Summary:

- Google announced a bunch of product updates related to generative AI technology at their I/O developers conference to remind the market of their technology leadership.

- The search giant has strong plans for incorporating generative AI chat results into Google.

- Google Search has only grown search market since the launch of ChatGPT.

- Even after the big rally, Google remains cheap at 15.5x 2024 EPS estimates.

Prykhodov

While Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka Google, got off to a slow start with launching AI chat, the company is quickly becoming a beast in the sector due to previous deep investments. Microsoft Corporation (MSFT) caught the tech giant off guard with a big investment in OpenAI following the launch of ChatGPT, but Alphabet is quickly re-entering a position of dominance, incorporating AI into Search and launching new AI tools. My investment thesis remains ultra Bullish on the stock even with the market recently catching on to the bullish thesis.

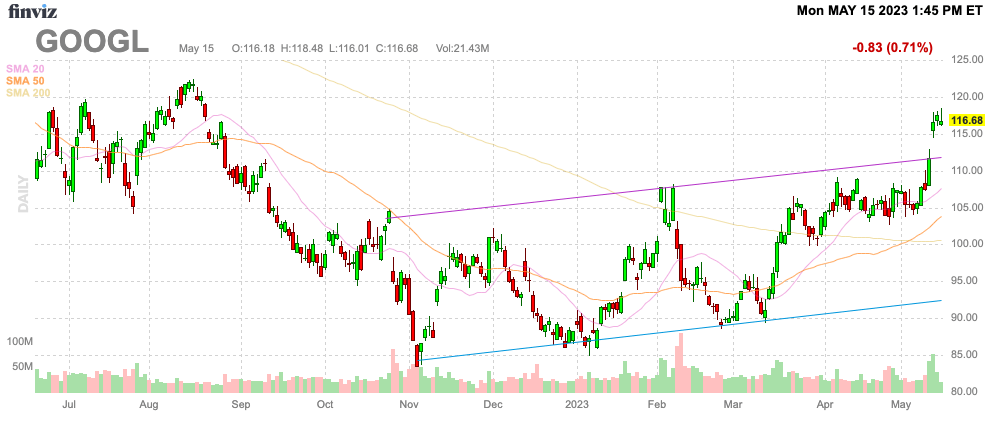

Source: Finviz

AI Gaining Steam

Anyone listening to the Google I/O developer conference last week quickly got a reminder that the tech giant is a leader in the AI space. The company was caught off guard by the quick launch of generative AI chat by Microsoft, but Google already had a ton of AI tools in the works that the company is quickly incorporating into various tools now.

The most important function is how Google will incorporate a generative AI experience into Search. As expected, the Search giant is incorporating the AI technology as a feature of search, providing users with the ability to select the best option for them.

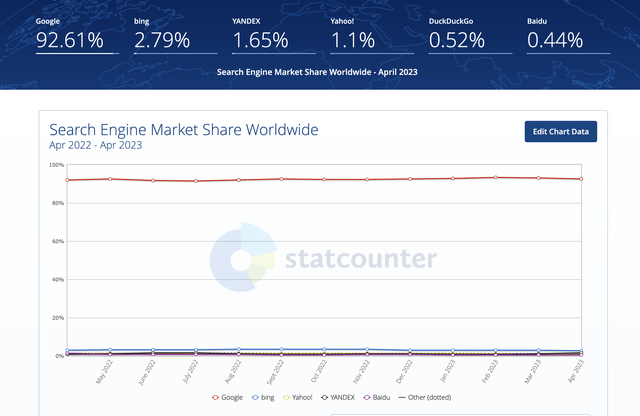

Google is enhancing what is already a powerhouse in the search space. Based on data from Statcounter, the company has only gained market share from search in the last few months.

Back in November, when ChatGPT was launched, Google was at 92.2% global search market share. The company is at 92.6% now in April 2023, which was up from 92.1% last April.

The data shows no impact to search market share from the launch of ChatGPT and any incorporation into Bing. In fact, Bing has seen market share dip 0.23 percentage points from last April.

