Summary:

- The stock market is pricing in an AI risk for Alphabet Inc. aka Google that doesn’t make sense.

- The recent “Gemini” controversy provides a buying opportunity for Google stock.

- Bill Ackman believes that Alphabet is ahead of Microsoft in the AI race and that investors are mistaking caution for being behind.

BrianAJackson/iStock via Getty Images

Thesis Summary

When it comes to Alphabet Inc. aka Google (GOOG, NASDAQ:GOOGL), the stock market is pricing in an artificial intelligence, or AI, risk that does not make sense to me.

The Gemini “controversy,” in my opinion, provides a fantastic opportunity to buy GOOGL at a discount.

In a recent interview, Bill Ackman went into detail explaining why Alphabet, Inc. is one of his largest holdings. I mostly agree, and that is why GOOGLE is my largest holding.

I rate GOOGL a strong buy, even following the recent rally.

Why did GOOGLE Sell Off?

When I last wrote about Alphabet, I compared the company to PayPal (PYPL).

While both companies are growing at double digits, highly profitable and dominant players in their respective markets, they have underperformed their peers.

Is this an opportunity for savvy investors? Bill Ackman certainly seems to think so.

Google has been at the center of significant controversy following the “Gemini” incident, which led to a substantial selloff in the stock.

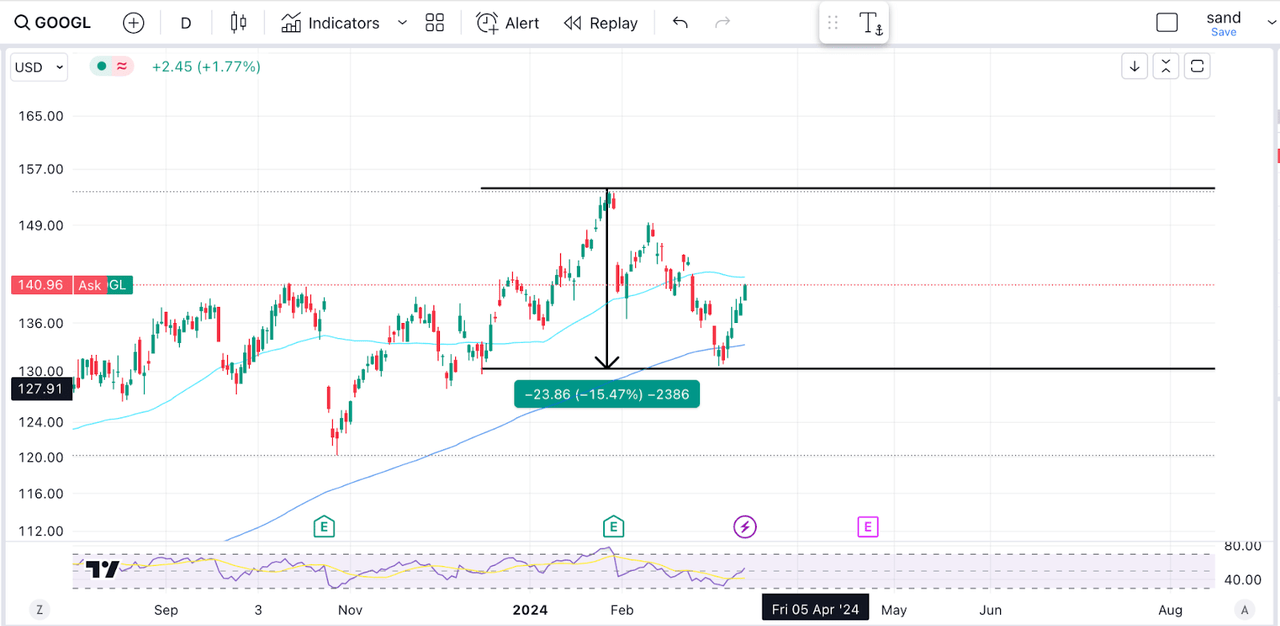

GOOGL stock sell-off (Tradingview)

Gemini was “criticized” after users pointed out that it had produced an image that included a black man and an Asian woman as an example of WW2 German soldiers. Other people pointed out that Gemini had made some of the founding fathers black.

Google had no choice but to admit its mistakes and has since put Gemini on Pause.

This led to a selloff in the stock, though the stock has recovered in the last couple of weeks.

