Summary:

- Alphabet/Google continues to trade risk-off due to fears that Bing Chat is a major risk to the search market.

- The market fears over Google losing default search deals for mobile traffic from Apple and Samsung are misplaced.

- Google stock trades at an EV of only ~11x ’25 EPS estimates.

MF3d

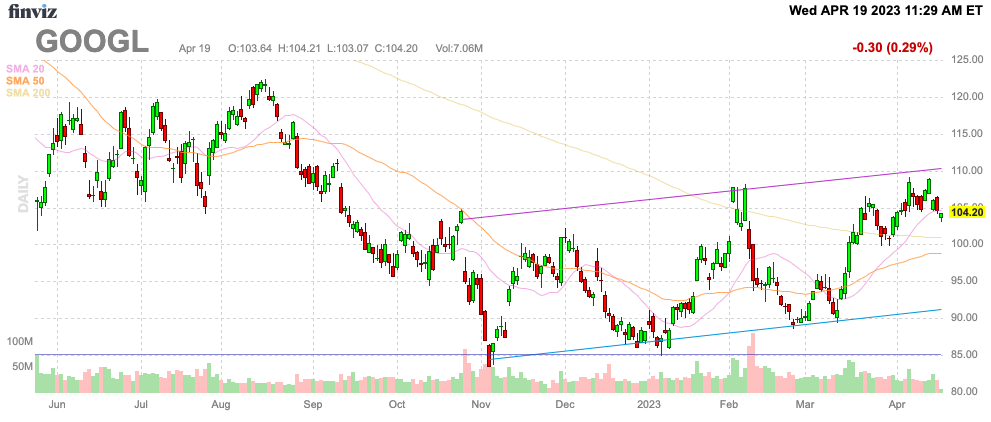

Within days, media reports have suggested Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google was at risk of losing search mobile browser default settings due primarily to new AI options. Microsoft Corporation (MSFT) search engine Bing is definitely a threat in AI, but the stock market is too fearful of this threat in Internet search. My investment thesis remains ultra Bullish on Google based on the cheap valuation and its dominant position in mobile search that is unlikely to be impacted by losing default browser settings.

Source: Finviz

Mobile Search Leader

The biggest threats to Google search are definitely Apple Inc. (AAPL) and Samsung (OTCPK:SSNLF) customer mobile searches. The search giant currently pays Apple over $20 billion and Samsung an estimated $3 billion to acquire customer traffic via the default search settings.

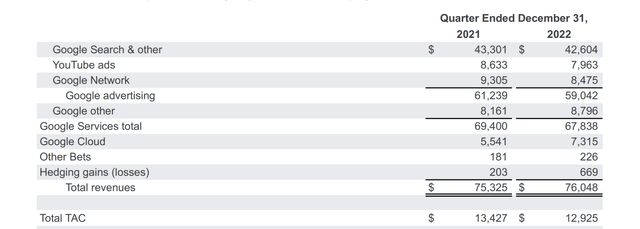

Internet search is the Golden Goose business for Google. Google Search is the prime driver of company profits, with Google Cloud and Other Bets producing a combined $2.1 billion loss in the last quarter alone.

Google Search produced $42.6 billion worth of sales in Q4’22 alone, accounting for 63% of sales in the quarter. The Google Services dividend delivers all of the profits of the business with areas like YouTube generating far lower margins.

Source: Google Q4’22 earnings release

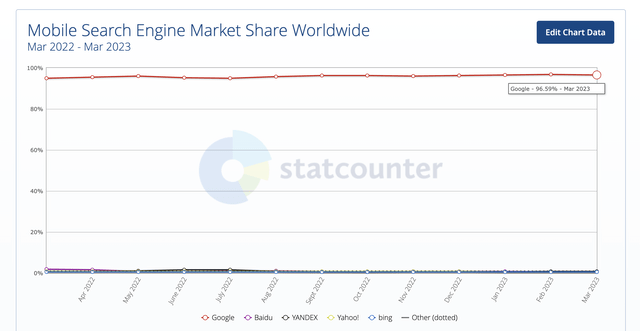

Google has ~93.2% of the global search market with the number rising to 96.9% of the mobile search market. One could summarize that Google obtains a few additional percentage points of search by being the default browser on iOS for Apple and Android for Samsung.

The real question is whether Google would lose any material search traffic by allowing Apple to point customers to Bing due to the focus on AI chat. The desktop data would support users loading Google search when it isn’t the default. In essence, Google is paying Apple over $20 billion in acquire traffic not necessarily required.

Remember, Google search has a larger market share than the iPhone with U.S. teens. The Piper Sandler teen survey only shows 87% of teens have an iPhone, while Google has over 90% of internet search.

The biggest risk is that customers become more comfortable using Bing or that Apple makes the path to Google search difficult. Naturally, Apple would run into a ton of regulatory scrutiny and user outrage due to a blocked path to using the dominant global search engine.

