Summary:

- The cloud computing market is a massive growth opportunity, with Alphabet’s Google Cloud showing robust revenue and profit growth, making it a compelling investment.

- Despite a recent stock dip, Alphabet’s long-term performance and forward pricing remain strong, justifying a continued ‘buy’ rating.

- Alphabet’s overall revenue and profits are growing, driven by its Google Services and rapidly expanding Google Cloud segment.

- Alphabet is a GARP (growth-at-a-reasonable-price) opportunity with improving margins and attractive relative valuation compared to peers.

JasonDoiy

If I had to make a list of the top five greatest growth opportunities of my lifetime, at least up to this point, one of the things that would absolutely be on that list would be the cloud computing market. This is a massive industry that is destined to grow even more. The flexibility, increased opportunity for cybersecurity, and cost benefits of the cloud market are undeniable. The two companies that have captured the largest chunk of this space have undoubtedly been Microsoft (MSFT) and Amazon (AMZN). But the third-largest player is none other than Google parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL).

Back in June of this year, I reaffirmed my ‘buy’ rating on the stock. This was based on continued strong and improving performance for its Google Cloud segment and the expectation that this would propel the company to even better performance in the future. Unfortunately, the stock has dropped by 7.4% since then, at a time when the S&P 500 has increased by 5.7%. But since I initially rated Alphabet a ‘buy’ for the same reasons back in June 2023, the stock is still up 36.1% compared to the 30% increase seen by the broader market. Looking at the data that is available today, I see no reason why investors should lose hope. Add on top of this, how shares are priced on a forward basis, and I personally remain very optimistic.

The picture keeps getting better

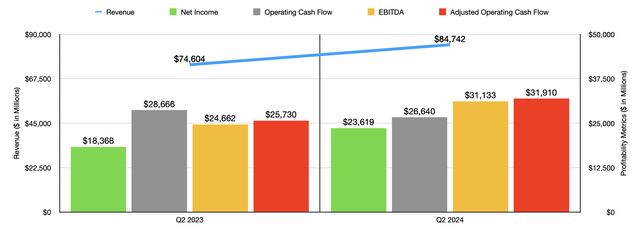

In my most recent article regarding Alphabet, investors had data covering through the first quarter of the 2024 fiscal year. But results now cover through the second quarter of the year. During that quarter, revenue for the company came in at $84.74 billion. That’s an increase of 13.6% over the $74.60 billion the company reported just one year earlier. The largest portion of this growth came from the company’s Google Services segment, which mostly involves the advertising services involving search, YouTube, and more. It also includes certain Google related subscriptions, devices, revenue from Google Play, and more. This piece of the company saw revenue climb by 11.5% from $66.29 billion to $73.93 billion.

Author – SEC EDGAR Data

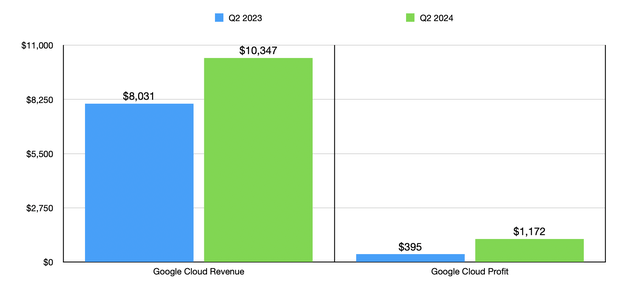

While this was the biggest driver of the revenue increase for the company, it is not the primary focus of this article. As I mentioned already, that belongs to Google Cloud. During the most recent quarter, this segment accounted for only 12.2% of the company’s overall sales. However, the year-over-year increase in revenue was a robust 28.8%. I don’t find this growth to be surprising in the least bit. According to the IDC, the global public cloud services market jumped by 19.9% in 2023, growing to an all-time high so far of $669.2 billion. They further expect this market to grow by 20.5% this year to roughly $806.4 billion. Another source estimates that the global cloud market will grow from $626.4 billion last year to $1.26 trillion by 2028. So this kind of rapid expansion, particularly for one of the big players in the market, should not be surprising.

Author – SEC EDGAR Data

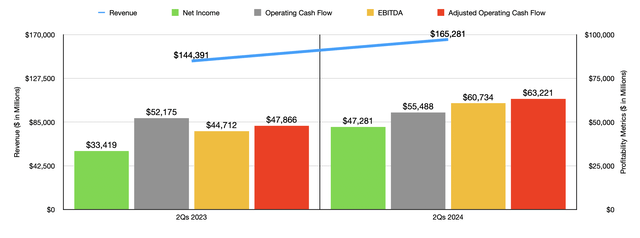

With the increase in revenue for the company also came an improvement in profits. Net income grew from $18.37 billion to $23.62 billion. Other profitability metrics largely followed suit. The one exception to this was operating cash flow, which dropped from $28.67 billion to $26.64 billion. If we adjust for changes in working capital however, we get a rise from $25.73 billion to $31.91 billion. And finally, EBITDA for the company expanded from $24.66 billion to $31.13 billion. In the chart above, you can also see financial results for the first half of 2024 as a whole, compared to the first half of 2023. As was the case in the second quarter, we see a nice amount of growth in revenue, profits, and cash flows. This shows that this is part of a larger trend for the company.

