Summary:

- Google’s AI capabilities and transparency are questioned after a controversial video demonstration is revealed to be edited and not a real-time reflection of its capabilities.

- Google has struggled to keep up with AI leaders like OpenAI and has been late to roll out conversational AI tools, impacting its market position.

- Microsoft’s integration of ChatGPT into Bing poses a serious competitive threat to Google’s search engine dominance, impacting its market share.

400tmax

Investment Thesis

I believe Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) position in the AI industry, particularly after the controversy surrounding its Gemini AI demonstration video, presents a challenging investment outlook. The video, dropped on December 6th, initially generated hype for showcasing Google’s developing AI’s interactive capabilities. Unfortunately, the video was later revealed as a non-real-time, edited presentation.

In my opinion, this raised significant doubts about the authenticity of Google’s AI capabilities and its transparency, as first reported by Bloomberg’s Parmy Olson and further clarified in a Google developer blog.

Google has struggled to keep pace with AI leaders like OpenAI. Despite its significant investments (and advancements) in AI technologies, such as their BERT model, MUM, and LaMDA, Google’s delayed entry into conversational AI allowed OpenAI’s ChatGPT to capture the spotlight. This delay, partly due to concerns about maintaining credibility and the higher costs associated with generative AI, has impacted Google’s market position both from an AI perspective, and is impacting Google Search’s market share through Microsoft’s integration of ChatGPT into Bing.

I rate Google a Strong Sell. The controversy over the Gemini video, combined with the delayed response to evolving AI trends and the competitive threat from Microsoft, has eroded my personal confidence, and if it erodes other investors’ confidence it could depress the stock price. Google’s stock appears to be a strong sell in my opinion amidst these challenges given many metrics now appear overvalued for a company that is facing a serious competitive threat.

Background: Google’s Gemini’s Video Risked Misleading Investors

Controversy surrounding Google’s Gemini AI demonstration video has raised significant questions about the authenticity of its AI capabilities. The video, titled “Hands-on with Gemini: Interacting with multimodal AI,” initially generated considerable hype due to its portrayal of the AI model’s ability to interact with various inputs in real-time. However, it was later revealed that this was not a genuine real-time demonstration.

Bloomberg’s Parmy Olson first reported the next day (December 7th) that the video was not conducted in real-time and involved editing to speed up outputs. Google’s YouTube notes on the video mentioned that “for the purposes of this demo, latency has been reduced and Gemini outputs have been shortened for brevity”.

The discrepancies in the video were further elaborated in a Google developer blog, revealing that the interactions shown were the result of a series of incremental prompts finely tuned to achieve the intended result.

Gemini Prompt Window (Google)

In this example from the Google Blog, Google uses helper sentences to increase the descriptions used by their model so it gets its output (in blue) correct.

This means that the real-time voice and visual interactions implied in the video were actually an edited presentation using still image frames and text prompts, which significantly diverges from the live, intuitive interaction initially portrayed.

Google’s response to the controversy has been to emphasize that the video was meant to “inspire developers” rather than deceive. According to Gemini’s co-lead, Oriol Vinyals, the user prompts and outputs in the video were real but shortened for brevity. The intention was to illustrate what multimodal user experiences built with Gemini could look like, showcasing its potential rather than its current, real-time capabilities. I’m not a fan of this personally, and I believe others also mistook the video as being a complete and real-time portrayal of Gemini’s capabilities.

Why Google Has Not Been Able to Catch Up In The AI Race

In my opinion, the bigger question here is why Google (with its vast financial resources, brand and technical talent) has struggled to catch up to OpenAI.

My research has shown that Google’s struggle to keep pace with OpenAI in the AI race can be attributed to several factors, including missed opportunities, internal challenges, strategic decisions, and the dynamics of the open-source community.

Firstly, we do have to note that Google has indeed been investing in AI for years, with developments such as

Bidirectional Encoder Representations from Transformers (BERT), Multitask Unified Model (MUM), and Language Model for Dialogue Applications (LaMDA). The original Transformers paper (which is the bedrock for LLMs) was written by Google employees in 2017.

