Summary:

- Alphabet’s innovator’s dilemma: successes and failures in the tech landscape.

- The clash of titans, Alphabet and Microsoft’s AI race and the contrasting markets they serve.

- Why investors should remain bullish on Alphabet.

Ole_CNX

Investment Thesis

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) stock hasn’t been given enough credit for its AI prospects.

Here I discuss some of the tragedies and triumphs in Alphabet’s history.

And why I remain bullish on Alphabet’s stock.

AI, the Next Wave

For now, the overarching theme amongst investors is that Alphabet is playing catch up with Microsoft (MSFT) as the leading AI innovator. On that basis, investors are not giving Alphabet the benefit of the doubt. And this leads to a contentious issue, that splits both the bulls and the bears.

Let’s address the bearish consideration in the first instance. The bearish insight is that Alphabet has a long history of being poor innovators outside of Search.

What follows are some examples,

- Alphabet’s mobile (hardware) offering.

- Google Plus, failed to compete with Meta (META) as a mainstream social networking platform

- Android Pay didn’t see wide adoption as the Android ecosystem is diverse, with various operating system versions, particularly when compared with the success of Apple Pay (AAPL).

On the other hand, when it came in later than the established competitors, Alphabet had successes and ended up taking significant market share.

- Google Cloud Platform, where Alphabet came in after Amazon Web Services (AWS) (AMZN) and Microsoft Azure.

- Chrome, which displaced Internet Explorer.

- Google Maps, which displaced MapQuest.

Consequently, I don’t believe one should be too quick to assert that Alphabet’s AI technology can’t coexist with Microsoft’s offering. The media likes to side with one ”story”, but the reality is that their offerings can serve very different markets.

With Microsoft, it’s more about serving enterprises. In contrast, Alphabet’s own business model is about consumers. Case in point, with Microsoft it may end up being that it’s more about offering the fast answer to a query. While with Alphabet it can be about driving discovery.

Looking Further Ahead Than Next Quarter

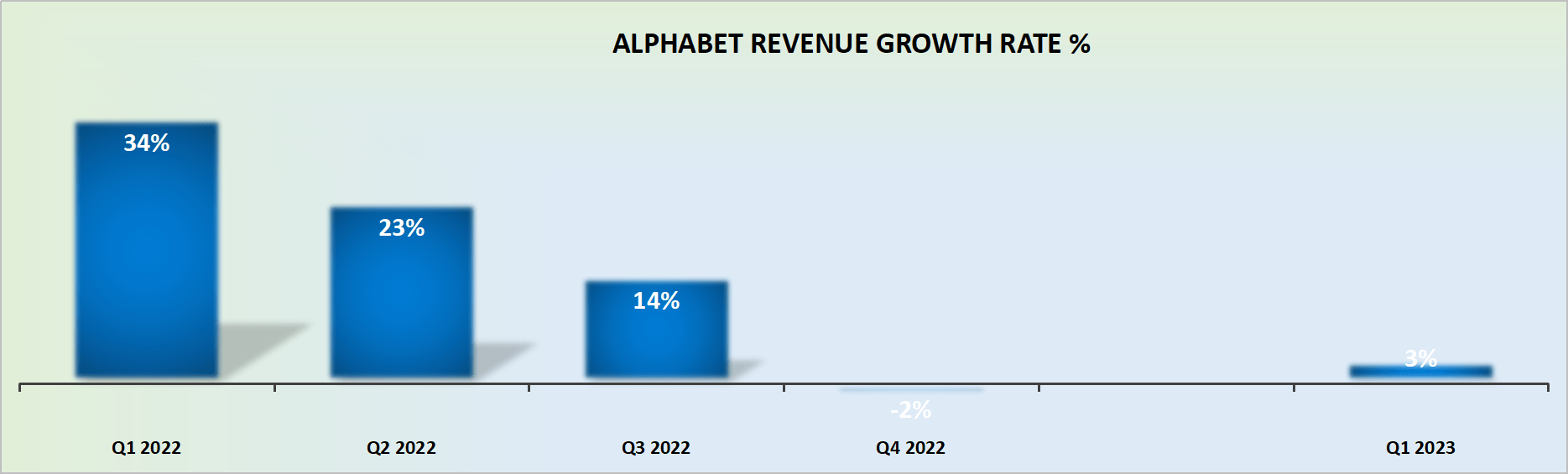

GOOG revenue growth rates

Presently, Alphabet faces the perfect storm. While investors are skeptical of its long-term prospects, contemporaneously, Alphabet’s recent quarterly results only posted 6% FX-adjusted revenue growth rates, and 3% on a GAAP basis.

For investors, this poor performance couldn’t come at a worse time. Not only are investors notoriously impatient, but further confounding matters, there’s just so much uncertainty facing Alphabet.

For instance, will Alphabet be a significant AI player? Can Alphabet’s YouTube at any point start to become a highly profitable endeavor? Will Amazon’s point-of-sale advertising continue to take market share away from Alphabet?

I don’t profess to know the answer to these crucial questions, rather I base my investment decision on Alphabet’s valuation.

GOOG Stock Valuation — 25x Forward Free Cash Flows

I follow many different adtech companies. And the consensus amongst these companies is that the advertising sector will return to strength in H2 2023.

Needless to say, this is just an assumption. Nobody knows whether advertising will truly be better in H2 of this year. However, I’m inclined to side with advertising industry titans such as Meta and The Trade Desk (TTD), while at the same time, sprinkling a wealthy dose of skepticism.

Along this assumption, I believe that Alphabet’s free cash flow could probably reach around $62 billion to $65 billion. This leaves the stock priced at approximately 25x forward free cash flows.

This is clearly a very reasonable multiple and it doesn’t give much, if any benefit of the doubt for Alphabet’s AI prospects, which could in time be a significant revenue stream for Alphabet.

Put more concretely, I don’t believe that paying 25x forward free cash flow for Alphabet implies that investors are being forced to pay for a ”story stock”.

The Bottom Line

There are two overarching considerations.

On the one hand, Alphabet’s revenue growth rates are far from satisfactory. On the other hand, Alphabet is acutely aware, as is the whole of Wall Street, that Alphabet is playing catch up on AI.

Investors have every reason to be impatient and to throw in the towel on this investment and to chase another ”shiny object”. However, I believe that the best time to invest in a stock is when it’s reporting strong free cash flows, in the midst of investor uncertainty and its multiple is compressed.

When the uncertainty starts to be lifted, the stock will take off. This may take 3 months or twelve months, but in time, investors will be rewarded for sticking with this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.