According to this data source, Microsoft only had 3.0% market share in April 2022, and the share has shrunk in the last year. On the FQ3’23 earnings call back in late April, Microsoft claimed 10% gains in Bing search revenue, but the market data doesn’t reinforce this view.

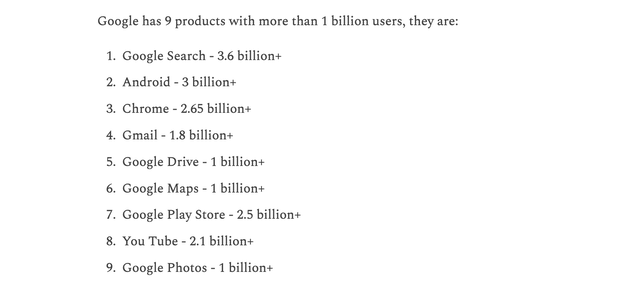

At the developers conference, Google released tons of updates where generative AI could be incorporated into existing products such as Cloud, Workspaces, Docs, Maps and Photos. A lot of these products have over 1 billion users and Google has the potential to monetize these users at a far higher clip using AI.

Some prime examples of the features being worked on for Bard, Google’s generative AI chat, are the following:

- Google Lens integration for image recognition

- Google Maps integration to visualize places

- Sheets integration to create detailed spreadsheets via a text prompt

- Gmail integration to write whole emails

- Google Photos gets an AI-assisted Magic Editor.

While Google didn’t appear ready for prime time when Microsoft and OpenAI caught the AI beast off guard, the company now appears ready to launch a full suite of tools. On top of these generative AI tools, Google is launching tools and APIs for developers to build upon their Large Language Models such as PaLM.

Still Cheap

Google has rallied back to $117 from a 52-week low of $83. The stock is up an incredible 41% off the lows, but the tech giant is still very cheap at levels close to the highs.

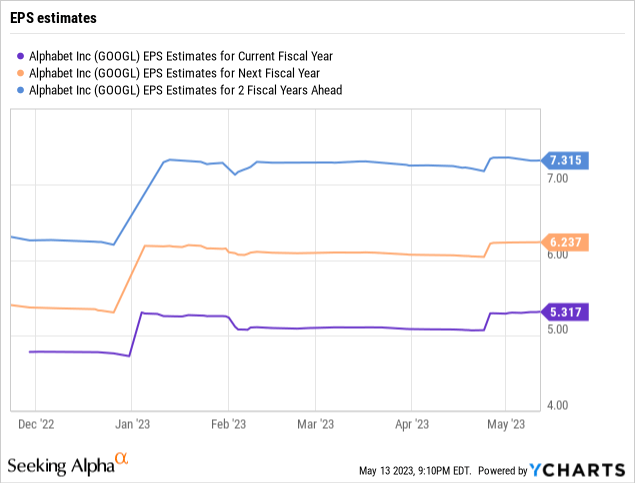

Over the course of the year, consensus EPS estimates have started trending upwards. The CEO has targeted 20% efficiency gains with Google already cutting 12,000 employees.

The 2024 EPS estimates are now up to $6.24 after the search giant reported a Q1 where revenues soared past analyst estimates by nearly $1 billion. Analysts now forecast revenue to return towards 10% growth over the next year after stalling at the end of 2022 when the ad market weakened.

The stock only trades at 18.9x consensus EPS estimates. Considering that the target growth rates are above 15% for years ahead due to the efficiency gains, Google is very cheap at these levels.

As a reminder, the Google estimates are based on GAAP. The company is cutting stock-based compensation costs in part due to lower employee counts, but the estimates still hold that SBC reduces EPS by $1.30 per share annually.

Using a 2024 EPS estimate of $7.54 highlights how much cheaper the stock is in reality. Google trades at only 15.5x these updated numbers and the tech giant has a net cash balance of $100 billion to further reduce the enterprise value multiple.

Takeaway

The key investor takeaway is that Google reminded the world why the company is an AI beast. The tech giant was so far along in AI work that the implementation of generative AI into leading products with over 1 billion users was only a matter of time and not a question of whether Google had the technology.

Alphabet Inc. stock remains exceptionally cheap, but investor might want to buy weakness after the big rally last week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.