Summary:

- Alphabet has a near-monopoly position in search and a pristine balance sheet.

- Despite their many strengths, the market appears to be questioning Alphabet’s resiliency and growth potential over the long term.

- This is the critical moment for management to position the business for future success.

- Investors are being asked to bet the jockey as the winning horse grows old.

- We are willing to give management the benefit of the doubt and view Alphabet as being reasonably valued.

400tmax

Thesis

Alphabet’s (NASDAQ:GOOG)(NASDAQ:GOOGL) search business is facing an uncertain future in light of the coming AI-based tools. A credible competitive threat is yet to emerge, yet the fear is present in both Google’s management and investor base. Every company eventually hits a wall in the part of their business that made them who they are. The question is whether that company can use their talent, resources, and experience to create another major success. We believe that Google’s management can pilot the business into another decade of success, but technology tends to move fast and they could get left behind if proper respect is not given to competitive threats. The company must have a renewed sense of urgency in order to win.

“Google” will be used to refer to the parent company “Alphabet” in this article.

Same Concerns Different Era

Back in 2012 Eric Schmidt and Peter Thiel were debating about technological innovation, specifically regarding big tech firms. Peter Thiel had a few notable quotes:

Google is a great company. It has 30,000 people, or 20,000, whatever the number is. They have pretty safe jobs. On the other hand, Google also has 30, 40, 50 billion in cash. It has no idea how to invest that money in technology effectively. So, it prefers getting zero percent interest from Mr. Bernanke, effectively the cash sort of gets burned away over time through inflation, because there are no ideas that Google has how to spend money.

Google is no longer a technology company, it’s basically a search engine. The search technology was developed a decade ago. It’s a bet that there will be no one else who will come up with a better search technology. So, you invest in Google, because you’re betting against technological innovation in search. And it’s like a bank that generates enormous cash flows every year, but you can’t issue a dividend, because the day you take that $30 billion and send it back to people you’re admitting that you’re no longer a technology company. That’s why Microsoft can’t return its money. That’s why all these companies are building up hoards of cash, because they don’t know what to do with it, but they don’t want to admit they’re no longer tech companies.

Eric Schmidt did not directly respond to the criticism over the large cash pile, and instead lamented about the challenges of growing at scale and the different factors that limit the pace at which large companies can grow and innovate.

As most readers will know, Google continued to grow over the past decade despite a perceived lack of innovation. Some of the same criticisms Peter Thiel had of the company are still true today. The company still makes the vast majority of their revenue from search and other ad-based sources. Their enterprise solutions and Google Cloud segments have been a step in the right direction for the company but they still lag far behind Amazon (AMZN) and Microsoft (MSFT) in cloud. Not to mention that these areas of the business are far less profitable than their ad-based revenue sources. Their “other bets” endeavors so far have resulted in disappointing commercial success, despite the numerous resources that have been available to the division over the years. This begs the question, are the Google critics finally correct regarding their perceived lack of innovation? Or will Google find a way to reinvent itself?

The Jockey and the Horse

We can view the situation at Google through the lens of a story:

There was once a successful jockey and horse. The pair won many races and earned a lot of money. Eventually the jockey retired in order to enjoy their wealth and was replaced by a new jockey. The new duo were able to win races, but observers noticed that the competition was catching up. The old horse and new jockey began to win fewer races and by a shorter margin than in the past. As the horse continued to grow older it was just a matter of time before the horse would be unable to remain competitive. The jockey then set out to train a new horse. The only problem was, their current horse was trained by someone else and this new jockey was unfamiliar with what it took to take a young colt and mold them into a champion. Despite having more resources than their predecessor the jockey had mixed success in training prospective racehorses, with none of them being even close to matching the performance of the prized horse.

This is where the story can take one of two paths. Either the success can be replicated and the new jockey can train a new winning horse or the new jockey was never that great to begin with and only succeeded because of the prized horse that their predecessor had trained.

Apple and Microsoft are two examples of big tech companies that found a way to reinvent themselves and take a dip in the “corporate fountain of youth”. In the case of Apple this was accomplished by the success of the iPhone and for Microsoft this was accomplished through migrating to cloud-based services. Google will need to find their next major success story or risk becoming yet another tech company that eventually stagnated and could never catch back up to rivals.