However, despite having the technology for conversational AI tools, Google has been late to roll them out, allowing ChatGPT to capture the spotlight. The search giant’s delay is partially attributed to Google’s concern about maintaining its credibility as the leading search engine and the higher computational costs associated with generative AI tools. These costs are approximately ten times higher than standard keyword searches, which could potentially impact Google’s search’s high incremental gross margins.

Furthermore, a senior software engineer at Google, Luke Sernau, highlighted that Google’s focus on competing with OpenAI may have distracted it from the rapid developments occurring within the open-source community. According to Sernau, this community is advancing AI models that rival those of big tech companies, offering faster, more customizable, and cost-effective alternatives. Even if they are able to catch up to OpenAI in the future, their ability to keep pace with the Open Source community could end up being the long run challenge, with Open-source AI models like Mistral accelerating in their development.

In a response to the memo, a spokesperson from Google “…confirmed the memo was authentic but said it was the opinion of one senior employee, not necessarily the company as a whole,” according to NBC News.

Microsoft, Bing & ChatGPT is Stealing Market Share

On the other side of Google’s missteps is Microsoft’s strategic integration of ChatGPT into its Bing search engine through ChatGPT+ or through the Microsoft Edge browser. I believe this is a significant move in the AI arms race, particularly in the context of challenging Google’s long-standing dominance in search and online advertising (going for the heart of their business). This shift represents a potential turning point in the search engine market, where Microsoft’s Bing, bolstered by ChatGPT’s AI capabilities, is making strides to capture market share from Google.

I believe this integration could potentially reshape the search experience, moving away from the traditional list of links and text snippets to more conversational and intuitive search responses. At the heart of this is the human nature to want answers fast. ChatGPT brings the potential promise to deliver you information confidently and quickly appearing as if it’s the right information.

This is the appeal of ChatGPT: its ability to provide direct answers to specific questions, which can be seen as superior in terms of substance and speed compared to sifting through multiple web pages in a traditional Google search. ChatGPT could potentially disrupt Google’s ad-based business model, especially if AI-generated content starts to dominate web pages where Google places its ads.

