Summary:

- The global auto industry is stunned by Google’s autonomous driving technology.

- Waymo leads in self-driving technology with commercial robotaxi operations.

- Alphabet’s dominance in search and advertising faces antitrust issues, but the company remains a strong investment opportunity.

Waymo self-driven taxi. Streets of San Franciso.

Marc Dufresne/iStock Unreleased via Getty Images

Nearly 15 years have passed since the global auto industry was stunned by a 2010 story in the New York Times disclosing that Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) – that was its corporate name before the change to Alphabet – had been experimenting quietly for a year with autonomous driving technology on California roads.

In short order, the news set off a spirited race among automakers and eventually other tech companies to match or surpass Google with systems that would enable a car to drive itself. Trucking companies are in the mix, as well as makers of vans, buses, and shuttles.

Aside from gaining immeasurable technological prestige, a self-driving venture that can safely convey passengers or merchandise on public roads in any weather holds transformative financial potential. Billions and possibly trillions in saved costs and additional revenue dance before the eyes of automotive executives – as well as the disastrous possibility that a breakthrough by a tech company could demote vehicle makers to the role of mere hardware providers in a world of mobility dominated by software.

Crowded field

Today’s field of budding self-driving providers is crowded, including major automakers like General Motors Company (GM) as well some like Ford Motor Company (F) that have scaled back from a competition that has proven costly and has yet to produce a clear winner. Several Chinese ventures such as Baidu, Inc. (BIDU) – that country’s Google – have joined the fray.

A clear leader of the pack, however, is Google, which is in turn the operator of its Waymo self-driving unit. Waymo has been running commercial robotaxi operations, using Jaguar EVs, in Phoenix, San Francisco, Los Angeles, and soon to begin in Austin.

From the Verge: Alphabet’s “Other Bets” unit, which includes Waymo, most recently delivered $365 million in quarterly revenue, up from $285 million a year ago. But the unit’s losses widened to $1.13 billion from $813 million in the second quarter of 2023.

In other words, Alphabet keeps Waymo’s revenue deliberately vague – though the numbers are far less important than the fact that the scale of operations keeps increasing – 2 million trips so far, growing at a rate of about 50,000 a week – with few reports of irregularities, such as the accident and sketchy reporting that sidelined GM’s Cruise in California. The numbers also are tiny in relation to Alphabet’s overall financial power in the Search, Cloud, and advertising categories.

Waymo robotaxis (Google)

A mark of Alphabet’s dominance in Search and advertising has been the antitrust case brought against the company by the U.S. Justice Department. In early August the court found “After having carefully considered and weighed the witness testimony and evidence, the court reaches the following conclusion: Google is a monopolist, and it has acted as one to maintain its monopoly,” US District Judge Amit Mehta wrote in Monday’s opinion. “It has violated Section 2 of the Sherman Act.”

Best in search

Although the trial judge acknowledged one of Alphabet’s strongest arguments – that the dominance of its search engine is due to its superiority over the competition – the ruling stands as a substantial regulatory rebuke against the company. Taken to its logical conclusion, a legal action such as this could end with a large fine, sanctions, or a breakup of the company, possibilities that will weigh on investors’ minds.

Other antitrust actions against Google are pending as well. At the same time, the company has said it will appeal, a process that could take years.

Simultaneously, self-driving technology continues to evolve with artificial intelligence playing a larger role. Google’s first self-driving vehicles relied heavily on sensors – cameras, radar, lidar, and ultrasonic – with software helping to execute driving maneuvers and make decisions based on incoming data. This approach has proved insufficient to master the most complex driving maneuvers and decisions in a manner equal to or superior to human abilities.

As the speed and capacity of semiconductor chips have increased, AI algorithms are able to integrate the data from several data sources, producing more accurate images of objects and movement and thus enabling the vehicle to improve safety and driving performance. The latest systems “learn” from millions and millions of videos that correlate real-world experience to driver performance – and then direct the vehicle to do the same based on what it sees and senses.

Starting in 2019, Waymo released driving scenarios that it had amassed to researchers and the public in order to stimulate self-driving technology.

Awake at the wheel

Notably, Tesla, Inc. (TSLA) currently sells what it calls full self-driving tech in the U.S. at a price of $8,000; the automaker says an FSD-enabled vehicle can drive on its own, though the driver must remain attentive and be ready to take the wheel, if necessary.

Unlike Alphabet, Tesla doesn’t offer robotaxi services, though the automaker’s CEO, Elon Musk, has predicted on numerous occasions that owners of Tesla models will be able to operate their vehicles as robotaxis.

Per the Wall Street Journal: “Last month, XPeng, one of China’s leading EV startups, made available nationwide a driving-assistance system that provides cruising on city streets and responds to traffic signals. XPeng said its system is powered by AI.”

All signs point to an industry that’s getting closer and closer to full self-driving capability for private ownership and the scaling up of robotaxis, Waymo being the leader, in the U.S. and for the moment. How and to what extent this technology can and will be monetized remains unclear.

Seeking Alpha’s valuation and underlying metrics rate the company as an F. Combined with other factor grades, GOOG’s Quant rating system calls the company a HOLD.

I beg to differ.

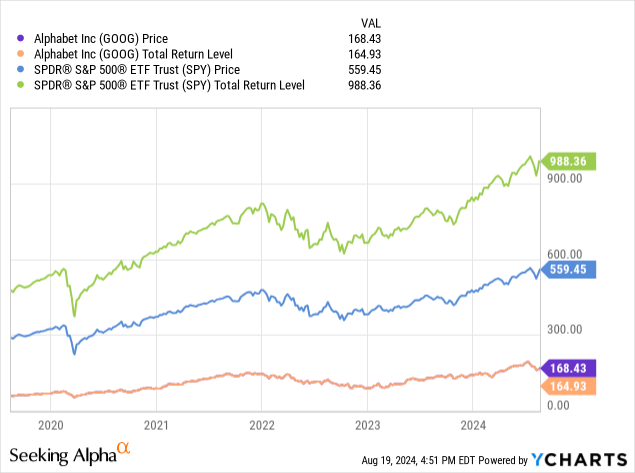

At a P/E of 24, Alphabet still sells at a discount to the S&P’s 28 – which alone suggests that the current price is a decent entry point. Strong growth of revenue and earnings, on top of rising profitability are self-evident. If one assumes that any damage or disruption from the government’s antitrust enforcers may take years – and not necessarily be injurious (as some analysts have argued), the company’s stock – with a market capitalization of more than $2.2 trillion – looks like a buy based on its core businesses and the prospect that self-driving could prove a bonanza.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.