Summary:

- Alphabet Inc./Google has fallen in the last month, but remains a cheap buy due to leadership in generative AI and market fears on OpenAI.

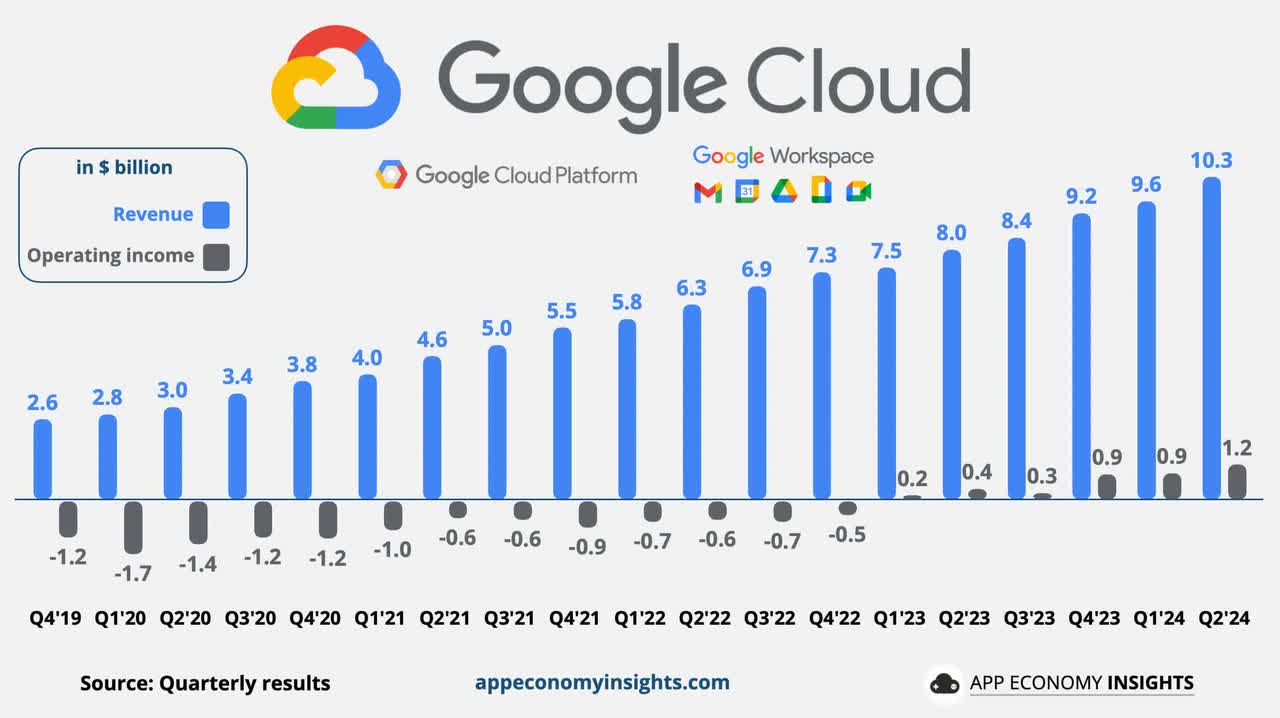

- Google Cloud is a big growth driver with revenues topping $10 billion for strong 29% growth, while Search market share remains dominant.

- The stock has dipped back to below 17x ’25 EPS targets, making Google one of the cheapest large-cap tech plays.