Valuation

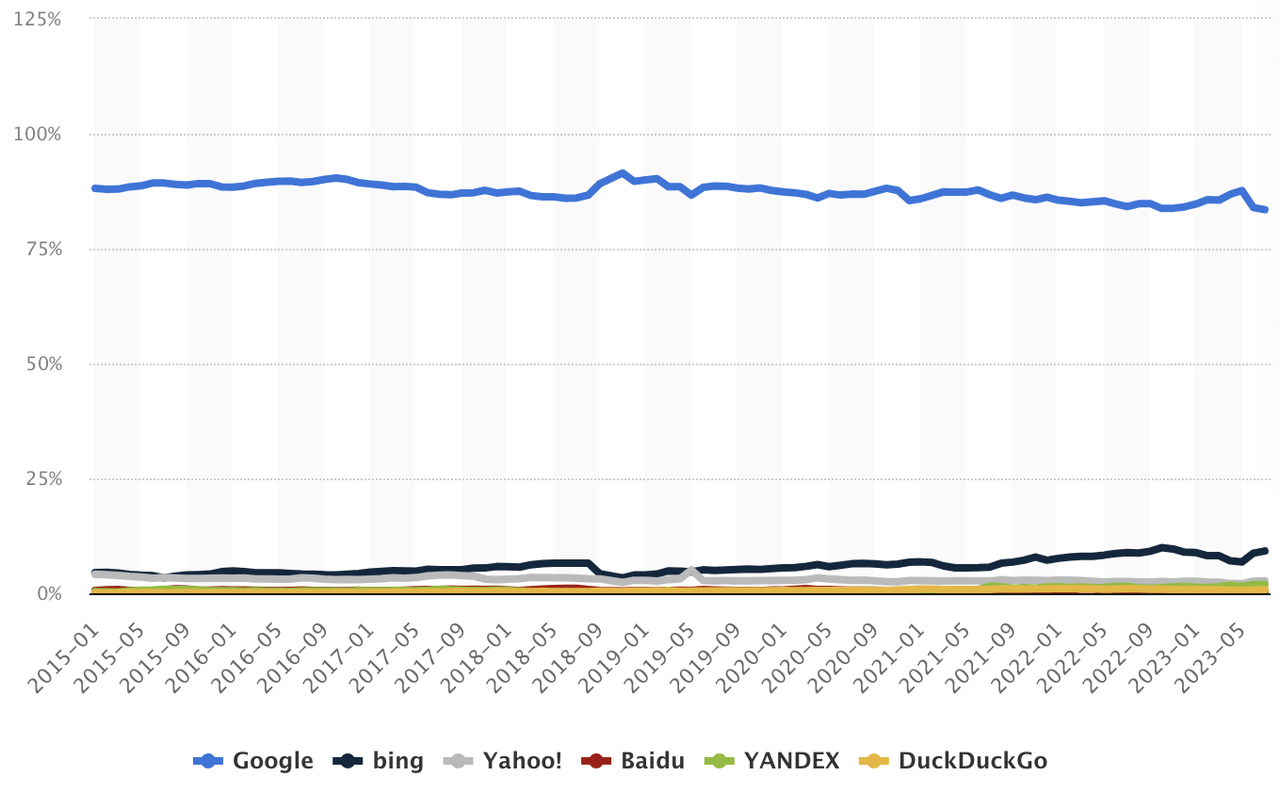

While Google still maintains a dominant position in the search engine space, their lead has been starting to slip.

Google’s market share peaked back in 2018 at 91.46% of global search volume. Following a 5 year trend, search volumes for Google have dropped off in 2023, partly because of the AI features enabled by Bing + ChatGPT with browsing (it already has 2% of Google’s monthly market share with ChatGPT web browsing being less than 12 months old).

Google Search Market Share (Statista)

While search revenue reached $44 billion in Q3 2023 (annualized at $176 billion), ChatGPT and Bing are starting to bite into market share. The penetration (albeit small) is meaningful given that Google has had such a hold on the market for so long.

