Summary:

- Due to better-than-expected business performance, Google stock is up 53% this year and still trades at a lower P/E than peers like Microsoft and Apple.

- Google’s impressive earnings growth prospects make it an attractive investment.

- Google’s continued dominance in search, revenue from YouTube, and potential in cloud and AI contribute to its strong business performance.

- I’m raising my 2024 price target for GOOGL to $162, with the potential for the stock to reach $200.

Deagreez/iStock via Getty Images

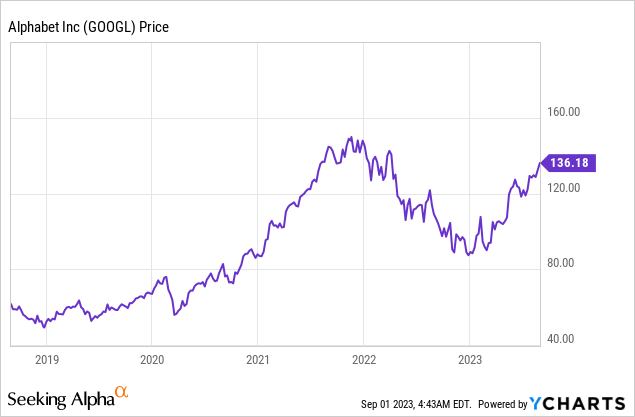

Large-cap tech has soared this year. Some of it is based on hype, rather than actual business results. Then there’s Google (NASDAQ:GOOGL). Google stock is up 53% this year with an avalanche of earnings estimate increases by analysts. Even with superior growth prospects, Google still trades for a lower P/E than peers like Microsoft (MSFT), and Apple (AAPL). Despite this year’s run, Google trades for less than 21x 2024 earnings, which is about the same as the S&P 500 at large and the lowest of any AI play that I’m aware of. With this in mind, I’m raising my price target for Google to $162, with the potential for the stock to run to $200 if investors wake up to its growth potential.

Google Is Bad At Marketing Itself…

Google started this year under $90 per share. This is value stock territory. ChatGPT was released in November, but AI hype had yet to fully permeate the market. AI hype started to take hold in January and push Google’s stock up, until the infamous Bard chatbot presentation in February. There, Bard gave incorrect information about the James Webb space telescope. Chaos ensued, panicked investors dumped Google stock, and Google’s valuation promptly retreated by $100 billion. If you ordered a pizza in Silicon Valley this spring and the driver dropped it off in a Tesla, your delivery driver may have been a former member of Google’s AI team! Of course, Bard was fine- ChatGPT makes ridiculous mistakes all the time, and one key difference between ChatGPT and Bard is that Microsoft only owns 49% of Open AI’s long-term profits, while Google owns all of Bard.

However, this speaks to a broader issue in Big Tech. Some tech companies are brilliant at marketing themselves, while some companies are not. In the short run, this is sometimes all that matters. But in the long run, all that matters is the underlying business and cash flow. 14 years of interest rates being at zero meant the “long run” was longer than it used to be, but with higher rates, there will be increasing pressure on companies to actually make money, which none of the hype-factory companies that changed their name to AI are capable of doing.

Would you rather invest in a company that makes tons of money but sucks at marketing or a company that loses fistfuls of money but is great at hype? Google is the former, while AI stocks like C3.ai (AI) are the latter. AI prom king Nvidia (NVDA) is winning the popularity contest for now, but it’s a cyclical stock with a nosebleed valuation. If competition erodes Nvidia’s profits or even its growth trajectory, there are a trillion dollars of downside. And even if AI didn’t exist, Google would still be a buy at its current valuation.

But Great At Making Money!

Google made about $61 billion in net income over the trailing twelve months, only topped by 2021’s blowout earnings from ad revenue. Per share, this works out to roughly $4.75. For 2023, analysts expect roughly $5.59 in earnings, followed by $6.59 in 2024 and. These are really strong growth numbers compared with more popular companies like Apple which have higher P/E ratios and lower earnings estimates.

What’s driving the earnings machine at Google?

- Google has retained its stronghold on search. Microsoft tried to make inroads to get Samsung to switch to Bing (likely with some sort of ChatGPT integration) on Samsung phones. In the end, Samsung went with Google because Google provides a better search experience than companies that are only partially focused on search.

- YouTube is a revenue juggernaut, with Google sharing on the most recent earnings conference call that revenue related to YouTube has reached $40 billion. YouTube is a great consumer product because of its long search tail and ability to learn about niche topics for free, while the growth in revenue has meant that more and more creators are able to make a living on the platform.

- Cloud and AI are where Google’s optionality comes from. Google’s chief advantage in the tech space is that they likely have the most data of any company in the world. Much of this data is transaction-specific data as well, which is why Google is the profit juggernaut that it is. AI should incrementally improve both Google’s advertising business, and its cloud business as well. Google’s cloud business first reached profitability in Q1 and made even more in Q2. Since they started the cloud business, this was costing Google money every single quarter, and now it’s contributing to their bottom line. Google doesn’t have to topple AWS here, but even giving them a run for their money could help keep the stock on track for $200 as time goes on. It seems logical that Google would be a winner from AI, yet the media trumpeted them as the company that would lose the most from AI. Of course, it didn’t happen, but because of the perception you can still buy Google stock and make money.

Google Price Target: Raising To $162

I previously had written in 2022 that Google offered 15.4% compound annual returns at $100 and 16% at $90, so Google was a great buy at lower prices. This was an underestimate. Because Google’s business has done better than expected, investors can expect to consolidate the gains they’ve made thus far and make even more. Analysts have Google earning $7.70 for 2025, and if we assume a 21x forward multiple (to be conservative), this gets us a price target of roughly $162 for Google by the end of 2024, or roughly an 18% return over the next 16 months. If you think Google blows out the analyst earnings estimates, then we could be closer to $200.

Since I’m writing about Google, I’ll also include my mandatory share-class discussion. Google Class A stock (GOOGL) and Class C stock (NASDAQ:GOOG) are for all intents and purposes identical, but you can buy the class A for about $1 cheaper. It’s my understanding that Google focuses its buybacks on class A stock, allowing it to make a slight profit off the ignorance of investors. You can share in this by buying GOOGL instead of GOOG.

Bottom Line

Due to better-than-expected business performance, Google is a reasonably good buy at current prices and an even better one on any pullback. I’m raising my year-end 2024 price target on GOOGL to $162.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.