Summary:

- Alphabet reported solid financial results for Q1 2023 as it beat both revenue and earnings estimates.

- Its revenue growth rate was still “slow” at just 2.6% YoY in Q1,23 but this was greater than the 0.98% rate reported in Q4,22, which could indicate a turnaround.

- Google Cloud continued to produce solid results with a 27.6% YoY growth rate to $7.4 billion. Google Cloud is utilized by 60% of the world’s 1,000 largest companies (Google Data).

- AI platforms such as ChatGPT (Microsoft backed) are a threat to Google’s core search business, but a Stanford paper indicates Alphabet’s PaLM AI model has more parameters at 540B vs 175B for GPT-3.

Justin Sullivan/Getty Images News

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has been in the headlines recently for all the wrong reasons, as the company was deemed to be “doomed,” thanks to the rise in AI platforms such as ChatGPT and the decline in the advertising market. However, upon further analysis, which I covered in prior posts Alphabet is still in a strong position in AI, and the technology is embedded into its entire ecosystem from advertising targeting to YouTube. For the first quarter of 2023, Alphabet shocked analysts and reported a beat for both its top and bottom line estimates. This is despite a “recessionary” environment and a decline in advertising spend. A positive is advertising tends to be cyclical by nature and thus I forecast a rebound long term. In addition, Google’s Cloud is still growing strong, as is its YouTube services such as Shorts and Subscriptions. In this post I’m going to break down its first quarter results, before revealing my forecasts and valuation for the stock, let’s dive in.

Steady First Quarter Results

Alphabet reported steady financial results for the first quarter of fiscal year 2023. Its revenue was $69.79 billion which beat analyst forecasts by $950.62 million but increased by just 2.6% year over year. On a constant currency basis, the growth rate was slightly better at ~6% YoY, but this was still substantially slower than historic levels. For full year 2022, Alphabet grew its revenue by 9.78% and for full year 2021, its revenue increased by a rapid 41.15%. The only silver lining is its recent (Q1,23) growth rate looks to be slightly faster than the 0.96% growth rate reported in Q4,22. Therefore this could signal the “bottom” may be in, and we’re now at the start of a new growth trend. However, I would personally like to see a few positive data points, especially given revenue has actually declined by ~8% quarter over quarter, which nobody seems to be talking about. The good news is this declining sequential growth rate also occurred between Q4,21 and Q1,22 at minus 9.71% (shown in red in my table below). Therefore, I will assume this is generally due to the holiday season, which has resulted in record advertising spend and thus higher revenue levels (shown in green).

Google Revenue Growth Rate Quarter Over Quarter (created by author Ben at Deep Tech Insights)

Note: The revenue column on the table is offset relative to the growth rates.

For extra details, I have created a chart which clearly shows the dip in revenue during the first quarter relative to the fourth quarter. But given revenue is still slightly higher year over year, the result is still positive.

Revenue Per Quarter Alphabet (Created by author Ben Alaimo at Deep Tech Insights)

For Q1,23, its operating income was $17.4 billion which declined by 13% year over year but still managed to achieve a 25% margin which was solid. This result was mainly driven by a 19% increase in operating expenses due to $2.6 billion in workforce and office space reduction expenses. A positive is I believe many of these expenses are “one-off” and thus longer term this should create a more streamlined business, with even higher margins. I will discuss more specifics on this in my “valuation and forecasts” section.

Advertising Headwinds

Alphabet generated 78% of its revenue from advertising as of Q1,23, down from 80%, as of Q1,22, therefore Alphabet could be slightly more diversified, or the 2% difference could be related to advertising market changes.

The main factor that’s weighing Alphabet’s growth rate down is the cyclical decline in advertising spend, driven by the “recessionary” environment. As someone who has worked in the digital marketing industry (consultancy owner), I have insight into this market. Even if we technically aren’t in a recession yet, the psychological impact results in real actions by advertisers. We already have seen many large public companies “cut costs” (see my other posts) and many smaller businesses have a similar mindset with advertising spending easy to slash at the click of a button. The economics of advertising also changes during a “recessionary” environment, the Cost of Customer Acquisition or “CAC” tends to rise initially as consumers are less free-flowing with purchases, which results in greater friction and effectively a harder sale. Ironically though, if advertising spending drains substantially this can actually make it more economical, as platforms such as Google Ads and YouTube ads tend to work on an auction-based system to set advertising rates.

Either way, a cyclical decline in advertising spend is nothing new to Google and the same thing occurred at the start of the pandemic in 2020, which acted as a catalyst for the stock price to plummet, I personally invested during that time and experienced gains of 96% as the advertising market rebounded. It should be noted, the dynamics of the market have changed slightly since just a couple of years ago as alternative platforms such as TikTok continue to rise (over 1 billion monthly active users), which has resulted in a migration of advertising spend and even AI platforms such as ChatGPT will likely result in lower search volume and thus fewer opportunities for advertising placements. I will discuss more on this later.

