Summary:

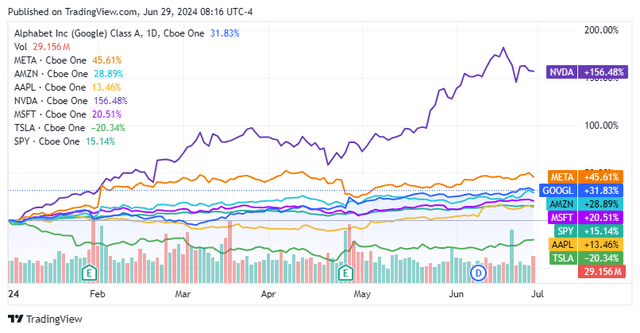

- The bull market continues to rise, led by the Magnificent Seven, with GOOGL up 31.83% YTD.

- Alphabet faced adversity with the Gemini incident but has proven the bears wrong, now up 38.62% since March 6th.

- GOOGL’s revenue and profitability continue to grow, making it an attractive investment at all-time highs with strong future growth potential.

400tmax

The bull market continues higher heading into Q2 2024 earnings, led by most of the Magnificent Seven. The S&P 500 Trust (SPY) has appreciated by 15.14% YTD, and only 2 of the Magnificent Seven are trailing the market. Apple (AAPL) is just slightly behind as it’s up 13.46% on the year, while Tesla (TSLA) is the only company whose stock price has declined from the Magnificent Seven in 2024. I have heard for years that the appreciation from these companies isn’t sustainable, but they continue to prove the bears wrong. Alphabet (NASDAQ:GOOGL) experienced some adversity in the beginning of the year as the Gemini incident caused financial outlets such as The Economist, and prominent investors such as Brad Gerstner from Altimeter Capital to discuss what the ramifications could mean for them. I remained very bullish as the incident was a fixable problem, and I didn’t believe advertising would be impacted or that customers would switch their cloud provider and phone operating system. GOOGL has proven the bears wrong and the bulls right, as it’s now up 31.83% in 2024 and climbed 38.62% since reaching $131.40 on March 6th, 2024. Regardless of how GOOGL has performed YTD or the fact its stock price is making all-time highs, I believe GOOGL is headed higher as there is a significant amount of revenue and earnings growth on the horizon. While the market could see some retracements in the future and a recession is inevitable sometime in the future, the largest companies keep getting larger, and I think the bull case for GOOGL is far from over.

Seeking Alpha

Following up on my previous article about Alphabet

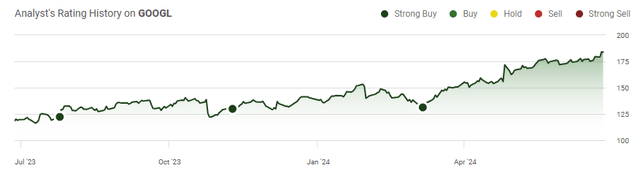

While GOOGL expanded on its financial dominance in Q1 after beating the consensus estimates by $1.84 billion for expected revenue and $0.38 on GAAP EPS, I decided to wait prior to releasing another update. I wanted to see how the Gemini situation would play out as I had outlined my thoughts about the matter in my recent article which was published on March 6th, 2024 (can be read here). Since then, shares of GOOGL have appreciated by 36.83%, and after paying their first quarterly dividend on June 17th, their total return was 36.99%. This outpaced the S&P 500 by a significant amount, as the index is up 6.9% during this period. As I predicted, the Gemini debacle wouldn’t be GOOGL’s destruction, and shares are now making all-time highs. I discussed my bull case when shares of GOOGL were hitting a rough patch, and I am still very bullish on GOOGL at all-time highs. I think there is still a massive opportunity for long-term investors, and while shares could cool off at some point, I believe shares will finish significantly higher at the end of 2024 than they are today.

