Summary:

- Google reported strong Q4 earnings, beating analyst estimates by over $1 billion.

- The market was disappointed with the lack of tangible data points on AI growth, favoring investment stories from companies like Microsoft and Nvidia.

- Google’s search and cloud revenues have seen significant growth, driven in part by AI tools.

- Stock only trades at ~16x non-GAAP EPS targets for 2024.

Alexander Koerner

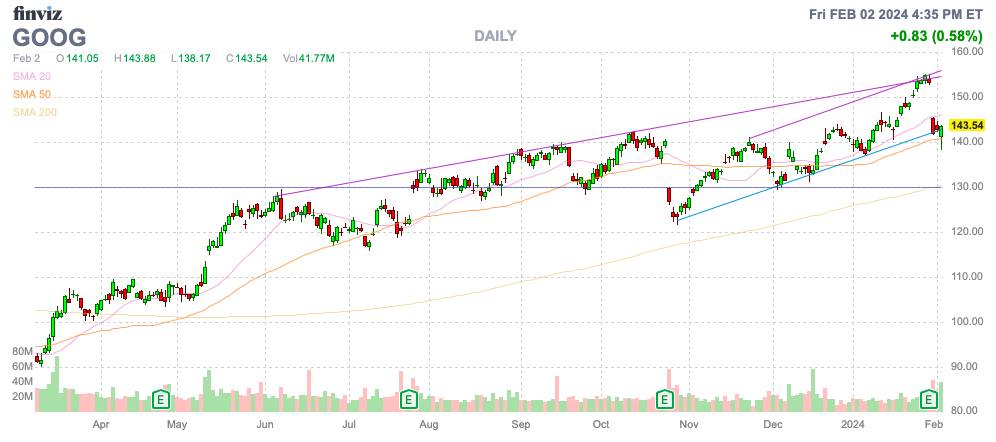

After a solid quarter, Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka Google, fell due to a market disappointment in the visible direction of the AI business. The tech giant continues to execute with strong growth rates, but the market is turning towards investment stories where the AI opportunity is more tangible. My investment thesis remains ultra Bullish on the stock trading at a discount to mega-cap tech stocks after several recent rallies leave Google behind.

Source: Finviz

Unwarranted Negativity

First and foremost, Google reported Q4’23 results that easily soared past analyst estimates as follows:

Source: Seeking Alpha

The search giant returned to solid growth with revenues jumping 13.5% over last Q4. Google beat analyst estimates by over $1.0 billion, so the quarter clearly wasn’t the problem with the post-earnings selloff. The market apparently was focused solely on the advertising business slightly missing a revenue target of $65.8 billion.

The market got through the earning calls and didn’t hear any tangible data points of where AI is driving growth. Microsoft (MSFT) charges for the Co-pilot software solution, OpenAI charges for ChatGPT, and NVIDIA (NVDA) has seen GPU chip sales soar by billions and the market likes these investment stories better.

Google remains the Internet search leader with a market share hanging in over 91%, similar to the 92% from last December. ChatGPT has been live for well over a year with integration into Bing with no real impact on search market share for Google.

The company has seen both Google Search and Google Cloud revenues jump in the last year. Google Cloud growing over 25% is a very bullish sign with the growth rate jumping from the nearly 23% clip in Q3:

- Google Search & Other: $48.02B (12.7%)

- YouTube Ads: $9.2B (15.6%)

- Google Network: $8.3B (-2.1%)

- Google subscriptions, platforms, and devices: $10.79B (22.6%)

- Google Cloud: $9.19B (25.5%)

The AI key is that both revenue numbers get boosts from the AI tools already implemented by Google, such as AI Hypercomputer, Duvet AI, and Vertex AI. The CEO specifically called out generative AI for the Google Cloud business reporting revenues topping $9 billion in the December quarter for the first time.

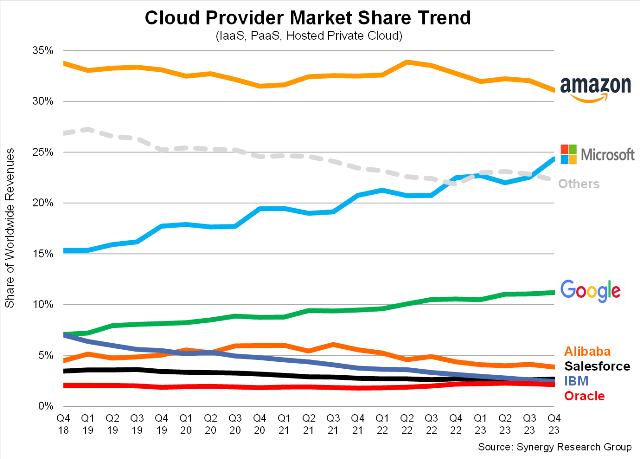

Microsoft reported cloud revenues grew by 28%. Both companies are taking market share from Amazon (AMZN) with AWS presumably slipping with the AI focus on Google and Microsoft cloud segments.

Source: Synergy Research Group

As important as market share, Google Cloud is now highly profitable. The cloud service generated $864 million in operating income for Q4’23 with a margin of 9% after only turning profitable back in Q1’23, in part helped by server depreciation costs.