Bank of America analyst Wamsi Mohan suggests Apple would be better off working a deal out with Bing to better monetize an installed base of 2 billion users. Though, Microsoft is highly unlikely to pay over $20 billion for a default search engine option knowing users might prefer going directly to Google search anyway.

This comes after the New York Times reported Samsung had looked into replacing Google as the default search engine. Though again, Samsung probably has no reason to pass on the $3 billion annual revenue from Google when Bing doesn’t monetize ChatGPT and users again could easily still use Google search.

Despite causing a stir, Mohan appears to answer his own question on why Apple is highly unlikely to move to Bing:

A higher rate per search might not offset the share loss in aggregate search. Further, if Google can monetize the search at a much higher level, it could be hard for Microsoft to compete for the contract

Google having a Code Red panic meeting isn’t the same as actually having a business model at risk. The tech giant should most definitely have a sense of urgency in ensuring Bing Chat doesn’t provide a route to users ultimately shifting search queries over to Bing.

CEO Pichai was interviewed on CBS’ 60 Minutes. While the market didn’t like his answer on the AI threat, his answer about the AI chat function only handling one to two percent of user requests is spot on to why Apple and Samsung will have a hard time switching any default search contract to Microsoft.

Google Search still has more time to battle the alternatives considering the tech giant has similar, if not better, AI chat technology with plans on releasing new functions in the next month followed by another release in the fall.

De-Risked

Since it’s our view that Google could become even more profitable by ending these default search deals, the stock is a strong buy. Going this route whether intentionally or forced by Apple or Samsung signing a deal with Microsoft definitely adds perceived risk to the story.

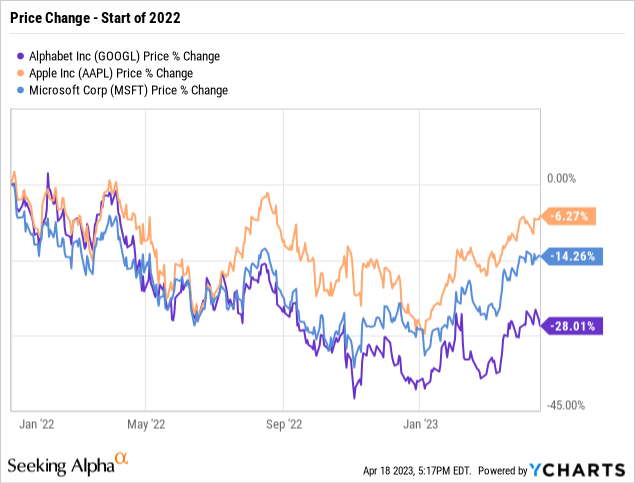

The current valuation of Google de-risks the story. The stock has traded back down below $105 leaving Google down nearly 30% from the levels to start 2022. Apple and Microsoft are both trading back toward those previous highs with Microsoft getting an extra boost from AI chat despite having to fork over an estimated $10 billion to acquire up to 49% of Open AI.

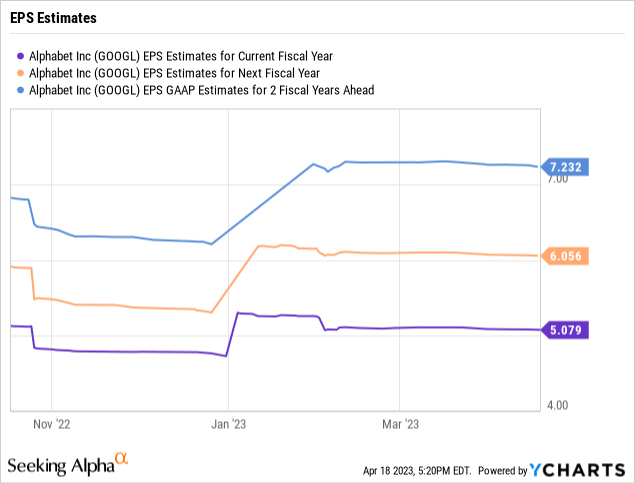

Google has seen some EPS estimates trend lower, but mostly due to economic weakness fears. Statcount shows search trends above pre-AI chat levels.

Analysts still forecast solid GAAP EPS growth over the next 3 years. Of course, the fears are that Bing Chat will ultimately crush these targets.

Remember though, our previous research has the non-GAAP EPS targets up an additional $3+. The EPS targets could approach $10 with all of the job cuts, if management follows through on the 20% efficiency goal.

In addition, Google has about $100 billion in net cash to reduce the enterprise value by a substantial amount, with the stock only worth $1.34 trillion now. Also, stock-based compensation adds another ~$1.34 to the above GAAP EPS targets.

Takeaway

The key investor takeaway is that Google Search doesn’t appear to face any real threat from AI Chat. The tech giant trades at ~11x 2025 EPS targets (non-GAAP) before fully incorporating 20% efficiency gains. With the Golden Goose not at any major risk, investors should continue using the weakness to load up on Google.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.