History Rhymes and Repeats

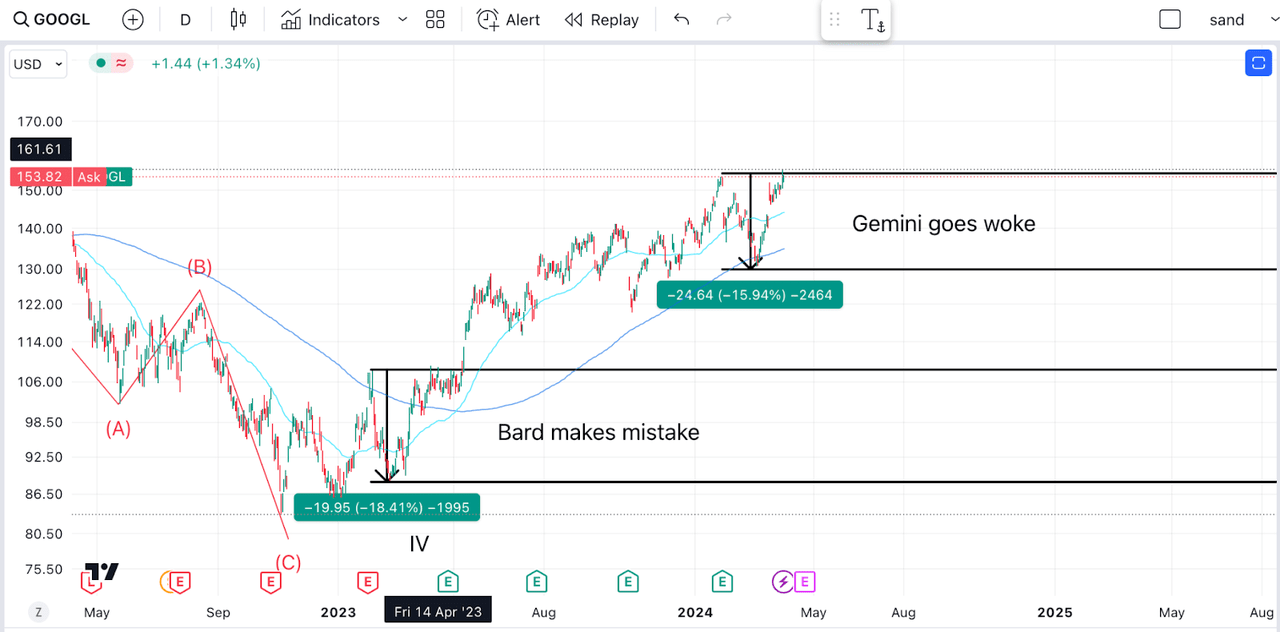

The curious thing is that we saw something very similar happen to Google’s stock in early 2023.

Gemini and Bard sell-offs (Tradingview)

Back on February 8th 2023, Alphabet showcased Bard.

The large language model, or LLM, made a mistake when answering a question about space, and this news led to a stock selloff of over 9% in a day.

Shares fell as much as 18% over the following days, but as we can see, this was only a hitch in what has otherwise been a strong uptrend.

Clearly, buying the dip when Bard made a mistake would have been a good idea, and the same can be said of the Gemini mistake-

Bill Ackman Agrees

Bill Ackman was recently interviewed by Lex Friedman on his podcast, and he spent a good amount of time talking about Google and AI.

