Summary:

- The appeal of ad bidding to rank higher in search results is undermined; the likelihood of users scrolling lower to find website links is subdued if Bard’s response is sufficient.

- Advertising revenue through ‘Google Network’ would also suffer as conversational-style queries through Bard reduce the need for users to visit websites to find answers, reducing ad impression on web pages.

- While Google is encouraging users to click on websites to learn more about something, users may be inclined to continue to chatting with Bard to find the answers.

- Google walks a fine line between optimizing the trustworthiness/usefulness of Bard responses and optimizing ad revenue.

- The fee-based business model of OpenAI could augment users’ perception of ChatGPT Plus as offering unbiased and useful answers, though it would need to prove its superior reliability over Google.

400tmax

Google (NASDAQ:GOOG) is under immense pressure to deliver on its AI promises, amid intensifying competitive pressures. The rise of ChatGPT forced Google to hastily introduce its own AI-powered chat technology, Bard, transforming the way people search for information through Google. While Bard has not been officially launched to the public yet, its introduction has been underwhelming, and the new technology could upend Google’s advertising business, pressuring profit margins over the foreseeable future. Given the risks ahead, the stock is not worth buying. Nexus Research has a ‘hold’ rating on the stock.

AI-powered search enhancements are essential to keep users engaged, though there are various concerns Google faces in the face of rapid innovation.

Google’s leadership in AI innovation is questionable

Despite Google’s AI-first approach over the last six years, they haven’t had first-mover advantages in several areas of search-related AI innovations. The rise of ChatGPT is one of the most prominent threats to Google’s search dominance, especially as Microsoft incorporates the technology into the Bing search engine.

Though there are also other areas where Google has fallen behind in innovation. Google likes to proclaim the capabilities and increased usage of Google Lens, its image-based search tool, as a reflection of Google’s AI advancements. CEO Sundar Pichai frequently proclaims the multimodal search capability of Google Lens, powered by its Multitask Unified Model (MuM) AI technology, enabling users to search using the combination of an image and words to more easily find what they are looking for. Though this feature has been available on Pinterest since 2017, while Google only launched its own feature in April 2022. For context, tech giants like Amazon and Meta also offer image-based search functionalities, undermining Google’s e-commerce ambitions through AI innovations like Google Lens.

Amid the recent competitive pressures, Pichai recently reminded employees that Google was not the first search engine either, but that did not stop it from becoming the dominant search engine of the world. While this argument has some merit, the tech industry has become a lot more competitive over the last two decades, and Google has been unable to offer an edge over competitors, even when it comes later to the party. The most recent instance of this would be the underwhelming introduction of Google Bard, which turned out to have a factual error within the demo.

Google’s ad business is under pressure

As if Google’s slow-paced AI innovation was not concerning enough, the evolving nature of search activity also requires Google to evolve its advertising solutions. Two key advertising segments most likely to be affected by evolving search behaviour are ‘Google Search & other’ and ‘Google Network’.

‘Google Search & other’ is advertising revenue that derives from website owners bidding to rank more prominently on Google’s digital properties, most notably the Search Engine Results Page (SERP). Google generates revenue when people click on the advertised website links appearing near the top of SERPs. ‘Google Search & other’ constituted around 57% of total revenue in 2022.

‘Google Network’ generates ad revenue from third-party publishers (website owners) selling ad spaces on their websites through Google Network partners (AdSense and AdMob), from which Google takes a cut per impression. This revenue stream requires people to visit websites participating in ‘Google Network’, also known as ‘Google Network partners’, in order to garner ad impressions. The segment made up around 12% of sales revenue in 2022.

