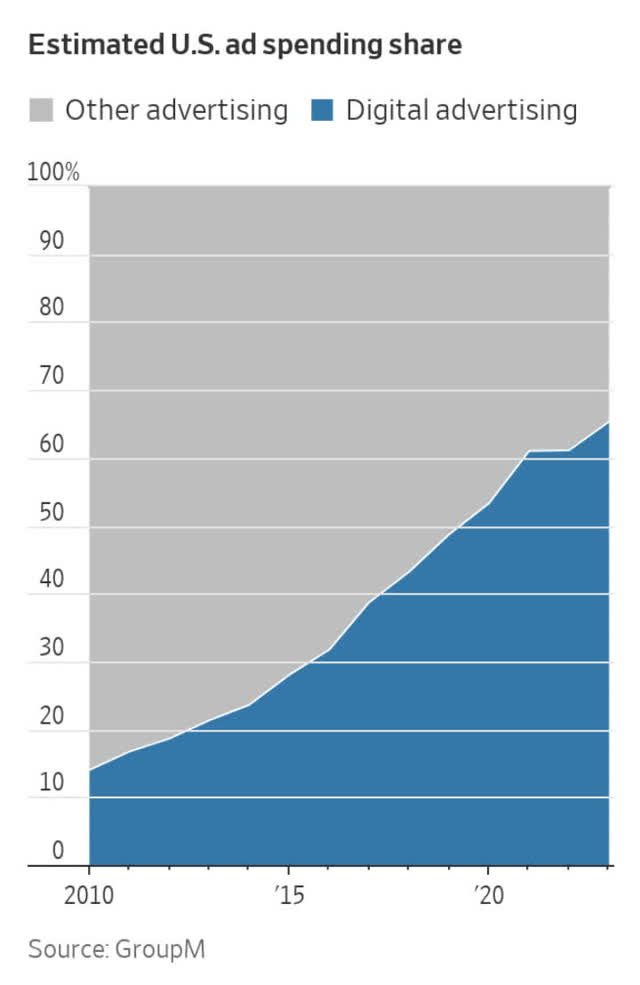

The WSJ shows how dramatically digital advertising has expanded in the US since 2010:

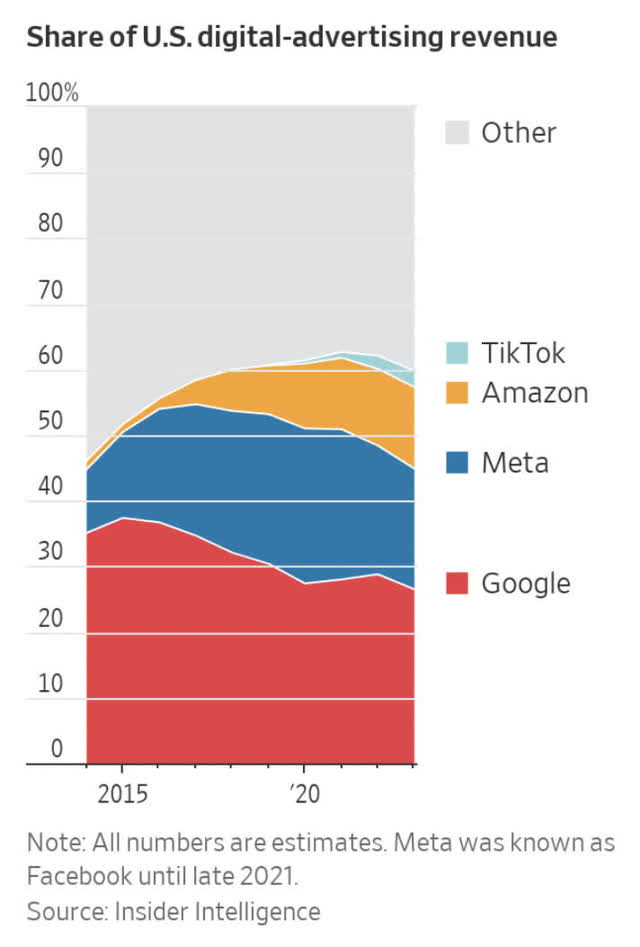

The WSJ article goes on to show Google’s drop in market share since 2015. Despite these losses, Google still has more share than anyone:

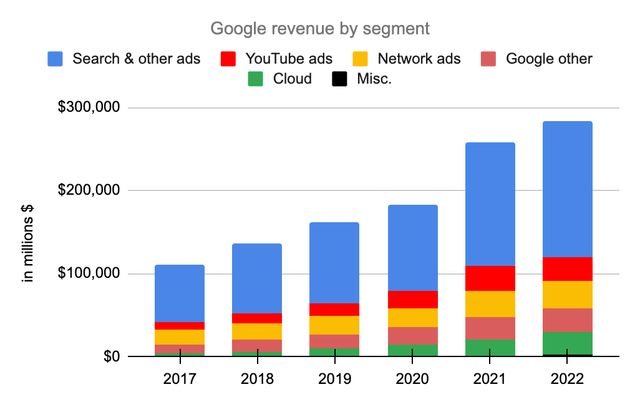

New solutions like ChatGPT make it virtually certain that Google’s market share of digital-advertising will continue to fall. However, Google still has a good chance to continue increasing revenue if the world keeps moving to digital at a faster pace than Google loses share. The advertising revenue numbers show that Google has been a great company from 2017 to 2022. I believe they are still a good company in 2023. In the five years since 2017, we’ve seen revenue CAGRs as follows for Google’s segments ($ in millions):

