Summary:

- UBS analyst Lloyd Walmsley has given a downgrade to Google due to the threat posed by AI to its search dominance.

- Google will face some challenges due to a change in technology but the net effect of AI growth is quite positive for the company.

- Google’s search engine is the default option in iPhone and other devices which gives the company a strong moat against competitors.

- Google Cloud is a rapidly growing segment for the company which will gain a strong tailwind as more on-premises IT work is moved to the cloud.

- Google has the cheapest forward PE ratio among Big Tech companies which is another positive for investors looking to bet on a future AI stock.

400tmax

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is one of the key companies which will be affected by new AI tools. In a recent interview, Bill Gates mentioned that AI will make Google Search obsolete. Other analysts like Lloyd Walmsley from UBS have predicted that AI tools can lead to lower advertising revenue as the users will directly gain answers from AI without a need to go to the original website. This led the analyst to downgrade Alphabet stock from Buy to Neutral.

However, this assumption will probably be wrong as all the AI tools are based on information from other sources. This makes the original content very valuable in building any AI answer. In a previous article, it was mentioned that Google is building a strong recurring revenue base which should shield the company against short-term headwinds.

Google is also very good at monetization in new platforms and technologies. We have seen this in smartphones, apps, YouTube, and other options. Another big moat for Google is that it is the default search option for most devices which prevents competitors from gaining market share by using a new AI tool.

AI will provide a strong tailwind to Google’s Cloud business which reported $7.5 billion in quarterly revenue or $30 billion in annualized revenue rate. A lot more on-premises IT services would need to move to the cloud in order to gain the advantage of expensive AI computing. Even at a modest 25% YoY growth rate, Google Cloud should hit an annualized revenue rate of $150 billion by 2030. Google stock has the lowest forward PE ratio among big tech companies which further increases the long-term returns potential for investors.

Google Search under threat?

Google’s advertising business is the bread and butter of the company. Close to 80% of the total revenue for Google comes from its advertising segment. Hence, any threat to this revenue stream is magnified by Wall Street. Several analysts have pointed out use cases of AI that will reduce the advertising click-through rate for Google. New platforms and technologies in the past few years have also raised fears that Google will lose its market share in Search. The biggest threat was the rapid growth of smartphones. However, the company has actually built a strong moat in smart devices by becoming the default search option for iPhone and Android users.

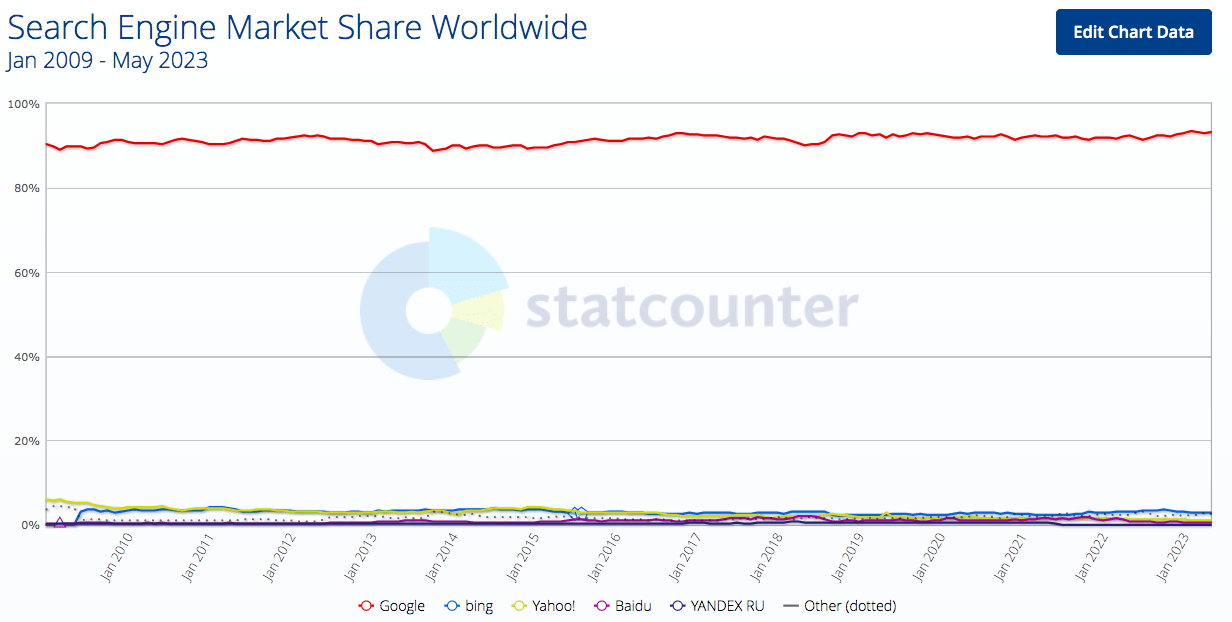

Statcounter

Figure 1: Stable market share of Google compared to Bing and other competitors.