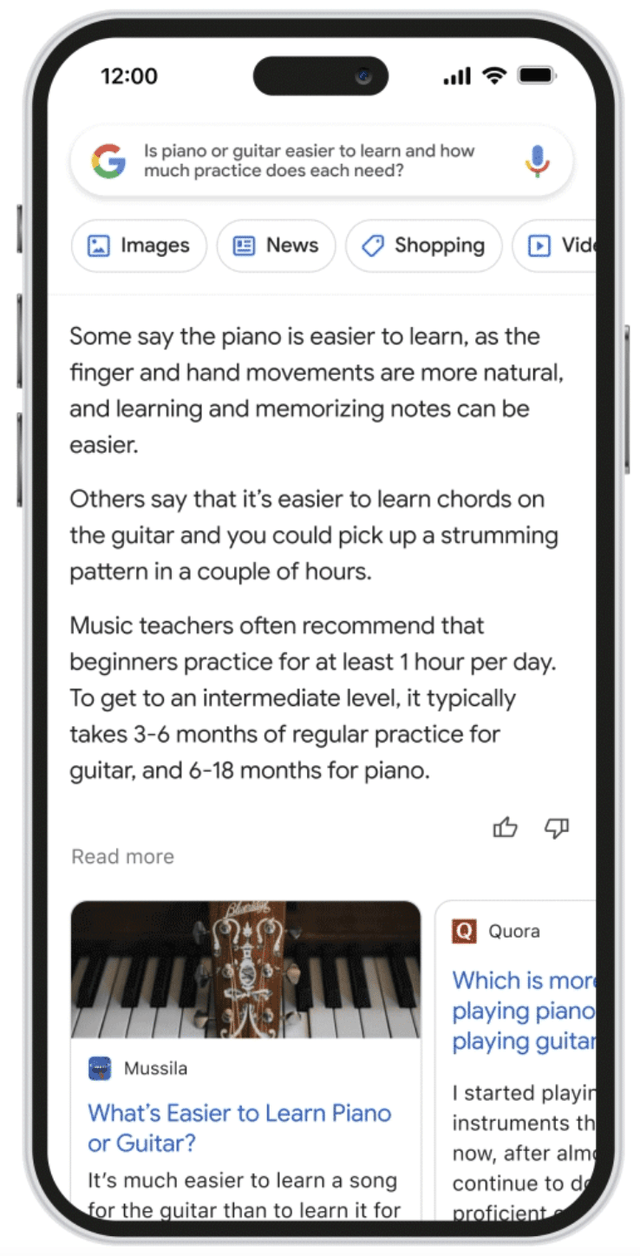

In CEO Sundar Pichai’s blog post introducing Bard, we got some more insights into how Google plans to design Bard responses to maintain users’ engagement with websites listed in Google search results.

Below Bard’s answer one can find a ‘Read more’ section, listing websites with more information relevant to the query. In the demo, the recommended articles did not appear to be ads. Instead, Google seems to be prioritizing the websites’ relevance to user queries. While this approach is prudent from the perspective of usefulness for users, it does throw a spanner in Google’s search ads business.

Bard’s response to user queries takes up notable amount of space on top of the SERP, moving website links lower and lower. Consequently, the appeal of ad bidding to rank higher is undermined, as the likelihood of users scrolling lower to find website links is subdued if Bard’s response is sufficient. This could indeed present a considerable blow to Google’s search-related advertisement revenue.

Google may need to re-imagine its ad solutions around Bard to sustain advertising revenue. Though the tech giant has not proven to be agile when it comes to monetizing new formats, just take YouTube Shorts as an example. The short-form video content feature launched in September 2020 following competitive threats from TikTok. While YouTube Shorts is able to attract 50 billion daily views, Google has still not been able to close the monetization gap between short-form and long-form content, two and half years since launch.

Moreover, as Google transforms its ad solutions amid evolving search behaviour, there is still the risk of displeasing advertisers with the way ad-solutions are designed around Bard, as they may deem website discoverability and monetization potential to still be undermined by Bard.

This would come at a time when Google is already facing intense advertising competition, amid the rise of Amazon advertising attracting ad dollars from merchants selling all sorts of physical items, as well as tough competition from social media platforms like Meta and Pinterest. Hence, advertisers have plenty of alternative options available while Google tries to figure out how to effectively monetize Bard.

Furthermore, advertising revenue through ‘Google Network’ would also suffer as conversational-style queries through Bard reduce the need for users to visit websites to find answers, reducing ad impression on web pages.

In his post, Pichai emphasised that answers from Bard will help users understand the big picture, implying that Google will encourage users to visit publishers’ websites for more extensive answers, in order to maintain Google Network ad revenue.

Nonetheless, intensifying competition could force Google to offer more granular Bard answers, depending on what competitors are doing. If competing services offer more in-depth answers without users needing to visit other web pages, Google would need to follow suit to remain competitive.

While Google’s Bard is trying to encourage users to click on publishers’ websites to learn more about a subject matter, users may indeed be inclined to continue to chatting with Bard to find the answers they are looking for, to save them having to scroll through web pages. Therefore, Google’s Bard could indeed be inclined to offer more in-depth answers to maintain convenience and usefulness of the service, at the expense of Google Network revenue.

Even if users do end up clicking through to websites in the ‘Read more’ section, not all websites will be Google Network partners. It remains to be seen whether Google ends up giving more prominence to Google Network partners/ highest-bidding advertisers in a potential Bard-driven search platform, in the interest of optimizing ad revenue. Though this approach would compromise the reliability of Bard responses / suggestions. Google walks a fine line between optimizing the trustworthiness/ usefulness of Bard responses and optimizing ad revenue.

Contrarily, OpenAI is striving to monetize ChatGPT through subscription fees as opposed to ad revenue. In February 2023, OpenAI introduced ChatGPT Plus for $20/month. This can augment users’ perception of ChatGPT relative to Google, especially if the incumbent stays inclined towards optimizing ad revenue. Such a scenario would induce users to perceive ChatGPT answers and suggestions as more useful, while Google would need to strive hard to overcome the perception of bias towards Google Network partners/ highest-bidding advertisers.

Both ChatGPT and Bard need more development and iteration to improve the trustworthiness of their answers. Though given that the end goal is to offer factual and reliable information, a fee-based business model (as with OpenAI) would make more sense than the ad-based business model overtime, especially if the former can indeed prove to be significantly more reliable.