Seeking Alpha

Risks to investing in Alphabet

No matter how much revenue a company generates or how profitable it has become, there are always risks to investing. Alphabet has enjoyed a duopoly with Meta Platforms (META) as these have been the 2 companies that have dominated the advertising space. Recently, Amazon (AMZN) became a third option as they generated $11.82 billion in advertising sales during Q1 2024, which was a 24% YoY increase. If AAPL gets into the sector and AMZN continues to grow its advertising revenue, the sector could become more diversified, and GOOGL could see its advertising revenue decline, which would impact future revenue and earnings projections. GOOGL could also see less revenue generated from YouTube as product offerings from other streaming services become more enticing. GOOGL could also see a slowdown in Google Cloud as AWS and Azure continue to expand their product offerings. It’s not impossible for GOOGL to face declining revenues as they are operating in sectors where the largest companies are trying to take revenue from their top-line.

Alphabet is reaching all-time highs for good reasons as it’s one of the best companies in the market

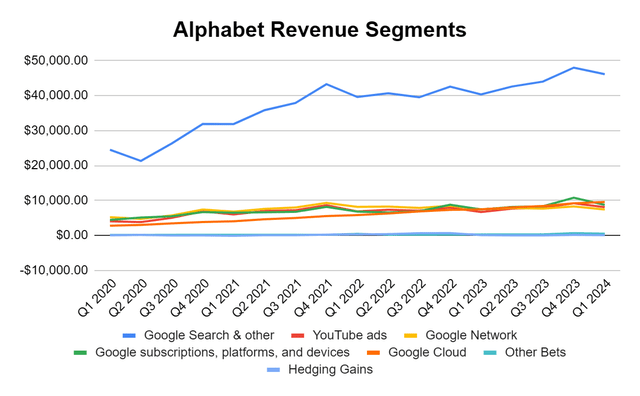

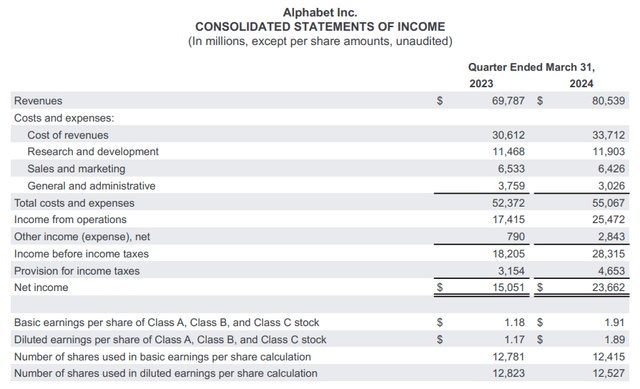

Despite how large GOOGL has become, it continues to find ways to innovate and grow. Over the past 4 years, GOOGL has increased its Q1 revenue by 95.68% as its grown from $41.16 billion in Q1 2020 to $80.54 billion in Q1 2024. When you’re a small company, it’s easy to grow at double-digit rates, but when you’re as large as GOOGL, it’s even more impressive to maintain double-digit growth rates on an annualized basis. In Q1 2024, GOOGL’s revenue grew by 15.41% YoY, adding $10.75 billion in quarterly revenue compared to Q1 in 2023. The growth for GOOGL continues to be massive, and while there has been a secular dip in revenue from Q4 to Q1 due to holiday spending, the overall revenue trend continues to be up and to the right.