Author – SEC EDGAR Data

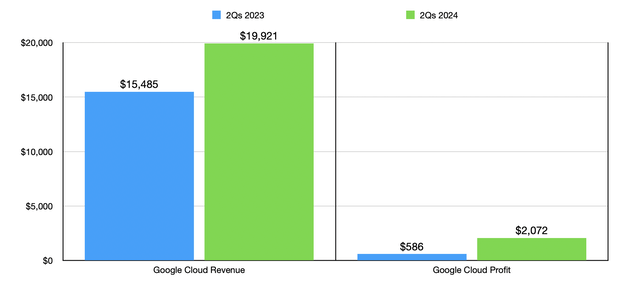

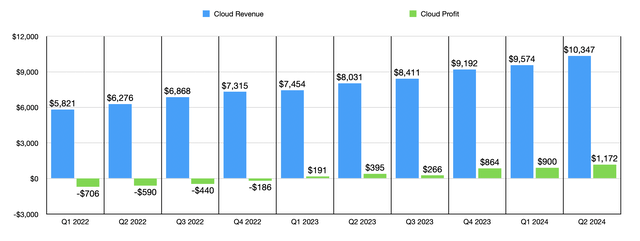

Even though Google Cloud still accounts for a relatively small portion of the company’s revenue, it is quickly beginning to contribute to the firm’s bottom line. Back in the second quarter of 2023, Google Cloud accounted for only $395 million worth of total segment profits. By the second quarter of this year, that number nearly tripled to $1.17 billion. In the chart above, you can see financial results for Google Cloud for the most recent quarter of this year compared to the same time last year. And in the chart below, you can see the results for the first half of this year compared to the first half of 2023. Clearly, management is doing something right.

Author – SEC EDGAR Data

This bottom-line improvement has been driven by the company finally achieving the kind of scale that it needs to in order to make its cloud operations thrive. In the chart below, you can see its cloud revenue and cloud profits covering the past several quarters. This shows continued growth without exception. But more importantly, it shows that the company has gone from consistently losing money on this business to now consistently generating a profit. In only one of the last ten consecutive quarters did the company report a decline in profitability on a sequential basis. That is difficult to achieve.

Author – SEC EDGAR Data

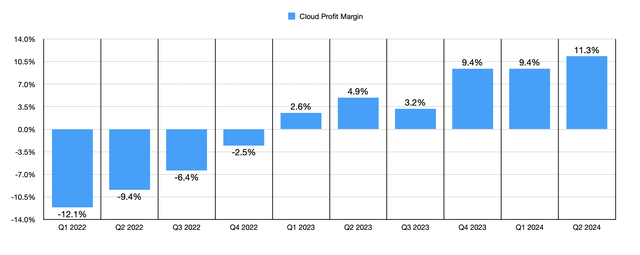

In the chart below, you can see some data put forth another way. This looks at the profit margin associated with Google Cloud. The $1.17 billion in profits that the segment achieved during the second quarter of this year implied a segment profit margin of 11.3%. That’s almost triple the 4.9% achieved the same time last year. It’s also well above the next best margin ever of 9.4% experienced in both the final quarter of 2023 and the first quarter of this year. I had thought that there might be some stagnation after seeing two quarters where the margin remained unchanged. But clearly, that was just a bump in the road.

Author – SEC EDGAR Data

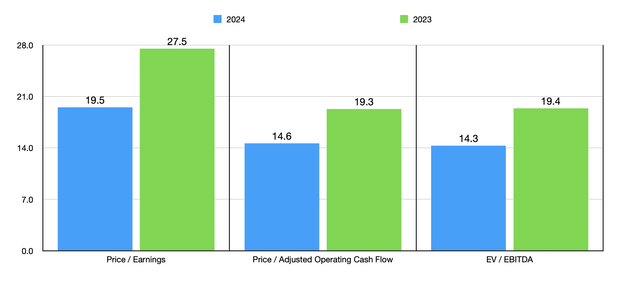

In my most recent article regarding Alphabet and its Google Cloud segment, I looked at a hypothetical scenario that projected out what segment profits might look like in the future. I don’t think it would be terribly valuable to rehash those details. However, I would say that the conclusion I arrived at from that analysis still holds true today. When it comes to valuing the company as things stand at the moment, the process is fairly simple. If we annualize results achieved during the first half of this year, we would get net income for 2024 of $104.41 billion. Adjusted operating cash flow would be $139.46 billion, while EBITDA would be $136.07 billion.

Author – SEC EDGAR Data

In the chart above, you can see what this would mean for the company’s valuation for the 2024 fiscal year. I also included, in that chart, a look at how the company is priced using historical results for 2023. There is a definite improvement from one year to the next. And this can be chalked up to the fantastic growth for the company across the board, and especially from the improvements on the bottom line that have been fueled in part by the Google Cloud segment. In the table below, I then compared Alphabet to five similar companies. I did this using three different valuation metrics. And what I found was that, in each case, only one of the three companies was cheaper than our candidate. So even on a relative basis, Alphabet is near the low end of the spectrum. I think it’s also worth noting that, even using the figures from 2023, we end up with only two of the five companies cheaper than it. So even on that basis, shares are attractively priced.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Alphabet | 19.5 | 14.6 | 14.3 |

| Meta Platforms (META) | 26.6 | 17.5 | 17.4 |

| Microsoft (MSFT) | 35.3 | 26.3 | 23.1 |

| Baidu (BIDU) | 11.1 | 6.2 | 5.7 |

| Oracle (ORCL) | 38.1 | 21.4 | 21.8 |

| ServiceNow (NOW) | 154.6 | 45.7 | 86.3 |

Takeaway

Based on the data provided, I do think that Alphabet continues to be a compelling opportunity for long-term investors. It is not a value prospect. But I would definitely consider it a GARP (growth-at-a-reasonable-price) opportunity. The business is growing at a nice clip, and the cloud operations under its belt are certainly helping on that front. The margins there are improving, and I see no reason to believe that this trend will stop for many years. Add on top of this the relative valuation of the company, and I do think that keeping it rated a ‘buy’ makes the most sense right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.