Breaking down the business by segment, Google’s total advertising revenue declined by 0.18%, year over year due to the aforementioned reasons. Google Network advertising dropped by 8.32% year over year, while Google Search was up 2% year over year to $40.4 billion.

Alphabet Segment Revenue (Q1,FY23)

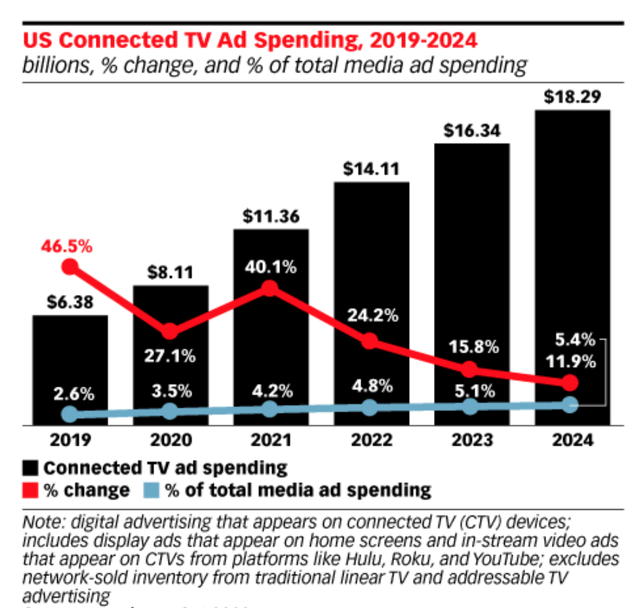

YouTube the Next Generation TV

YouTube ads were down 2.56% year over year to $6.693 billion, but I wouldn’t write off this segment just yet. YouTube is the second-largest search engine in the world and the largest video-based platform globally. According to a study by eMarketer, U.S. connected TV advertising spend has been growing at a steady rate and is expected to be worth $18.29 billion by 2024. The study also references that YouTube, Hulu, and Roku accounted for around half of CTV advertising dollars. In addition, Younger generations such as Gen Z, are extremely unlikely to watch traditional TV and tend to consume content on social media platforms and YouTube (which is also technically social media). Therefore, I believe these industry trends will continue to benefit YouTube and thus Alphabet.

US connected TV inc YouTube (emarketer)

YouTube also has continued to add new features to its platform such as its “Shorts” (TikTok equivalent short-form video style). This format has continued to be adopted with the number of daily Shorts up daily by “over 80%” year over year, according to management on the earnings call. This doesn’t surprise me as when YouTube first introduced “Shorts,” the dashboard setup meant these videos were placed next to a creator’s regular videos. This didn’t go down well with creators who were concerned about losing engagement on their main channel by posting shorts (there were many YouTube videos online about this). The good news is YouTube made a change (I believe in Q4,22) that enabled these videos to be posted in a separate tab, which I believe boosted engagement. I can attest that it did this for my own large channel and client’s channels who were now eager to post videos without risk.

In previous posts I referenced that a concern I had was that Shorts are more challenging to monetize, but this was a “short-term” issue in my mind.

It’s clear that the thesis is now playing out as management reported positive progress with monetization, as more users were “converting on ads”. Revenue for creators via YouTube shorts also was only introduced in February 2023, therefore, it’s still early days and even the first quarter wouldn’t have fully digested the impact of Shorts advertising. In addition, this program should help to drive a surge in the number of creators on the platform. For example, Meta’s Instagram Reels don’t offer creators a simple advertising revenue program nor does its rival TikTok. These platforms do offer “Reel bonuses” for creators, but for the majority of creators, these are inaccessible, due to the high bar (millions of views).

Google’s “Other” revenue also grew by 9% year over year to $7.4 billion in Q1,23. This was driven by strong growth in YouTube subscriptions, with momentum around YouTube TV, and even an NFL Sunday Ticket offering.