Steven Fiorillo, Alphabet

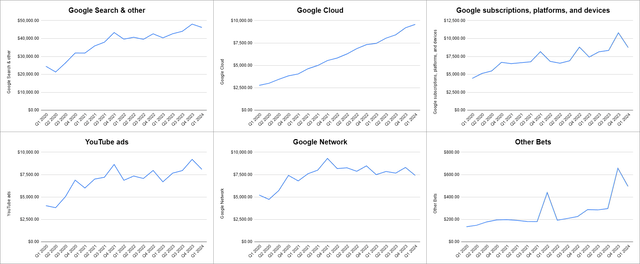

It took GOOGL more than 15 years to reach the $100 billion level of annualized revenue, and over the past 6 fiscal years, they have gone from $110.86 billion to $307.39 billion. So many people were worried about Search taking a hit, but Chat GPT and GOOGL Gemini haven’t cannibalized its revenue-generating ability in the slightest bit. I broke out each segment individually in the charts below because I wanted to emphasize the individual growth these segments have accomplished. While Search continues to provide GOOGL with a revenue foundation and growth, YouTube Ads, Google Subscriptions, and Google Cloud are providing strong growth engines to the underlying metrics. Viewers are consuming more than 1 billion hours of YouTube content daily while surpassing 100 million music and premium subscribers. YouTube ads increased by 21% YoY, and YouTube has paid out more than $70 billion to content creators over the past 3 years. GOOGL has announced more than 1,000 new features over the past year within its Google Cloud infrastructure. GOOGL is offering its cloud clients access to a mixture of GPUs from NVIDIA Corporation (NVDA) in addition to their own TPUs. GOOGL is estimating that 60% of funded generative AI startups and 90% of generative AI unicorns are GOOGL Cloud customers. The subscription business continues to be led by YouTube subscription revenue as YouTube bleeds over into two segments.

Google Cloud continues to expand at a quick pace. In 2020 Google Cloud generated $13.06 billion in revenue, and over the next 4 years, its revenue increased by 169.61% as it grew to $35.21 billion in the trailing twelve months (TTM). Since 2020 Google Cloud has grown into GOOGL’s 3rd largest revenue generator as it surpassed YouTube ad revenue and slightly trails the subscriptions, platforms, and devices segment. Between YouTube ads and Google Cloud, they have added $68.12 billion to the top line, and management believes that they will generate over $100 billion in revenue from all of YouTube’s components and Google Cloud in 2024. It’s hard for me to get bearish on GOOGL’s future or consider exiting my position when double-digit growth rates have been maintained on an annualized basis, and the largest segments of the business continue to expand.

Steven Fiorillo, Alphabet

It’s not just the top line that’s growing at GOOGL, its profitability continues to increase. In GOOGL’s Q1 of 2024, they generated $25.47 billion in operating income, which was an increase of 46.27% ($8.06 billion) YoY. This was an operating margin of 31.63% compared to 24.96% In Q1 of 2023. GOOGL was able to grow its profitability while becoming more efficient and increasing its operating margin by 6.67% YoY. GOOGL was able to grow its net income by 57.21% YoY in Q1 to $23.66 billion while growing its EPS by $0.73 to $1.91, which was an increase of 61.86%. I believe this is more impressive than the revenue growth because GOOGL isn’t being irresponsible in growing its top-line as its profitability increases and margins expand. As profitability expands, GOOGL is able to invest more in its business, and this has fueled its growth cycle over decades, not years. There were 13 weeks in Q1, and GOOGL generated $1.82 billion in net income per week. It’s extremely difficult for startups or even established competitors to compete with GOOGL when they are generating close to $2 billion in profitability on a weekly basis. GOOGL has $24.49 billion in cash and another $83.6 billion in short-term investments on its balance sheet, which places their on-hand liquidity at $108.09 billion. GOOGL has another $33.99 billion in long-term investments on the books, with only $11.87 billion in long-term debt. I think GOOGL’s reign at the top of the mountain will continue for years to come, and I believe that its revenue growth combined with it’s profitability makes it one of the best companies to invest in.

Alphabet

Shares of Alphabet look inexpensive and I would buy more at all-time highs

Some investors don’t like buying at all-time highs, but I believe in the theory of time in the market rather than trying to time the market. I can’t time tops and bottoms and make my investment decisions based on my forward investment thesis. I can’t tell you how many people freaked out in March of 2020 because the S&P 500 went from being at 3,380 on 2/14/20 to 2,304.92 on 3/20/20. By the middle of August, the market had made new all-time highs and had pushed forward through 2021. Even if I look at the bear market in 2022, it may have taken a bit longer, but the S&P 500 has ultimately made new highs. Shares of GOOGL could certainly retrace, and it’s possible that they miss earnings at some point, but I believe they will continue to increase over the long-term and short-term fluctuations that are part of investing in equities. The Board approved an additional $70 billion in repurchases while declaring its first cash dividend of $0.20. GOOGL is enhancing its capital allocation program, and the additional allocation toward buybacks should provide a boost to EPS in the future.

