Summary:

- Google’s Gemini AI model has faced criticism for inaccuracies and focusing too much on DEI issues rather than accuracy and factual results.

- Despite these concerns, Google’s investment in AI, including Gemini and DeepMind, positions the company well for the future of the AI market.

- The financial implications of Google’s AI integration could lead to higher margins and increased productivity, making the stock a strong long-term investment.

metamorworks/iStock via Getty Images

I am a Google (NASDAQ:GOOGL) (NASDAQ:GOOG) shareholder, and my opinion of the present Gemini AI issues related to inaccuracy in presentation and underperformance against ChatGPT in public perception and utility is that the company should redirect its operational and value focus away from DEI-influenced bias. Even amid the current concerns, I believe the stock is undervalued, and the financial implications of AI integration are very favorable for Google over the long term.

I last covered the company in January, and since then, my understanding, research, and experience with Google’s AI tools have deepened my perspective on the troubles it is currently facing in the domain. In essence, my thesis remains intact that the firm is a worthy long-term holding, but my analysis in this piece acts as a deeper dive into present risks related to its AI operations which are fundamental to its long-term continued success overall.

Gemini Analysis

Google introduced Gemini, its most advanced AI model to date, with three versions, namely Ultra, Pro, and Nano, for different user cases. It has notably achieved exceptional results in benchmarks, like a 90% score in Massive Multitask Language Understanding, which surpasses human expert performance.

Then, Google introduced Gemini 1.5, enabling it to process 1 million tokens, as opposed to the 32,000 tokens for Gemini 1.0. The model has undeniably shown strengths in data extraction and synthesis, and the capabilities of the technology do position the firm as a leader in AI at the time of this writing.

However, the most notable criticism of the AI model to date has been around its “wokeness”. For example, it has generated historically and contextually inaccurate images in an effort to make them DEI-appropriate. But the irony of the matter is that this is actually inappropriate for an AI to do. To me, this underscores a deeper issue within Google and many leading Western companies at this time, as they are too focused on DEI issues and not enough on accuracy, meritocracy, and data-driven results.

CEO Sundar Pichai has addressed the issue as a grave mistake on Google’s part, and I commend him for this. But investors should consider the deep-seated issue here that could affect Gemini’s long-term reputation against leading rivals like OpenAI and Microsoft’s (MSFT) ChatGPT, which I deem to be the far stronger model of the two.

Notably, Bill Ackman’s firm Pershing Square (OTCPK:PSHZF) has a sizeable stake in Google, and he has openly spoken out about the issues of DEI on business performance in his interview with Lex Fridman. Google comprises roughly 18.5% of Pershing Square’s assets, and I believe Bill Ackman’s history as an activist investor could be valuable here if he takes a guiding role in helping the company to become less focused on DEI initiatives and more on meritocracy to drive technology quality and operational success.

Broader AI Market Analysis

The AI market is becoming increasingly saturated by the day, and I believe it is important for investors to take a step back and truly assess where the long-term value is going to be. The main competitors to Google’s Gemini and DeepMind operations at the time of this writing are likely:

- OpenAI: Known for its GPT (Generative Pretrained Transformer) models, OpenAI is arguably the largest commercial competitor, with advanced language and reasoning models. It has also ventured into video and image creation with growing success in these areas.

- IBM (IBM) Watson: This offers a plethora of services and applications in AI, including natural language processing and data analysis. It is utilized in healthcare, finance, and customer service.

- Microsoft AI and Azure AI: Through Azure, it offers machine learning, bot services, and cognitive services. It mostly caters to businesses and developers. Notably, it has mentioned that it has expanded its native AI capabilities so that it is not reliant on its stake in OpenAI.

- Amazon (AMZN) Web Services: Its AI and machine learning services provide tools and platforms for developing AI applications. For example, Amazon SageMaker facilitates machine learning model development. Other models include tasks involving language, vision, and chatbots.

I believe that Google’s investment in Gemini and DeepMind is going to become particularly important as the market for AI evolves, and typical search engines may become obsolete and replaced by more efficient AI models. At this time, while OpenAI’s ChatGPT utilizes the internet for its search results, there is arguably going to come a time when the database of knowledge in AI models is larger based on historical texts, creating immense utility of information sourcing through AI prompts. Google must tread very carefully in this regard, and I believe it is doing the right thing by investing heavily in artificial intelligence at this time to prepare itself properly for the shift that is underway in the search market.

Future Financial Implications

Suppose Google can manage to effectively compete in AI over the long term with Gemini and future iterations of this. In that case, I believe it will continue to do extraordinarily well as a firm overall. As such, my outlook for Google is stronger than you might think. It appears that one of the significant detriments is that the market has not provided any meaningful stock correction in light of Gemini’s recent failures. Instead, the market supposes, and perhaps rightly, that the investment is going to continue to perform well. Arguably this is because investor sentiment is that Google will fix its problems with its AI model and successfully iterate towards a more desirable and competitive product. I agree with this in many respects, but I also believe that the firm has a lot more room to grow and could see large financial benefits if it plays its cards correctly in the next few years, perhaps by making its organizational structure leaner and integrating AI more prominently through automated tasks to reduce expenses and drive growth. As a leader in technology, it could also lead the way in driving growth through such automation and hiring in new roles that would support even further advancements in operational efficiency. By doing this, shareholders could see large future financial gains, and the stock would continue to be a resounding Buy.