Google Bard compute costs are high

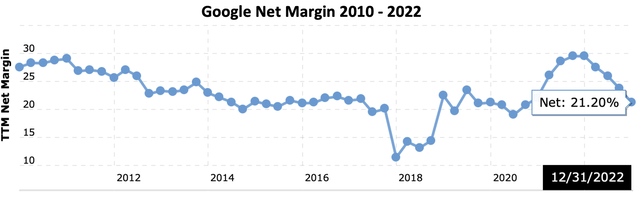

Google does not disclose operating income granularly for its individual advertising units. Instead, the company reports results for the ‘Google Services’ segment, which includes ‘Google Search & other’, ‘YouTube ads’, ‘Google Network’ and ‘Google Other’. In 2022, the operating margin for ‘Google Services’ was 34%. Note that the other segments, ‘Google Cloud’ and ‘Other Bets’ are both loss-making. Google’s net margin in 2022 stood at 21.20%.

AI-powered searches are estimated to be ten times costlier for Google than traditional searches. On the last earnings call, an analyst asked about the “impact on CapEx of the higher compute intensity of these AI tools, potentially impacting margins over the next couple of years”. CFO Ruth Porat responded:

It is more compute-intensive, but also opens up many more services and products for our users, for creators, for advertisers…

we’re very focused on further optimizing the cost of compute, and that’s across all elements, data center, servers and our supply chain. So we’re continuing to invest with a keen lens on the return on that capital…

we are focused on durable improvements to our expense base… they take longer to implement, execute. They’re in process now, and they continue to build on themselves and continue to provide added upside as we go through time, which is why I indicated you would see more of an impact on 2024 than in 2023.

Durable improvements should improve cost control overtime, but intensifying competition may subdue Return on Investment [ROI] potential, and pressure top line growth. Moreover, Google’s executives frequently proclaimed the efficacy of the AI-powered advertising and marketing solution, Performance Max, on the last earnings call. Performance Max was launched in November 2021, and is an upgrade from smart shopping campaigns, aimed at bolstering retail activity through Google.

Despite the AI-driven advancement, Google Advertising revenue grew by just 7.15% in 2022, with executives primarily blaming macro conditions for the slowing growth. Comparatively, Amazon’s advertising business grew 21.11% over the same period. The point is, durable improvements in Google’s cost structure may not necessarily result in margin expansion, as the intensifying competition in AI-driven services may subdue revenue growth potential.

Google’s net margin of 21.20% remains considerably higher than the sector median of 3.38%. Nevertheless, barring the ‘stay at home’ boost during the pandemic, Google’s net margin has been trending mostly lower for over a decade.

Google’s highly profitable advertising business has been subsidizing its loss-making segments, particularly Google Cloud, for over a decade. If Google’s advertising division itself faces margin compression going forward amid the intensifying AI race, Google’s net margin could be in trouble.

Google stock currently trades at a Forward P/E of 18.34x, while the sector median stands at 18.70x. The market is right not to assign a premium valuation to Google stock, given the dire outlook for profitability.

Habitual search behaviour

On a positive note, bulls like to proclaim that Google is well-ingrained into people’s search activity habits, and changing this habit towards alternative services would be an uphill battle. In February 2023, 93.37% of worldwide search queries were through Google. The tech giant certainly has a strong reign over the search engine market, bolstered by strong brand recognition. In fact, amid the hype around ChatGPT, AI consultant Tobias Zwingmann pointed out in December 2022 that “the way it works currently is people use ChatGPT and then go to Google to verify the results”, which is testament to Google’s brand power.

That being said, while altering search behaviour would be challenging, it is not impossible. Google may be well-ingrained into the habits of certain generations, but younger generations may not necessarily be as attached to Google, especially amid the rise of new platforms like TikTok, where users often go to learn more about certain subject matters (e.g. get financial advice).

Additionally, regulatory scrutiny looking to dismantle the Apple-Google partnership, whereby ‘Google’ is set as the default search engine on Apple devices, could further undermine the search giant’s ability to sustain the habitual search behaviour of users.

Is Google a buy?

The hasty rollout of Google Bard may upend Google’s core advertising business. The appeal of ad bidding to rank higher in search results is undermined, as the likelihood of users scrolling lower to find website links is subdued if Bard’s response is sufficient. This presents a notable threat to Google’s search-related advertising revenue.

Ad revenue through ‘Google Network’ would also suffer as conversational-style queries through Bard reduce the need for users to visit websites to find answers, reducing ad impression on web pages. While Google is encouraging users to click on websites to learn more about something, users may be inclined to continue to chatting with Bard to find the answers.

Google walks a fine line between optimizing the trustworthiness/ usefulness of Bard responses and optimizing ad revenue. On the other hand, the fee-based business model of OpenAI could augment users’ perception of ChatGPT Plus as offering unbiased and useful answers, though it would need to prove its superior reliability over Google to win market share.

The investment community is right not to assign a premium valuation to Google stock, amid the dire outlook for profitability. Given the AI-related risks and uncertainties ahead, the stock is not worth buying. Nexus Research has a ‘hold’ rating on the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.