Google has maintained over 90% search engine market share in the last decade. The AI threat is not a major threat to the company. The bigger problem for Google is that its search engine might be seen as monopolistic by regulators who might try to give bigger fines to the company.

The argument that AI would answer the queries of users without the need to actually go to the original website does not seem logical. AI builds answers based on the prior information available to it. This requires updated information from different sources. If no information source is available to the AI platform, it would not be able to give the desired result. Google Search also prioritizes content from updated websites and does not usually give results that might be 5 or 10 years old.

Google is also very good at monetizing new platforms. It has done a very good job of building a good revenue stream from advertising on smart devices. Google has the resources and skilled manpower to build effective advertising tools in the AI era. The long-term impact of AI on Google Search is unlikely to be very negative as forecasted by many analysts.

Tailwind for Google Cloud

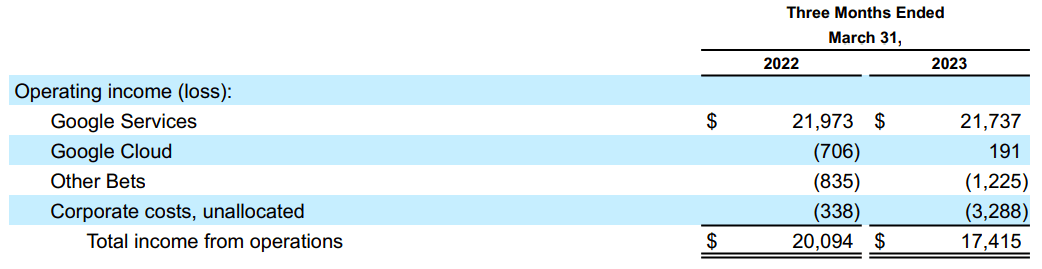

Google reported $7.5 billion in cloud revenue in the recent quarter up from $5.8 billion in the year-ago quarter. This equates to a 29% YoY growth rate which is a lot higher than the 16% growth rate reported by Amazon’s (AMZN) AWS. Google Cloud reported positive margins in the recent quarter, improving its operating income to $191 million from negative $700 million in the year-ago quarter.

Company Filings

Figure 2: Operating income of different services of Google.

AI will be a major tailwind for all cloud providers as it forces companies to use cloud services to reduce the exorbitant costs of implementing on-premises AI chips and tools. In a recent letter to shareholders, Amazon’s CEO Andy Jassy mentioned that over 90% of IT spending still takes place on-premises. This gives cloud players a long growth runway to deliver good CAGR growth in the next few years.

Even at a modest 25% YoY growth rate, Google Cloud should hit $150 billion in annual revenue base by 2030. A 20% operating margin in this segment would add $30 billion to Google’s operating income. On a standalone basis, this segment alone would increase Google’s operating income by 5% annually till 2030. This makes AI growth a strong tailwind for Google Cloud and the entire company.

