Summary:

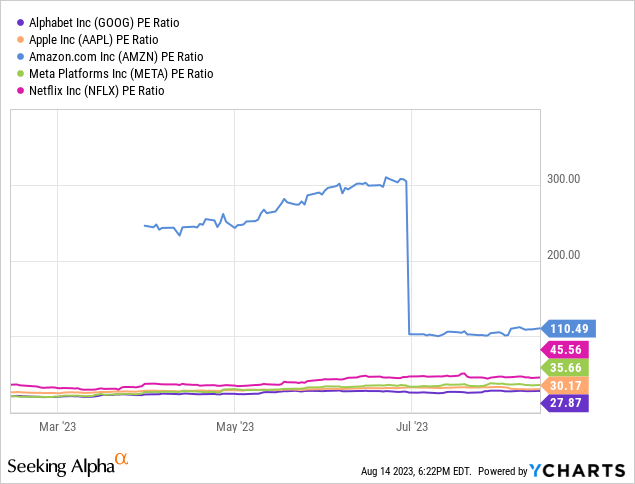

- Alphabet stock trades at a lower valuation than its FAANG peers, indicating lower market confidence in the company’s future.

- Alphabet’s cloud revenue growth and profitability, as well as its upcoming NFL season and football package, could be catalysts for a higher stock price.

- I’m currently rating the stock a hold at $131.83.

by_nicholas

Alphabet trades at a lower valuation than its FAANG peers. I think a simple way of thinking about that is that the market isn’t as confident in the future of the company and that the risk adjusted return isn’t viewed as strongly.

One of the jobs of the CEO is to be chief communicator. A great salesperson can woo Wall-Street by effectively articulating strategy and results, and can often be rewarded with a higher stock price. That’s great for short term performance but in the long run you have to deliver. So it’s more of a voting machine vs weighing machine phenomenon. If your job is to beat other stock pickers every 90 days that’s very different than investing for the long-term where you have more emphasis on the scale than the popularity contest.

Every CEO has strengths and weaknesses but in my opinion Sundar Pichai is losing the PR battle with his peers. That’s disappointing considering he received nearly $226 million in compensation last year. Google has the lowest expectations via valuation, but should they? Whether right or wrong the average person probably thinks ChatGPT/Microsoft (MSFT) is in the lead for AI. We’ve all used ChatGPT and we all heard of the code red warning issued from Pichai. In the most recent earnings call they said they’ve been an AI first company for 7 years and they mentioned the word AI 90 times. Over compensate much?

This wouldn’t be the first time Google is in a trailing position to tech titan peers. Amazon (AMZN) and Microsoft (MSFT) are way ahead in the cloud battle. They are so far ahead that if Google didn’t launch GCP when they did, they might have been boxed out of the market in my view.

So if Alphabet is going to earn a higher multiple, things are going to have to change, and I believe investors are going to have to think and see things differently.

Catalyst 1 – Cloud

Nobody can predict the future, you can invest on valuation or growth expectations but nobody can really predict what the future holds. If I had to look at the market and bet on a “sure thing”, it’s that organizations will move to the cloud. It’s happening, it will continue to happen, and Amazon, Microsoft and Alphabet will benefit tremendously as the leaders.

In the most recent quarter Google Cloud revenue was $8.03 billion, up 28% year over year. Azure revenue grew 27%, AWS revenue grew 16%. That’s exciting because right now AWS leads the market with 32% market share, Azure with 22% and GCP with 11%. Also of note is that Google Cloud is profitable with $395 of operating income (compared to a $590 million loss year over year). Showing profitability when so many tech companies are struggling to do so and doing it in an area with tremendous runway is encouraging.

Catalyst 2 – YouTube TV, NFL Sunday Ticket

Google TV has 6.6 million subscribers as of August 1, 2023. Plans currently cost $73 per month and there’s a $65 per month promo for the first 3 months. They are now the 5th largest TV provider and two of the leading cable companies are losing subscribers at a rate of 6,000 to 8,000 per day. The 4th leading provider, DISH Network (DISH) with 7.416 million subscribers is certainly going to get passed during the upcoming NFL season by YouTube TV if they add 2+ million new subscribers as expected.

