Summary:

- Could AI benefit or harm Alphabet’s search engine? That’s what investors are attempting to figure out.

- Alphabet is fighting two fights. Cutting back expenses and cost optimizing, and at the same time ramping up investment in AI.

- Google Cloud becomes profitable (with some minor accounting). However, the timing couldn’t be better.

D-Keine/iStock via Getty Images

Investment Thesis

Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) is at an important crossroads. On the one hand, investors are clamoring to know how much progress Alphabet made to position its business for the AI wave.

While at the same time, Alphabet is having to cost-cut and find savings throughout its organizations.

The quote from Alphabet’s CEO Sundar Pichai epitomizes this dynamic,

We continue to significantly invest in infrastructure to drive our many AI opportunities. Improving external procurement is another area where data suggests significant savings, and this work is underway.

I charge that the best time to invest in a compounding business is when investors are uncertain about its future prospects. Here, there couldn’t possibly be more uncertainty.

Search, Alphabet’s core business, is weak and over-bloated, contemporaneous with investors fearful that Alphabet could be missing out on the AI race.

The Race for AI, Inflection Point

“We see huge opportunities ahead, continuing our long track record of innovation.” (CEO Sundar Pichai)

Alphabet faces two problems. Firstly, Microsoft (MSFT) is clearly taking charge in AI. That’s one problem, how much of AI is media hype versus near-term potential?

In fact, as you know, nearly every single innovation cycle is met in the first case by massive investor enthusiasm, and oftentimes technologies die down, or fail to live up to early expectations.

For example, we saw that with the early internet (dotcom bubble), streaming wars (think HBO, Netflix (NFLX), Amazon Video (AMZN), and fintech (buy now pay later services), indeed, the list is too long to enumerate.

And yet, it’s hard to deny the profound impact that these technological advancements have had on our world over time.

The second problem that Alphabet faces is that its core business, Search, isn’t as strong right now as it was in recent quarters.

Consequently, rather than being able to embrace AI from a position of strength, Alphabet is having to “re-engineer [its] cost base”, another term for cost-cutting, while at the same time ramping up capital to catch up on the AI wave.

Alphabet knows better than most companies what it meant to be left behind on the smartphone wave. Also, the dissatisfaction investors had seeing Alphabet miss out on the first cloudification wave.

Hence, what can Alphabet realistically do now to not only get on the offense in AI and AGI (Artificial General Intelligence) but to become a leader in this space?

For their part, Alphabet stated during the earnings call,

We’ll continue to incorporate generative AI advances to make Search better in a thoughtful and deliberate way.

We’ll be guided by data and years of experience about what people want and our high standards for quality. And we’ll test and iterate as we go because we know that billions of people trust Google to provide the right information.

The key message from Alphabet was that Alphabet’s Search is “the” default search engine and that Alphabet has accumulated billions of data points over the years and knows best how to provide users with the right information.

Having said that, it’s important to keep one key consideration at the forefront of our minds, neither Microsoft (MSFT) nor Alphabet has yet made meaningful inroads into AI. For now, both companies are simply attempting to move as quickly as possible toward AI products. This is my critical assertion, not all is lost.

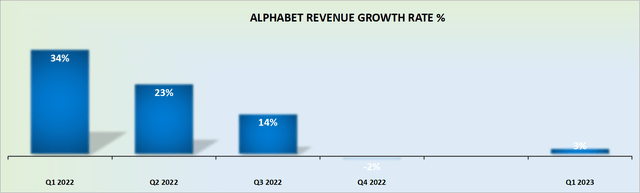

Revenue Growth Rates, Under Pressure

Further compounding matters for Alphabet, as touched on already, the core business, Google Services, delivered unenticing results, up a 1% y/y.

How much of this is the macro environment, where advertisers are pulling back on advertising? And how much of this is Alphabet losing market share? Ultimately, this is the most crucial aspect to form a view on.

Because if it’s “just” the macro environment, whence the global economy, but particularly the US economy, strengthens, then Alphabet could resume its solid growth prospects.

However, if it’s indeed the case that Alphabet is losing market share to the likes of Meta (META), Amazon, and perhaps, dare I say it, to Bing, then this dramatically changes the whole investment thesis, and what investors are being asked to underwrite here.

Simply put, this is the key question, can Alphabet figure out a way to raise its revenue per advertisement, while still ensuring its customers still get high ROIs?

How to ensure that the users on Search get a more comprehensive understanding of information, while at the same delivering traffic to the websites that pay for that advertisement?

To put it more concretely, this is the core value position in question, how to improve the relevancy and performance of shown ads in a measurable manner?

Let me provide an example, is the user “just searching”? Or is it an intent-based search that could culminate in a transaction? How to understand the difference and improve the bidding process for advertisers across all Google Networks, including YouTube?

Can Alphabet reshape its future so that it can go beyond delivering information to improving the monetization of its user?

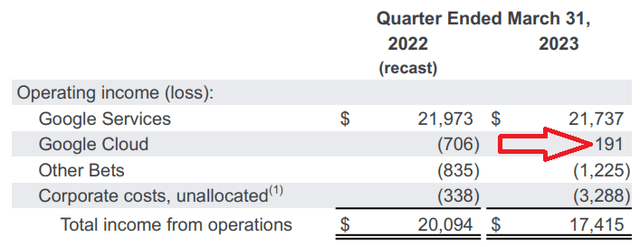

Cloud Shines Bright

Google Cloud made a massive swing in profitability in Q1. Although, note that there were some changes in accounting for useful life servers that played some role here.

Nevertheless, this didn’t get the limelight on the earnings results and post-earnings reaction.

However, I believe that when investors calm down from the AI post-earnings reaction, investors will soon return to recognize the appeal of a profitable segment within Alphabet that’s fully independent and diversified from advertising.

Furthermore, consider what Pichai stated on the call,

Over the past 3 years, GCP’s [Google Cloud] annual deal volume has grown nearly 500%, with large deals over $250 million growing more than 300%.

Nearly 60% of the world’s 1,000 largest companies are Google Cloud customers, and many leading start-ups and millions of small and medium enterprises use Google Cloud.

As I alluded to earlier, Alphabet had to come from behind AWS and Microsoft to now capture 60% of the 1,000 largest companies. Think about that aspect for a moment.

The Bottom Line

At the core of what Alphabet provides through Search is information. The problem with AI is that it could make the search process too efficient, that you get the end result too quickly and users see fewer ads.

How to marry up those two opposing dynamics is what Pichai has to navigate: Delivering maximum relevancy to end users, while not losing out on paid advertising.

Altogether, I believe that paying 21x forward earnings is an attractive valuation for Alphabet. Yes, there are some crucial unanswered questions, but that uncertainty is already reflected in the current valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.