What This Means

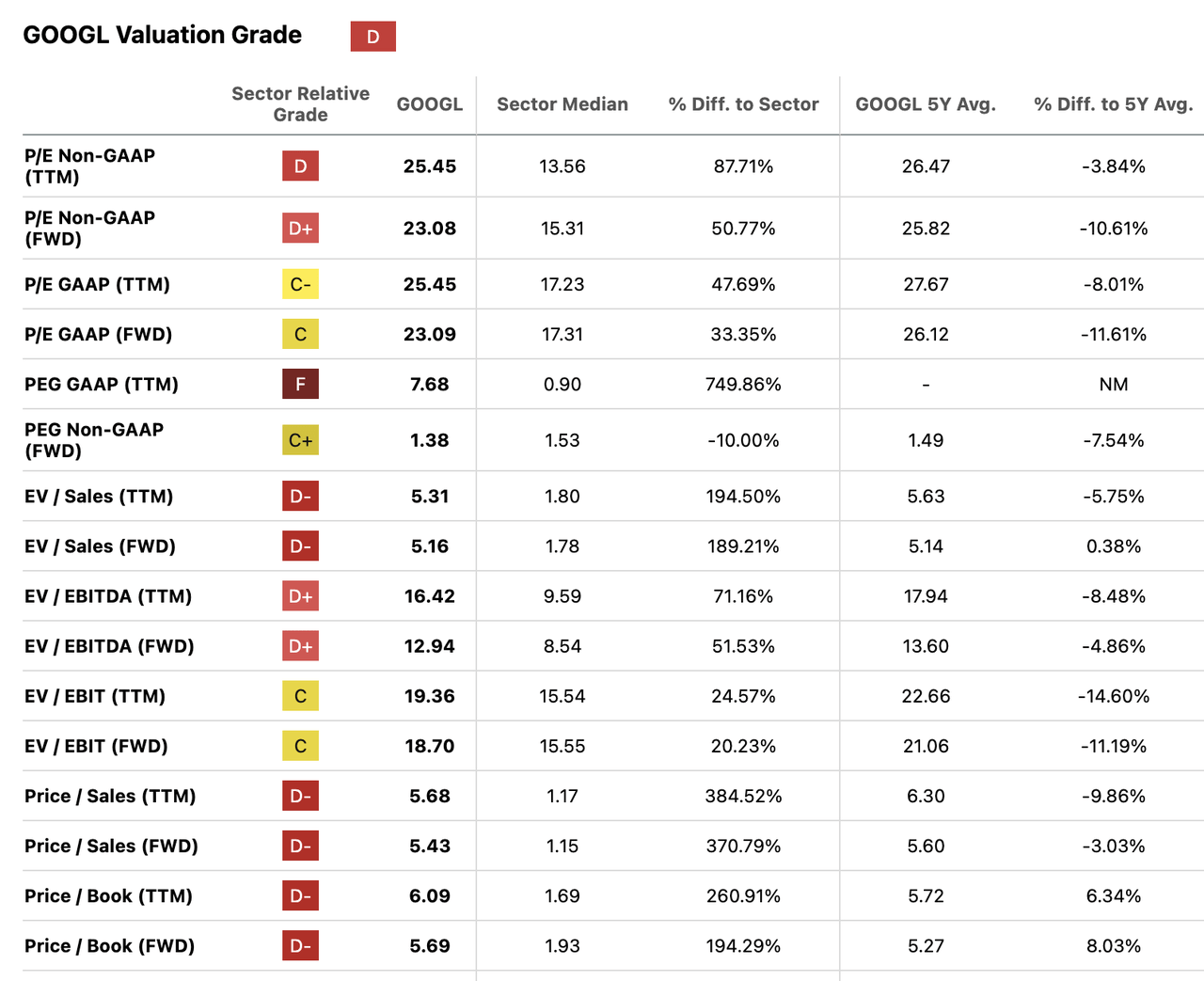

As ChatGPT and Bing become the risk factor for Google, Google’s P/E ratio needs to be examined.

Already, their forward P/E ratio of 23.09x is 33% higher than the industry average of 17.31. I believe the company is going to have issues trying to compete against new AI models made by open source competitors and OpenAI (to name a few). With this, I think there is no reason to reward the firm with such a strong P/E ratio. I know given the company’s legacy, some investors may wish to reward the company with a strong forward P/E but I think this is misleading. I fundamentally believe that the competitive landscape has changed for Google and they are struggling to adjust.

They are still wildly profitable and have a cash-rich balance sheet, but this does not address the long-run fact that the firm’s business model may be in question.

If investors were to value Google on its balance sheet (and cash) as I have heard some pundits mention, the firm’s forward price-to-book ratio is 194% above the sector average.

Besides this, most other forward multiples appear stretched too, with Google (Alphabet) as a whole receiving a ‘D’ for its overall valuation grade.

GOOGL Valuation Metrics (Seeking Alpha)