The Decade to Come

The decade to come will be telling for Google. Will the company be able to use their strengths to take advantage of the opportunities ahead of them, or will their weaknesses sink them like an anchor?

Strengths

Thanks to their near-monopoly position in search, Google has a massive user base and a large amount of accumulated data. This combination of data generation and stored data will be an asset that increases in value as the demand for and importance of data grows larger each day.

Google has an experienced employee base and a massive pool of talent. This means that it is reasonable to assume that there will be an ample amount of current and future Google employees that will have good ideas. As long as management is able to foster an atmosphere of innovation these employees will be able to make their good ideas a reality. Unfortunately, large companies have a habit of squashing good ideas for a plethora of reasons. These include the new idea posing a threat to current revenue sources, organizational politics, and personal biases.

Google has a strong balance sheet and ample cash to fund investments in the business. This is a major source of strength, but one that their big tech peers also have. The company should be willing to spend as much as it takes to secure their future.

Opportunities

Google has a lot of data and now they must find new ways of utilizing it. The major opportunity going forward lies in Google’s expertise in handling, manipulating, generating, and storing data. This experience will prove useful in the age of AI as long as the company is able to execute.

Some potential opportunities for the company include incorporating generative AI into Google enterprise and search products as well as utilizing advances in computing to increase efficiency within their business. Google’s silicon unit could make breakthroughs in lowering the cost and increasing the speed of training computer models such as AI-based tools.

The truth is that many of the future opportunities are not going to be obvious. The important thing is for Google’s management to build and foster a culture of innovation where their employees are encouraged to disrupt and think big/think outside the box.

Weaknesses

Google may have a potentially bureaucratic culture stifling innovation. This eventually becomes a concern with all large companies, as comfort breeds complacency if left unchecked. A large company fending off the temptation to become bureaucratic is akin to cutting back jungle that is growing onto a road. If they neglect to do this the jungle will eventually overtake the road and cause problems. It’s a constant struggle and one that the management and board must understand or eventually face the consequences of negligence.

Google has what could be considered by some to be an ideological employee base that has demonstrated an ability to derail projects and initiatives within the company. An example of this is Project Maven. It’s likely that Google’s new Public Sector Cloud Division will eventually result in uproar as well. Microsoft and Amazon have much more experience as public sector vendors for this very reason, and even if Google’s employees don’t complain anymore about their public sector work the company is still behind their competitors in this area. An ideological employee base may turn off current and potential employees which over time will magnify groupthink and bureaucracy issues. Many people hear “ideological employee base” and immediately jump to politics, but ideologies aren’t only political. They can also be related to processes, priorities, and pursuits within a company. An organization can get set in their ways and be resistant to change. This would be detrimental to Google’s long-term prospects.

Price Action

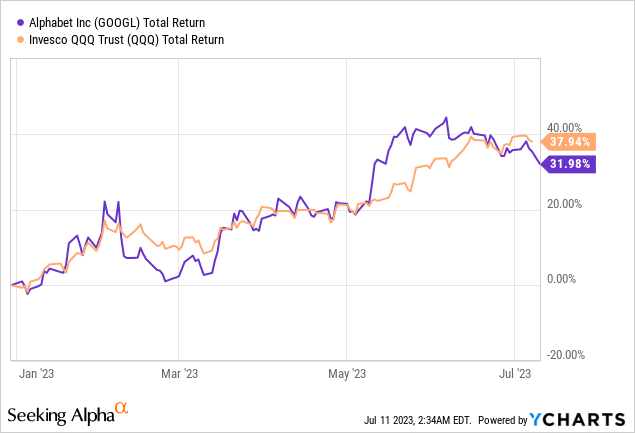

Google has had a nice rally YTD but is currently lagging the QQQ. This underperformance could be due to a perception that Google will not benefit as much from AI-based technological advances as their big tech peers.

