Summary:

- Google’s Gemini large-language model presents an opportunity for it to establish itself as an operating system for foundational LLMs.

- Gemini’s multimodal capabilities and benchmark scores position Google effectively against competitors like GPT-4, Claude, and Llama.

- The introduction of Gemini could lead to revenue growth in Google’s Cloud segment through chatbots, copilots, API usage, and potential licensing fees.

Ole_CNX

Investment Thesis

Earlier in November, I covered Google (NASDAQ:GOOG) where I discussed the company’s strong balance sheet and potential for high shareholder returns. In this article, I will discuss the company’s recent launch of its AI system, Gemini. This is an important development and shows significant strides Google has been making in AI. Gemini’s large-language model in three variations presents a strong opportunity for it to establish itself as an operating system for foundational LLMs. Based on benchmark scores, Google’s Gemini model appears to be closing in on performance parity with GPT-4 and other Large Language Models. This positions Google effectively to extend the use of its Gemini models beyond its own applications, potentially generating revenue through chatbots, copilots, and API usage on the Google Cloud platform. I believe the introduction of Gemini could lead to a growth boost of low to mid-single digits for its Cloud segment. Apart from revenue from cloud usage and copilot adoption, there’s also the potential for licensing fees if businesses choose to adopt Gemini as a standard. Hence, I maintain my buy rating on Google given its current valuation gap vs peers.

Gemini AI Paving the Way for Multimodal Advancements

Google’s new AI model, Gemini, marks a significant stride in bridging the technology gap with major AI players like OpenAI’s GPT-4, Meta’s Llama, and Anthropic’s Claude. Developed by Google DeepMind, Gemini is designed to be a multimodal AI, capable of understanding and operating across different types of information, including text, images, audio, video, and code. This makes it highly versatile and sophisticated in its reasoning and coding capabilities.

The launch is poised to expand Google’s influence in the AI domain, particularly by leveraging its widespread distribution channels such as Google Search, YouTube, and the Android ecosystem. These platforms are expected to accelerate the development and refinement of large language models at a quicker pace compared to its competitors.

Gemini offers three distinct versions, each designed for specific purposes: Ultra, Pro, and Nano. These variants are fine-tuned for different applications, with Ultra serving as the most extensive and powerful model suitable for intricate tasks, Pro excelling in versatility across a broad spectrum of tasks, and Nano being the most efficient choice for on-device operations. This adaptability enables Gemini to perform effectively on various platforms, spanning from extensive data centers to mobile devices like the Google Pixel 8 Pro.

In terms of practical applications, Gemini’s capabilities are diverse. For instance, it can generate code based on various inputs, combine text and images, and perform visual reasoning across languages. Its ability to understand and process different types of data simultaneously opens up new possibilities for AI applications in various fields.

Alphabet has the potential to generate additional revenue through its Gemini foundational Large Language Model, particularly in the domains of cloud training and inferencing due to its native multimodal capabilities. While OpenAI GPT-4 is also multimodal, Google’s benchmarking data suggests that it has significantly closed the performance gap with its competitors, including Anthropic’s Claude and Meta’s Llama.

Meanwhile, Microsoft’s enhancements to Bing search and the introduction of copilots for GitHub and Office 365 are expected to boost revenue among its enterprise user base. However, Microsoft relies on OpenAI as the foundational LLM, while Google has the potential to incorporate native LLM capabilities into its Android operating system.