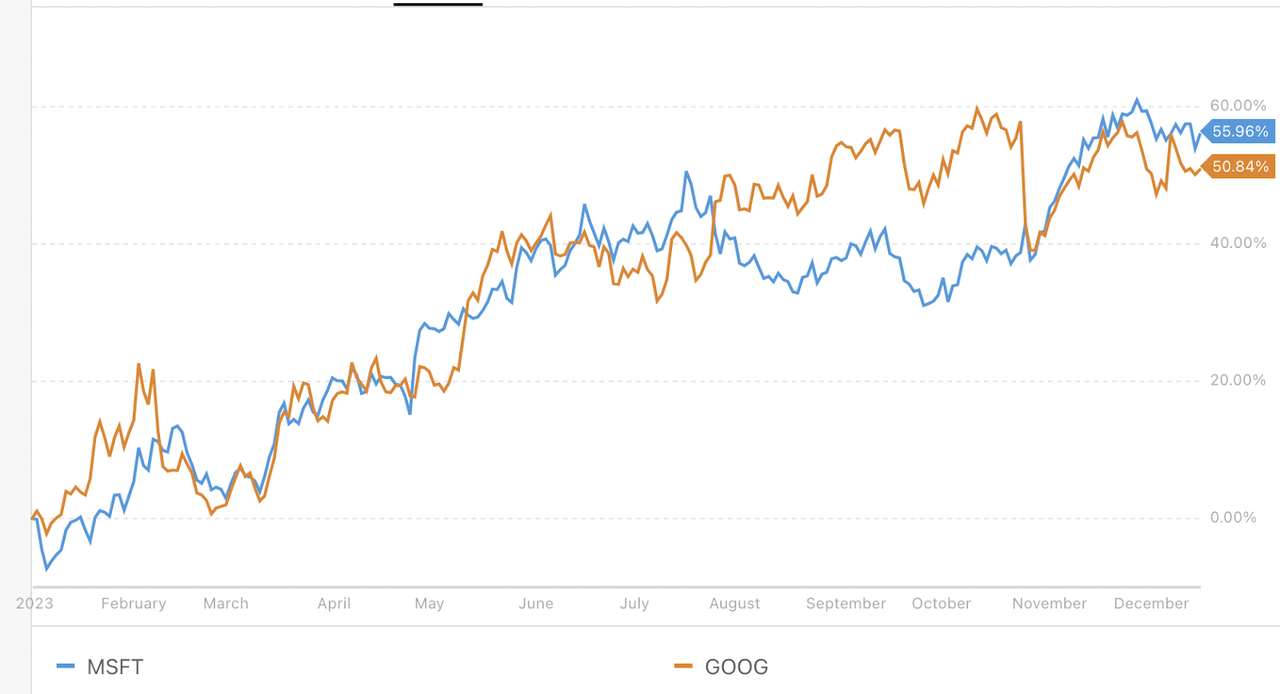

I think the firm’s stock price underperformance since Q3 earnings in October (see the drop in stock price) is indicative of investors starting to price in a world where Google cannot catch up to Microsoft/OpenAI.

MSFT vs. GOOG 2023 Performance (Portfolios Lab)

Bull Thesis (What I Could Be Missing?)

The potential bullish case for Google does center around its recently released Gemini API, now available for free through Google AI Studio. This innovative model is designed to handle a variety of tasks, including complex reasoning and advanced coding, by processing and understanding combinations of text, images, audio, video, and code. The Gemini Pro version, accessible via the Gemini API, offers a range of features like function calling, embeddings, semantic retrieval, custom knowledge grounding, and chat functionality, supporting 38 languages across over 180 countries.

Developers and enterprises can access Gemini Pro for free, with the platform allowing 60 requests per minute, 20 times more than some other free offerings. This move democratizes AI development, potentially leading to a surge in AI-driven innovations across various sectors. The free access to Gemini API signifies Google’s commitment to AI development, positioning it as a leader in AI platforms and potentially attracting a wide range of users and developers. For many developers, this free version will be more than enough for their uses. This undercuts some of OpenAI’s APIs. The question remains, however, how Google plans to make money with this.

Takeaway

Google’s controversy around the non-real-time Gemini AI video has cast doubts on the authenticity of Google’s AI demonstrations, impacting its credibility. Despite having advanced AI models like BERT, MUM, and LaMDA, Google’s delayed entry in conversational AI allowed OpenAI’s ChatGPT to overshadow it, partly due to concerns over credibility and higher costs.

Furthermore, with Microsoft’s integration of ChatGPT with Bing, this represents a direct challenge to Google’s search engine dominance. I believe the overall sentiment leans towards Google being a strong sell. The stock multiples at this point do not seem to justify the valuation given the future impediments Google will have to get through.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Co-Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.