Alphabet paid $2 billion per year for 7 years to broadcast NFL games.

Sunday Ticket Football packages cost between $300 and $489. There are discounts and add-ons depending on if you own YouTube TV and if you want the Red Zone channel.

One estimate by LightShed partners has YouTube TV picking up 2 to 3 million new subscribers. This article says that DirecTV has 1-2 million paying customers. Assuming the base $300 package, 1 million customers is $300 million, 2 million is $600 million in revenue. That assumes all these DirecTV Sunday ticket customers jump ship because of Sunday NFL Ticket. Some existing YouTube TV customers will buy Sunday ticket and some will buy more than just the $300 base package. Some of the newly acquired customers will stick with YouTube TV paying $73 per month for a new long-term revenue stream. This article says that YouTube will need 4.5 million subscribers to break even which looks like a solid estimate. I’d bet the under and say that Google overpaid when they spent $14 billion for 7 years of broadcast rights.

Don’t estimate the butterfly effect here as word of mouth is a great advertisement. What are you doing for TV? “Oh I use YouTube TV and it’s great!” Especially when hanging out at a friend’s house watching games. So I think Alphabet is obviously trying to use NFL Sunday Ticket to lure new customers, but some could cut the cord and switch to YouTube TV just because they heard their friends are. They would not be paying for the $300+ for the package but would help improve the bottom line, so I’d expect this boost to occur. These are people who cut the cord or drop Sling due to quality but don’t buy the football package.

The other point is that this could have very well been a defensive move as Amazon was doing Thursday Night football games, and somebody else (cable/Satellite company) could have paid more money to boost revenue or stop the bleeding. This goes with the theme of Alphabet playing catch up, not wanting to get shut out of cloud, music, or TV by more dominant players.

One interesting point from the last earnings call was that, YouTube delivers higher ROI than TV and other online video on average.

Take The Hershey Company. As part of a multiyear partnership to optimize its YouTube strategy, Hershey’s brands have been tapping into CTV, efficient AI-powered formats and Made for Platform creative, leading to YouTube becoming its number one ROI driving media partner, producing a 65% plus increase in ROI from 2018 to 2023.

The NFL package could be a catalyst to pour gas on the fire of cord cutting cable companies to streaming. Higher ROI is where advertisement dollars will flow. This is a big bet, $2 billion dollar per year bet. One that I don’t see immediately paying off but the company maybe had to do it.

Takeaways

Alphabet has a dominant ~90% market share in search. It’s one of the crown jewels anybody can own. If you read the book, “The Age of Surveillance Capitalism” you can appreciate just how dominant Google is. Information is the new oil and Google is a tycoon.

Google has not had a good track record with “other bets” as they are losing money. You have a bunch of smart people looking for moonshots and so far they aren’t adding to the bottom line. Keep in mind Alphabet does not pay a dividend, the high executive compensation and the stock based compensation to regular employees.

You don’t want to be dubbed a one trick pony (search) because the market likely sees that as concentrated risk. Especially when you are blind sided by ChatGPT and when Bill Gates is publicly saying you could eventually become obsolete. That’s not happy for markets, that spooks markets.

The cloud growth and profitability is highly encouraging. That diversifies profitability and shows you are a serious player in a space with a ton of runway. The upcoming NFL season and football package could be another catalyst that leads to multiple expansion and higher stock price due to millions of new YouTube TV subscribers.

Alphabet is currently my 3rd largest holding so I’ll be watching closely. At $131.83 and given my large position, no dividends and savings accounts paying yields not seen in years, I think it’s a hold. If you are curious as to my other holdings they can be viewed in this article, Opening the books on my 65 stock portfolio. Thank you.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.