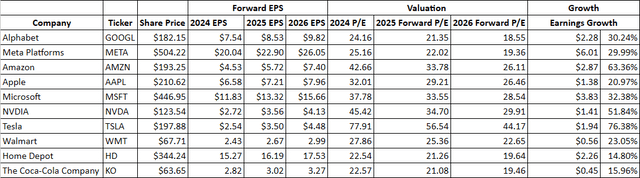

When I make investments into companies like GOOGL at all-time highs, I want to see that there is a patch for continuous top and bottom-line growth. GOOGL is expected to produce $1.84 of EPS in Q2 2024, which is a 27.5% increase YoY. When I look at the forward revenue growth GOOGL is expected to grow its top-line by 12.76% YoY in 2024, then by 11.04% in 2025, and by another 10.6% in 2026. I am invested in all the Magnificent Seven companies except for Microsoft, and I have been adding to these positions with the market at all-time highs. I believe that technology will continue to carry the market higher over the next several years, and when I compare all these companies to each other from a forward earnings perspective, GOOGL looks inexpensive.

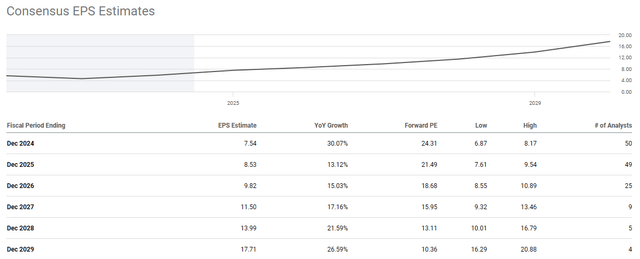

When anyone makes an investment, they are buying equity in a company that represents all of the future growth on the top and bottom line, which will be achieved until they exit the position. GOOGL is expected to generate $7.54 in EPS for its 2024 fiscal year and grow its EPS by 30.24% over the next 2 years through 2026. On a forward earnings basis, GOOGL trades at the cheapest valuation in the Magnificent Seven based on 2024, 2025, and 2026 earnings. Even at all-time highs, investors are still paying 24.16 times 2024 earnings and 18.55 times 2026 earnings. The Magnificent Seven trade at an average 2024 forward P/E of 40.73 and 27.59 based on 2026 earnings. GOOGL is trading significantly below the peer group average, while it has more projected growth than Meta Platforms (META) or Apple (AAPL). I have also added Walmart (WMT), Home Depot (HD), and The Coca-Cola Company (KO) to my comparison to indicate just how inexpensive GOOGL is. KO is trading at 19.46 times 2026 earnings with 15.96% forward EPS growth expected from the end of 2024 through 2026. GOOGL is trading at a lower forward valuation based on 2026 earnings than KO, with almost double the projected growth. I believe that GOOGL is still the most undervalued company in the Magnificent Seven.

Steven Fiorillo, Seeking Alpha

Seeking Alpha

Conclusion

Earnings season is around the corner, and the Magnificent Seven is expected to start reporting on 7/19 as TSLA will get things started off. The market has continued higher through 2024, and GOOGL continues to make new all-time highs as its appreciated by 31.83% YTD. If you’re a long-term investor, I think GOOGL looks inexpensive as it’s top-line is expected to grow at double-digit percentages YoY for at least the next 3 years. GOOGL is also expected to grow its EPS by over 30% from the end of 2024 through 2026. GOOGL trades at less than 19 times 2026 earnings, and the Board just authorized an additional $70 billion in buybacks. I plan on adding to my position heading into earnings as I feel GOOGL is the most undervalued Magnificent Seven company in the market today. It’s hard to bet against GOOGL as it generated more than $1.8 billion in net income per week in Q1 and has more than $100 billion in cash on hand.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, AAPL, META, TSLA, NVDA, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.