News has been circulating that Google’s ad sales division is going through a large overhaul, potentially laying off 30,000 people. This is significantly driven by the integration of AI into its Performance Max ad tool. I have heard many concerns about human labor being replaced, and while I understand these concerns, I must reiterate my above point. The labor demand should not wane; instead, it should change and adapt, and I believe it is of utmost importance that workers realize the significant shift underway, especially if they work in technology markets, and continue to train in specialties that offer companies value in driving higher efficiencies through the utilization of AI under human direction, creative engineering, and stewardship. The announcement of Google’s lay-off decision was made internally by Sean Downey, Google’s President of the Americas and Global Partners. Google is not the only company undergoing this shift. Microsoft recently announced the elimination of 10,000 jobs to adapt to changes in cloud computing, and Duolingo (DUOL) has also opted for AI over human translation.

My thesis is that the future financial implications of these operational changes could be much higher margins as productivity is vastly increased, and the cost of production should go down. As such, the economy could begin to move into a deflationary period, which is something outlined by Cathie Wood recently. While I agree with Wood’s comments that the advent of AI will spark high levels of productivity, margin growth, and deflation, I believe that her estimates are somewhat too pronounced. I believe that the AI market will cause the results that she mentions in a less significant but still prominent manner.

Valuation

It is unfortunate that the present issues with Google’s Gemini did not more severely affect its stock price for any extended period of time, as I believe it would have made for an excellent buying opportunity. However, to my mind, the stock still remains a long-term Buy and is undervalued at the time of this writing. For peer analysis, consider the following table of technology competitors:

| Microsoft | Apple | ||

| Forward P/E Ratio (‘GAAP’) | 22.85 | 36.42 | 25.93 |

| 3Y EPS CAGR Consensus Estimate | 16.02% | 16.81% | 8.3% |

| Forward Price-to-Cash-Flow Ratio | 15.25 | 28.69 | 22.38 |

| 5Y Avg. Operating Cash Flow Growth | 18.91% | 15.78% | 10.05% |

As we can see from the table, Google offers a particularly compelling valuation when compared to its top technology peers, with the lowest forward P/E ratio and forward price-to-cash-flow ratio of the group. However, it also has very competitive growth estimates, almost in line with Microsoft and almost double that of Apple (AAPL). Considering this, it is undeniably the strongest investment of the three from a value standpoint, in my opinion.

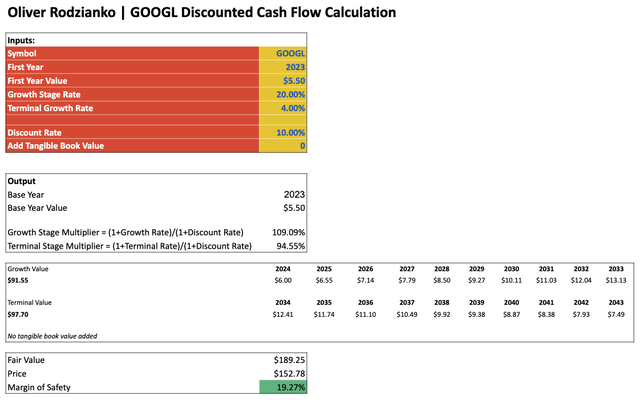

It is no surprise, then, that Google performs well in a discounted cash flow analysis. Consider that it has grown its free cash flow at 20.53% as an annual average over the past five years. Therefore, I have used 20% for my DCF calculation as my annual growth rate for my 10-year growth stage. Following this, I have used a 4% terminal-stage annual growth rate, which is in line with typical US inflation. I have then used a 10% discount rate, which is my low-end expected annual total portfolio return. My fair value estimate is $189.25, a 19.27% margin of safety on the present stock price of $152.78.

Further Risks

While I consider Google to be a good investment despite its current troubles with Gemini, there is a risk that it does not successfully work out its technological difficulties here and does not piece together a model that is commercially as successful as ChatGPT or other offerings from Microsoft. If this is the case, I believe over the long-term investors in Google will suffer. It is arguable that at this time, it is still speculative to ascertain how proficient Google’s model will become, but what is evident is that it has the team, expertise, infrastructure, and funding to successfully make the changes necessary for its AI offerings to be competitive, if not the best, in the field.

Additionally, ChatGPT already has a significant advantage in that, in many people’s eyes, it was the first to offer its generative AI capabilities to the public at a meaningful scale. As such, it is very difficult for some users to imagine switching over to another provider, even if the competitor’s model is better. Google will be facing the marketing challenge of competing with the first dominant provider, which is always difficult to shift public perception on. This could significantly affect shareholder returns and be disheartening for the teams working on Google’s AI capabilities amid the present negative perception.

Conclusion

Based on my analysis, there are significant risks at the moment for Google as it navigates this shift in demand and technological change. However, I believe it is well-equipped and has the correct general direction to successfully navigate its present issues surrounding AI accuracy. I am a Google and a Microsoft shareholder, and I believe that Google offers very good value at this time, so I am considering increasing my stake. My hope is that more Google shareholders will speak up to encourage the company’s management to move in the direction of unbiased AI focused specifically on the accuracy of representation based on as factual a foundation as possible.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.