tomch

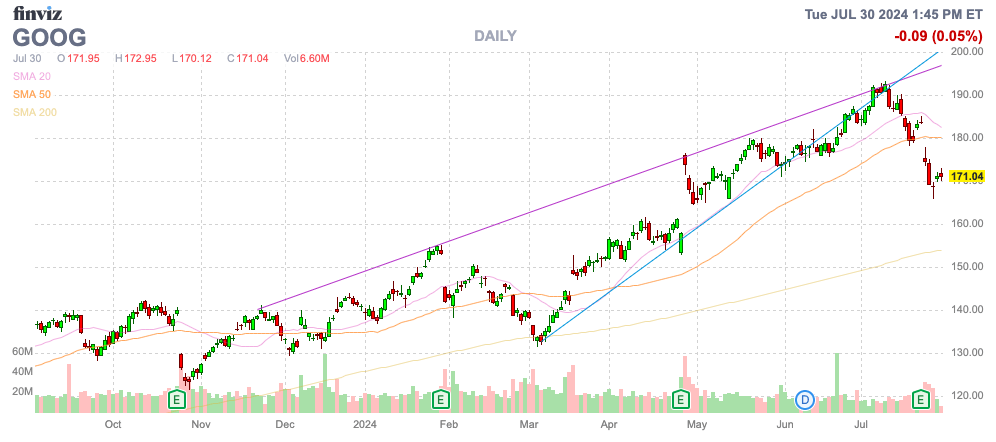

As with many tech stocks, Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL, NEOE:GOOG:CA), aka Google, has fallen in the last month. Not all large cap tech stocks are buys on this dip, but Google is cheap with their leadership in generative AI and the market fears on OpenAI. My investment thesis remains ultra-Bullish on the stock following the dip back below $170.

Source: Finviz

Cloud Boom

Google has substantial opportunities to generate revenues from generative AI demand via either AI search or cloud services tied to AI. The tech giant reported Q2 ’24 revenues surged to $84.7 billion for 13.6% growth.

The big growth driver is Google Cloud with revenues topping $10 billion for the first quarter for strong 29% growth. Along with Google Search, Google saw these key areas tied to AI grow by a combined 16% with several billion in Google Cloud already related to AI.

The company is seeing limited growth in YouTube ads and Google subscriptions, mostly tied to the media business. As with many larger businesses, Google can’t always grow every unit at a fast clip.

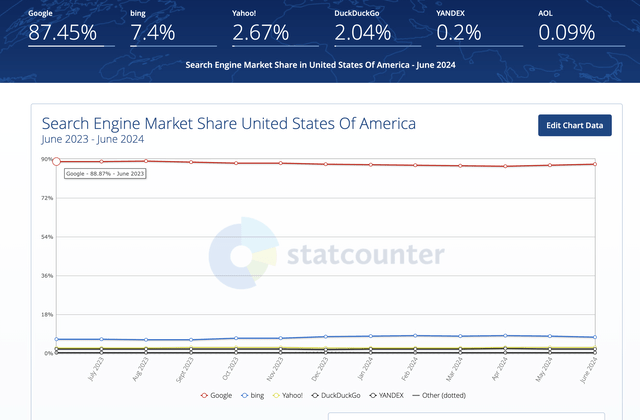

OpenAI has supposedly been the biggest threat to the Search business, but Google is passing with flying colors here. Generative AI is increasing the pie in this category with the Search market share dipping slightly, yet Google is still reporting soaring revenue growth.

In the key U.S. search market share, Google is still at 87.5%, though down from 88.9% last year. Global market share remains 91.1% for total dominance by Google, with Microsoft (MSFT) Bing only grabbing a 3.7% share.

The thesis remains that a small portion of users are replacing Google with generative AI searches from ChatGPT, but the majority of people still go to Google to search for product related information. ChatGPT is more useful for obtaining information, than product information tied to advertising sales.

The latest fear is OpenAI entering the search space, but the view is that the majority of non-tech users will continue going directly to Google. Besides, Google has launched Gemini AI and is full speed ahead on incorporating generative AI into search.

SearchGPT is only being tested by 10,000 users and publishers. OpenAI officially launched ChatGPT all the way back in November 2022 and Google hasn’t slowed down this whole period.

OpenAI is apparently spending up to $7 billion annually on AI computing power, and the Search test doesn’t even include ads. One has to wonder if OpenAI can invest aggressively in a competing search product against Google with a cash balance of $100 billion.