Growth in subscriptions

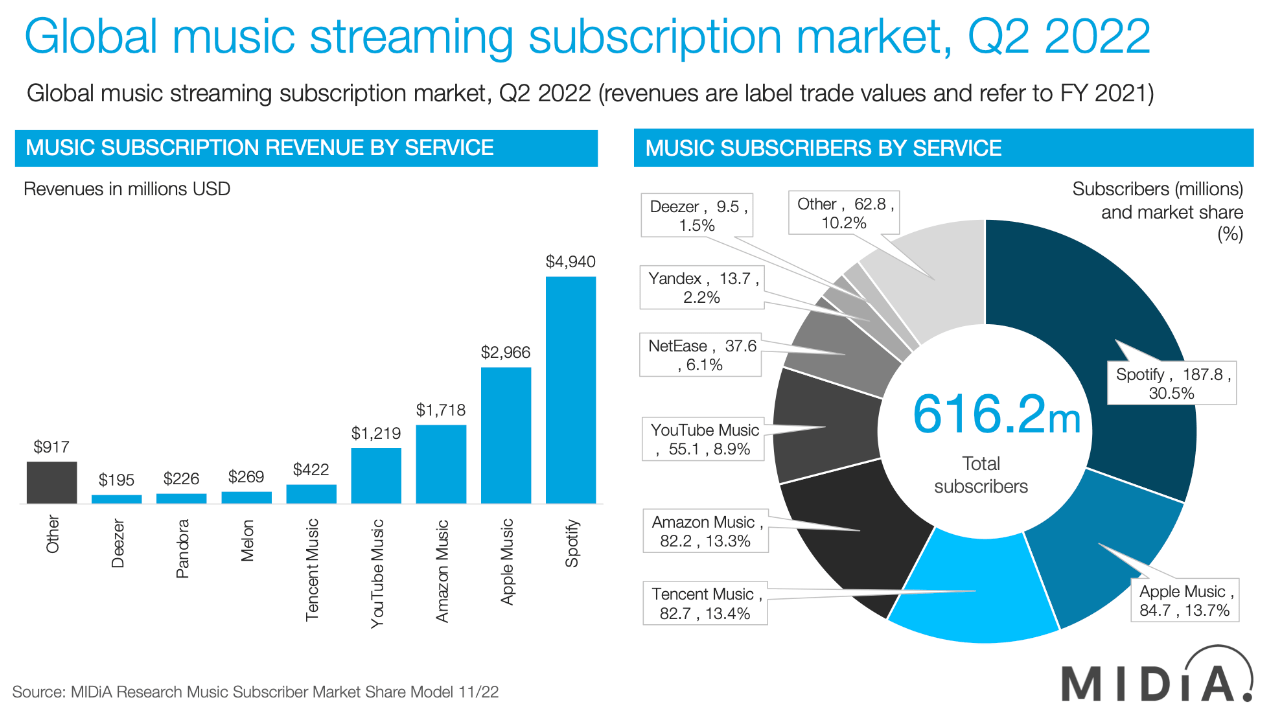

Google is also improving its subscription business. It had been a latecomer in the music streaming business. But within a few quarters, it has added tens of millions of subscribers. In the last update, Google mentioned that they had over 80 million subscribers as of September 2022. This was a 60% YoY growth which is the highest among the major music streaming players.

MIDiA Research

Figure 3: Market share of music streaming players in Q2 2022.

Apple Music has not updated the numbers for a few years which might indicate a slowdown in growth rate. According to third-party estimates, both Apple Music (AAPL) and Amazon Music have close to 80 million subscribers. Google’s YouTube Music has likely overtaken both these giants and this might be reflected in the next update by Google in a few months.

A recurring subscription revenue base helps Google build a stronger moat toward its services. TikTok also uses a lot of AI tools to deliver content. However, YouTube Shorts has been able to gain significant traction in the last few quarters. This shows that the company is not far behind in terms of AI adoption curve.

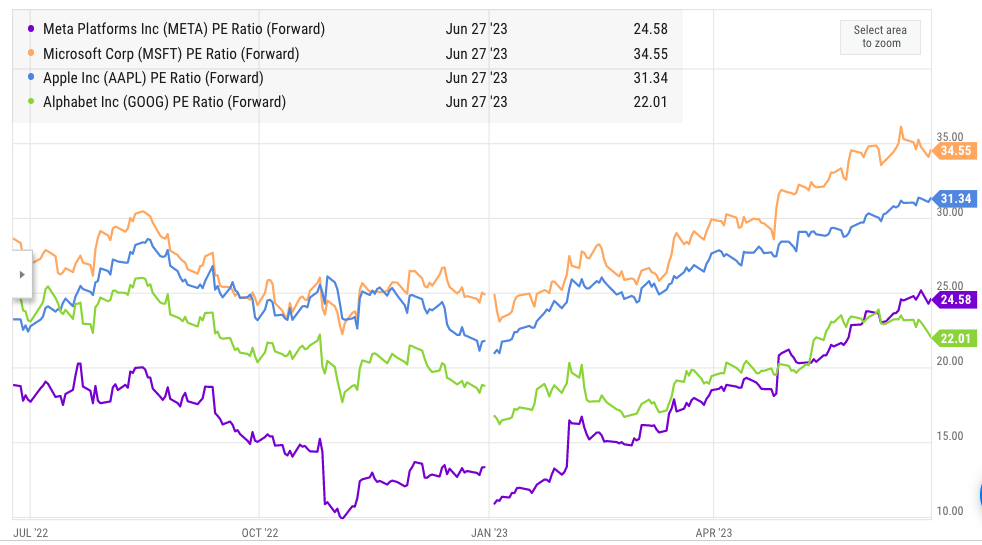

Relatively cheap stock

Another major positive about Google stock is the relatively cheaper valuation compared to other big tech companies. After the recent bull run in the tech sector, Google stock has the lowest forward PE among major tech companies. This gives the stock a longer growth runway and improves the long-term return potential for the stock.

Ycharts

Figure 4: Forward PE ratio of major tech companies in the last one year.

Alphabet stock is trading at a forward PE ratio of 22 compared to a forward PE ratio of 31 by Apple. Google’s YoY revenue growth rate was positive in the recent quarter compared to the negative 2.5% reported by Apple.

AI is unlikely to be a threat to Google Search and as the revenue share of non-search segments increases, Wall Street could give a more premium valuation to Alphabet stock.

Investor Takeaway

Several analysts have forecasted that Google Search will face a significant decline in advertising revenue due to the growth of AI-based search tools. However, the past performance of the company shows that it has been quite agile in dealing with new platforms and technologies. AI also needs a lot of updated information which reduces the possibility that the search would become irrelevant.

Google Cloud should gain a strong tailwind due to the growth of AI in the cloud industry. This segment could deliver a revenue base of $150 billion by 2030 which will make it a key growth driver for the company. Google has also built a strong subscription business which will give the company a recurring revenue base. Alphabet stock is trading at a relatively cheap valuation compared to other tech companies. This makes it a better option for investors looking for longer-term returns from a stable company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.