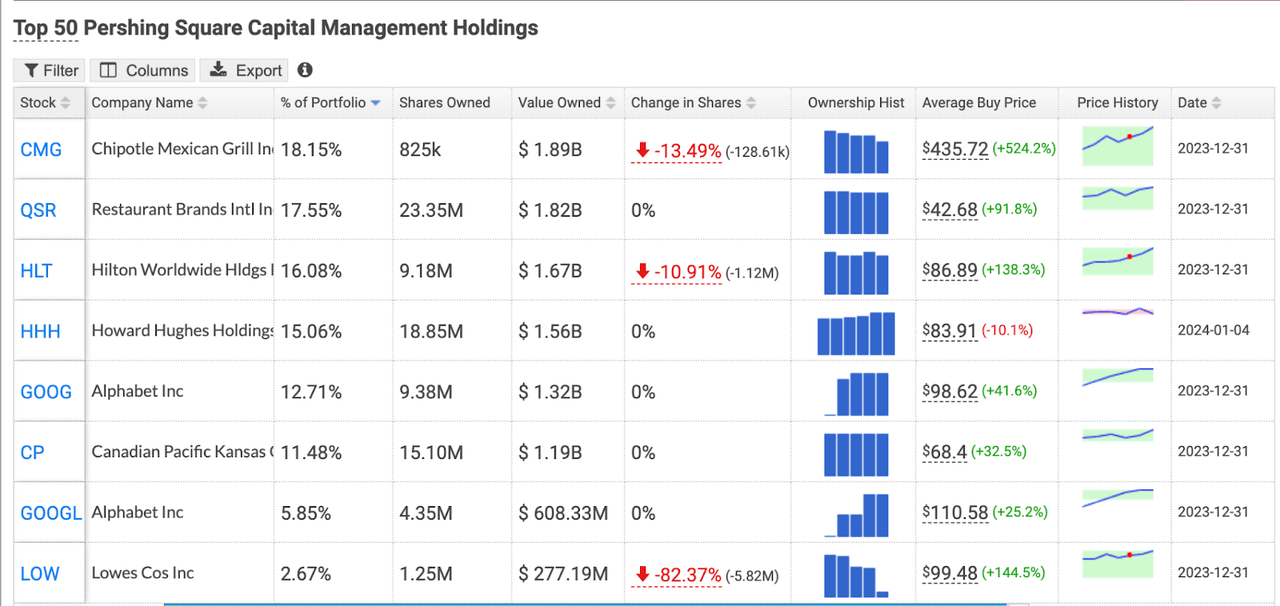

Pershing Square holdings (Datorama)

Google stock is the fifth largest position in Pershing Square and accounts for over 12% of Pershing Square holdings, which is Ackman’s hedge fund.

In the interview, he claims that, after conversations with industry insiders, he has concluded that Alphabet is tied, if not ahead of Microsoft (MSFT), in the AI race, and that investors are mistaking caution for being behind.

GOOGL’s size means it has to be more cautious with its new products, given the possible regulatory concerns and the immense scrutiny that consumers put it under. Proof of this is, in fact, all the fuss that has been made regarding Gemini.

Google may seem to the average person as if it is behind in the AI race, but it’s hard to see how given the fundamental advantages it possesses over its competitors.

Google has access to much more data than Microsoft thanks to its dominance of the search market and all the products and services the company offers.

Furthermore, with the exception of Apple, (AAPL) it has the deepest pockets in the tech sector, with over $110 billion in cash. In the long term, I think Google has the odds stacked in its favor and also the widest moat.

Speaking of which, the potential partnership with Apple to bring generative AI search to the iPhone is just proof of what I just said above. Google isn’t to be underestimated.

When a business becomes a verb, that’s usually a pretty good sign about the moat around the business.

Source: Bill Ackman.

Another quote from the interview I really liked was this one.

AI is the ultimate disruptable asset.

Source: Bill Ackman.

AI is still a new and uncertain technology, but in my opinion, GOOGL offers the most certainty as far as AI investing goes.

Valuation

Google continues to be the best-priced company out of the Magnificent five.

|

GOOGL |

META |

AMZN |

MSFT |

NVDA |

|

|

P/E Non-GAAP (TTM) |

26,81 |

32,98 |

62,40 |

38,39 |

69,67 |

|

P/E GAAP ((FWD)) |

22,85 |

24,61 |

43,64 |

36,42 |

39,20 |

|

PEG Non-GAAP ((FWD)) |

1,39 |

1,19 |

1,85 |

2,43 |

1,04 |

|

Price/Cash Flow (TTM) |

19,00 |

17,61 |

22,13 |

30,73 |

79,17 |

Data Source: Seeking Alpha.

Google has the most attractive P/E when compared to other mega-cap tech stocks.

However, in terms of forward PEG, Meta Platforms (META), and Nvidia Corporation (NVDA) are cheaper, but this is based on forward estimates of earnings, which could change.

NVDA is expected to double its earnings next year. META has had a great year of efficiency, and it trades at almost the same PEG as Google.

On the other hand, MSFT, which is GOOGL’s most direct competitor when it comes to AI, trades at a much higher valuation in every single metric.

And for the cash flow lovers out there, Google is still one of the most attractive stocks based on cash flow. A couple of weeks ago, just after the Gemini sell-off, it was trading at just 17x cash flow.

On balance, Google is the most attractively priced out of the Mag 5, and it still has plenty of levers to pull.

Risks

But perhaps Bill Ackman and I are wrong. What if Google doesn’t catch up?

The only variable we can’t account for is the human element.

To this extent, I must concede that Google has not had the best track record of innovation in the last few years. In fact, Google Podcast just recently joined the extensive graveyard of Google products.

Perhaps Google is falling asleep on its laurels, and too fat and happy to care about disrupting in the AI industry

Google’s management will no doubt be put to the test, and this time, failure could mean extinction, not just another botched project like.

Having said this, Pichai has a pretty strong record within GOOGL of product innovation.

Pichai joined Google in 2004, where he led the product management and innovation efforts for a suite of Google’s client software products, including Google Chrome[27] and ChromeOS, as well as being largely responsible for Google Drive. He went on to oversee the development of other applications such as Gmail and Google Maps.”

Source: Wikipedia.

Takeaway

All in all, investors continue to underestimate Google. Not only is this one of the highest-quality companies out there, but it is also one of the best-priced and most importantly, one of the businesses with the most potential going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video