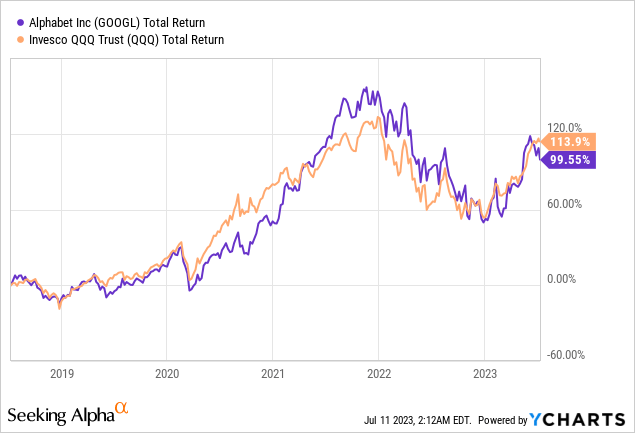

The company has underperformed the QQQ on a 5-year basis as well. Investors who view this dislocation as being unjustified could profit from a closing of the relative performance gap.

Valuation

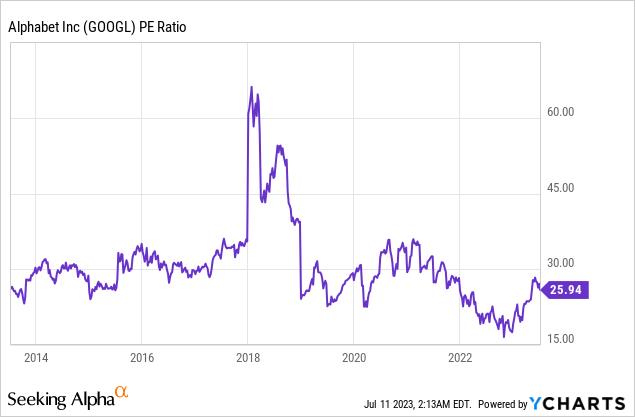

Google is trading around the middle of their long-term average P/E. Google could still represent a good value for investors who are bullish on the company’s future, and the price is attractive enough to ensure a margin of safety. We view anything under a 30 P/E as being reasonable given the company’s market positioning and strong balance sheet. Anything over that and we would look to lighten up a bit depending on market conditions. We believe there is justification for some level of uncertainty discount to be applied to the company until they can further diversify their business away from ad-based search.

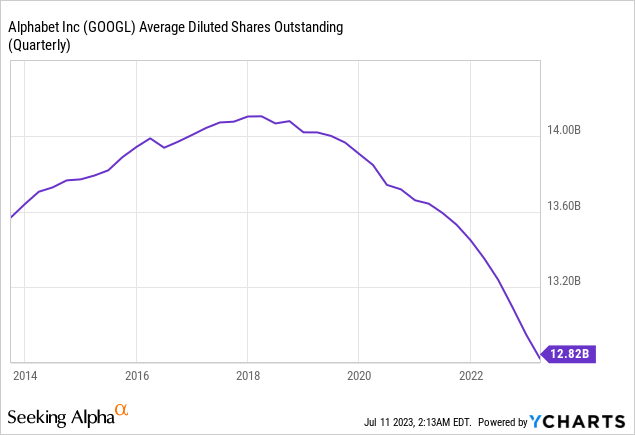

Google has done well to start reducing their shares outstanding and we would expect their robust shareholder return plans to continue. As long as management can balance reinvestment with shareholder returns the risk of underinvesting in the business is minimal.

Risks

The major risk to Google is the potential for their management to be unable to position their business for the technological realities of the future. This would result in Google facing a similar fate as former tech darlings such as IBM (IBM), Cisco (CSCO), and Intel (INTC). It’s unlikely that the business would just disappear, so investors aren’t risking too much by taking a position here. In our opinion, a poor investing outcome regarding Google would be more likely to result in dead money than a large permanent loss.

We view the risk/reward as being reasonable and are willing to give Google’s management the benefit of the doubt for now.

Key Takeaway

Google is a company where investors are required to bet the jockey. If management is able to capitalize on their strengths they can position themselves to benefit from the coming technological changes over the next decade. We believe Google stock remains a buy and that long-term investors can continue to add at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to GOOG and GOOGL.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.