|

Segment |

2017 revenue |

2022 revenue |

CAGR |

|

Search & other ads |

$69,811 |

$162,450 |

18% |

|

YouTube ads |

$8,150 |

$29,243 |

29% |

|

Network ads |

$17,616 |

$32,780 |

13% |

|

Google other |

$10,914 |

$29,055 |

22% |

|

Cloud |

$4,056 |

$26,280 |

45% |

I also like to look at these numbers in a way that shows every year individually as the CAGRs have not been smooth; the biggest inflection point was the jump from 2020 to 2021:

Google segment revenue (Author’s spreadsheet)

Valuation

Again, Google services had operating income of $86,572 million in 2022 and I believe the segment is worth 18 to 20x this amount implying a range of $1,560 to $1,730 billion when we round to the nearest $10 billion.

Google never should have been four years behind AWS with the cloud business but late is better than never. Today the cloud business is very different from where it was four years ago. We see this by looking at the operating losses from Google Cloud now versus the operating income from AWS four years ago based on similar levels of revenue:

|

in millions $ |

||||||

|

Google Cloud Qtr End |

Google Cloud Operating Income |

Google Cloud Revenue |

AWS Qtr End |

AWS Operating Income |

AWS Revenue |

|

|

Dec 2019 |

$ (1,194) |

$2,614 |

Dec 2015 |

$580 |

$2,405 |

|

|

Mar 2020 |

$ (1,730) |

$2,777 |

Mar 2016 |

$604 |

$2,566 |

|

|

Jun 2020 |

$ (1,426) |

$3,007 |

Jun 2016 |

$718 |

$2,886 |

|

|

Sep 2020 |

$ (1,208) |

$3,444 |

Sep 2016 |

$861 |

$3,231 |

|

|

Dec 2020 |

$ (1,243) |

$3,831 |

Dec 2016 |

$926 |

$3,536 |

|

|

Mar 2021 |

$ (974) |

$4,047 |

Mar 2017 |

$890 |

$3,661 |

|

|

Jun 2021 |

$ (591) |

$4,628 |

Jun 2017 |

$916 |

$4,100 |

|

|

Sep 2021 |

$ (644) |

$4,990 |

Sep 2017 |

$1,171 |

$4,584 |

|

|

Dec 2021 |

$ (890) |

$5,541 |

Dec 2017 |

$1,354 |

$5,113 |

|

|

Mar 2022 |

$ (931) |

$5,821 |

Mar 2018 |

$1,400 |

$5,442 |

|

|

Jun 2022 |

$ (858) |

$6,276 |

Jun 2018 |

$1,642 |

$6,105 |

|

|

Sep 2022 |

$ (699) |

$6,868 |

Sep 2018 |

$2,077 |

$6,679 |

|

|

Dec 2022 |

$ (480) |

$7,315 |

Dec 2018 |

$2,177 |

$7,430 |

|

|

$ (12,868) |

$ 61,159 |

$15,316 |

$57,738 |

The figures above are staggering! Google Cloud had cumulative operating losses of $12.9 billion from the 4Q19 quarter to the 4Q22 quarter based on cumulative revenue of $61.2 billion. AWS had a 4-year head start and they had cumulative operating income of $15.3 billion from the 4Q15 quarter to the 4Q18 quarter based on cumulative revenue of $57.7 billion. On the one hand, this isn’t great for Google but on the other hand, it shows that we are unlikely to see new entrants at this late stage.

In 2022, AWS had operating income of $22,841 million on revenue of $80,096 million for a margin of 28.5%. Given their first-mover advantage, I think they’ll have a higher operating margin than Google Cloud for the foreseeable future. However, I can see Google Cloud getting to an operating margin of 15% to 20% eventually and if we use those hypothetical margins today on Google Cloud’s 2022 revenue of $26,280 million then we’re talking about $3.9 to $5.3 billion of operating income. Using a multiple of 18 to 20 times and rounding to the nearest $5 billion gives us a valuation range of $70 to $105 billion.

Here is my sum of the parts valuation summary:

$1,560 to $1,730 billion Google Services

$70 to $105 billion Google Cloud

$0 Other Bets

—————————–

$1,630 to $1,835 billion Total

The 2022 10-K shows 5,956 million A shares plus 883 million B shares for a sub total of 6,839 million which we multiply by the April 10th GOOGL share price of $106.44 to get a partial consideration of $727.9 billion. It also shows 5,968 million C shares which we multiply by the April 10th GOOG share price of $106.95 to get the other partial consideration of $638.3 billion. Adding these together gives us a market cap of $1,366 billion. The enterprise value is well less than the market cap seeing as the cash and marketable securities sub total of $113.8 billion heavily outweighs other balance sheet considerations. The stock is below my valuation range and I believe it is a buy for investors willing to hold it for at least three years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AMZN, META, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.