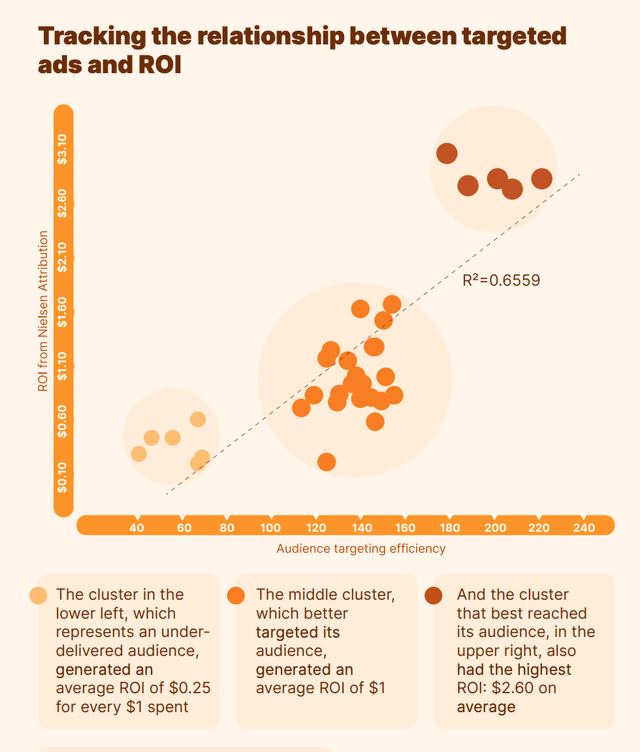

According to a study by Nielsen, YouTube’s Return on Investment (ROI) for advertisers is 40% higher than linear TV. Therefore, YouTube has a major opportunity to benefit from advertising spend migration from these traditional services. The high ROI doesn’t surprise me as YouTube advertising offers highly advanced AI-powered targeting, which has been refined for over a decade and across billions of data points. Also, the micro-channel nature of YouTube means advertisers can be assured that the targeting is much more relevant and effective. The chart below shows there’s a clear relationship between targeted advertising and Return on Investment (ROI). I believe Alphabet has a competitive advantage in this space and even if advertising runs a “test budget” on platforms such as Netflix (NFLX) (which has recently rolled out advertising), I imagine its ROI will be lower than YouTube initially.

ROI and targeted Advertising (Nielsen)

YouTube also has huge potential to grow its “shopping” service and has partnered with Shopify to enable store connection directly to channels. According to management, over 100,000 creators have connected their product stores to YouTube. I also see huge potential for interactive shopping and live-stream shopping. The livestream e-commerce market was worth $17 billion in 2022 and is expected to triple over the next four years according to forecasts by Statista. I believe YouTube will be a primary beneficiary of this growth trend.

Cloud and AI Growth Drivers

Google Cloud has continued to produce solid growth with revenue growth of 27.6% year over year to $7.4 billion. The cloud industry is forecast to grow at a 17.9% compounded annual growth rate and reach a value of $1.2 trillion by 2027. I believe Google Cloud is forecast to continue to benefit from this digital transformation trend, as the third largest cloud provider behind AWS and Microsoft Azure. Over the past three years, Google Cloud has increased its annual large “deal volume” (worth over $250 million) by over 300%, which is a positive sign as larger organizations tend to offer great lock in and expansion opportunities.

In previous posts, I have discussed Alphabet’s strong leadership position in Artificial Intelligence despite being late to market with its Baird AI platform for generative AI, relative to ChatGPT. Alphabet’s PaLM generative AI model actually has more parameters (540 billion) than Open AI’s GPT 3 at 175 billion parameters, according to a Stanford paper. Open AI hasn’t released data on the number of parameters for GPT 3.5, but there are rumors that GPT 4 will have “over 1 trillion” parameters but I believe this is just speculation and not based on evidence. In fact, Open AI’s founder and CEO Sam Altman stated in an interview with StrictlyVC that the “rumor mill is crazy,” “people are begging to be disappointed” and “we don’t have an actual AGI.” Therefore, I believe Alphabet is still in a powerful position, but I do think they are being overly cautious with their release. Baird has a waitlist access door setup, when a user signs up for its waitlist, access has started to be granted shortly after. However, I believe this still adds friction to the process and means Alphabet may miss out on the “AI hype” to a certain extent and capture less new training data. I understand Google is being cautious to avoid damaging its brand with poor results, but this just shows the negatives of a larger organization. I believe Alphabet should spin off its generative AI as a separate entity and then own a stake (similar to the setup Microsoft has with Open AI, 50% owner). Therefore, the smaller business can “move fast and break things” while still benefiting from an “800-pound Gorilla” in its corner.