Google is already using the Gemini foundation model to enhance search results and improve advertiser campaigns while Bard provides a generative AI option for users. On the Q4’23 earnings call, CEO Sundar Pichai summed up the AI-powered solution as follows:

…launching the Gemini era, a new industry-leading series of models that will fuel the next generation of advances. Gemini is the first realization of the vision we had when we formed Google DeepMind, bringing together our two world-class research teams. It’s engineered to understand and combine text, images, audio, video and code in a natively multimodal way and it can run on everything from mobile devices to data centers.

The tech giant didn’t provide any specifics about the revenues contributed by AI leading to limited excitement from analysts. Investors became more concerned with advertising revenues facing pressure from Microsoft Bing incorporating generative AI features and the usage of ChatGPT.

A key note here is that Microsoft is only forecast to produce 15% growth in the next year after hitting over 17% in Q4. Whether or not Microsoft can provide tangible services with specific AI boosts, the total revenue growth isn’t far off from the numbers just produced by forecasts for Google.

Cheapest Tech Giant

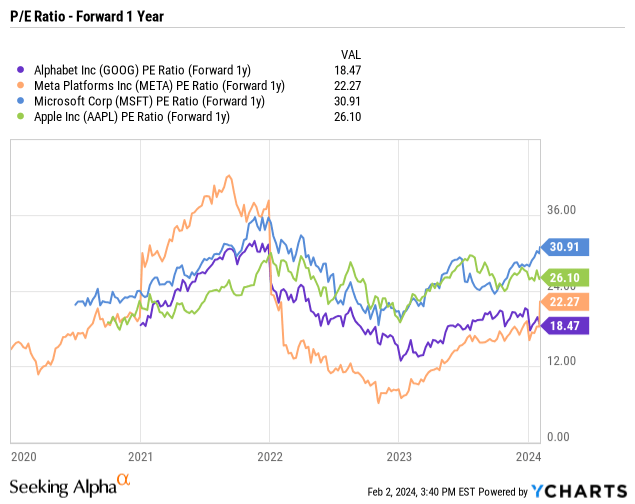

With the huge Meta Platforms (META) surge of 20% following the strong Q4’23 report, Google is now the cheapest giant tech stock. Only slightly over a year ago, Meta was in the dumps trading for below $100 while the stock has now soared to over $450 in a sign of how the market tends to fret too much.

Using the listed GAAP numbers from analysts, Google trades at only 18.5x forward EPS targets, with Microsoft and Apple (AAPL) trading at levels closer to 30x. Note, Apple just reported another quarter with challenged growth, and tech analyst Gene Munster is now predicting FQ2 sales fall by 5.5%, yet the tech giant trades at a premium to Google.

As with Meta last year when my thesis was an improving business along with a catalyst to boost earnings provide strong upside for the stock, Google is in that position now. The market has fallen out of favor with the AI company, yet Google Search and Google Cloud both show signs of tangible revenue growth due to AI.

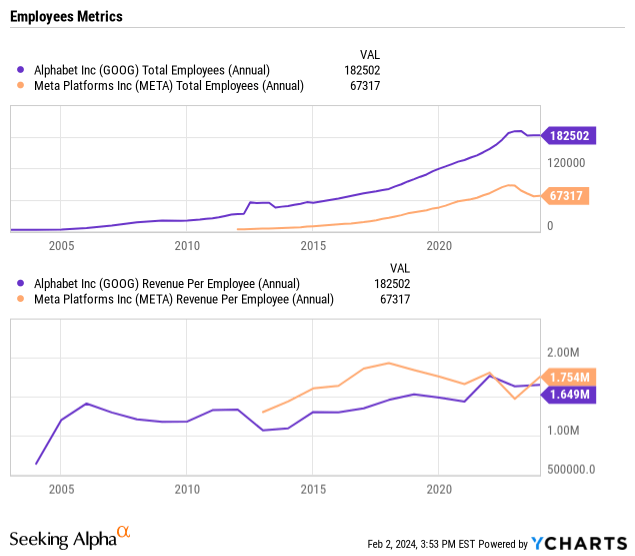

Both tech giants took a path to implement efficiency programs during the last year, but Google hasn’t made the same shifts as Meta. Google has nearly 3x the employee base of Meta, but the company has only cut approximately the same amount of employees. Meta has now pushed the revenue per employee back above Google providing another catalyst for the company to reduce costs and further boost profits.

Google would seem to have the ability to cut more employees to provide more upside for the business. However, a bigger issue is the existing large stock-based compensation hidden in the GAAP earnings report along with one-time income and cost metrics making the quarterly results difficult to compare.

As discussed prior, the stock remains exceptionally cheap with Google only trading at ~17x operating cash flows of $102 billion for 2023 alone. The company remains on pace for 2024 EPS of close to $7 and stock-based compensation of ~$24 billion this year (up from $22.5 billion in 2023) contributes another $1.50+ in non-GAAP EPS.

Google only trades at ~16x non-GAAP EPS targets for 2024 when factoring in $111 billion in cash. The company has similar growth rates and focuses on AI as Microsoft, but the stock trades at a major discount to the valuation multiple of the perceived leader in AI.

Takeaway

The key investor takeaway is that Google reported a big beat for Q4’23 and the market took an odd position to find the results disappointing. Investors should use the post-earnings weakness to continue owning the stock or build a position as Google implements AI into all aspects of the business. The market wants a more tangible talking point around AI revenue growth, but the search leader is using AI to boost a massive business with $300 billion in revenues already. The end result should be the growth rates to warrant a much higher stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.