Forbes

Strong Benchmark Scores Compared to GPT4

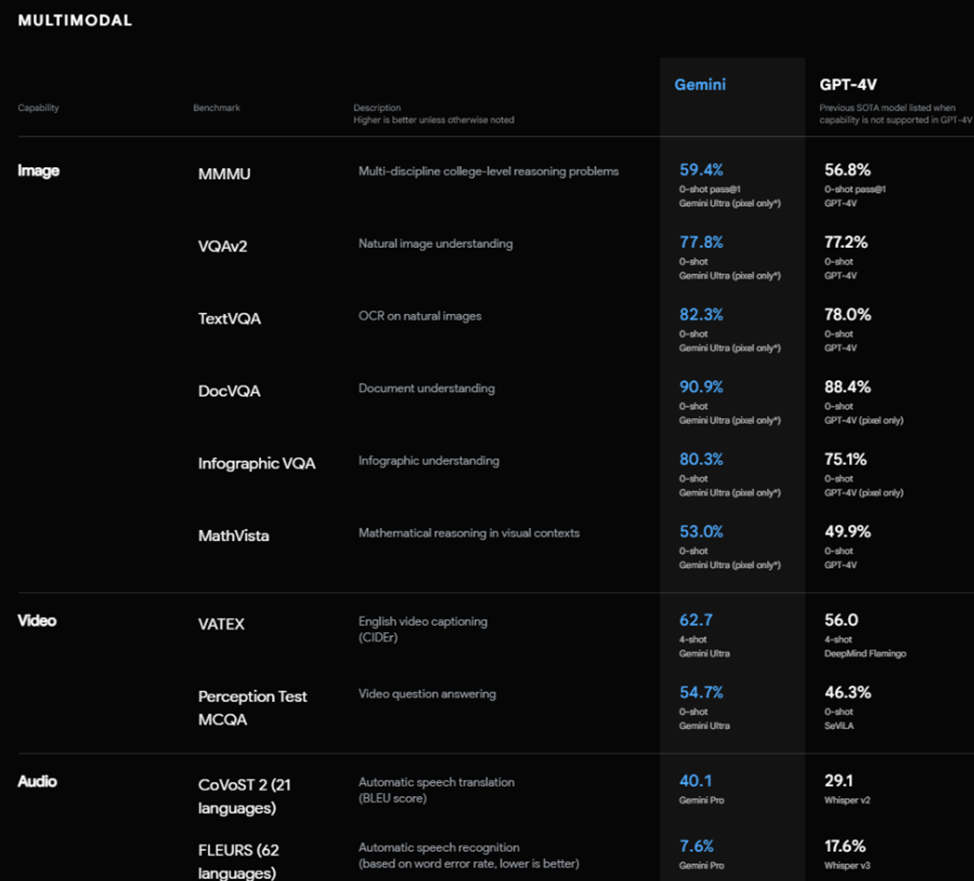

Gemini demonstrates impressive performance across a range of AI benchmarks. It achieves a remarkable score of 90.0% on the Massive Multitask Language Understanding benchmark, surpassing human experts. Additionally, Gemini outperforms existing models on 30 out of 32 commonly used benchmarks in the field of large language models. For example, in the realm of multimodal tasks, Gemini Ultra stands out with a score of 59.4% on the MMMU benchmark, which involves complex tasks that demand careful reasoning.

The impressive performance of Google’s Gemini models in comparison to other major AI models like GPT-4, Claude from Anthropic, and Meta’s Llama indicates that Google has effectively responded to the competitive landscape in foundational large language models. This suggests that Google is well-positioned for rapid advancements and iterations in the future. Additionally, the multimodal functionality of Gemini, an enhancement over its predecessor PaLM2, sets a new standard in the AI field. This advancement may create a competitive challenge for specialized models that are focused solely on singular modalities like images or videos, underscoring the growing importance of versatile, multimodal AI capabilities.

I expect Google to introduce changes to its user interface, including features like summarized views and the capability to generate text and images, similar to what Bing-ChatGPT offers. These changes would be aimed at retaining user engagement on Google’s search page and maintaining its edge in providing real-time search results compared to ChatGPT, which uses a pre-trained generative model.

Google

Valuation

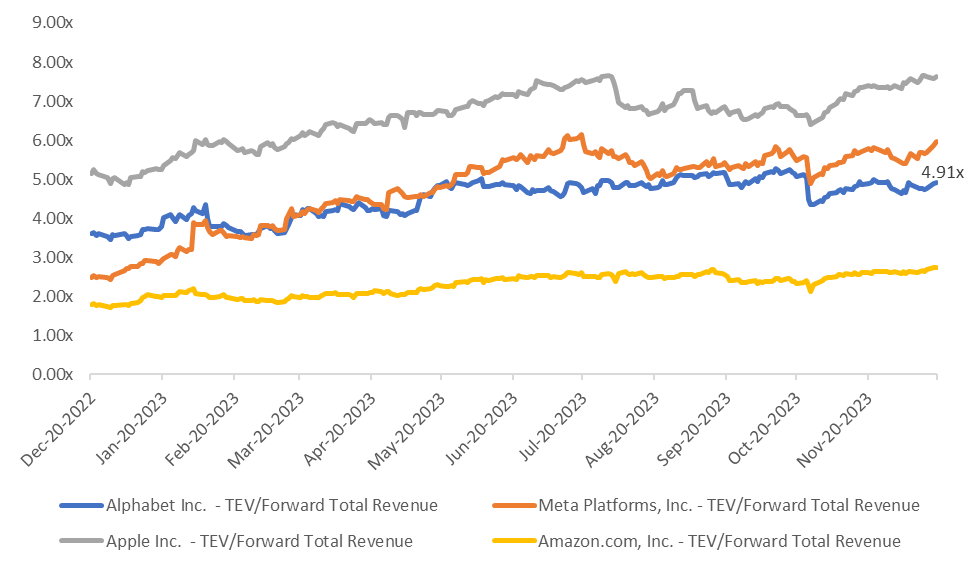

Alphabet has made progress in narrowing the valuation gap compared to its peers. The impact of Bing-ChatGPT on Google’s core search business is diminishing, but Alphabet continues to face regulatory scrutiny in the US and Europe due to concerns about its dominance in the search market. YouTube’s prospects have improved slightly, thanks to the shift to connected TVs and a rebound in digital advertising spending. The profitability of Alphabet’s cloud business has also improved, driven by the demand for cloud infrastructure for AI workloads, and cloud revenue estimates have been positively revised with expectations of IT spending recovery in early 2024. The company has substantial annual free cash flow, a significant cash reserve of over $100 billion, and a strong equity-to-debt ratio, supporting its excellent financial position. The growing importance of artificial intelligence in the tech industry is expected to further strengthen the fundamentals of major tech companies, providing room for increased investment and mergers and acquisitions.

Alphabet’s forward EV/revenue is roughly in-line with the FAANG group’s average. The stock trades at a premium to Amazon but at a discount to Apple, Meta Platforms, and Netflix. At current levels, I maintain my stance that Alphabet is undervalued and, therefore, maintain a buy rating for the stock.

Capital IQ

Key Risks

Competitive behavior remains a key issue among digital-ad providers. The Department of Justice’s antitrust lawsuits against Alphabet pose a risk to the company’s ad revenue. The potential fines on data-privacy rules and the spread of misinformation on YouTube will have Alphabet’s revenues. Google currently has three major lawsuits targeting Google’s valuable ad-tech chain of businesses likely present the most serious antitrust threat for the tech giant to date. The suits are pending in three different districts and expected to be jury trials. This triples the risk to Google, which could have a difficult time defending business tactics that appear aggressive to a jury. One of the matters survived early dismissal efforts and we believe the others might, too.

Conclusion

Google’s launch of Gemini marks a significant event in the company’s progress on AI systems. The high benchmarks positions the company to effectively use its models beyond its own applications, potentially generating revenue through chatbots, copilots, and API usage on the Google Cloud platform. My positive outlook on the company remains unchanged, and I maintain my buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.