Investing For The Future

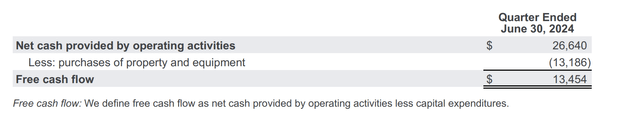

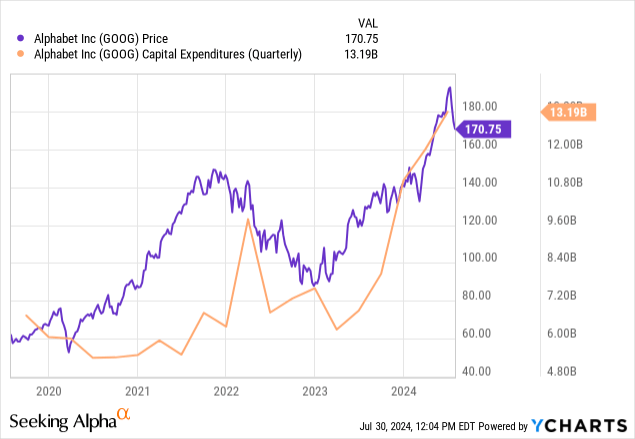

The stock market is definitely concerned about excess spending for building out AI. Google spent an incredible $13.2 billion on capital spending for equipment and property in the quarter, while still leaving $13.5 billion in free cash flow.

Source: Google Q2’24 presentation

Google saw capex dip below $7 billion back in Q1 ’23 before the generative AI opportunity exploded. The stock price has continued higher due to the investments paying off over time and the ability of the tech giant to spend aggressive on an AI leadership position without even really slowing down free cash flow generation.

The higher capex spending will ultimately flow through to higher depreciation expenses and could damper earnings going forward, with the CFO pointing out this issue for Q3 results. Google will need to continue to invest in AI going forward, with plans to spend at least $12 billion in capex per quarter in the 2H.

In Q2 ’24, depreciation costs were only $3.7 billion, though up from $2.8 billion in the prior-year quarter. The costs flowing through the income statement are still relatively low and more in line with capex levels from several years back.

Another part of investing in the future is self-driving cars. Waymo is already delivering 50,000 paid rides a week in San Francisco and Phoenix. Tesla (TSLA) continues to promote a massive robotaxi future, while Google is already living it. The company announced plans to spend another $5 billion on funding Waymo development, yet the company doesn’t really get much credit for this business opportunity ahead.

The stock has now dipped back to $171. Google isn’t the same bargain as in the past, especially in the late 2022 dip below $100. Still, the stock has fallen from a peak of $193 and offers a much better deal after this pull back and more confirmation of riding the generative AI wave via strong sales growth.

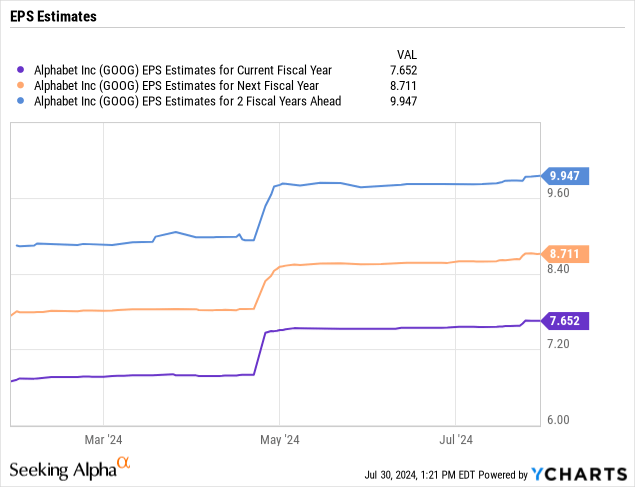

The consensus estimates now have Google earning $8.71 in 2025 for nearly 14% growth next year. The stock is back to trading below 20x these GAAP numbers.

For 2023, Google spent $22.5 billion on SBC and the company remained relatively flat in 1H of the year at $11.1 billion. At the end of June, the employee count was down nearly to 179K in a sign SBC should remain at a similar level in 2024.

At a 15% tax rate and with ~12.5 billion shares outstanding, the EPS impact is ~$1.53 per share. Based on the 2025 EPS target, Google is set to earn a non-GAAP EPS of $10.24. The stock trades below 17x these EPS estimates.

Google remains one of the cheapest large cap tech stocks, trading at only 20x forward GAAP EPS estimates. The stock is far cheaper when considering the non-GAAP numbers and $100 billion in cash.

Takeaway

The key investor takeaway is that Google remains too cheap to ignore again. The tech giant is a leader in AI while being one of the cheapest tech stocks.

Investors should use the recent weakness to load up again, while other tech stocks still trade at nearly double the forward PE multiple, even after the pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end July, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.