Valuation and Forecasts

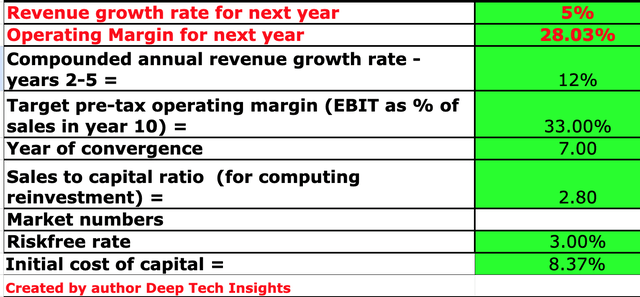

In order to value Alphabet, I have plugged its latest financial data into my discounted cash flow valuation model. I have forecast 5% revenue growth for “next year,” which is 1% higher than the level I forecasted in my prior post on Alphabet. This is because its year-over-year growth rate of 2.6% reported in Q1,23 was not as bad as the 0.98% reported in Q4,22. In addition, foreign exchange rates have started to ease with the U.S. dollar correcting down against most other currencies. In addition, China’s partnerships with countries such as Brazil to move away from the U.S. dollar should devalue the currency which will likely cause a more balanced exchange rate situation, although the long term this could be an issue for the U.S., but that is out of the scope for this post. Either way, I have forecast a 12% operating margin over the next two to five years as the advertising market rebounds. This is 1% higher than my prior post and is driven by the strong adoption of Shorts and continued monetization ability, as well as continued growth in the cloud.

Alphabet stock valuation 1 (created by author Ben at Deep Tech Insights)

To increase the accuracy of my valuation model, I have capitalized R&D expenses which has boosted its operating margin slightly to 28%, which I have kept as equivalent for “next year” or the next four quarters. Over the next seven years I have forecast a pre-tax operating margin of 33%. This may seem bold, but this is only ~2% higher than the 30.55% margin generated in 2021. Given Google Cloud is continually growing, as is its subscription services, I deem this to be achievable as advertising rebounds. This also is not taking into account any of Alphabet’s “Moonshots” such as its autonomous driving business Waymo. Waymo has applied for the final permit to sell its autonomous vehicle rides in California and thus this segment is close to being able to generate revenue.

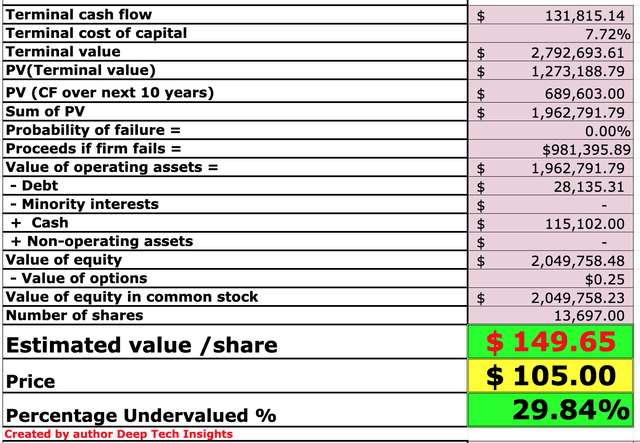

Alphabet also has a fortress balance sheet with $115.1 billion in cash, cash equivalents, and marketable securities. In addition to $13.7 billion in long-term debt, which is manageable.

Alphabet stock valuation 2 (created by author Ben at Deep Tech Insights)

Given these factors I get an intrinsic value of $149.65 per share, the stock is trading at $105 per share and thus it’s ~29.84% undervalued, according to my forecasts and model.

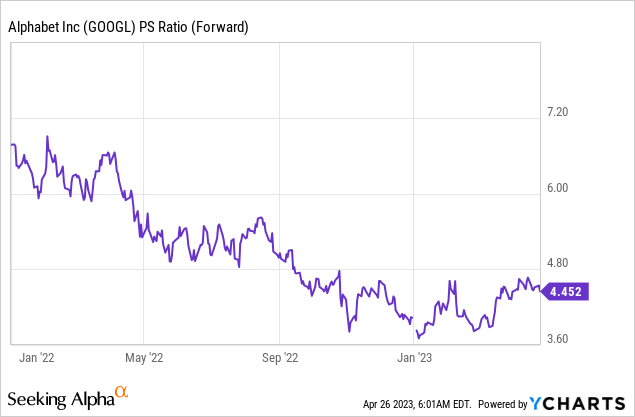

The stock also trades at a price-to-sales ((P/S)) ratio equal to 4.45, which is 25% cheaper than its five-year average.

Risks

Advertising headwinds/competition

As discussed prior, Alphabet is facing challenges from the cyclical decline in the advertising market due to the forecasted recession. The company also faces competition in its core search business for the first time in many years, thanks to the rise of ChatGPT and its backing by Microsoft with its Bing Search engine. In addition, Alphabet faces competition on the advertising spend front from TikTok, Meta, and even Netflix with its ad-supported programs. These are all risks, which I have assessed and factored into my forecasts.

Final Thoughts

Alphabet is experiencing slowing growth and a number of challenges for the first time in decades. However, I believe given its targeting advertising advantage, strong growth in the cloud and YouTube, the company is still in an immensely strong position. Few companies have the scale advantage Alphabet has with a fortress balance sheet and a track record of attracting the greatest talent. Given my valuation model and forecasts indicates the stock is undervalued intrinsically, I will deem it to be a “buy” for the long term, although do expect headwinds for at least the next year, until the advertising market recovers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.