Summary:

- Google, with a market cap of almost $2 trillion, is a tech giant demonstrating strong market staying power.

- The company excels in entering new markets, such as training Apple Intelligence, showcasing its adaptability.

- Google’s ability to generate robust shareholder returns is evident throughout its operations.

- The article underscores Google’s potential for sustained growth and profitability, making it a compelling investment.

da-kuk

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is one of the largest tech companies in the world, with a market capitalization of almost $2 trillion. The company showed a strong staying power in its market and the ability to enter new markets, such as training Apple Intelligence. As we’ll see throughout this article, Alphabet has the ability to generate strong shareholder returns.

Alphabet Quarterly Performance

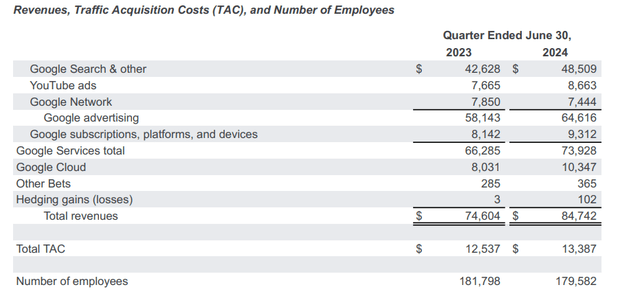

The company saw almost $85 billion in revenue for the recent quarter, up 15% YoY, showing the continued strength of its business.

The company saw 32% operating income margins, with roughly double-digit margin growth, as the company’s operating income grew to more than $27 billion. That resulted in diluted EPS of $1.9/share, or $7.6/share annually, putting the company at a P/E of just over 20. That’s an incredibly low valuation for a company growing so quickly.

The company has an incredibly powerful positioning and incredibly strong tech at the center of the market.

Alphabet Segment Performance

The company has seen strength in a variety of different segments in which it operates.

The core of the company’s business was Google search and the resulting revenue. The company’s revenue grew to almost $49 billion here which is strong double-digit growth as the company remains the dominant search platform in the world. The company’s YouTube ads business which is also the dominant streaming platform over Netflix, also did well.

Lastly, Google Cloud is clearly a top 3 cloud platform from the company, in a rapidly growing and very profitable business, enabling the company’s revenue to grow from $74.6 to $84.7 billion with a decrease in employee count.

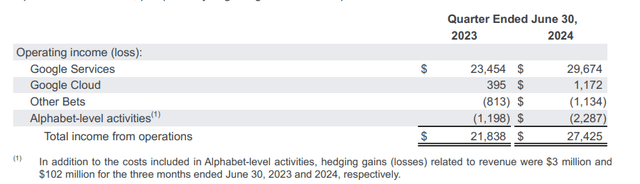

The company’s operating income came in at $27.4 billion as the company continues to run an impressive portfolio of “Other Bets” such as Waymo which your author has tried in San Francisco and likes more than both taxis and Uber. More importantly though, the company’s “Other Bets” comes in at $5 billion in annualized losses, a relatively much lower level than companies such as Meta’s concentrated other bets.

The company’s income from operations are more than $27 billion, showing the company’s continued ability to throw off a massive amount of cash. That’s cash that the company can use for shareholder returns.

Alphabet Antitrust

A major risk for Alphabet that’s worth its own discussion is the antitrust lawsuits the company has continued to face. The company still has the risk of being broken up.

The company effectively lost its antitrust case to the U.S. government, and now the judicial department is attempting to decide next steps. Rumors are that there could be a breakup, but nothing can be known yet. Expect any proposed breakup to be litigated in its own right by the company and drag out. It’s worth noting the government first proposed but didn’t end breaking up Microsoft 25 years ago.

There are scenarios where such a breakup could actually help, for example, if Google stops paying $20+ billion a year to Apple, but remains the dominant search engine if Apple cannot create a viable competitor. That’s because the payments have been ruled as illegal, but that doesn’t mean Apple could build a viable competitor.

However, it’s worth noting that this can be expected to be a major risk and overhang for the company in the coming months.

Alphabet Shareholder Returns

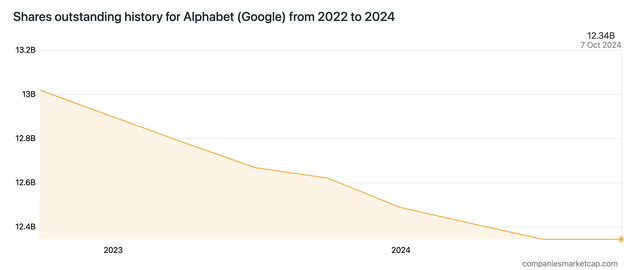

Google is a cash flowing machine and the company has recently decided to convert that to shareholder returns. The company has initiated a modest dividend at 0.5%, and it’s focused on aggressively buying back stock with a $70 billion buyback.

The company clearly feels its stock is undervalued and, despite share-based compensation, has managed to reduce its share count by ~5% over the last year and a half. The company’s earnings should enable a continued quick pace of buybacks, and we’d like to see the company’s buybacks continue. If the company continues to increase cash and shareholder returns, that could make it a valuable investment.

Thesis Risk

The largest risk to our thesis is that dominant companies in tech have historically not stayed dominant forever and Alphabet has substantial (and wealthy) competition.

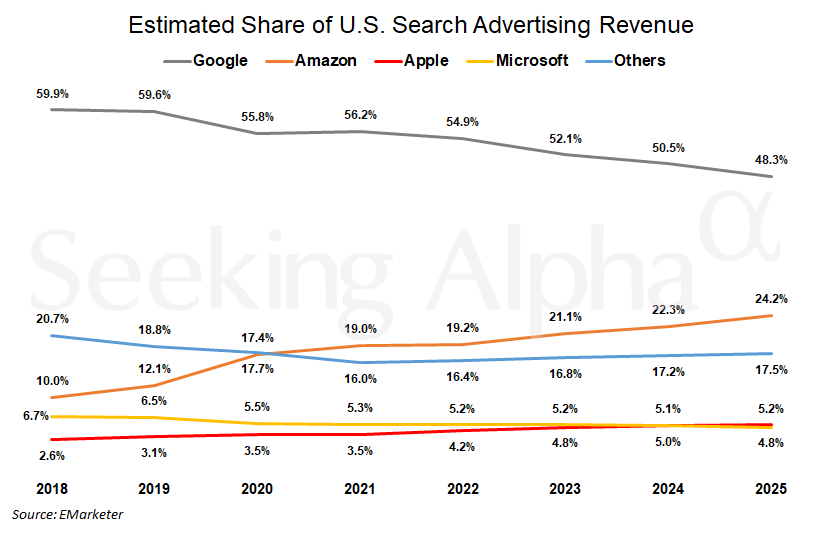

Google Market Position

For example, the company has seen its estimated share of U.S. search advertising revenue continue to decline as Amazon, especially along with Apple have both seen steady increases in their market share. Amazon, as the largest selling platform in the world, is especially well positioned to gather advertising dollars.

That doesn’t count the continued growth of artificial intelligence and the chance for another search engine to affect Alphabet. Either could be a big threat to the company’s continued growth.

Conclusion

Google is a company with a phenomenal portfolio of technology assets. The company has continued to invest in its technological strength and hidden segments of that are revealed through announcements such as Apple Intelligence being trained on Google TPUs. The company continues to innovate and build up its portfolio.

The company has managed to build up double-digit revenue growth in its portfolio with strength in every segment. The company is investing in every segment of its portfolio, with strength seen on all fronts. At the same time, the company is investing heavily in shareholder returns. That will enable strong shareholder returns going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.